Homemade Foreign Trading

Our recent study provides evidence that Chinese mainland insiders tend to evade see-through surveillance by round-tripping via the Stock Connect program. After the regulatory reform of the Northbound Investor Identification Model in 2018, the correlation between insider trading and northbound flows decays, as does the return predictability of northbound flows. The reduction of return predictability is especially pronounced among less prestigious foreign custodians and cross-operating mainland custodians, behind which mainland insiders are more likely to hide.

Among all the accesses to the Chinese capital market, the Connect Program launched on November 17, 2014, is the newest “opening up” effort from Chinese policymakers, and it quickly became the dominant investment channel for foreign investors. The Stock Connect works like a bridge that enables investors from Hong Kong and overseas, as well as qualified investors from mainland China, to directly trade eligible shares listed on the other market via their local exchanges, without the need to adapt to the operational practices on the other market. Representing one of the greatest reform innovations by China’s top authorities, this program achieves the goal of international financial integration (in certain stock/bond markets) with the rest of world without opening up China’s capital account.

This paper highlights one of the dark sides of the Stock Connect. Echoing the literature on financial innovations where new financial products may often lead to regulatory arbitrage, we argue that the program creates regulatory loopholes for opportunistic mainland investors to arbitrage by round-tripping.

How does the Stock Connect help conceal investors’ identities? The mainland exchanges adopt a see-through surveillance scheme for trading and clearing, in which orders from any stock trading account must be mapped to the corresponding trader’s personal information. In contrast, under Hong Kong’s jurisdiction, financial intermediaries (brokers or custodians) hold their clients’ securities under the names of intermediaries. During the first three years after the launch of the Stock Connect, northbound trading adopted a scheme consistent with Hong Kong’s jurisdiction. Therefore, the Stock Connect offers an opportunity for domestic traders in mainland markets to disguise themselves by trading eligible A-shares of connected firms indirectly.

The see-through regulatory reform on northbound trading in the third quarter of 2018 is a game changer. In a joint announcement made by the two regulators on both sides on August 24, 2018, the Stock Connect would establish the Northbound Investor Identification Model, under which northbound custodians are required to assign a unique identifier, known as the Broker-to-Client Assigned Number (BCAN), to each northbound client. Each BCAN was mapped to the Client Information Data (CID) of that particular client, which includes the client’s name, identity document issuing country, ID type, and ID number. Each broker is required to submit the BCAN-CID mappings for all of its northbound trading clients to the HKEX, which then sends the mapping files received to the mainland exchanges every trading day. Via this see-through surveillance, the mainland regulator can identify the actual beneficial owner of northbound trades and deal with those irregular mainland investors.

A natural question then arises: why would someone conceal their identity? Researchers have explored such motivations as tax evasion, tunneling, and market misleading (Hanlon, Maydew, and Thornock 2015; Liu, Sheng, and Wang 2021), but this paper examines round-tripping of mainland insiders who are subject to heavy scrutiny and choose to profit on their non-public information through the Stock Connect.

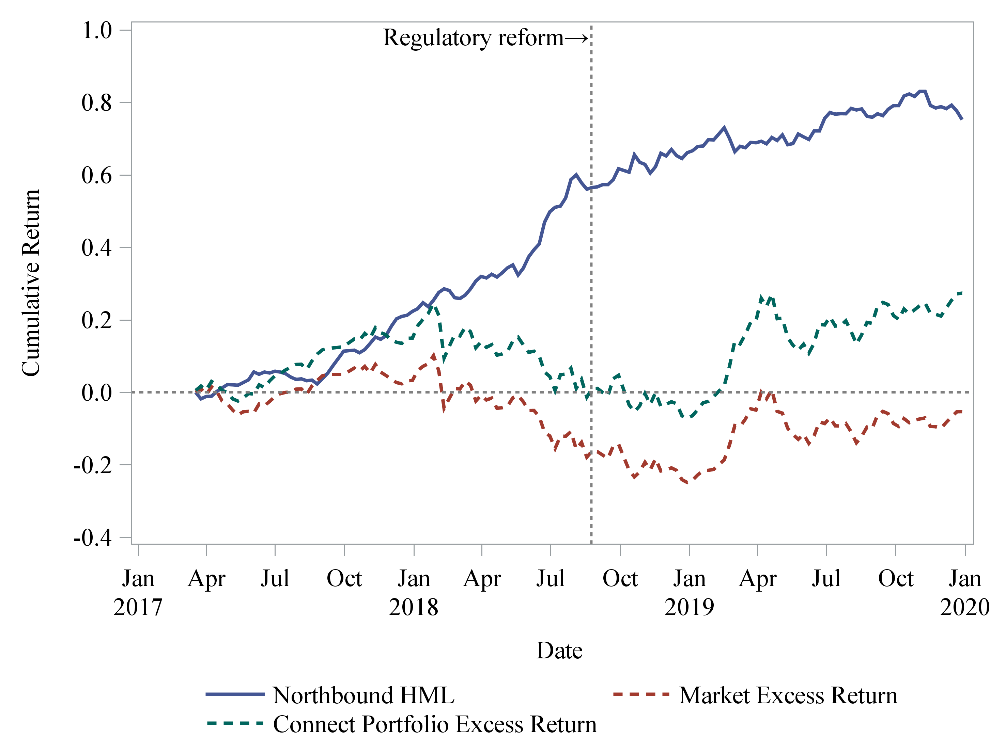

As preliminary supporting evidence, there is a dramatic weakening of the return predictability of northbound flows, which lined up surprisingly well with the timing of the see-through surveillance reform. Consistent with the literature (Chen, Wang, and Zhu 2019; Lundblad et al. 2022), Figure 1 shows that the weekly rebalanced long-short strategy between the top- and bottom-decile portfolios sorted by northbound investor flows generated an annual return of 37.2% during the 17-month period before the reform on August 2018, which is extremely impressive compared to the contemporaneous annualized excess return of the market portfolio (-11.7%) as well as the value-weighted portfolio of all connected stocks (0.7%). However, during the post-reform period, these portfolios increased at a similar rate.

Figure 1: Return predictability of northbound investor flows

This figure shows the cumulative returns of a long-short strategy between the top- and bottom-decile portfolios sorted by aggregate northbound investor flows with weekly rebalancing (blue solid). Also shown are the cumulative returns of the entire A-share market portfolio (red dash) and of the value-weighted portfolio of all connected stocks (green dash), in excess of the one-month China Development Bank bond yield as a proxy for the risk-free benchmark following Amstad and He (2020). The sample spans from March 17, 2017, when the HKEX started to release daily northbound holding, to December 31, 2019. We weight stocks by their floating market capitalization winsorized at the 5% and 95% levels. The vertical line corresponds to the announcement date of the regulatory reform by the CSRC on August 24, 2018.

Additionally, we find that returns to these investments placed through certain custodians (who may have been more willing to accommodate round-tripping) have deteriorated since the reform. More specifically, although the trading activities of less prestigious foreign custodians and cross-operating mainland custodians were informative in the early days of the Stock Connect, their northbound flows have become uninformative about future stock since regulations were introduced to crack down on homemade foreign trading.

Taking the homemade foreign trading hypothesis as a whole, we show that mainland insider selling among the connected firms first experienced a decline after the introduction of the Stock Connect, and that this trend reversed after the 2018 see-through surveillance system was established. More formally, we show that concurrent trading activities of northbound investors from problematic custodians and mainland inside sellers became relatively infrequent after the regulatory reform.

All evidence points to the presence of homemade “foreign” investors who are likely to be mainland insiders concealing themselves behind northbound flows, and hence urges caution regarding the conclusions of prior studies showing the informativeness of foreign investors in China.

In the era of global regulatory cooperation, the effort to crack down on cross-border regulatory arbitrage continues. On June 24, 2022, the China Securities Regulatory Commission (CSRC) made an amendment to the regulations on investor eligibility: as of July 25, 2022, northbound brokers are no longer allowed to set up trading accounts for mainland investors. This presumably will lead to an elevated transaction cost and litigation risk for engaging in homemade foreign trading in China, which will hopefully encourage the flow of genuine foreign investment into the emerging capital market and improve market efficiency.

References

Amstad, Marlene, and Zhiguo He. 2020. “Chinese Bond Markets and Interbank Market.” In The Handbook of China’s Financial System: Chinese Bond Markets and Interbank Market, edited by Marlene Amstad, Guofeng Sun, and Wei Xiong, 105–48. Princeton, NJ: Princeton University Press.

Chen, Keqi, Yuehan Wang, and Xiaoquan Zhu. 2019. “The Value of Information in the China’s Connected Market.” SSRN Working Paper No. 3395141. https://dx.doi.org/10.2139/ssrn.3395141.

Hanlon, Michelle, Edward L. Maydew, and Jacob R. Thornock. 2015. “Taking the Long Way Home: US Tax Evasion and Offshore Investments in US Equity and Debt Markets.” Journal of Finance 70 (1): 257–87. https://doi.org/10.1111/jofi.12120.

Liu, Renliang, Liugang Sheng, and Jian Wang. 2021. “Faking Trade for Capital Control Evasion: Evidence from Dual Exchange Rate Arbitrage in China.” SSRN Working Paper No. 3728855. https://ssrn.com/abstract=3728855.

Luo, Yadong, and Rosalie L. Tung. 2007. “International Expansion of Emerging Market Enterprises: A Springboard Perspective.” Journal of International Business Studies 38, 481–98. https://doi.org/10.1057/palgrave.jibs.8400275.

Lundblad, Christian T., Donghui Shi, Xiaoyan Zhang, and Zijian Zhang. 2022. “Are Foreign Investors Informed? Trading Experiences of Foreign Investors in China.” Working Paper. https://abfer.org/media/abfer-events-2022/webinar-series/cmd/Are-Foreign-Investors-Informed_Trading-Experiences-of-Foreign-Investors-in-China_ChristianLunblad.pdf.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email