Can a Housing Boom Lead to Rent Inflation?

The housing boom and bust cycle has called attention to the volatility of housing prices and its impact on other markets. We challenge the conventional wisdom that housing prices are the present value of future rents and show that housing price uncertainty can affect household property investments, which in turn affect rent. Using data from Hong Kong and the Chinese mainland, we find a significant effect of housing price on rent and draw important implications for monetary and macro-prudential policies.

From a standard financial asset perspective, housing prices are the present value of all future rents. This leads to a conventional discounted cash flow analysis that begins with rent as the fundamental of property valuation. However, Shiller (2008) shows that it is difficult for rent or housing construction costs to explain U.S. housing prices in recent years. Moreover, rent is not discretionary as in the case of stock dividends but is determined in the rental market. Thus, an interesting and important question is whether the behavior of housing prices can exert an influence on rent. In particular, can a housing bubble lead to rent inflation?

A firm or household with an opportunity to invest in a real asset holds a “real option” analogous to a financial option—the right but not the obligation to buy or sell an asset at some future time of its choosing. The option value of waiting is highly sensitive to uncertainty about the future value of investments and has a significant impact on firm-level investment decisions (Henry,1974;Dixit and Pindyck,1994) as well as macro-level fluctuations in aggregate investments (Bernanke, 1983). After the recent financial crisis, considerable attention has been given to the impact of uncertainty shocks. For example, Bloom (2009) shows that higher uncertainty increases the real option value of waiting so firms scale back their investments and hiring. In parallel with this argument, we show that uncertainty has real options effects on the property investments of households as well as cyclical fluctuations in the rental market (Wang, Yu, and Zhou, 2018).

Our View: A Real Options Story

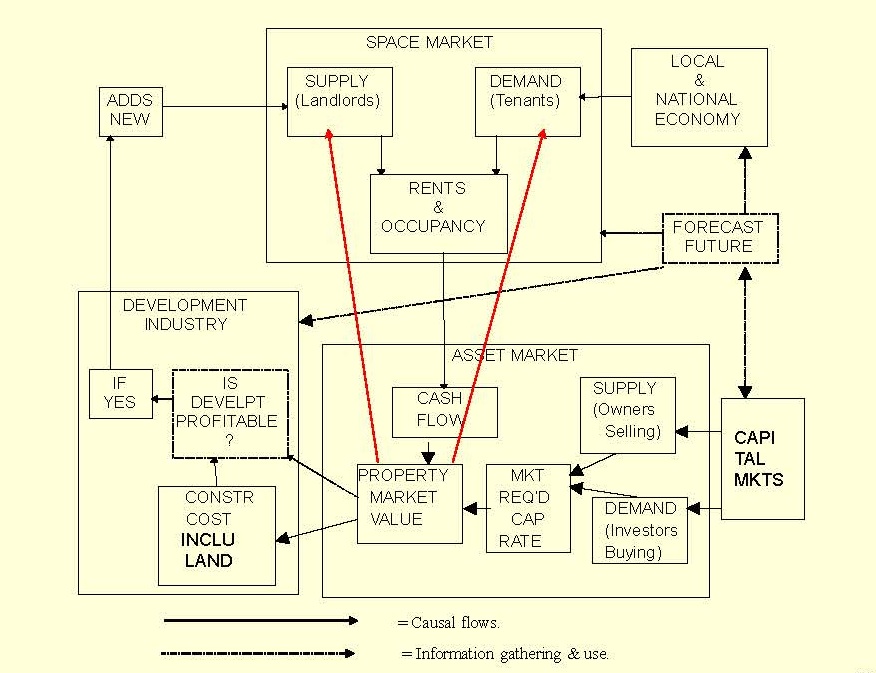

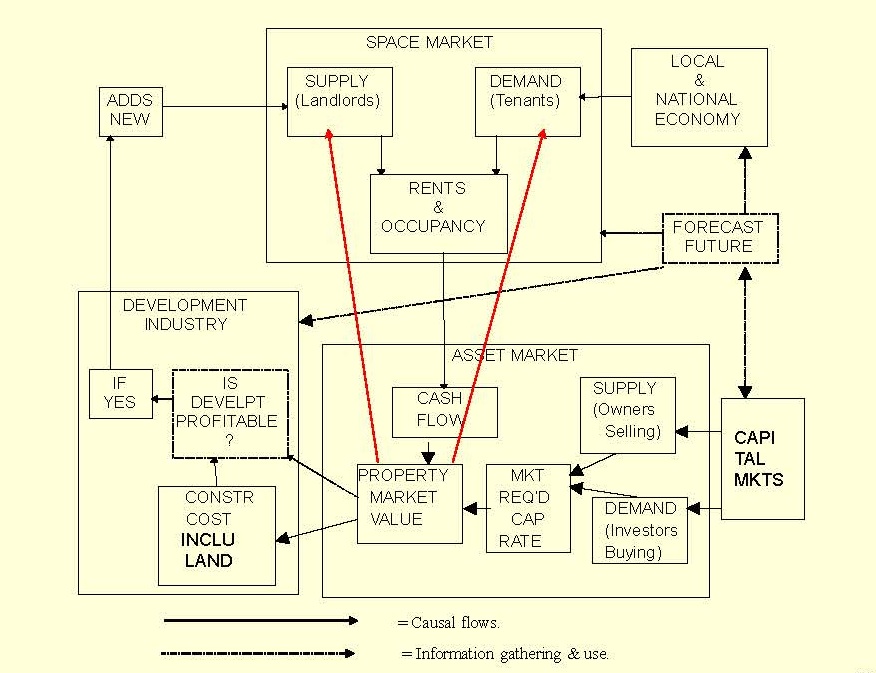

By extending the theory of investment under uncertainty, we model a renter’s decision to buy a house and a landlord’s decision to sell as the exercising of real options of waiting and examine real options effects on rent. The innovation of the idea is shown by two red arrows in Figure 1 of the textbook real estate system.

Owning a house is risky because the house’s price is volatile and its fluctuation can have a sizable effect on the owner’s wealth. Renting thus provides a hedge against housing price uncertainty by offering a put option on the house value. The decision on the timing of a purchase becomes an optimal stopping problem for renters. A rational renter will delay the decision to buy if the housing price is higher than a threshold related to their private valuation of the house, but there is hope in waiting for the price to drop.

Likewise, landlords own a call option on the housing value, which allows them to choose the optimal timing of sale. A rational landlord will delay the decision to sell if the housing price is lower than a threshold related to their private valuation, but there is hope in waiting for the price to recover. Further assuming that the private valuations of renters and landlords are drawn from known distributions, we can derive the rental demand and supply as well as the relation between the equilibrium rental rate and the housing price and housing price volatility.

Real Options Effect on Rent

The price effect is straightforward. An increase in rental demand is associated with a decrease in rental supply in a rising housing market because more renters are reluctant to buy and more landlords are willing to sell. In contrast, in a downward housing market, rental demand will decrease because more renters are willing to buy while rental supply will increase because more landlords are reluctant to sell. This induces a positive relation between the equilibrium rental rate and the housing price.

Meanwhile, both renters and landlords are more eager to hold on to their real options given an increase in housing price volatility. This produces greater rental demand and supply. The effect on the equilibrium rental rate depends crucially on the relative size of the demand and supply increases. When the private valuations of the renters and landlords are similarly dispersed, we show that the expansion of rental demand plays a dominant role, yielding a normally positive relation between housing price volatility and rent. However, as the housing price falls, more renters depart the rental market to become homeowners, eventually leaving those who are insensitive to price and volatility shocks. As this point, an increase in housing price volatility mostly expands the rental supply while the rental demand remains largely fixed, yielding a negative relation between housing price volatility and rent.

What is New?

Our model contributes to the literature on investments under uncertainty. A firm or household with an opportunity to invest in a real asset is holding a “real option” analogous to a financial option—the right but not the obligation to buy or sell an asset at some future time of its choosing. We obtain a closed-form solution for the equilibrium rent that contains the option premium of waiting driven by housing price uncertainty and offer a new and richer explanation based on the “hold out” phenomenon. Both renters and landlords hold out in a volatile housing market, and their aggregate effect on the equilibrium rental rate depends on the distributions of their private valuations.

Our model also adds to the recent literature that has abandoned the traditional “rent drives price” view. One line of literature suggests that the housing price deviates from fundamentals largely due to strong (speculative) demand shocks in conjunction with supply constraints. Another line of recent research allows both rent and the housing price to be simultaneously determined. We treat the housing price as exogenous. This is realistic in some circumstances because the property market is integrated into the capital market and is more easily exposed to external shocks such as a large capital flow, which induces significant change in demand for housing, whereas the rental market is highly segmented and local.

Evidence from Hong Kong and the Chinese Mainland

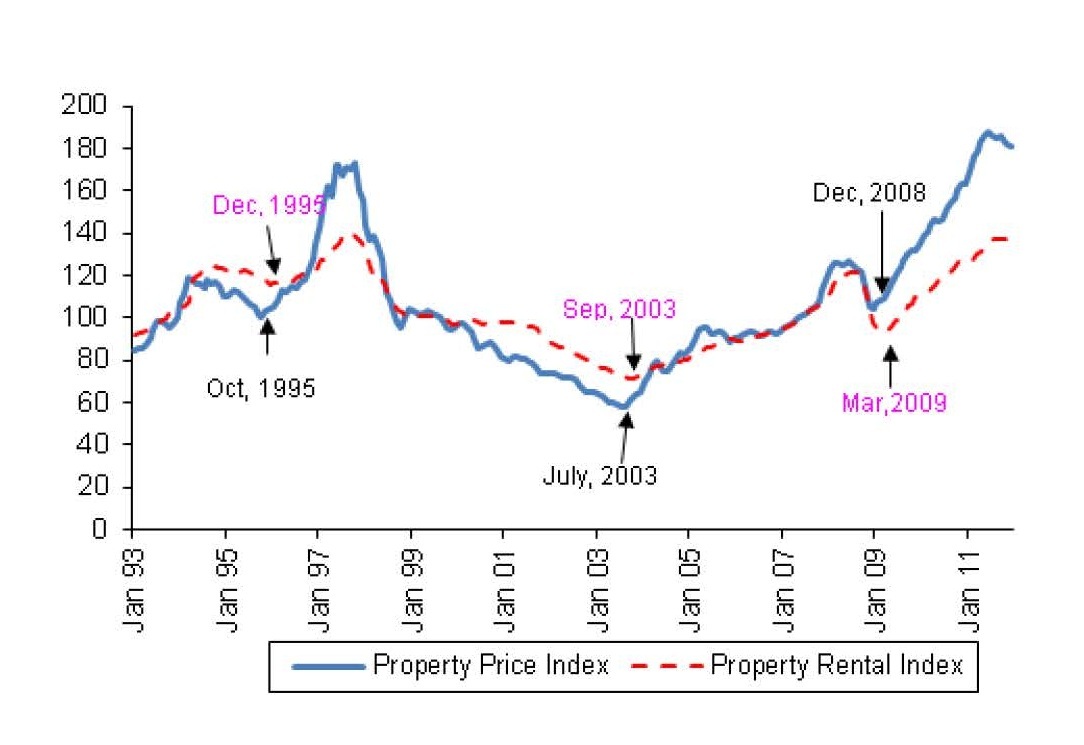

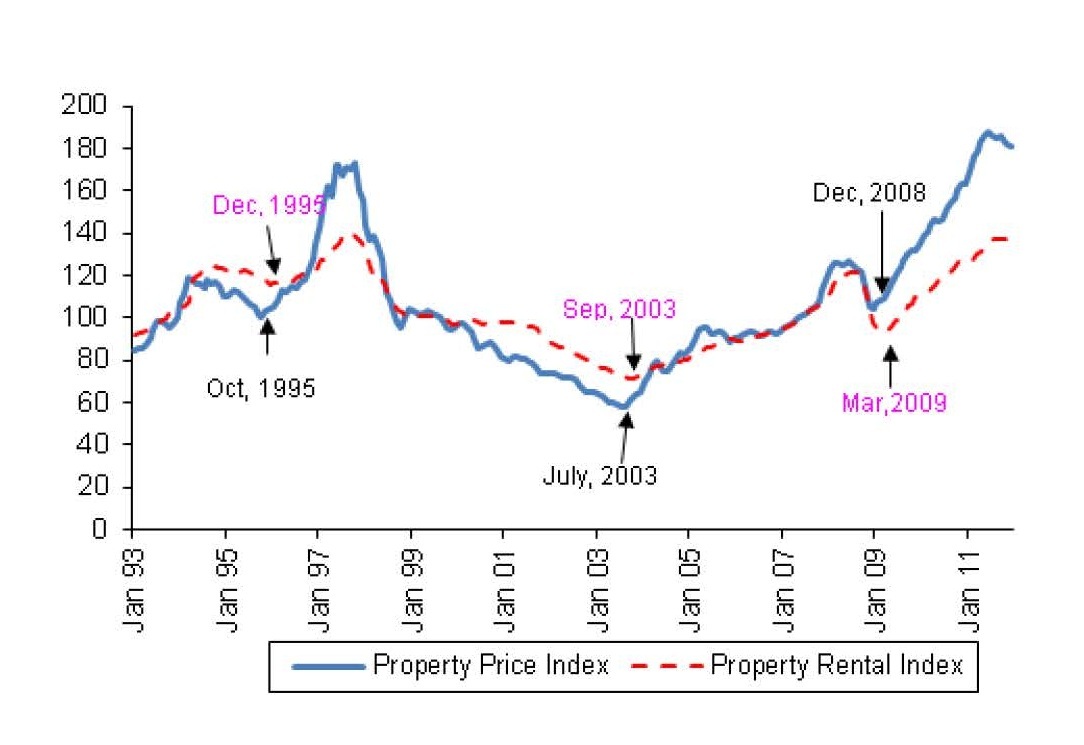

Empirically, we find strong real option effects of the housing price on rent for Hong Kong and large cities in the Chinese mainland. Hong Kong is an ideal laboratory to test our model predictions because it is a small open economy and its housing market is subject to external shocks. We collected the Hong Kong residential rental and property markets data published by the Hong Kong Rating and Valuation Department (R&VD). Figure 2 shows that rent tends to follow the housing price in Hong Kong.

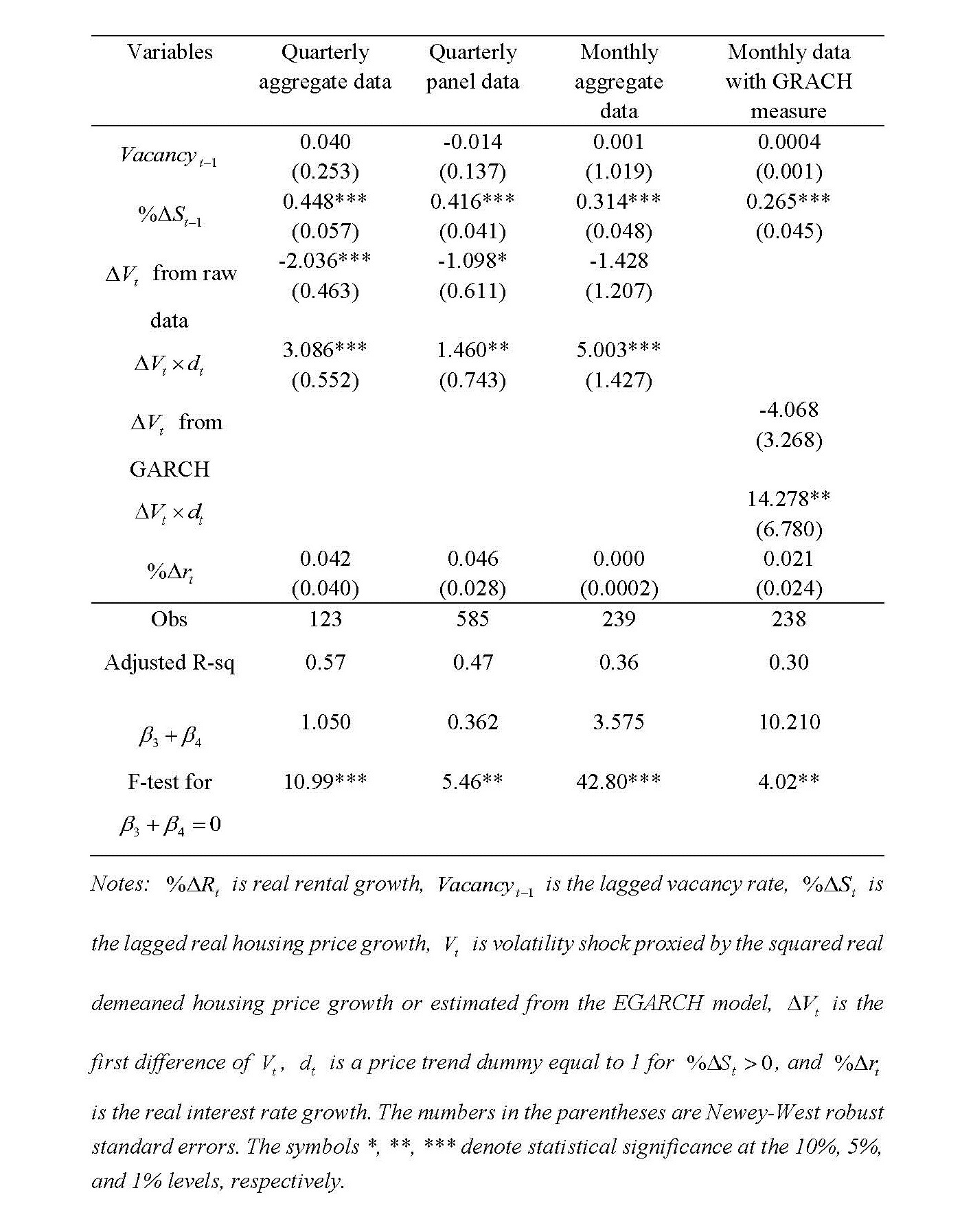

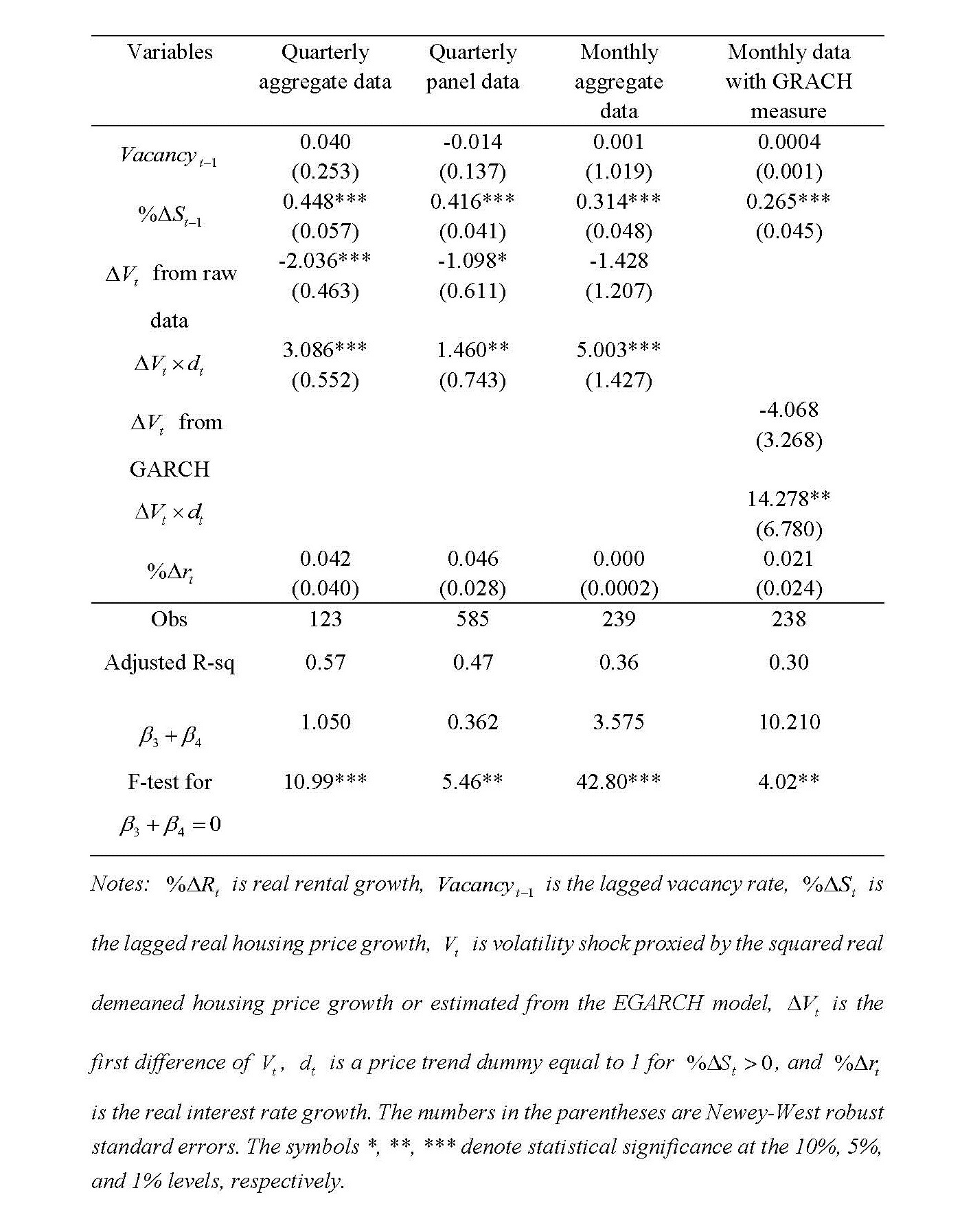

Table 1 presents the estimation results of rent determinants using Hong Kong quarterly data from Quarter 1 of 1980 to Quarter 4 of 2011 and monthly data from January 1993 to March 2013 We can see the monotonic price effect as housing price has a significantly positive correlation with the rental rate. Moreover, the housing price variance has a positive impact on the rental rate when the housing price is rising (β3 + β4 > 0) , but it has a negative impact on the rental rate when the housing price is falling (β3 < 0), confirming the regime-dependent variance effect. These results suggest that the expansion of rental supply due to a greater housing price uncertainty dominates the expansion of rental demand when the housing market is trending downward, leading to lower rental rates. Therefore, it seems that Hong Kong landlords as a group are more sensitive to real options effects of uncertainty than renters are when the housing price drops sharply, while the opposite is true when the housing price rises.

Policy Implications and Suggestions

Our analysis carries important policy implications. It suggests that housing price dynamics contribute to cyclical fluctuations in the rental market. Due to the large weight of rent in the CPI, rent inflation driven by housing price bubbles can therefore exert considerable influence on measures of overall and core inflation, giving another reason for regulators to target asset prices in general and stabilize the housing price dynamics in particular. Thus monetary policy and macro-prudential policy should not be independent but coordinated with each other to manage asset bubble and inflation.

Moreover, our findings are relevant for the detection of property bubbles: the conventional gauge of price-to-rent ratio may misstate the size of housing bubbles because rent can be driven up or down by housing price uncertainty. A more accurate measure should adjust for the option component of rent.

Bernanke, B. S. 1983. Irreversibility, Uncertainty, and Cyclical Investment. Quarterly Journal of Economics, 98 (1), 85-106. https://www.jstor.org/stable/1885568

Bloom, N. 2009. The Impact of Uncertainty Shocks. Econometrica, 77 (3), 623-685. https://www.jstor.org/stable/40263840

Dixit, A., and R. S. Pindyck. 1994. Investment Under Uncertainty. Princeton University Press.

Henry, C. 1974. Investment Decisions under Uncertainty: The Irreversibility Effect. American Economic Review, 64 (6), 1006-1012. https://www.jstor.org/stable/1815248

Shiller, R. 2008. Understanding Recent Trends in House Prices and Homeownership. In Housing, Housing Finance, and Monetary Policy, Jackson Hole Conference Series, Federal Reserve Bank of Kansas City, 85-123. https://www.kansascityfed.org/publicat/sympos/2007/PDF/Shiller_0415.pdf

From a standard financial asset perspective, housing prices are the present value of all future rents. This leads to a conventional discounted cash flow analysis that begins with rent as the fundamental of property valuation. However, Shiller (2008) shows that it is difficult for rent or housing construction costs to explain U.S. housing prices in recent years. Moreover, rent is not discretionary as in the case of stock dividends but is determined in the rental market. Thus, an interesting and important question is whether the behavior of housing prices can exert an influence on rent. In particular, can a housing bubble lead to rent inflation?

A firm or household with an opportunity to invest in a real asset holds a “real option” analogous to a financial option—the right but not the obligation to buy or sell an asset at some future time of its choosing. The option value of waiting is highly sensitive to uncertainty about the future value of investments and has a significant impact on firm-level investment decisions (Henry,1974;Dixit and Pindyck,1994) as well as macro-level fluctuations in aggregate investments (Bernanke, 1983). After the recent financial crisis, considerable attention has been given to the impact of uncertainty shocks. For example, Bloom (2009) shows that higher uncertainty increases the real option value of waiting so firms scale back their investments and hiring. In parallel with this argument, we show that uncertainty has real options effects on the property investments of households as well as cyclical fluctuations in the rental market (Wang, Yu, and Zhou, 2018).

Our View: A Real Options Story

By extending the theory of investment under uncertainty, we model a renter’s decision to buy a house and a landlord’s decision to sell as the exercising of real options of waiting and examine real options effects on rent. The innovation of the idea is shown by two red arrows in Figure 1 of the textbook real estate system.

Figure 1: Real estate system

Owning a house is risky because the house’s price is volatile and its fluctuation can have a sizable effect on the owner’s wealth. Renting thus provides a hedge against housing price uncertainty by offering a put option on the house value. The decision on the timing of a purchase becomes an optimal stopping problem for renters. A rational renter will delay the decision to buy if the housing price is higher than a threshold related to their private valuation of the house, but there is hope in waiting for the price to drop.

Likewise, landlords own a call option on the housing value, which allows them to choose the optimal timing of sale. A rational landlord will delay the decision to sell if the housing price is lower than a threshold related to their private valuation, but there is hope in waiting for the price to recover. Further assuming that the private valuations of renters and landlords are drawn from known distributions, we can derive the rental demand and supply as well as the relation between the equilibrium rental rate and the housing price and housing price volatility.

Real Options Effect on Rent

The price effect is straightforward. An increase in rental demand is associated with a decrease in rental supply in a rising housing market because more renters are reluctant to buy and more landlords are willing to sell. In contrast, in a downward housing market, rental demand will decrease because more renters are willing to buy while rental supply will increase because more landlords are reluctant to sell. This induces a positive relation between the equilibrium rental rate and the housing price.

Meanwhile, both renters and landlords are more eager to hold on to their real options given an increase in housing price volatility. This produces greater rental demand and supply. The effect on the equilibrium rental rate depends crucially on the relative size of the demand and supply increases. When the private valuations of the renters and landlords are similarly dispersed, we show that the expansion of rental demand plays a dominant role, yielding a normally positive relation between housing price volatility and rent. However, as the housing price falls, more renters depart the rental market to become homeowners, eventually leaving those who are insensitive to price and volatility shocks. As this point, an increase in housing price volatility mostly expands the rental supply while the rental demand remains largely fixed, yielding a negative relation between housing price volatility and rent.

What is New?

Our model contributes to the literature on investments under uncertainty. A firm or household with an opportunity to invest in a real asset is holding a “real option” analogous to a financial option—the right but not the obligation to buy or sell an asset at some future time of its choosing. We obtain a closed-form solution for the equilibrium rent that contains the option premium of waiting driven by housing price uncertainty and offer a new and richer explanation based on the “hold out” phenomenon. Both renters and landlords hold out in a volatile housing market, and their aggregate effect on the equilibrium rental rate depends on the distributions of their private valuations.

Our model also adds to the recent literature that has abandoned the traditional “rent drives price” view. One line of literature suggests that the housing price deviates from fundamentals largely due to strong (speculative) demand shocks in conjunction with supply constraints. Another line of recent research allows both rent and the housing price to be simultaneously determined. We treat the housing price as exogenous. This is realistic in some circumstances because the property market is integrated into the capital market and is more easily exposed to external shocks such as a large capital flow, which induces significant change in demand for housing, whereas the rental market is highly segmented and local.

Evidence from Hong Kong and the Chinese Mainland

Empirically, we find strong real option effects of the housing price on rent for Hong Kong and large cities in the Chinese mainland. Hong Kong is an ideal laboratory to test our model predictions because it is a small open economy and its housing market is subject to external shocks. We collected the Hong Kong residential rental and property markets data published by the Hong Kong Rating and Valuation Department (R&VD). Figure 2 shows that rent tends to follow the housing price in Hong Kong.

Figure 2: Hong Kong housing price and rental price indices

Table 1: Rental determinants with Hong Kong data

Meanwhile, first-tier cities in China have experienced a spectacular ongoing housing boom. From the WIND database, we collect the available monthly housing price, rent, and interest rate data of the following five large cities: Beijing, Shanghai, Guangzhou, Shenzhen, and Tianjin. Consistent with our belief, in recent years, positive housing price shocks produce rapid rent growth while negative shocks have reversed. Moreover, rent growth increases with housing price variance shocks when the housing price is rising and decreases with variance shocks when the housing price is falling. More interestingly, the rents of first-tier cities in China have seen a sharp increase in recent months due to a housing price control in property markets.

Policy Implications and Suggestions

Our analysis carries important policy implications. It suggests that housing price dynamics contribute to cyclical fluctuations in the rental market. Due to the large weight of rent in the CPI, rent inflation driven by housing price bubbles can therefore exert considerable influence on measures of overall and core inflation, giving another reason for regulators to target asset prices in general and stabilize the housing price dynamics in particular. Thus monetary policy and macro-prudential policy should not be independent but coordinated with each other to manage asset bubble and inflation.

Moreover, our findings are relevant for the detection of property bubbles: the conventional gauge of price-to-rent ratio may misstate the size of housing bubbles because rent can be driven up or down by housing price uncertainty. A more accurate measure should adjust for the option component of rent.

(Honglin Wang, former researcher at Hong Kong Institute for Monetary Research; Fan Yu, Robert Day School of Economics and Finance, Claremont McKenna College; Yinggang Zhou, Department of Finance at School of Economics, and The Wang Yanan Institute for Studies in Economics, Xiamen University)

Bernanke, B. S. 1983. Irreversibility, Uncertainty, and Cyclical Investment. Quarterly Journal of Economics, 98 (1), 85-106. https://www.jstor.org/stable/1885568

Bloom, N. 2009. The Impact of Uncertainty Shocks. Econometrica, 77 (3), 623-685. https://www.jstor.org/stable/40263840

Dixit, A., and R. S. Pindyck. 1994. Investment Under Uncertainty. Princeton University Press.

Henry, C. 1974. Investment Decisions under Uncertainty: The Irreversibility Effect. American Economic Review, 64 (6), 1006-1012. https://www.jstor.org/stable/1815248

Shiller, R. 2008. Understanding Recent Trends in House Prices and Homeownership. In Housing, Housing Finance, and Monetary Policy, Jackson Hole Conference Series, Federal Reserve Bank of Kansas City, 85-123. https://www.kansascityfed.org/publicat/sympos/2007/PDF/Shiller_0415.pdf

Wang, H., F.Yu, and Y.Zhou. 2018 Property Investment and Rental Rate under Housing Price Uncertainty:A Real-Options Approach. Real Estate Economics, forthcoming. https://onlinelibrary.wiley.com/doi/epdf/10.1111/1540-6229.12235

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email