Equilibrium Consequences of Corruption on Firms: Evidence from China’s Anti-Corruption Campaign

The announcement on May 17, 2013 that CPC’s Central Commission for Discipline Inspection (CCDI) would start to conduct several rounds of inspections of provincial governments, may serve as a rare natural experiment to examine the equilibrium consequences of corruption on firms. Professors Haoyuan Ding of Shanghai University of Finance and Economics, Hanming Fang of the University of Pennsylvania, and Shu Lin and Kang Shi, both of The Chinese University of Hong Kong exploit event studies to show that the stock market overall reacted positively to the CCDI announcement, and they also show that there is interesting heterogeneity across firms in their reactions to the news. They argue that the CCDI announcement on May 17, 2013 has likely triggered an expectation of norms change of bureaucratic behavior.

Corruption is a widespread phenomenon in many developing and transitional economies. In China, official corruption has risen significantly over the last three decades. Immediately after the conclusion of the 18th National Congress of the Communist Party of China (CPC) on November 14, 2012, the new leadership of China headed by President Xi Jinping launched an anti-corruption campaign. This anti-corruption campaign has turned out to be unlike past campaigns and is still ongoing, which has led many observers to conclude that it is “more severe, far-reaching and persistent than any other” (e.g., The Economist, 2014). To date, this new anti-corruption campaign has punished over 160 officials whose ranking is at the vice-ministerial level or higher, and more than 270,000 lower-level bureaucrats.

In our paper (Ding, Fang, Lin, and Shi, 2017), we argue that the anti-corruption campaign, particularly the announcement on May 17, 2013, that CPC’s Central Commission for Discipline Inspection (CCDI) would conduct several rounds of inspections of provincial governments, serves as a rare natural experiment to examine the equilibrium consequences of corruption on firms.Corruption and Economic Development: The Nexus?

There are different views of the effect of corruption on economic development (see Bardhan, 1997, and Fisman and Golden, 2017). The conventional wisdom is that the “grabbing hands” of bureaucrats increase the cost of operating businesses, leading to less entry on the extensive margins and to smaller scales on the intensive margins (e.g., Klitgaard, 1991; La Porta, et al., 1999; Shleifer and Vishny, 1993). An alternative view, first put forth by Leff (1964), argues that in an environment with excessive bureaucratic burden, corruption can be the “grease for the squeaking wheels” that may help firms avoid bureaucratic delays and make government officials work harder.

Yet a third view attempts to link the “grabbing hands” and “grease for the squeaky wheels” views in an equilibrium framework. To the extent that red tape and misguided regulations are endogenous choices of bureaucrats, rent-seeking incentives by bureaucrats can serve as the source of the red tape and misguided regulations that lead to distortions; at the same time, corruption can serve as the grease to at least partially undo the distortions created by the red tape and misguided regulations. The effect of corruption (and anti-corruption campaigns) on economic performance in the equilibrium framework is thus rather nuanced. It crucially depends on the institutions that are in place when corruption is rooted out (e.g., Kaufmann and Wei, 1999).

Empirical Challenges to Evaluate the Equilibrium Effects of Corruption on Firms

There are at least two empirical challenges to evaluating the equilibrium consequences of corruption on firms. First, we need to observe firms’ performance under different norms of corruption, all other things being equal. But typically the norms of corruption in a country change only in conjunction with a radical change in the government caused by uprising, revolution, or foreign invasion, all of which make it impossible to disentangle the effect of corruption on firms from other disturbances to the economy.

The second empirical challenge is that it would likely take a long time for the equilibrium outcomes following the shift of the corruption norm to fully manifest themselves; but during the long time horizon many other factors can also change, which would then make it harder to distinguish the effects of the changes in the corruption norm from the effects of other concurrent changes.

We argue that China’s recent strong anti-corruption campaign offers a rare opportunity to overcome the first empirical challenge as the anti-corruption campaign, albeit unprecedented, is occurring in a stable country and economy. To overcome the second empirical challenge, we exploit the fact that the stock market incorporates expectations about future developments in the current pricing of a firm’s equity. Thus an event study approach can be used to evaluate the market’s expectation of the equilibrium effect of the anti-corruption campaign on firm performance.

Why Was the CCDI Inspection Announcement on May 17, 2013, a Special Event?

Anti-corruption has been an official theme since President Xi Jinping officially became the Party Secretary in the Eighteenth National Congress. The first official pronouncement of the anti-corruption campaign was the Eight-point Regulation announcement on December 4th, 2012, just weeks after the end of the Eighteenth National Congress. Lin, Morck, Yeung, and Zhao (2017) focused on this event. The Eight-point Regulation was a significant event, but there are at least four arguments supporting the view that it was unlikely to be the event that signaled that this anti-corruption campaign would be different from past campaigns:

1. The Eight-point Regulation was issued very shortly after the 18th National Congress, and this was a routine action taken by a new leadership. Therefore, to the officialdom, this might still have suggested the temporary nature of the campaign.

2. The Eight-point Regulation did not specify punishments or enforcement.

3. An ex post examination of the officials above the vice-ministerial level since 2012 showed that only two officials at the vice-ministerial level were investigated after the Eight-point Regulation but before the inspection announcement. The majority (over 160) were investigated after the inspection announcement, including 21 top officials at the ministerial level or above. Moreover, among all investigated officials, only 12 were investigated due to violation of the Eight-point Regulation, and those 12 officials all received minimal punishment such as an official warning.

4. Even though two vice-ministerial level officials were investigated between the Eight-point Regulation announcement and the CCDI inspection announcement, the pace was not unusual relative to the period before the Eight-point Regulation announcement. From 2008 to 2012 before the Eight-point Regulation announcement on December 4, 2012, a total of 38 officials at the vice-ministerial level were investigated.

In contrast, the CCDI inspection announcement on May 17, 2013, was unprecedented. The announcement that the inspections would eventually cover all provinces, Ministries, major SOEs, and universities suggests that the anti-corruption campaign would be the new, lasting norm. Indeed, as of this writing, a total of twelve rounds of inspections have been conducted. There are no signs of slowing and some agencies have been inspected more than twice. On July 17, 2017, Wang Qishan, the CPC Politburo Standing Committee member in charge of CCDI, wrote in the People’s Daily that CCDI inspections are now a “strategic institutional arrangement” to curb and prevent corruption by CPC government officials.

What Do We Find?

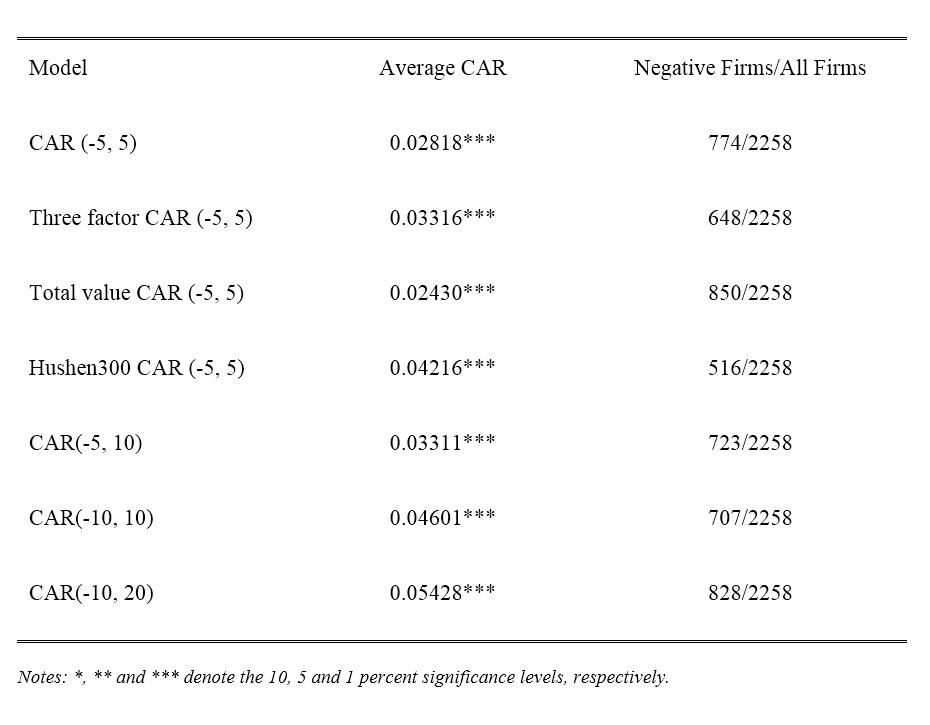

We use stock returns and financial data extracted from the China Stock Market and Accounting Research Database (CSMAR) maintained by GTA Information Technology. Our sample includes 2258 non-financial companies publicly listed as of the end of 2012. We first estimate a market model over a 180-day estimation window ending 11 days before the announcement date of May 17, 2013. We adopt a value-weighted average return of all stocks in our sample as the market return. We then calculate cumulative abnormal returns (CARs) over an 11-day (-5, 5) event window centered on the inspected announcement date (May 17, 2013) and test their statistic significance. For robustness we also use other measures of CARs.

Table 1 summarizes our basic finding. The average CARs over an 11-day window indicates that the market gains 2.818% in the 11-day event window on average. We find only 774 out of 2258 firms decline in the 11-day event window. This basic finding is robust to other measures of CARs or different event windows. This suggests that the weakening of the “the grabbing hands” and/or the expected equilibrium reductions in bureaucratic red-tape following the unprecedented announcement of CCDI inspections generates positive effects on firm performance overall, more than compensating for the possible reduction in the “greasing of the wheels.”

on May 17, 2013

Finally, there is also evidence that local institutions matter. While private, small firms or firms without political connections earn higher announcement returns than state-owned, large, or connected firms, the return differentials are significantly lower in provinces with better legal protections (where there is a smaller grabbing-hand effect) or less developed factor markets (where there is a larger greasing-of-wheel effect).

(Haoyuan Ding, Shanghai University of Finance and Economics; Hanming Fang, the University of Pennsylvania; Shu Lin, The Chinese University of Hong Kong; Kang Shi, The Chinese University of Hong Kong.)

References

Bardhan, Pranab (1997). “Corruption and Development: A Review of Issues.” Journal of Economic Literature, Vol. 35, No. 3, 1320-1346.

Cai, H., Fang, H., Xu, L.C. (2011). “Eat, drink, firms and government: An investigation of corruption from entertainment and travel costs of Chinese firms.” Journal of Law and Economics, 54, 55-78.

Ding, H., Fang, H, Lin, S. and Kang, S. (2017). “Equilibrium Consequences of Corruption on Firms: Evidence from China’s Anti-Corruption Campaign.” Working Paper, University of Pennsylvania.

The Economist (2014). “No Ordinary Zhou.”

Fang, Hanming, Quanlin Gu, and Li-An Zhou (2014). “The Gradients of Power:

Evidence from the Chinese Housing Market.” NBER working paper, No. 20317.

Fisman, Ray and Miram A. Golden (2017). Corruption: What Everyone Needs to Know. Oxford University Press.

Kaufmann, D., and Wei, S. J. (1999). “Does ‘grease money’ speed up the wheels of commerce?” NBER working paper, No. w7093.

Klitgaard, R. (1991). “Gifts and bribes.” Strategy and Choice, 419-435.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., and Vishny, R. (1999) “The quality of government.” Journal of Law, Economics, and Organization, 15(1), 222-279.

Leff, Nathaniel H. (1964). “Economic Development through Bureaucratic Corruption.” The American Behavioral Scientist, 8(2), 8-14.

Lin, Chen, Randall Morck, Bernard Y. Yeung, and Xiaofeng Zhao (2016). “Anti-Corruption Reforms and Shareholder Valuations: Event Study Evidence from China.” NBER Working Paper No. 22001, forthcoming, Journal of Financial Economics.

Qian, Nancy, and Jaya Wen (2015). “The Impact of Xi Jinping’s Anti-Corruption Campaign on Luxury Imports in China.” Preliminary Draft.

Shleifer, A., and Vishny, R. (1993). “Corruption.” Quarterly Journal of Economics, 108, 599–617.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email