The Definition and Measurement of China’s Shadow Banking System from the Perspective of Credit Money Creation

Keywords: Banks’ Shadow, Traditional Shadow Banking, Credit Money, Bank Accounting

Authors: Guofeng Sun, The People’s Bank of China (Beijing 100800); Junyi Jia, Ph.D., School of Finance, University of International Business and Economics (Beijing 100029).

In recent years, China’s shadow banking system has become an integral part of the financial system. Shadow banking provides credit to the real economy. From the perspective of micro entities, both money creation financing and money transfer financing ultimately increase the funds available to enterprises and individuals, showing the same result. However, from a macro perspective, as the correlation between money and macro variables differs from that between credit and macro variables, it is necessary to distinguish money creation financing from money transfer financing. To do this, we must focus on whether shadow banking creates credit money. We are the first to investigate Chinese shadow banking from the perspective of credit money creation. We analyze the operation mechanisms of China’s shadow banking system, distinguish traditional shadow banking from banks’ shadow, measure the scale of China’s shadow banking system between 2004 and 2016, and propose suggestions for the macro-prudential regulation of China’s shadow banking system.

Internationally, broad attention to and research on shadow banking issues have increased since the global financial crisis. Attention has been paid to the liability side of shadow banking, which is similar to deposits and has certain monetary functions. At the time of the crisis, the Federal Reserve introduced the concept of shadow banking for non-banking institutions.

Research on Chinese shadow banking has mainly focused on leverage and related financial risks, and its support of the real economy. Of the numerous studies on shadow banking, we are interested in three strands of literature.

The first concerns the definition of shadow banking. Researchers and institutions have made different interpretations according to different criteria. The International Monetary Fund (IMF) summarizes three criteria for defining shadow banking. First, the participating entities are usually financial intermediaries that are not prudentially regulated and that correspond to banks. For example, Adrian and Shin (2009) describe the participating entity as market-oriented financial intermediaries; Acharya et al. (2013) define it as non-bank financial intermediaries that conduct maturity transformation and leverage activities, but that are less regulated than the traditional banking system; and Pozsar et al. (2010) and Ricks (2010) interpret shadow banking as financial intermediaries that conduct maturity, credit, and liquidity transformation without access to central bank liquidity or public sector credit guarantees. Second, shadow banking activities include the use of innovative financial instruments and related financial activities, such as less regulated banking business or unregulated credit intermediary activities (FCIC, 2010; Claessens and Ratnovski, 2012; Li et al., 2014) and asset securitization (Kocjan et al., 2012). Third, the shadow banking market is usually referred to as the securitization market or the financial derivatives market. For example, Gorton and Metrick (2012) define it as the securitization market and the short-term repurchase market.

Due to different levels of national economic development and financial structure, shadow banking is interpreted differently depending on location. As the Financial Stability Board (FSB) concluded in the Global Shadow Banking Monitoring Report 2013, there may not be commonly applicable criteria for the shadow banking business across jurisdictions. Furthermore, it depends on domestic financial and regulatory systems. Compared with developed countries, China’s shadow banking system has its own particularities. Thus, the definition proposed by the FSB is not directly applicable to China. This view is well recognized by most scholars. The president of China’s central bank, Zhou Xiaochuan, suggested that “shadow banking in China has very different constitutions as compared with the developed markets” and is “smaller in size, relatively simple in product structure, not highlighted in its risks.”

In fact, shadow banking has emerged since the establishment of the credit money system. There are traces of shadow banks in the history of the economic crisis, indicated by the existence of financial institutions and instruments that departed from the traditional credit monetary system. Referring to the 1857 European financial crisis, Karl Marx stated that the root of the crisis was not junk bank notes, but bank savings and the rise of credit (the decisive force of money in the hands of the public), which was not regulated by a formal financial system and consisted of the shadow banking of that period. With continuous innovation of financial instruments, shadow banking has become a new form of savings and credit and has also developed a certain monetary function. With the outbreak of the global financial crisis, Pozsar (2014) supports this view in addressing the level of monetary expansion. Pozsar (2014) divides money claims into four core types: reserves, deposits, repos, and constant net asset value (NAV). Repos and NAV are issued by dealer banks and money funds, respectively, and are less regulated and lack liquidity and credit support from the government. Thus, they may be referred to as “shadow money.” Some of the latest literature has investigated shadow banking from the perspective of its credit creation function, such as Shin et al. (2010), the FSB (2011), and Harutyunyan et al. (2015). The FSB (2011) defines shadow banking as “all forms of non-traditional credit intermediation outside the regulated banking system.” This definition is based on the basic functions of finance (i.e., credit intermediation and credit creation) and is more applicable. As such, many scholars have quoted it, especially in studies on shadow banking outside of the U.S., such as in Europe (e.g., Bakk-Simon et al., 2012; Bengtsson, 2013) and Canada (e.g., Gravelle et al., 2013).

Many studies focusing on China’s shadow banking system have demonstrated the above reasoning. Yin et al. (2013) classify Chinese shadow banking into banks’ balance sheet items that create credit but that are not counted as credit creating activities (major part) and as innovative business by non-bank financial institutions. Zeng (2013) highlights the differences between interbank and non-banking markets. Whereas credit and funding created from the interbank market flow into real sectors, the non-banking market creates credit to support the financial system, which is a more general definition of credit. However, several critical issues are missing in this credit creation function. Credit provision by banks creates credit money and simultaneously leads to the expansion of assets and liabilities. Furthermore, banks’ on- and off-balance sheet liabilities, such as wealth management products (WMPs), may stem from the creation of credit money through bank loans or credit-like business. However, financing standards classify the liabilities of the financial system into two components according to funds stability. That is, core liabilities (high stability, such as ordinary deposits) and non-core liabilities (low stability, such as interbank deposits and foreign currency liabilities). Based on this classification, Shin et al. (2011) analyze the relationship between non-core liabilities and financial system stability. However, this classification method confuses the causality between bank assets and liabilities.

The second strand of literature focuses on laying out the theoretical foundation for measuring the scale of shadow banking (i.e., the product aggregation approach). Most methods directly sum up the subcategories of shadow banking. In this case, different definitions or classifications of shadow banking categories lead to greater differences in measurement results. Yan et al. (2014) define six measures of Chinese shadow banking according to regulation intensity. Whereas the broadest measure of shadow banking is 67.03 trillion yuan, the narrow measure is only 10.3 trillion yuan. Liu (2013) estimates the size of “other debts than formal credit lending” to be approximately 25 trillion yuan, of which the scale of shadow banking is approximately 10 trillion yuan. Gao et al. (2013) focus on banks’ off-balance sheet financing and make an estimation based on the indicators of total social financing, which they find to range from 7.1 trillion to 21.9 trillion yuan. The preceding measuring methods are intuitive and easy to implement, but double counting and missing seem unavoidable. For example, double counting may be induced by the overlapping of shadow banking subcategories, and missing may be caused by the different accounting practices of different institutions, such as identical items listed under different accounting subjects. In this sense, the liability side approach introduced by Harutyunyan et al. (2015) provides a solution. Compared with the traditional subcategory summation method that is only applicable to off-balance sheet securitization (a major component of U.S. shadow banking), the liability side approach is more suitable for capturing on-balance sheet asset securitization (which is the main form of shadow banking in European countries, such as guaranteed securities and covered bonds). The measurement results are replicable across time and countries. It provides a tool for historical and international shadow banking comparison. Yet, no such research has been conducted on Chinese shadow banking.

The third strand of literature proposes a theoretical basis and policy implications for more effective regulation of shadow banking, mainly concerning whether and how to regulate it. In terms of whether to regulate shadow banking, opinions may be grouped into three categories: overall regulation, appropriate regulation, and discretionary regulation. Regarding overall regulation, evidence from empirical research and theoretical models of money demand shows that asset securitization in U.S. (or Chinese) shadow banking has weakened the effectiveness of monetary policies through both credit and liquidity channels. The corresponding policy implication is that regulatory authorities should adopt wider macro indicators and gradually improve the regulatory monitoring system. Regarding appropriate regulation, Ghosh et al. (2013) and Schwarcz (2013) present both the pros (in filling funding gaps of the real economy and enhancing market effectiveness) and cons (in increasing leverage, exaggerating pro-cyclicality, and facilitating the propagation of systemic risk) of China’s shadow banking system. Regulatory authorities should balance these pros and cons and take measures to protect “shadow funds.” Regarding discretionary regulation, more stringent regulation on traditional banks leads to more active shadow banking activities and reduces overall social welfare (Zhu et al., 2012). Thus, regulators should avoid applying overly strict traditional policies on traditional banks. In terms of how to regulate shadow banking, general regulation guidance and specific regulatory measures are critical. Current suggestions for regulation guidance include macro-prudential and counter-cyclical regulation in the Basel III framework, functional regulation proposed by Pozsar (2010) and Wang (2012), and category-based regulation proposed by Ba (2013).

The literature highlights the differences in shadow banking between advanced economies and China, especially in terms of credit money creation. In advanced economies, shadow banking is essentially credit currency transfer with certain monetary attributes. Thus, it must be analyzed from the angles of the participating entities, activities, and innovations in the market. However, in China, shadow banking concerns mainly pertain to its role in supporting the real economy and generating financial risks. Few studies have analyzed the mechanisms of shadow banking and its measurement from the perspective of credit money creation. We fill this gap by providing a thorough analysis of the credit creation mechanisms of Chinese shadow banking and by measuring its scale accordingly. Our key tools include credit money creation theory1, bank balance sheets, and banks’ accounting tactics in handling shadow banking items.

1. According to credit money creation theory, banks’ behavior in loan granting and deposit creation is money creation behavior. Furthermore, there is no currency circulation or generating behavior while banks use deposits to grant loans that are deposited back into the bank. Sun (1996, 2001, 2004) analyzes this idea.

2. Definition of China’s Shadow Banking System and Credit Creation Mechanism

2.1 Definition of China’s Shadow Banking System: Banks’ Shadow and Traditional Shadow Banking

Clarifying the definition of China’s shadow banking system is essential for further research. Considering different credit creation mechanisms (credit money and non-money mechanisms),2 we classify Chinese shadow banking into two categories, namely banks’ shadow and traditional shadow banking. Banks’ shadow refers to bank3 activities that provide funding for enterprises through the creation of credit money, but that circumvent regulatory restrictions and constraints on loan granting by adopting non-standard accounting bookkeeping. Banks’ shadow includes 1) assets channeled by other banks, such as the dual-buyout of credit assets, the reverse repo of bills, interbank payment, purchases, and resales, and 2) activities channeled by non-bank financial institutions, such as the transfer of the beneficiary right of trust, credit-linked total return swap, the oriented asset management plan of security brokers, and specific asset management fund plans.4 Banks’ shadow is inherently identical to bank loans in the sense that it creates credit to fulfill the funding need of the real economy while expanding assets and creating money. However, it differs from bank loans in the sense that it is not listed as a loan in balance sheet items. Banks’ shadow is mainly channeled through a third-party financial institution. Therefore, it exists in terms of interbank assets (on the asset side of the bank balance sheet), investment assets, or off-balance sheet items (e.g., off-balance sheet interbank assets that correspond to off-balance sheet WMPs).

2. Hsu et al. (2013) adopt a similar classification. They divide financial institutions into monetary financial institutions (MFIs) and non-MFIs according to whether credit money is created. MFIs include financial entities that create money (and credit at the same time), such as commercial banks and money market funds (which must be discussed). Non-MFIs include financial entities that do not create money (but create credit), such as investment funds, financial instrument companies, pension funds, hedge funds, securities companies, loan companies, and other financial subsidiaries.

3. Banks in this paper refer to deposit-type financial institutions and non-bank financial institutions refer to non-depository financial institutions.

4. Banks rarely have their own shadow banking businesses, but they usually have third-party financial institutions as their channels.

Traditional shadow banking pertains to credit creation activities undertaken by non-bank financial institutions. It transfers money independently out of the banking system to provide funding for enterprises. As its credit creation mechanisms are analogous to those in advanced economies (e.g., money market funds and asset securitization), this category of Chinese shadow banking is called traditional shadow banking. The mode of traditional shadow banking is mainly non-bank financial institutions’ (e.g., trust companies, securities companies, finance companies, financial leasing companies, and microcredit companies5) transfer funds that are raised to the real economy borrowers (not a channel for banks) through trust loans6, asset management plans, equipment leasing, mortgages, and credit loans. In this process, non-bank financial institutions act as credit intermediaries. Credit scale increases, but the quantity of money is unchanged, as credit is created by adjusting the distribution of money (i.e., money is transferred from investors to financiers).

5. Microcredit companies are not currently classified as financial institutions, but they have similar credit intermediation functions and also relatively complete statistic systems. Thus, they are included in our shadow banking analysis.

6. Banks also have a smaller scale of traditional shadow banking, such as the entrusted loan business between two companies. The current balance of entrusted loans is quite high. However, entrusted loans are mainly between non-bank financial institutions and enterprises and between cash collection businesses within enterprise groups. Entrusted loans between two enterprises are quite few.

According to the preceding definition, China’s shadow banking system explicitly differs from shadow banking in advanced economies (e.g., Europe and America) in terms of its background, operation mechanism, and risk profile. The main funding source of shadow banking in advanced economies is mutual funds, with underlying assets as sub-prime loans and products mainly including asset securitization and repo. According to an FSB report released in October 2014, the largest subsector of the monitoring universe of non-bank financial intermediation (MUNFI) is other investment funds, including equity funds, fixed-income funds, and other funds (i.e., those that are neither equity or fixed-income funds). It accounted for 38% of MUNFI assets in 2013, followed by broker-dealers (15%), structured finance vehicles (8%), Dutch special financing institutions (7%), finance companies (6%), money market funds (6%), and trust companies (3%). In advanced economies, shadow banking mainly pertains to the traditional shadow banking that performs credit money transferring. Furthermore, the use of funds is determined by the source. Contrarily, China’s shadow banking system mainly pertains to banks’ shadow, with credit money created through the expansion of liabilities with loan-alike assets at its core.

2.2 Credit Creation Mechanism of Banks’ Shadow

Banks’ shadow and traditional shadow banking differ significantly in their credit creation mechanisms and impacts on total financing volume. Traditional shadow banking increases credit, but does not increase money due to its money transferring mechanism. Banks’ shadow creates both credit and money. Thus, its newly created credit and money expansion are consistent. Sun (1996, 2001, 2004) introduces the above-mentioned credit money creation model, with four types of market participants: monetary authorities, banks, non-bank financial institutions, and non-financial departments (enterprise and resident). Only banks have the money creation function. Banks increase customer deposits and create credit money while expanding assets through loans, foreign exchange purchases, and corporate bond purchases. This process is constrained by restrictions on cash, clearing, and required reserve by the monetary authorities and is also subject to restrictions on capital7 and credit policy. Banks’ asset expansion capacity and operating profit are limited by regulations, such as through the high-risk weight of loans, capital consumption, and restrictions on providing liquidity to certain fields (e.g., excess capacity industry, local government financing platforms, and real estate). Therefore, to reduce capital consumption8 and avoid credit restrictions, banks have an incentive to seek alternative asset allocation channels to move certain assets from loan items to less capital-consuming and less regulated assets (e.g., interbank lending, interbank payment, and trust entitlement) and other off-balance sheet assets. Meanwhile, banks create equal amounts of deposits on the liability side to meet the financing needs of non-financial enterprises. These assets and off-balance sheet lending are essentially loans, with the same mechanism of credit money creation as loans. Alternatively, when banks increase their holdings of certain asset types, an equal amount of deposits is added on the liability side, with such deposits constituting newly created credit money.9 This credit money creation is the same as that generated from loans and also meets the financial needs of enterprises and individuals. However, a non-standardized accounting record is applied to these types of assets, which are listed under non-loan accounting items or moved off-balance sheet to avoid strict regulation or requirements on loan provisions. This process appropriately reflects the concept of shadow banking.

7. Capital constraint refers to the general constraint of bank capital on asset expansion, such as capital adequacy regulation, provision requirement, and the dynamic adjustment mechanism of the differential reserve.

8. According to regulations, the risk weight of commercial bank claims on other commercial banks is 25%. The risk weight is 20% for claims that have an original period of no longer than 3 months, which is a much lower weight than the general loan risk weight of 100%.

9. Deposits created by banks’ shadow are sometimes embodied as the interbank deposits of non-bank financial institutions and then transferred to enterprise deposits through entrusted loans. The interbank deposits of non-bank financial institutions are counted in M2. Thus, they are also part of credit money.

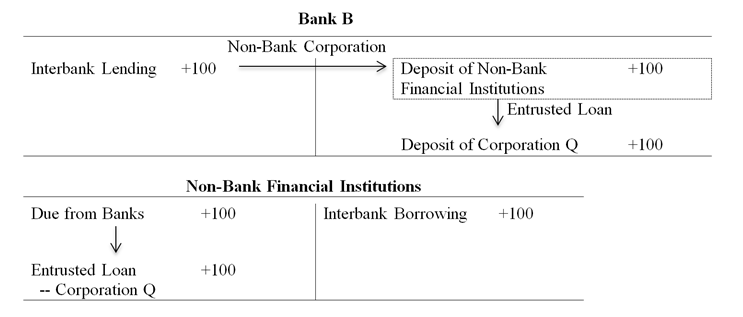

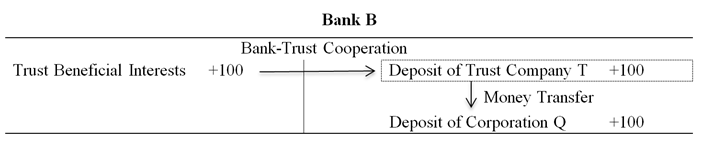

Analyzing the composition of bank assets facilitates our understanding of the operation mode and business types of banks’ shadow. Banks’ shadow can be decomposed into the “interbank channel” and “investment channels” according to different asset types. Considering different counterparties, the interbank channel consists of “interbank channels” (the counterparties are commercial banks, such as interbank payment and reverse repo) and “non-bank channels” (the counterparties are non-bank financial institutions, such as lending to non-bank financial institutions). Investment channels refer to activities converting loan assets into investment assets, such as bank-trust cooperation, bank-security corporations, broker-dealer channels, fund subsidiary channels, notes, and beneficiary right of trust. A detailed analysis of the above three modes of the shadow banking credit money creation mechanism is provided below.

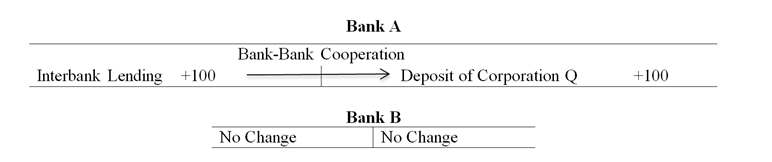

With the interbank channel, banks provide loan-alike financing to corporations and create the same amount of money, but circumvent capital adequacy requirements and credit allocation restrictions by cooperating between two banks and recording the assets as interbank assets. The top three commonly used operating modes include the reverse repo of bankers’ acceptance notes, interbank payment, and the reverse repo of beneficiary trust.10 Consider interbank payment. Bank A acts as an agent of bank B in providing financing to corporation Q, where bank B commits to paying back the principal and interest to bank A at a later date. The related accounting practices are shown in Table 1. Bank A records the interbank funding as interbank lending and matches it with an equal amount of deposits from corporation Q on the liability side. This practice simultaneously increases the money supply and credit provision by the same amount. Alternatively, banks provide credit to corporations by creating money. Meanwhile, the balance sheet of Bank B does not change, as bank A’s commitment to repay the principal and interest is recorded off-balance sheet. In this case, bank A is a “channel institution” for concealing assets. Bank B is the source of the funds and the lending risk taker, and makes the principal and interest payment on a specified date. Similar accounting practices apply to both the reverse repo of bank acceptance notes and the reverse repo of trust beneficial interests. As demonstrated, the interbank channel is not fundamentally different from traditional loans.

10. In the first half of 2011, considering that some rural credit cooperatives were exercising non-standard accounting practices to hide a lot of discount loans as “reverse repo financial assets,” the China Banking Regulatory Commission (CBRC) introduced related accounting requirements.

11. In October 2011, the People’s Bank of China included deposits of non-depository financial institutions in commercial banks into the money supply, which is also credit money. Thus, this type of banks’ shadow creates credit money, just like other banks’ shadow businesses and traditional businesses, such as loans.

12. Financial assets available for sale usually include bonds, notes, trusts, and other beneficial rights. Commercial banks tend to hide loans as “notes” and “trusts and other beneficial rights.”

13. Receivable investment is a type of bank investment business, referring to non-derivative financial assets that are not quoted in the active market but that have fixed or determined payoffs. Commercial banks tend to hide loans under corresponding secondary subjects.

Table 3 Credit Creation Mechanism of Bank-Trust Cooperation (Unit: RMB Yuan)

14. Since 2013, the People’s Bank of China has stipulated that all financial institutions must incorporate on-balance sheet WMPs in structured deposit statistics.

Table 4 Credit Creation Mechanism of Banks’ WMP (Unit: RMB Yuan)

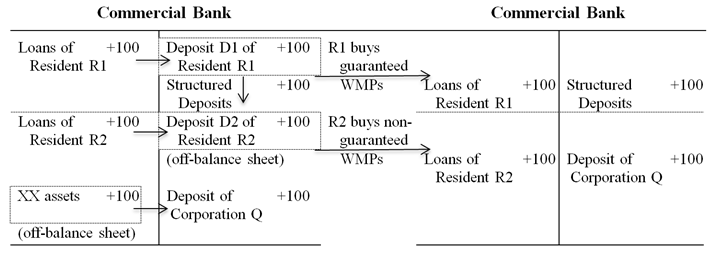

As illustrated above, the purchase of WMPs only leads to changes in deposit accounts or moves deposits off-balance sheet, rather than transferring to the deposit accounts of corporation Q. In this sense, WMPs are not fundraising channels for buying assets or supporting the projects of corporation Q. In fact, the funding for corporation Q is raised from credit money creation through non-standard lending practices that add trust beneficial interests on the asset side, but not from deposits D1 and D2. While moving deposit D2 off-balance sheet for balancing purposes, an equal amount of XX assets (mainly bonds and non-standard assets) are also moved off-balance sheet. These assets are the origins of creating the deposits of corporation Q and meeting its financing needs. In other words, the banks create the deposits of corporation Q by expanding XX assets (one mode of shadow banking) to meet the funding needs of the real economy. Meanwhile, if resident R2 invests in non-guaranteed WMPs, then banks artificially match XX assets with an equal amount of saving deposits that are used to purchase non-guaranteed WMPs. This is why there is no natural linkage between XX assets and WMP funds (referring to the intuitive interpretation of the raised WMP funds being used to purchase assets). WMPs essentially constitute a manner of attracting deposits with the backdrop of unfinished interest rate liberalization. They neither create money or credit, nor provide funding for corporations. Instead, XX assets create credit and meet the funding needs of corporations. This is exactly why double counting exists in some studies on measuring the scale of shadow banking, which considers both XX assets and WMPs. Non-guaranteed WMPs enable banks to release capital (by moving XX assets off-balance sheet) and reserves (by transferring deposit D2 into WMPs and then moving it off-balance sheet) and to provide more space for banks’ asset expansion (which requires more capital) and credit money creation (which requires more reserves). This logic is consistent with an IMF study on Chinese banks’ WMPs showing a negative relationship between the issuance of WMPs and the bank leverage ratio (asset to Tier 1 core capital ratio). Yet, WMPs neither create credit (or money), nor serve as credit intermediaries. Thus, they are not included in the scope of how shadow banking is defined in this paper.

The preceding analysis shows that although shadow banking involves different modes and various participating institutions, it is essentially banks’ credit business, the key to which judgment lies in whether the ultimate credit money obtainer is the same as the actual debtor of banks’ increased credit debt assets. Given the original motivation of banks’ shadow and its operating mechanism, the debtor is the ultimate credit money obtainer (the corporation) and the ultimate creditor is still the bank, as the so-called non-bank financial institutions’ channel between banks and enterprises does not take credit risk. Alternatively, regardless of the transaction structure and parties involved, the original providers of funding are banks and the ultimate obtainers of funding are mostly financing entities that have difficulty obtaining loans directly from banks. The complicated transaction structure is designed to establish an indirect link between banks and entities that are unable to obtain financing from banks. Therefore, in essence, banks’ shadow is actually banks’ credit business.

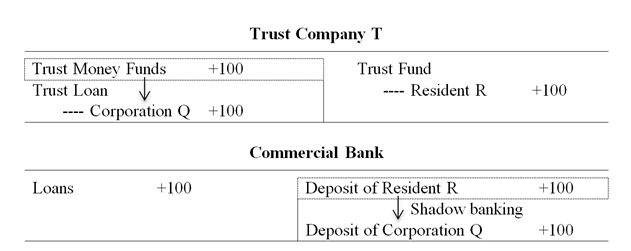

2.3 Credit Creation Mechanism of Traditional Shadow Banking

Traditional shadow banking refers to the activities of non-bank financial institutions, such as trust companies, securities companies, fund companies, finance companies, leasing companies, and microfinance companies, that create credit through money transferring to meet social financing needs. As shown in Table 5, without acting as a channel of banks’ shadow, trust company T raises idle funds from resident R by issuing financial products. It transfers funds to corporation Q in the form of loans. For accounting purposes, the trust company adds the trust funds of R to the liability side and the raised money funds to the asset side. However, granting trust loans with such funds leads to a reduction in currency funds on the asset side and increments in the trust loan assets.

This process of credit money creation (intermediary) is illustrated on banks’ balance sheets as both a reduction in the deposit of resident R and an increase in the deposit of corporation Q. Therefore, the credit creation of non-financial institutions (e.g., trust companies and securities companies) is done via money transfer, which neither creates deposits to increase money nor makes deposits flow out of the banking system. The credit creation (intermediary) behavior of non-bank financial institutions does not affect the total amount of money created by banks.

The premise of a comparative analysis between banks’ shadow and traditional shadow banking is to clarify the relationship between credit and money. The economic meaning of credit is a creditor-debtor relationship in which the lender is the creditor and the borrower is the debtor. The credit relationship is the unity of credit and debt. A basic characteristic of (credit) money is a debt certificate, based on the economic meaning of credit as a general equivalent. The relationship between the two is as follows: the scope of credit includes but is not limited to money; money is a special form of credit, which is generally acceptable to the government and the non-bank private sector. Depending on whether money is created, credit money creation can be divided into money creation and money transfer types. Specifically, social credit creation activities consist of three parts: credit money creation by banks, money transfer by non-bank financial institutions, and money transfer between non-financial sectors that is not processed through non-bank financial institutions. They correspond to three types of social financing: bank financing, non-bank financial institution financing, and private financing. According to the theory of credit money creation, banks create deposit money while issuing loans. The essence is an exchange of credit and debt between banks and customers, which belongs to the money creation type of credit. Non-bank financial institutions and private finance cannot create money, but can only create credit through money transfers, indicated by transferring cash or bank deposits from resident R to corporation Q. In this process, no money is created, but the total amount of credit in the society is increased, which implies that it is a money transfer type of credit.

3. Measuring the Scale of Chinese Shadow Banking

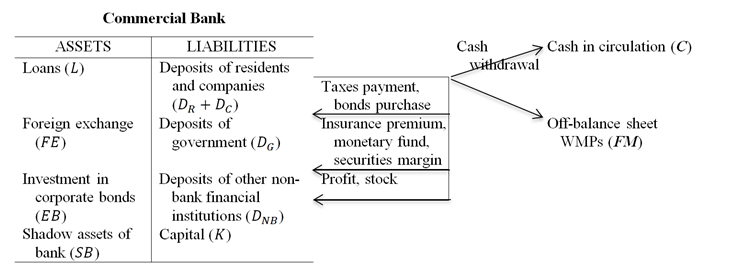

Measuring the scale of Chinese shadow banking includes both the measurement of banks’ shadow and of traditional shadow banking. For banks’ shadow, a direct measurement from the bank assets side is extremely difficult due to its diversified business modes, the complicated accounting subjects involved, and the complicated participation mechanism. Given the basic accounting principle that total debits must equal total credits for each transaction, the asset expansion of banks’ shadow must equal the deposit size created in the subsequent phases. Therefore, banks’ shadow may be measured from banks’ liability side, by deducing all “non-shadow assets” (including traditional assets, such as loans, foreign exchanges, and corporate bonds) from the possible liabilities.

NSB + SB = L+ FE + EB + SB + D (1)

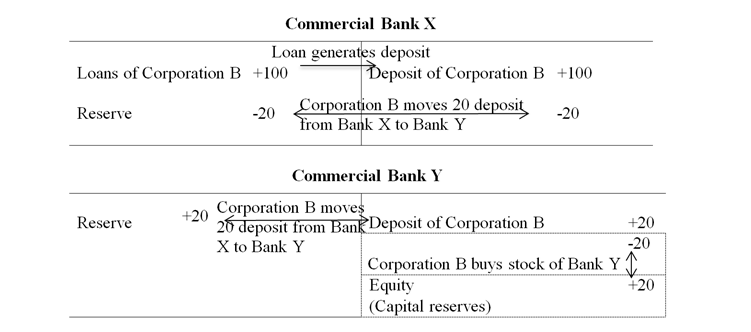

Deposit D mainly includes the deposits of residents (DR) and non-financial companies (DC), cash in circulation (C), fiscal deposits (DG), the deposits of other non-bank financial institutions (DNB), and bank capital (K). First, cash in circulation (C) is the total circulation of the central bank created cash deducted by the cash held by banks. People hold cash for transaction purposes, which transfers part of the deposit money into cash money. As it is initially generated by the expansion of bank assets, this part of the deposits held by non-bank departments should be added to the right-hand side of equation (1). Second, DG denotes the fiscal deposits that come from the deposits of residents and enterprises through tax payments and bonds purchases. DG includes the fiscal deposits of banks (DGB) and the central bank (DGC1). However, it must be deducted by fiscal deposit increments that correspond to the treasury bond holdings of banks (TBB) and the central bank (TBC). Banks’ government bond purchase does not belong to shadow banking and the fiscal deposit it creates should not be reflected in D. Another component that should not be reflected in D is the treasury bond holding of the central bank, as the central bank can only buy treasury bonds from a secondary market with main counterparties as banks and this part of treasury bonds is purchased and held by banks but does not belong to shadow banking. Third, some resident deposits are transferred to be deposits of other non-bank financial institutions (DNB) and must be added back to D. For example, residents’ investments in money market mutual funds, insurance fee payments, and securities margin raises deposited in the bank by fund companies, insurance companies, and securities companies. Note that interbank deposits (DB) are not part of this, as they do not lead to increments in corporate deposits, whereas traditional loans, foreign exchange business, and the interbank channels discussed above all increase corporate deposits. Fourth, capital account K of the bank balance sheet comes from deposits, whereas K includes share capital, capital reserves, surplus reserves, and undistributed profits. As shown in Table 7, when bank Y issues stocks, the deposits of stock buyer B reduce and the share capital or capital reserves under the capital account increase by the same amount. Surplus reserves and undistributed profits mainly come from interest income, whereas undistributed profits are also converted from deposits by corporation B. For example, the deposits of enterprise B on the liability side reduce by 120 yuan, of which 100 yuan is used to repay the principal. This leads to an equal amount of reduction in loans of enterprise B. The remaining 20 yuan is used to pay interest, leading to a 20-yuan increase in bank profits. Table 7 illustrates the accounting practice of this example.

D = DR + DC + C + DG + DNB + K (2)

Importantly, although banks’ off-balance sheet WMPs (FM) are not part of our defined shadow banking (with the credit creation function), they must be added back to banks’ balance sheets for debtors’ liabilities to measure the scale of shadow banking. As demonstrated in Table 4 on the asset side of banks’ balance sheet, whereas the deposit D2 for buying off-balance sheet WMPs is moved off-balance sheet, the loans of resident R2 that created the deposit still stay on-balance sheet, preventing it from being matched within on-balance sheet liability D. In this case, the scale of shadow banking is underestimated if we adopt the deduction method by subtracting non-shadow assets from liability D due to over-deduction of R2. Therefore, the off-balance sheet WMPs should return to the balance sheet to reflect the corresponding traditional banking business (e.g., granting loans to R2 and subsequently creating deposit D2) both on banks’ asset side D and liability side non-shadow assets. In this way, the measurement of shadow banking is accurate. Substituting equation (2) into equation (1) and accounting for off-balance sheet WMPs,15 the scale of banks’ shadow16 is expressed as follows:

SB = (DR + DC + C + DNB) + DG + K + FM - (L + FE + EB)

= M2 + (DGB + DGC - TBB - TBC) + K + FM - (L + FE + EB) (3)

For measurement purposes, money supply17 is M2 ≈ DR + DC + C + DNB and the net deposit of the government is DG = (DGB + DGC - TBB - TBC) , where DGB and DGC are the fiscal deposit balance of banks and the central bank, respectively, and TBB and TBC are the treasury bond holding of banks and the central bank, respectively. To convert foreign exchange (FE) back to local currency, the exchange rate of FE purchase (et-p) is adopted, rather than the spot exchange rate (et). As the left-hand side of equation (1) is actually the bank deposit, the equation holds only when the FE on the right-hand side is in increments of RMB deposits that correspond to foreign exchange.

15. Currently, there are no public data about banks’ WMP classifications. According to the 2013 Annual Report on China’s Banking Wealth Management Market, off-balance sheet WMPs (with floating interest payments, but principals not guaranteed) accounted for 63.80% of the entire wealth management market until December 31, 2013. Provided this statistic, we roughly estimate off-balance sheet WMPs as 60% of the total scale of WMPs.

16. The data sources include the People’s Bank of China, the CBRC, China Central Depository & Clearing Co., Ltd., and the China Wealth Website.

17. Since October 2011, the People’s Bank of China has incorporated the deposits of non-depository financial institutions at depository financial institutions into money supply statistics. For consistency, we make the corresponding adjustments to the money supply data after October 2011. Data on the deposits of non-depository financial institutions at depository financial institutions are retrieved from the Balance Sheet of Other Depository Corporations published by the People’s Bank of China.

During the first stage (January 2006 to October 2008), the scale of banks’ shadow was quite stable, but its proportion in money creation decreased sharply. Before the sub-prime crisis, the gap between banks’ deposit liabilities and traditional assets (mainly loans and foreign exchanges) was positive, with a scale of approximately 5 trillion to 7 trillion yuan. However, it is irrelevant to banks’ shadow, mainly due to the reform of state-owned banks before 2004, during which period banks bought bonds of asset management companies, massively wrote off non-performing loans, and injected capital with foreign exchange reserves. From 2006 onward, the gap remained stable and the proportion of banks’ shadow in money creation decreased dramatically year by year, indicating that the main credit money creation channels were traditional bank loans and foreign exchange channels.

During the second stage (October 2008 to October 2011), the scale of banks’ shadow and its proportion in money creation were both stable. The 4 trillion yuan investment plan of the Chinese government stimulated the asset expansion of banks and banks’ balance sheets expanded rapidly, causing the gap between the deposit liabilities and traditional assets to increase from 5.3 trillion yuan at the beginning of this period to 14.71 trillion yuan in June 2011. Nevertheless, as the amount of credit money created by banks was also quite large, the proportion of the gap in total money creation increased moderately, from 10.61% to 13.32%. This implies that during the above stage, the role of banks’ shadow asset channel in banks’ credit expansion did not change fundamentally. Furthermore, the main channels were still traditional loans and foreign exchange channels.

During the third stage (October 2011 to May 2014), both the scale of banks’ shadow and its proportion in money creation increased. In the second quarter of 2010, the monetary authorities began to implement prudent monetary policies, introduced macro-prudential policies characterized by capital constraints to strengthen regulations, and applied specific credit regulations to sectors with excess capacity (e.g., real estate). To circumvent the above regulations and capital restrictions, banks converted loan assets to banks’ shadow through tools, such as investment and interbank businesses, to meet the rigid financing needs of real estate developers and local government financing platforms. As shown in Figure 1, from October 2011, the scale of banks’ shadow continued to increase, hitting a record high of 29.63 trillion yuan in May 2014; the corresponding proportion in money creation also increased to 21.76%.

During the fourth stage (June to December 2014), the scale of banks’ shadow and its proportion in money creation began to decrease. Influenced by the regulation titled, “Notice about regulating interbank business of financial institutions,” which was jointly issued by the People’s Bank of China, CBRC, CSRC, CIRC, and Foreign Exchange Bureau, both the scale and proportion show a gradually decreasing trend after June 2014. Until the end of December 2014, the size of banks’ shadow decreased to 28.35 trillion yuan and the corresponding proportion decreased to 20.43%. This may be attributable mainly to stricter regulations, but also to other factors, such as the slowing down of economic growth and the increase in credit risk. Nevertheless, the scale of banks’ shadow is still quite high and may surge again once external environmental changes or banks continue to carry out financial innovation aimed at circumventing regulations.

Compared with banks’ shadow, China’s traditional shadow banking is relatively small. Before 2010, traditional shadow banking18 developed very slowly, with a scale of less than 2 trillion yuan, taking less than 2% of the total credit money created by banks, with non-bank financial institutions contributing less in meeting social financing needs. Since 2010, traditional shadow banking has gained its momentum in the growth of scale. Its proportion in banks’ credit creation has also increased. Until September 2014, the scale of the traditional shadow banking reached 15.07 trillion yuan and took 11.07% of bank-created credit, whereas non-bank financial institutions enhanced the efficiency of utilizing existing money stock and played an important role in credit creation and meeting social financing demands. Note that according to the analysis above, we find that the banking sector still dominates credit creation, leading to the tremendous scale of banks’ shadow and the high proportion of credit money creation and significantly affecting macroeconomic regulation and financial risk management. Thus, related regulations must be investigated from the macro perspective.

18. To measure the scale of traditional shadow banking, we consider four components: the balance of microfinance company loans, financial companies’ claims to non-financial companies and residents, the balance of finance lease contracts, and the balance of trust assets (excluding bank-trust cooperation). The data sources include the People’s Bank of China, China Leasing Union, and China Trustee Association.

4. Shadow Banking Regulations

As analyzed in the previous sections, China’s shadow banking system includes both banks’ shadow and traditional shadow banking. As banks’ shadow is essentially a process of credit money creation and leads to changes in money volume, it influences price level, economic growth, and risk management. First, on the micro level, it influences bank risk. According to the credit creation mechanism of banks’ shadow, banks’ WMPs are irrelevant to the credit money created to meet the financing needs of enterprises. Although banks use WMP contracts to match WMP investors and enterprises, they cannot rid of their essential identity as creditors. The risk of banks’ off-balance sheet business remains on-balance sheet. Although risk is realized, banks usually have to absolve losses. The second type of risk is a macro risk. Banks’ shadow is essentially loans, but in the form of other assets. It makes it difficult for monetary regulations targeting loans to take effect and leads to the accumulation of systemic risk, the regulation of which includes credit policy, capital adequacy requirements, and a macro-prudential regulation system based on the capital adequacy ratio. Third, it influences monetary policy regulation. Facing the structural shortage of liquidity,19 monetary authorities mainly rely on liquidity in the banking system (base currency) to control the total social financing scale. However, banks’ shadow lengthens the social financing chain, accompanied by its opaque and non-standard accounting practice, leads to severe information asymmetry, increases the instability of banks’ liquidity demand, and makes it hard for monetary authorities to regulate the monetary environment through liquidity control. This is one of the reasons for the large fluctuations in China’s money market interest rate in June 2013.19. Refer to Sun (2001, 2012).

Banks’ shadow is essentially the credit money creation behavior of banks. However, unlike currency, credit money has no real value, and its quantity is not restricted by natural conditions, but is created by banks’ asset expansion activities. Thus, it must be restrained by external governance and laws. The Fourth Plenary Session of the 18th Central Committee of the Chinese Communist Party proposed comprehensive laws for governance. To fundamentally prevent the risk of banks’ shadow, the government must start by regulating the behavior of bank credit money creation via governance laws.

A basic characteristic of bank management is that banks can create credit money through asset expansion. According to different asset types that banks buy to create credit money, there are three methods for banks to create credit money. The first method is buying creditors’ rights to principals holding credit money, namely loans. The second method is buying creditors’ third-party rights, such as foreign exchanges and government bonds. The third party is foreign banks in the case of foreign exchanges and the Ministry of Finance in the case of government bonds. The third method is buying goods (e.g., office buildings) for themselves. This can be done in two ways. With method 1, customers can eliminate their holdings of bank liabilities (deposits) via loan repayment, thus the creation and elimination of credit money are symmetric. With method 2, customers are unable to eliminate their holdings of bank liabilities (deposits) via loan repayment and are limited by banks if they want to sell their third-party claims to the banks. Therefore, it is more difficult for customers to eliminate credit money with method 2 than method 1. Such difficulty may lead to the excessive creation of credit money. Method 3 is clearly unfair for the non-bank sectors. In this sense, method 1 is superior to method 2 and method 2 is superior to method 3. An implication is that different types of bank assets make big differences in credit money creation, and not all bank asset expansion activities should be allowed to create credit money. Money creation behavior must be strictly regulated under the framework of governance laws, by restricting the scope of assets that banks purchase to create credit money, allowing banks to buy customer claims, limiting banks’ purchase of third-party claims, and banning goods purchasing for themselves, to delimit the boundary of banks’ ability to create money and prevent excessive bank credit money creation.

Banks’ money creation is realized in the form of asset-generating liabilities and by means of accounting for double-entry accounting methods. It must start with accounting legislation, to regulate the banks’ credit creation from the legal perspective. If the legislation is too general in limiting banks’ credit creation, it may be ineffective, as banks may use alternative non-standard manners to create credit money (For example, although the CBRC regulates interbank business, banks hide loans under investment subjects.). Accounting usually refers to corporate accounting, with a main purpose to provide information for internal operation and management. The related laws and regulations focus on setting accounting standards from the perspective of profit accounting. Bank accounting not only solves the problems faced by the bank as a corporation, but also solves the more important credit money creation problem. Bank loans create deposit money in banks’ accounting entries:

Debit: loans

Credit: deposits

Credit money is created when banks’ accounting bookkeeping increases the number of corporate deposits. Therefore, accounting is a record of business conduct for corporations. However, for banks, accounting is not only a record of operating activities, such as credit creation, but also the creation of credit money itself to a certain extent. It is important to fully recognize that bank accounting determines the boundaries of credit creation. There is currently no law on bank accounting in China, although there are laws concerning the central bank, banking supervision and management, commercial banks, and accounting (separately). It is necessary to enact bank accounting laws to legitimize the bank as a special accounting entity.

The banks’ shadow method of creating credit money seems to be method 2. That is, banks buy creditors’ third-party rights. However, it is essentially method 1. That is, banks buy claims on subjects that hold credit money. Considering that banks may utilize accounting tactics to hide loans under other entities, the information it reflects is inaccurate and regulators face big challenges in using confusing accounting data for supervision. Therefore, it is critical to legislatively prohibit banks from recording banks’ shadow business (e.g., claim on creditors) as interbank businesses and to require banks to keep actual banks’ creditor rights and debts on-balance sheet. In such a way, under the existing credit regulation framework, regulators can utilize monetary tools, such as the reserve requirement ratio, credit policies, and the capital adequacy ratio, to supervise bank credit money creation.

The fifth Plenary Session of the 18th Central Committee of the Chinese Communist Party states that China must persevere in innovation and development, innovation must be the core of national development, and constant innovation must be applied to various fields (e.g., theory, institutions, technology, and culture). To strengthen the supervision of shadow banking, institutional innovation is needed to design macro-prudential regulation tools for banks’ shadow and traditional shadow banking. After regulating the root of banks’ shadow on the legal level, monetary authorities should implement different regulations on commercial banks and non-bank financial institutions. That is, they should implement “asset reserve” requirements on banks and “risk reserve” requirements on non-bank financial institutions. Different from the “deposit reserve” requirement, the asset reserve requirement is based on the risk characteristics of different bank assets. Banks are then required to deposit in the central bank on a certain scale. On the premise of standardized bank accounting, assets with different risk characteristics are listed under different asset entities. Asset reserves can control not only asset risk, but also and more importantly money creation from the source (assets rather than liabilities), which can improve the efficiency of policy transmission. Different from banks, the operating mechanism of non-bank financial institutions is not loans generating deposits, but absorbing deposits and granting loans, similar to the banking business mode in the real money system. Therefore, referring to reserve requirement, the risk reserve requirement would request non-bank financial institutions to retain part of the deposits that they absorb to cope with liquidity risk. The remaining deposits could be used to grant loans or for investment activities, such as buying bonds. Although the credit creation of non-bank financial institutions does not change the balance sheets of banking and monetary authorities, it affects the social balance sheet. Furthermore, the process of credit creation can lead to changes in the assets and liabilities of non-bank financial institutions, residents, and enterprises. The risk reserve requirement can bind the credit creation of traditional shadow banking to the balance sheet of monetary authorities and effectively restrain the credit creation of non-bank financial institutions. Equipped with the preceding two kinds of institutional arrangements, a generalized macro-prudential regulation framework can be erected. Combining this framework with other policies, such as micro-prudential regulations, would form a comprehensive law and regulation system for shadow banking supervision.

References

(1962). Collected Works of K. Marx and F. Engels (Volume 12). People’s Publishing House, pp. 571-581.

Acharya, V. V., Khandwala, H., & Öncü, T. S. (2013). The growth of a shadow banking system in emerging markets: evidence from India. Journal of International Money & Finance, 39(2), 207-230.

Adrian, T., & Shin, H. S. (2009). The shadow banking system: implications for financial regulation. FRB of New York Staff Report, No. 382.

Ba, S. S. (2013). Evaluate shadow banking objectively from the perspective of financial structure evolution (in Chinese). Economic Review, 2013(4).

Bakksimon, K., Borgioli, S., Giron, C., Hempell, H. S., Maddaloni, A., & Recine, F. et al. (2012). Shadow banking in the euro area: an overview. European Central Bank Occasional Paper Series, No. 133.

Bengtsson, E. (2013). Shadow banking and financial stability: European money market funds in the global financial crisis. Journal of International Money & Finance, 32(1), 579-594.

Claessens, S., & Ratnovski, L. (2015). What is shadow banking? IMF Working Papers, 12.

Communiqué of The Fifth Plenary Session of the 18th Communist Party of China (CPC) Central Committee (in Chinese). Renmin Ribao. 2015-10-30, front page. Available at http://www.china.org.cn/chinese/catl/2015-11/30/content_37196189.htm.

Estrella, A. (2002). Securitization and the efficacy of monetary policy. Federal Reserve Bank of New York Economic Policy Review, 8(1), 243-255.

Financial Crisis Inquiry Commission (FCIC) (2010). Shadow banking and the financial crisis. Preliminary Staff Report.

Financial Stability Board (2011). Consultative document: strengthening oversight and regulation of shadow banking, 5-8.

Financial Stability Board (2013). Global shadow banking monitoring report, 12-15.

Financial Stability Board (2014). Global shadow banking monitoring report, 13-14.

Gao, S. W., Mo, Q., & Qu, C. (2013). The rise and impacts of the shadow banking system in China (in Chinese). China Finance Review, 2013(2).

Ghosh, S., Gonzalez del Mazo, I., & Ötker-Robe, I. (2013). Chasing the shadows: how significant is shadow banking in emerging markets? World Bank – Economic Premise, 1-7.

Gorton, G., & Metrick, A. (2012). Securitized banking and the run on repo. Journal of Financial Economics, 104(3), 425-451.

Gravelle, T., Grieder, T., & Lavoie, S. (2013). Monitoring and assessing risks in Canada’s shadow banking sector. Financial System Review, 55(6), 55-65.

Harutyunyan, A., Massara, A., Ugazio, G., Amidzic, G., & Walton, R. (2015). Shedding light on shadow banking. IMF Working Papers, 15(1).

Hsu, S., Li, J., & Qin, Y. (2013). Shadow banking and systemic risk in Europe and China. CITYPERC Working Paper Series, No. 2013/02.

IMF (2014). Risk taking, liquidity, and shadow banking: curbing excess while promoting growth. Global Financial Stability Report, October 2014, pp. 65-73.

Kocjan, J. et al. (2012). The Deloitte Shadow Banking Index: shedding light on banking’s shadows. Deloitte Center for Financial Services, New York.

Li, J., Hsu, S., & Qin, Y. (2014). Shadow banking in china: institutional risks (in Chinese). China Economic Review, 31, 119-129.

Liu, Y. H. (2013). China’s shadow banking (in Chinese). China Finance, 2013(4).

Pozsar, Z. (2014). Shadow banking: the monetary view. OFR Working Paper, July 2, 2014.

Pozsar, Z., Adrian, T., Ashcraft, A. B., & Boesky, H. (2010). Shadow banking. Staff Reports, 105(458), 447-457.

Qiu, X., & Zhou, Q. L. (2014). Shadow banking and monetary policy transmission. Economic Research Journal, 2014(05), 91-105.

Ricks, M. (2010). Shadow banking and financial regulation. Colombia Law and Economics Working Paper, No. 370.

Schwarcz, S. (2012). Shadow banking and financial regulation. SSRN Electronic Journal.

Schwarcz, S. (2013). Shadow banking and regulation in China and other developing countries. GEG Working Paper, No. 83.

Shin, H. S., & Shin, K. (2011). Procyclicality and monetary aggregates. NBER Working Papers, No. 16836.

Sun, G. (1996). A study on the Chinese monetary policy transmission mechanism. Studies of International Finance, 1996(5).

Sun, G. (2001). Money creation and bank operation in the credit money system. Economic Research Journal, 2001(2).

Sun, G. (2004). Structural liquidity shortage and monetary policy operating framework. Available at http://www.doc88.com/p-016703910844.html.

Sun, G. (2012). China’s Financial Reforms ---- Through Eyes of a Front-bencher (in Chinese). China Economic Publishing House, pp. 82-106.

Sunderam, A. (2012). Money creation and the shadow banking system. Review of Financial Studies, 28(4), 939-977.

Wang, D. (2012). Shadow banking system in the United States: development, operation, influence and regulation. Studies of International Finance, 2012(1).

Yan, Q. M., & Li, J. H. (2014). Research on Chinese Shadow Banking Regulation (in Chinese). China Renmin University Press.

Yin, J. F., & Wang, Z. W. (2013). Shadow Banking and Banks’ Shadow (in Chinese). Social Sciences Academic Press (China).

Yu, J. (2013). Research on the impact of shadow banking on monetary policy: an empirical analysis with VAR model. Lanzhou Academic Journal, 2013(4).

Zeng, G. (2013). Shadow banking: a regulatory arbitrage perspective. Financial Market Research, 2013(04), 51-57.

Zhou, X. C. (2011). Macroprudential policy framework: background, logic, theoretical explanation and main contents (in Chinese). Journal of Financial Research, 2011(01), 1-14.

Zhu, M. N., Ye, F., Zhao, X., & Wang Y. G. (2012). Regulatory issues of shadow banking system: an analysis based on optimal capital supervision model. Studies of International Finance, 2012(7).

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email