Assessing and Addressing the Coronavirus-Induced Economic Crisis: Evidence from 1.5 Billion Sales Invoice

We probe the effects of the COVID-19 pandemic and the subsequent containment policies on business activities in China by exploiting big data on 1.5 billion sales invoices. The average drop in sales was between 23% and 35%, depending on firm size, for the 12-week period after the Wuhan lockdown. Firms in industries requiring more intensive face-to-face interactions suffered more as a result of public health measures. Cities relying on investment-driven economic growth were more resilient. Local governments’ economic stimulus policies were more effective for medium-sized and large firms.

T he COVID-19 crisis, a once-in-a-century pandemic, has caused a mounting number of deaths and created a perfect storm for the global economy. Debates among policy makers and experts have emerged over the trade-off between strict containment measures aimed at preventing viral outbreaks and the most effective reopening strategies to ameliorate the economic crisis (Mulligan 2021; Barrot, Grassi, and Sauvagnat 2020; Lin and Meissner 2020).

Policy makers and academics face several challenges when addressing the dilemma. First, the COVID-19 pandemic is still evolving, with the possibility of future waves, and thus a region or a country could see the situation change over time. Therefore, traditional survey-based macroeconomic indicators at low frequency cannot provide timely measures of economic responses. Second, because containment strategies and reopening stages vary significantly across cities and counties within a country, nationwide economic measures are insufficient to evaluate policy effectiveness. Third, official macroeconomic data are often revised and smoothed (Bell and Wilcox 1993; Wilcox 1992; Borup and Schütte 2022), so they may filter out information essential for policy making. As a result, sales data directly collected from daily business activities provide a more accurate gauge of the devastating effects of COVID-19 on the economy.

In this paper, we use a proprietary data set on firm sales in China to assess the economic impacts of the pandemic and subsequent containment policies, as well as the speed of recovery after the country reopened. Specifically, we obtain high-frequency and granular data from transaction invoices for value-added tax (VAT) claims. The data set contains more than 1.5 billion sales invoices issued between January 1, 2019, and April 16, 2020, accounting for 11% of total firm sales in China.

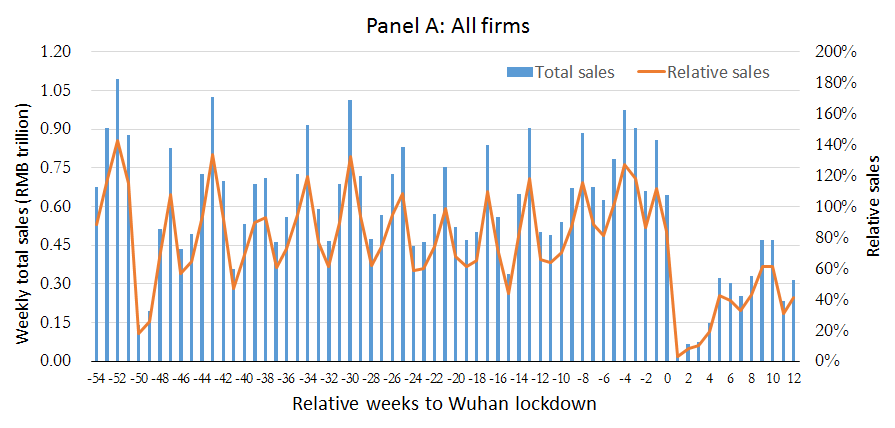

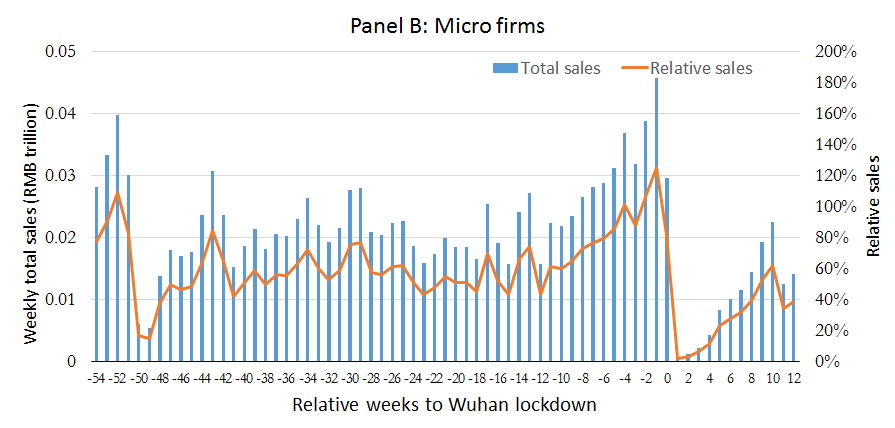

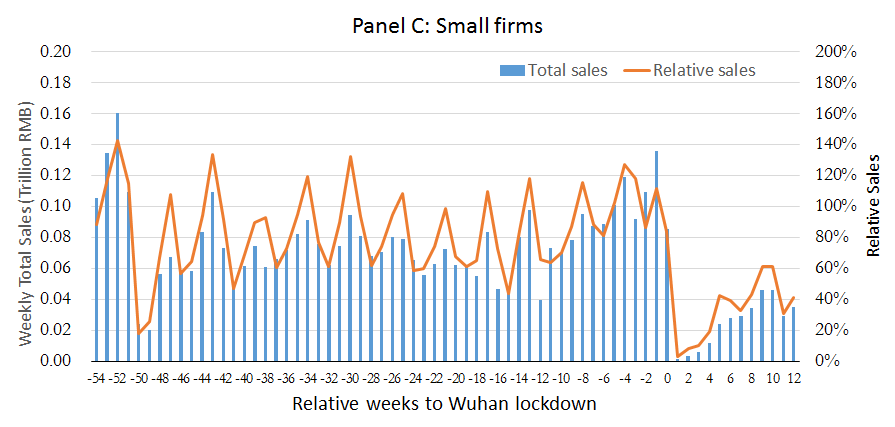

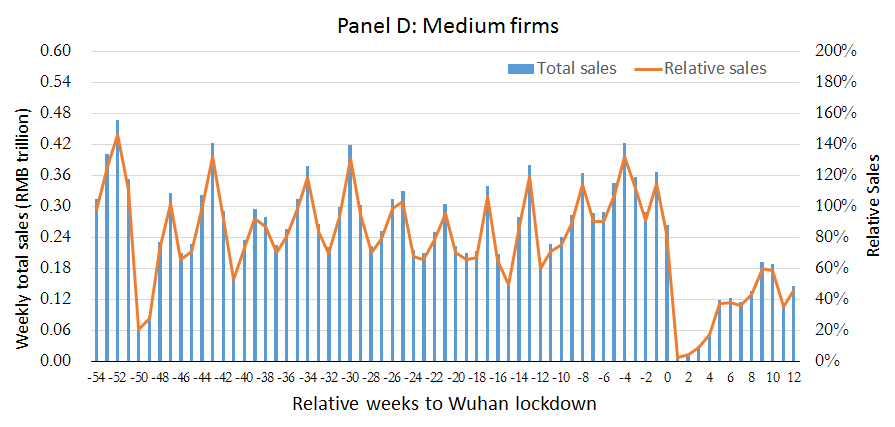

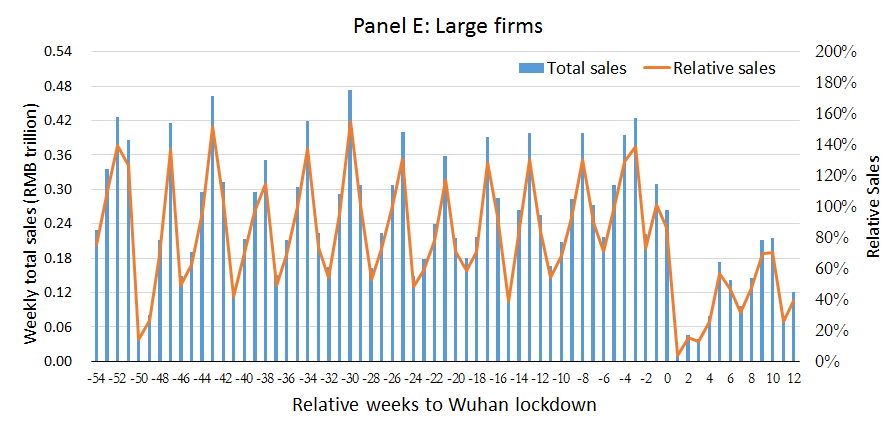

Figure 1 plots weekly RMB sales and the relative sales with regard to the four-week average before the Wuhan lockdown. A few observations are worth discussing. First, after the lockdown, business activities, as measured by firm sales, dramatically plunged to almost zero and slowly recovered to around 50% of the pre-lockdown level after 12 weeks. Second, even though the lockdown coincided with the 2020 Chinese New Year holiday, the impact of COVID-19 was prominent as it took less than four weeks for business activities to fully resume after the 2019 holiday. Third, there was clear end-of-month seasonality for sales, probably because firms tended to clear transactions at a pre-determined monthly frequency. Fourth, sales across all four firm-size categories experienced a dramatic drop in the first eight weeks after the announcement of the Wuhan lockdown.

Figure 1. Weekly aggregate sales

Note: This figure plots weekly aggregate sales and relative sales during our sample period of January 1, 2019, to April 16, 2020. Week 0 is the week ending on January 23, 2020, when Wuhan was under complete lockdown. Relative sales (y-axis) have been calculated as weekly sales over the average sales from week -3 to week 0.

The impact of the pandemic and heterogeneity

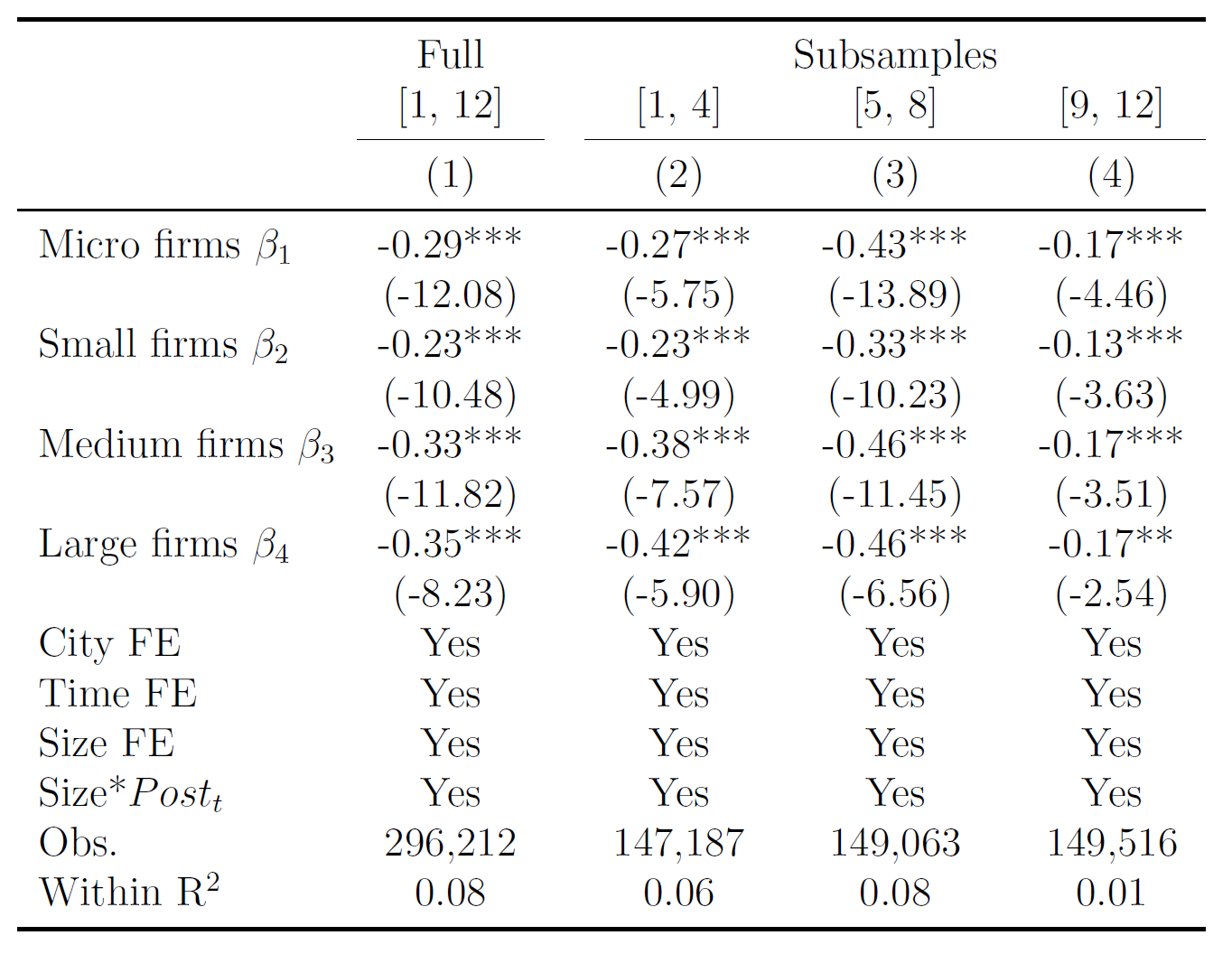

To formally evaluate the impact of the pandemic on economic activities, we implement a difference-in-differences approach to compare post-lockdown sales across size groups with 2019 values, which we used as the benchmark. Table 1 presents the results.

Over the 12-week period after the Wuhan lockdown, large firms experienced the most substantial sales drop, 35%, followed by 33% for medium-sized firms, 29% for micro firms, and 23% for small firms, suggesting that larger firms may have better complied with public health measures. On the other hand, small firms, which are usually privately owned and have been historically less resistant to negative shocks, must keep business going, at least to some extent, to survive. The most severe impacts happened during the second four-week subperiod, when businesses (unable to foresee the COVID-19 pandemic) would normally have reopened after the Chinese New Year holiday.

Table 1: Impacts of COVID-19 on sales

Notes: The dependent variables are relative sales, which are defined as daily sales divided by the pre-lockdown 28-day average of each corresponding year. The event day is set to January 23, 2020, when Wuhan was under lockdown and a lunar calendar matched event day for 2019 is set to February 3, 2019. ᵝ1/ᵝ4 measures the average impact at the city-day level for micro/large firms.

We also explore the heterogeneous impacts of the COVID-19 pandemic by industry. Industries that require more intensive face-to-face interactions, including wholesale and retail, hotel and catering, and education witnessed larger and longer decreases in sales, and around one-third of sales disappeared when the provincial governments announced public health measures. Meanwhile, primary and secondary industries, such as agriculture, mining, and utilities, experienced much smaller decreases in sales, indicating that necessary production and services remained stable.

Effects of local stimulus policies

The Chinese government acted quickly to mitigate the economic impacts caused by the COVID-19 pandemic and issued hundreds of stimulus policies to stabilize the economy and employment. We focus on local governments’ economic stimulus measures and classify all local policies into three non-exclusive groups: financial assistance, fee reductions, and tax exemptions. We find that, except for the tax exemption policies that benefited small firms, all three policies positively affected the recovery of medium-sized and large firms. None of these policies had any significant effect on micro firms’ activities. Therefore, while local governments intended to alleviate the COVID-19 shock for micro and small businesses, those policies did not appear to achieve their goal.

Cross-city determinants of the impact of COVID-19 and recovery

Because of different levels of severity of the COVID-19 pandemic, Chinese cities have implemented different public health measures. As a result, one would expect that business activities across cities would also be affected differently. Our empirical findings indicate that large cities with higher populations were more resilient to the shock. In addition, cities in which economic growth is driven by investment were less affected by the pandemic, implying that service-driven economies may have experienced steeper growth slowdown. On the other hand, local economic development measured by income per capita does not have a clear relationship with the severity of the sales drop.

Conclusion

The COVID-19 pandemic has had devastating effects on the global economy. We estimate the impact of the COVID-19 pandemic on business activities and analyze how firms recovered by exploiting transaction-level data on firms’ sales from 1.5 billion invoices in China. Over the 12-week period after the Wuhan lockdown, large and medium-sized firms suffered more losses in sales compared with small and micro firms. We find differences in the effects of COVID-19 across industries, with stronger effects observable in industries requiring more face-to-face interactions. We also find that all three types of policy measures, namely, financial assistance, fee reductions, and tax exemptions, alleviated pandemic-induced shock for medium-sized and large firms, whereas micro and small firms did not enjoy clear benefits from these policy responses. Lastly, regional, heterogeneous impacts exist, and firms located in smaller and service-dependent cities have suffered more after the lockdown.

References

Barrot, Jean-Noël, Basile Grassi, and Julien Sauvagnat. 2020. “Estimating the Costs and Benefits of Mandated Business Closures in a Pandemic.” CEPR Discussion Paper No. DP14757. https://ssrn.com/abstract=3603989.

Bell, William R., and David W. Wilcox. 1993. “The Effect of Sampling Error on the Time Series Behavior of Consumption Data.” Journal of Econometrics 55 (1-2): 235–65. https://doi.org/10.1016/0304-4076(93)90014-V.

Borup, Daniel, and Erik Christian Montes Schütte. 2022. “Asset Pricing with Data Revisions.” Journal of Financial Markets 59 (B): 100620. https://doi.org/10.1016/j.finmar.2021.100620.

Chen, Zhuo, Pengfei Li, Li Liao, and Zhengwei Wang. 2022. “Assessing and Addressing the Coronavirus-Induced Economic Crisis: Evidence from 1.5 Billion Sales Invoices.” PBCSF-NIFR Research Paper. http://dx.doi.org/10.2139/ssrn.3661014.

Lin, Zhixian, and Christopher M. Meissner. 2020. “Health vs. Wealth? Public Health Policies and the Economy During Covid-19.” NBER Working Paper 27099. https://doi.org/10.3386/w27099.

Mulligan, Casey B. 2021. “Economic Activity and the Value of Medical Innovation During a Pandemic.” Journal of Benefit-Cost Analysis 12 (3): 420–40. https://doi.org/10.1017/bca.2021.5.

Wilcox, David W. 1992. “The Construction of US Consumption Data: Some Facts and Their Implications for Empirical Work.” American Economic Review 82 (4): 922–41. https://www.jstor.org/stable/2117351.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email