Are the Most Aggressive Investors in China Actually Informed?

Using a unique Chinese data set capturing the trading behavior of particularly aggressive investors, we provide new evidence that is consistent with the presence of informational advantages. Critically, an advantage of our data is that we can also directly identify several plausible channels through which such an informational advantage could arise. Specifically, return predictability around key value-relevant events is most pronounced in the presence of aggressive traders who share the same geographic location as the firms in which they trade.

Financial economists have long engaged in research, both theoretical and empirical, designed to enhance our understanding of the financial market price discovery process. A particular subset of this research involves a close examination of the potential informational advantages among various types of investors. Largely empirical, this research scrutinizes a range of candidates from institutional investors engaged in short-selling to small retail investors (See Note 1). One study (Berkman et al., 2014) even explores the performance of guardians in charge of children’s accounts.

However, early theoretical studies in market microstructure often portray informed traders as particularly aggressive (see, for example, Holden and Subrahmanyam, 1992, 1994; and Vives, 1995) and this designation has continued in more recent work (Collin-Dufresne and Fos, 2016). Despite this focus, incomplete data has limited researchers’ capacity to identify aggressive investors; that is, using largely U.S. market data, one is not generally able to observe the investors who contribute the most to daily trading volume across the market. Using a unique dataset from China that does permit the identification of aggressive investors, we show in a recent paper (Lundblad, Yang, and Zhang, 2017) that aggressive investors have sizeable informational advantages and that geographic proximity is a plausible channel through which such informational advantages arise.A Unique Chinese Dataset to Detect Aggressive Investors

There are two trade channels in Chinese stock markets. The first is trade through the regional branches of a brokerage firm and all individual investors trade through this channel. The second is to have one’s own accounts registered in the stock exchange. Mutual and pension funds, as well as other institutional investors, trade through this channel. Our novel data provide the activity for all stocks traded on the Shanghai Stock Exchange for each day for the top ten most active trading accounts in terms of both net purchases and net sales by either brokerage branches or mutual/pension funds regardless of channel. We focus on this subset of traders in order to isolate the potential informational advantage of the most aggressive investors (those who contribute the most to daily trading volume), their locations, and the locations of the firms in which they trade. A study like this has only been possible with the collection of novel Chinese data and serves as a reminder of the degree to which old questions sometimes can be examined more precisely with non-U.S. data that contain the required level of detail.

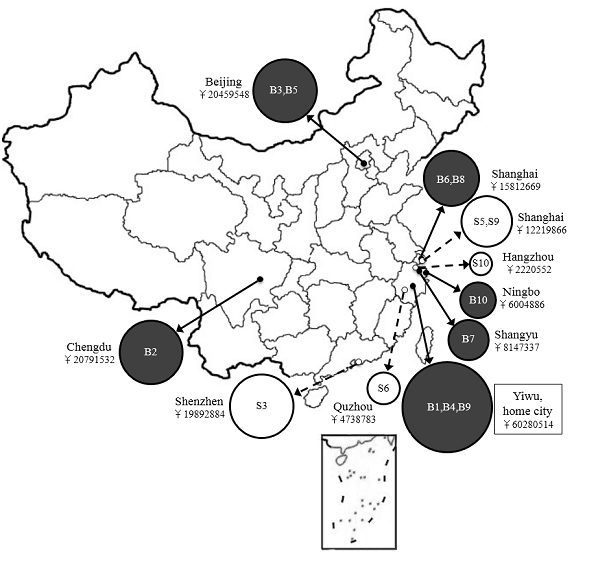

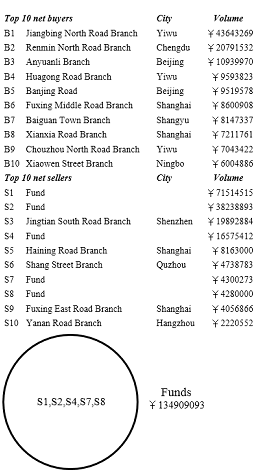

To better demonstrate the nature of our data, we present an example of a stock prior to a value-relevant corporate event. The particular company is Zhejiang China Commodities City Ground Co., Ltd., whose main businesses are real estate development and commodity sales. This company’s stock experienced a suspension of trading from December 11, 2007, to March 4, 2008, due to an ongoing unreported corporate event (a restructuring, in this case). On March 5, 2008, the company announced that it would issue shares to its controlling shareholder, Yiwu State-owned Assets Investment Co., Ltd., in exchange for a real estate project. Once trading resumed, the price appreciated significantly (hitting daily price change upper-limits several days in row). Interestingly, our branch-level data allow us to observe that some investors nevertheless started aggressively trading on December 10, 2007, even before the suspension announcement. Figure 1 provides a visual representation of the top ten net buying and selling branches or fund accounts from our database on the last trading day (December 10th, 2007) prior to the suspension. Specifically, a particular feature of the aggressive pre-suspension buying originated from several accounts located in the firm’s home city, Yiwu. Given that the stock significantly appreciated over the next several days after trading resumed, this local net buying suggests an informational advantage and episodes of concentrated, aggressive trading warrant further exploration.

While the example we provide is intriguing, we econometrically demonstrate that volume associated with particularly aggressive investor buying (selling) predicts, on average, large positive (negative) abnormal returns up to 20 trading days after relevant events. Specifically, we demonstrate that return predictability associated with trading by these top ten accounts is particularly pronounced around key, value-relevant corporate events (such as earnings announcements, the announcement of merger and acquisition activity, the announcement of a lawsuit, etc. See Note 2). For example, we find that stocks heavily accumulated by aggressive investors in the ten days prior to all events, on average, exhibit abnormal returns that exceed the abnormal returns of stocks heavily sold by about 1.3 percent in the two-day event window around announcements and 2.5 percent over the next trading month. These statistically significant results are consistent with the idea that, in aggregate, aggressive investor trading prior to potentially value-relevant announcements contains pertinent information. The most aggressive Chinese investors indeed appear to be informed and we can further postulate as to how.

Origin of Aggressive Investors’ Informational Advantage

Critically, the top ten trading accounts data also permit an identification of the location from which the investors submit their trades within China. Financial market research has explored the degree to which informational advantages might reflect location (See Note 3). Given the detailed nature of our data, we can further assess whether geographic proximity might be a channel through which our return predictability effects arise. That is, we disaggregate our data based upon the location of the listed firms as well as the location of the most aggressive investors themselves. Across all of the various events we consider, we find that aggressive pre-event trading by investors who share the same home city (and, in some cases, the same home province) with the headquarters of the firms in which they trade consistently demonstrates the most significant and economically meaningful return predictability.

To further corroborate the importance of locational advantages, we focus on a subset of events for which there is also an important counterparty involved in the origin of potentially value-relevant information. In the case of a newly issued bank loan, we consider the issuing bank. In an M&A deal, we consider the counterparty involved in the deal. If proximity to the origin of information in our sample of aggressive investors is the primary reason behind the return predictability that we document, investors close to the location of the relevant counterparty may also exhibit significant return predictability stemming from an informational advantage. We find this to be the case.

Finally, we consider a political event of particular relevance to the Chinese context associated with the change in local governors. Given the critical role the state plays in the allocation of resources in China, this political shift likely represents an important and value-relevant event. Further, the decision to remove a governor takes place among a body of higher-level government officials residing in Beijing or elsewhere. Hence, we consider a change in a mayor as potentially impacting all firms with headquarters located in the target city. For a change in a provincial governor, we consider the firms in that province as potentially impacted. Most importantly, we examine the return predictability associated with aggressive trading by investors originating from the same cities as the political superiors who made the changes. For changes in provincial governors, this is presumed to come from Beijing directly; for changes in mayors, the corresponding provincial capitals are employed. Remarkably, we find that the trading imbalance associated with investors from the decision-making city, either Beijing or the provincial capital, is associated with significant return predictability. Most interestingly, given the particular importance of local connections in the allocation of resources for state-owned firms, is the fact that we observe that this return predictability is highly significant for state-owned firms but not private firms (See Note 4).

Lingering Questions Regarding Financial Market Regulation

While the ability to detect the most aggressive investors can push forward our understanding of the nature of price discovery in a general sense, research such as this may also have important regulatory implications. To be clear, if an informational advantage is gained by skill or effort, then regulators should encourage such behavior in order to improve market efficiency. However, if the informational advantage is instead a reflection of insider trading and unfair advantage, restrictive regulations should be considered.

Any evaluation of our findings for the Chinese market, where insider trading rumors endlessly swirl, must acknowledge the potential for the informational advantages that we detect to be at least partially attributable to insider trading. Certainly, some of the interesting locational examples we provide above might sway a reader to come to such a conclusion.

For the time being, our view remains relatively agnostic. While we share a reader’s casual suspicions, we are reluctant to make any definitive statements about the exact breakdown of our results across the two explanations (earned informational advantages versus illegal activity). However, we freely acknowledge that our results likely represent some fraction of each type. Building upon this, our next endeavor is to augment the regulatory toolbox by employing some of the rich investor and locational variation in our data to better detect trading patterns that look more like one type or the other. Stay tuned.

Note 1: Among others, Asquith et al. (2005), Boehmer et al. (2008) and Engelberg et al. (2012) examine short-sellers. Berkman et al. (2014) explore the performance of guardians in charge of children’s accounts; Coval and Moskowitz (2001), Hau (2001), and Baik et al. (2010) explore local investors; Kaniel et al. (2012) examine individual investors; Kelley and Tetlock (2013) consider retail investors; and, finally, Yan and Zhang (2009) focus on short-term institutional investors.

Note 2: In the case of a trading suspension, the returns are calculated for the trading days after the suspension concludes and trading resumes. During or at the end of the suspension, the listing company typically makes some important announcement; for example, the M&A event described above. For this particular type of event, our return predictability analysis is still meaningful. If some investors possess an informational advantage about the upcoming event, they may trade aggressively prior to the suspension. Furthermore, there are no selection issues; after suspensions, all stocks resume trading, so all suspension events are included in our sample.

Note 3: Coval and Moskowitz (2001), Hau (2001), Malloy (2005), Ivkovic and Weisbenner (2005), Shive (2012), and Baik et al. (2010), among many others

Note 4: Within our framework, we do not need to identify whether a change in the governor is up or down. Rather, this is similar to an earnings announcement, which could deliver either positive or negative news. As long as governor changes are value-relevant events for the listed companies, investors possessing an informational advantage will buy (sell) before events with realized positive (negative) return impact. In our portfolio analysis, the group of stocks heavily purchased by aggressive investors should outperform the group of stocks that are heavily sold.

(Christian T. Lundblad, University of North Carolina and the PBC School of Finance, Tsinghua University; Zhishu Yang, Tsinghua University; Qi (Jacky) Zhang, Durham University.)

Asquith, Paul, Parag A. Pathak, and Jay R. Ritter, 2005, “Short Interest, Institutional Ownership, and Stock Returns,” Journal of Financial Economics 78, 243-276.

Baik, Bok, Jun-Koo Kang, and Jin-Mo Kim, 2010, “Local Institutional Investors, Information Asymmetries, and Equity Returns,” Journal of Financial Economics 97, 81-106.

Berkman, Henk, Paul D. Koch, and P. Joakim Westerholm, 2014, “Informed Trading through the Accounts of Children,” Journal of Finance 69, 363-404.

Boehmer, Ekkehart, Charles M. Jones, and Xiaoyan Zhang, 2008, “Which Shorts are Informed?”, Journal of Finance 63, 491-527.

Collin-Dufresne, Pierre, and Vyacheslav Fos, 2016, “Insider Trading, Stochastic Liquidity, and Equilibrium Prices,” Econometrica 84, 1441-1475.

Coval, Joshua D., and Tobias J. Moskowitz, 2001, “The Geography of Investment: Informed Trading and Asset Prices,” Journal of Political Economy 109, 811-841.

Engelberg, Joseph E., Adam V. Reed, and Matthew C. Ringgenberg, 2012, “How are Shorts Informed? Short-sellers, News, and Information Processing,” Journal of Financial Economics 105, 260-278.

Hau, Harald, 2001, “Location Matters: An Examination of Trading Profits,” Journal of Finance 56, 1959-1983.

Holden, Craig W., and Avanidhar Subrahmanyam, 1992, “Long-lived Private Information and Imperfect Competition,” Journal of Finance 47, 247-270.

Holden, Craig W., and Avanidhar Subrahmanyam, 1994, “Risk Aversion, Imperfect Competition, and Long-lived Information,” Economics Letters 44, 181-190.

Ivković, Zoran, and Scott Weisbenner, 2005, “Local Does as Local Is: Information Content of the Geography of Individual Investors' Common Stock Investments,” Journal of Finance 60, 267-306.

Kaniel, Ron, Shuming Liu, Gideon Saar, and Sheridan Titman, 2012, “Individual Investor Trading and Return Patterns Around Earnings Announcements,” Journal of Finance 67, 639-680.

Kelley, Eric K., and Paul C. Tetlock, 2013, “How Wise are Crowds? Insights from Retail Orders and Stock Returns,” Journal of Finance 68, 1229-1265.

Lundblad, Christian T., Zhishu Yang, and Qi Zhang, 2017, “Informed Trading Volume and Asset Prices: The Role for Aggressive Investors,” Working paper.

Malloy, Christopher J, 2005, “The Geography of Equity Analysis,” Journal of Finance 60, 719-755.

Shive, Sophie, 2012, “Local Investors, Price Discovery, and Market Efficiency,” Journal of Financial Economics 104, 145-161.

Vives, Xavier, 1995, “Short-term Investment and the Informational Efficiency of the Market,” Review of Financial Studies 8, 125-160.

Yan, Xuemin Sterling, and Zhe Zhang, 2009, “Institutional Investors and Equity Returns: Are Short-term Institutions Better Informed?”, Review of Financial Studies 22, 893-924.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email