Investor Memory and Biased Beliefs: Evidence from the Field

We explore how investor memory drives belief formation and trading behavior, fueling financial market volatility. Drawing on surveys of over 17,000 Chinese retail investors linked to trading records, our study finds that recollections of past returns—shaped by both salient market events in the past and current market conditions—strongly influence expectations of future returns and investors’ portfolio choices, often outweighing objective historical data. These findings suggest that memory-driven biases amplify boom-and-bust cycles, with policy implications for improving market stability by counteracting distorted recall.

Financial markets are volatile, with extreme fluctuations ranging from the post-COVID bull run and the meme stock surges of 2021 to the boom-bust cycles of cryptocurrencies. Research attributes this volatility to highly variable and often irrational beliefs (Barberis et al. 2018, Bordalo et al. 2020). Despite access to vast amounts of financial data, investors form expectations that deviate significantly from fundamentals, fueling speculative bubbles and sharp corrections.

But if price swings stem from shifting beliefs, what drives these shifts?

Our recent study provides a novel answer: investor memory (Jiang et al. 2025). We argue that shifts in beliefs stem from memory, which is dynamic and shaped by market conditions. When markets rise, investors tend to recall past experiences more positively, leading to overly optimistic expectations of future returns. Conversely, during downturns, negative memories dominate, driving pessimistic beliefs. These memory shifts shape expectations and trading behavior, amplifying market swings.

By highlighting the role of memory, our research examines the psychological roots of market volatility. This contributes to the growing literature on memory in economic decision-making. For instance, studies find that economic agents’ expectations and decisions rely more on subjective memory than objective data (Coibion et al. 2024) and that anecdotal stories are recalled more often than statistical facts (Graeber et al. 2024).

Research design: Capturing investor recall and beliefs

To examine memory’s role in financial decision-making, we conducted a large-scale survey of over 17,000 Chinese retail investors, a group that drives substantial trading volume. Our sample included both everyday traders and high-net-worth individuals. For some respondents, we linked survey data with trading records, allowing us to compare recalled experiences with actual market behavior.

Our survey captured two key aspects of investor memory:

1. Free recall: Investors recalled the first market episode that came to mind and estimated its return, mirroring experimental memory studies.

2. Probed recall: Investors reported their own portfolio returns over time horizons from one day to five years.

Beyond memory, we elicited expectations about future returns, perceived crash risks, and psychological traits, including personality, social engagement, and wealth allocation. Merging this data with trading records allowed us to assess recall accuracy and its link to beliefs and behavior.

This approach improves on lab experiments in three ways. First, our participants are real investors making high-stakes decisions. Second, stock investments often form a large share of their wealth, enhancing the study’s relevance. Third, by using real market cues rather than artificial stimuli, we capture memory processes as they naturally occur.

Memories are cued

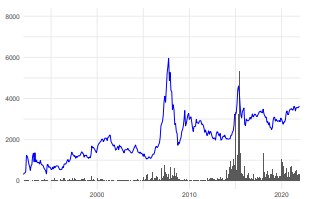

Certain market episodes—sharp crashes and dramatic rallies—are disproportionately recalled, regardless of when they occurred (see Figure 1). This suggests that memory is shaped not only by recency, a well-documented effect (e.g., Malmendier and Nagel 2011), but also by the salience of past experiences. Events like the 2015 Chinese stock market crash or the 2020 COVID-induced sell-off leave a lasting imprint, influencing expectations long after they pass. These findings underscore that memory is driven by both temporal proximity and the emotional or narrative weight of extreme market events.

Figure 1: Investors are asked to recall a past market episode that first comes to mind. We plot the distribution of start and end months of the reported episodes. The solid blue line represents the Shanghai Composite Index. The solid black bars represent the frequency of responses. The legends on the y-axis represent the level of the Shanghai Composite Index.

Furthermore, investor memories are not static but dynamic, shaped by current market conditions. On days when stock prices rise, investors are more likely to recall past bullish episodes in the free recall task, particularly recent ones. Similarly, strong market performance leads to positively biased recollections of personal investment returns in the probed recall task, even after accounting for actual past performance. These results support a memory-based model of belief formation, where investors retrieve past experiences based on their resemblance to present conditions. Positive market cues evoke memories of gains, while negative cues bring downturns to mind. This cued recall mechanism helps explain why investor beliefs are highly sensitive to short-term market fluctuations.

Memories affect beliefs and trading

Our study further highlights the crucial role of investor memory in shaping expectations and trading behavior.

First, recalled experiences strongly correlate with return expectations. Investors who recall higher past returns are more optimistic about future market performance. Economically, as recalled past one-month returns increase from the 25th to the 75th percentile, expectations for next-month and next-year returns rise by 0.7 and 1.8 percentage points, respectively.

Second, memory-driven beliefs influence trading. Investors with more optimistic recollections are more likely to increase equity holdings shortly after the survey, linking memory directly to real-world financial behavior. Our findings challenge traditional models that assume rational belief formation. Recalled experiences predict expectations better than actual historical returns, suggesting that subjective memory outweighs objective reality in shaping beliefs.

Finally, memory-based belief formation exhibits horizon dependence: when forecasting long-term returns, investors rely more on recalled experiences from similar horizons. This alignment reinforces the idea that memory serves as the foundation for imagining the future.

Conclusion and policy implications

Our research reveals how investor memory shapes beliefs and trading behavior, contributing to market volatility. Memory is not just a function of time—it is influenced by event salience and current market conditions. This selective recall distorts beliefs, fueling extrapolative expectations in financial markets.

From a policy perspective, two key implications emerge:

1. Memory-driven volatility: Investor memory biases may amplify market instability, weakening policies aimed at stabilizing markets. As memories shift with market conditions, they reinforce boom-and-bust cycles, making it harder to anchor beliefs to fundamentals.

2. Communicating historical data: Regulators could improve market stability by reminding investors of objective historical data. Counteracting memory biases may help realign beliefs with fundamentals and curb speculative behavior.

Understanding memory’s role in belief formation is crucial for designing effective market policies. Models incorporating memory processes—such as context retrieval and similarity-based recall—offer a deeper understanding of investor behavior and can help policymakers manage financial market volatility.

This article first appeared on VoxEU.

References

Barberis, Nicholas, Robin Greenwood, Lawrence Jin, and Andrei Shleifer. 2018. “Extrapolation and Bubbles.” Journal of Financial Economics 129 (2): 203–27. https://doi.org/10.1016/j.jfineco.2018.04.007.

Bordalo, Pedro, Nicola Gennaioli, Yueran Ma, and Andrei Shleifer. 2020. “Overreaction in Macroeconomic Expectations.” American Economic Review 110 (9): 2748–82. https://doi.org/10.1257/aer.20181219.

Graeber, Thomas, Christopher Roth, and Florian Zimmerman. 2024. “Stories, Statistics, and Memory.” Quarterly Journal of Economics 139 (4): 2181–2225. https://doi.org/10.1093/qje/qjae020.

Jiang, Zhengyang, Hongqi Liu, Cameron Peng, and Hongjun Yan. 2025. “Investor Memory and Biased Beliefs: Evidence from the Field.” Quarterly Journal of Economics: qjaf035. https://doi.org/10.1093/qje/qjaf035.

Malmendier, Ulrike, and Stefan Nagel. 2011. “Depression Babies: Do Macroeconomic Experiences Affect Risk-Taking?” Quarterly Journal of Economics 126 (1): 373–416. https://doi.org/10.1093/qje/qjq004.

Salle, Isabelle, Yuriy Gorodnichenko, and Olivier Coibion. 2024. “Lifetime Memories of Inflation: Evidence from Surveys and the Lab.” VoxEU. https://cepr.org/voxeu/columns/lifetime-memories-inflation-evidence-surveys-and-lab.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email