State Versus Market: China’s Infrastructure Investment

In 2005, the Chinese government launched the landmark “36 Clauses” reform, marking a critical step toward forging a more favorable market environment. Our analysis reveals that after the implementation of the 36 Clauses, the positive effect of infrastructure investment on firm productivity increased by 42.5% for private firms in industries that benefitted from improved market entry opportunities and an even more striking 97.9% in provinces where arbitrary fines were curtailed. These findings underscore the complementary roles of state interventions and the development of market mechanisms in boosting firm productivity.

In the wake of the 2008 financial crisis, further intensified by the unprecedented global disruptions of the COVID-19 pandemic, the world has seen a dramatic reevaluation of the role of state interventions in economic development. These significant events have fostered a renewed interest among nations in adopting more proactive stances in guiding their economies. This sentiment transcends traditional economic divides, with developed and developing countries becoming more receptive to the idea of industrial policies, as recently reviewed by Juhász, Lane, and Rodrik (2023). Even traditionally free-market economies like the US and the European Union are adopting similar industrial policies to support and defend their domestic industries against external challenges.

Emerging economies are increasingly focusing on expansive infrastructure projects, from enhancing transportation networks to expanding digital connectivity. The justification for such infrastructure investments is well-established, highlighting their role in boosting firm productivity, catalyzing economic activity, and facilitating trade, as highlighted by Rodrik (1999), Aschauer (1989), and Stiglitz (1993). Moreover, Sanchez‐Robles (1998), Démurger (2001), Calderón and Servén (2010), Sahoo and Dash (2012), and Kodongo and Ojah (2016) provide empirical evidence of the positive link between infrastructure development and economic growth, especially in economies where public capital is striving to reach a balanced “equilibrium level.”

However, this optimistic view is tempered by significant concerns about the implications of large-scale public investments. One critical issue is the potential for states to leverage substantial infrastructure spending as a facade, diverting attention from the crucial need to establish robust institutional frameworks that promote market mechanisms and protect private businesses. This concern is echoed by Nazmi and Ramirez (1997), Ramirez and Nazmi (2003), and Mitra (2006). Distinguished economists like Williamson (1985), North (1991), and Acemoglu and Robinson (2012) have emphasized that a vibrant market ecosystem is essential for the efficient allocation of resources. This raises a pivotal question: can state-led infrastructure initiatives truly spur economic growth in the absence of a well-functioning market system?

In our new paper, Qian, Ru, and Xiong (2024), we address this issue by analyzing the effects of the Chinese government’s considerable infrastructure investments on the productivity of private firms, which form a major segment of China’s economy. As China transitioned from a centrally planned economy to a more market-oriented one, it has undertaken massive infrastructure projects, adopted broad industrial policies, and fostered the development of market mechanisms and private enterprise. This complex mix has ignited a vigorous debate among economists and policymakers about the roots of China’s economic success: is it a result of the extensive state interventions, or could China have reached even greater economic heights with less state involvement? Specifically, the discourse extends to the potential distortions introduced by government interventions in the world’s second-largest economy, as discussed by Allen, Qian, and Qian (2005); Hsieh and Klenow (2009); and Song, Storesletten, and Zilibotti (2011).

We leverage a pivotal policy change in China aimed at fostering a conducive market environment to examine the relationship between state-driven infrastructure investments and market development. In 2005, the Chinese government launched the landmark 36 Clauses reform, marking a critical step toward forging a more favorable market environment. Among the 36 clauses, the Market Entry Clause is particularly noteworthy for its advocacy of equal market access for all types of economic entities. This clause was universally implemented by all provinces. It has been especially beneficial to private firms, affording them unprecedented entry into industries that were traditionally under the control of state-owned enterprises (SOEs). The effectiveness of this reform is reflected in the substantial decrease in the average asset ratio of SOEs, which fell from 29.8% in 2004 to 17.6% by 2009, with a more marked reduction observed in sectors previously dominated by SOEs.

We adopt a difference-in-differences (DID) approach to analyze how this policy change affects the efficacy of state-driven infrastructure investments in boosting private firm productivity. Our analysis focuses on the effects of city-level infrastructure investments on various measures of firm efficiency, such as total factor productivity (TFP), return on assets (ROA), operating return on assets (OROA), total sales, and sales per worker. We examine these metrics before and after the implementation of the 36 clauses within province-industry groups that were dominated by SOEs as of 2004.

We anticipate that firms within these sectors would witness more significant improvements in productivity from infrastructure post-policy enactment. A more conducive market environment not only makes it easier for new firms to enter an industry dominated by SOEs, but also allows existing nonstate firms to easily expand their operations, amplifying their productivity gain from the government’s infrastructure investment.

To test this hypothesis, we analyze several measures of the productivity of nonstate firms from 2000 to 2010 by estimating the following DID regression:

We control for macroeconomic conditions in the past year, such as the natural logarithm of the total population, city GDP, budget revenue, and province-level unemployment rate. We also control for firm-level characteristics in the past year, including logarithm of total assets, leverage, and tangibility. Besides firm fixed effects and year fixed effects, we also include Province×Industry and Year×Industry fixed effects to further alleviate concerns that unobserved factors could influence our findings. Moreover, we cluster the error terms at the city level for robustness.

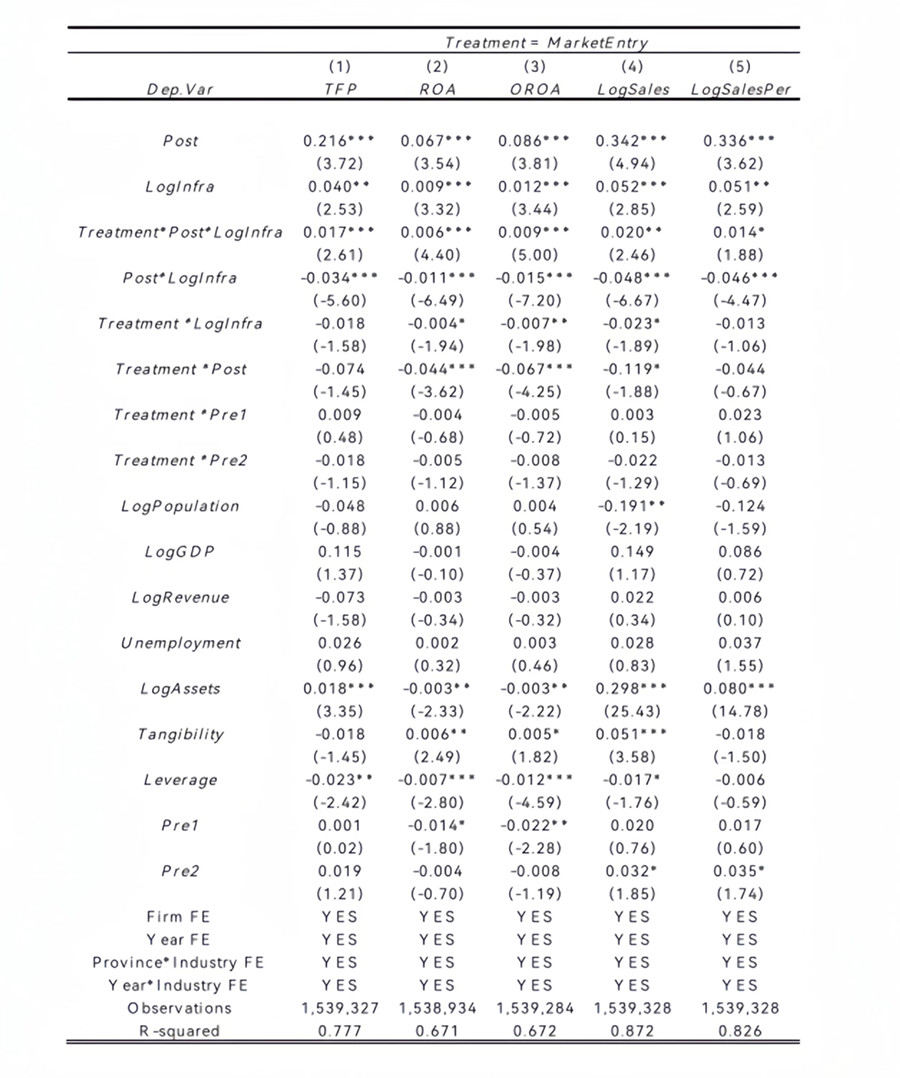

Table 1: DDD Analysis of the Market

Entry Clause

Our firm-level regression analyses provide robust support for our hypothesis. Table 1 shows that doubling infrastructure investment correlates with increases of 4% in TFP, 0.9% in ROA, 1.2% in OROA, 5.2% in total sales, and 5.1% in sales per worker. Moreover, the parallel trend assumption is validated, indicating no pre-policy differences between province-industry groups with varying levels of SOE dominance. Crucially, our analysis reveals that after the implementation of the policy, the beneficial impacts of infrastructure investment on TFP, ROA, OROA, total sales, and sales per worker are amplified by 42.5%, 66.67%, 75%, 38.5%, and 27.5%, respectively, in groups that were previously SOE-dominated.

We have also examined the impact of other clauses designed to improve different aspects of the market environment. Each province has implemented a unique set of these clauses in response to the central government’s 36 Clauses. Notably, the Arbitrary Penalty Clause, which aims to curtail arbitrary fines on firms, has shown positive outcomes. Utilizing the DID approach, we find that provinces adopting this clause in their provincial regulations witnessed a greater reduction in fines levied on firms, contributing to a better business environment. More importantly, the DID analysis reveals that the beneficial impacts of infrastructure investments on firm productivity—across measures such as TFP, ROA, OROA, sales, and sales per worker—are notably magnified post-policy, with increases of 97.9%, 127.3%, 87.5%, 95.2%, and 86.8%, respectively, similar to the effects observed with the Market Entry Clause.

Our analysis also extends to the Fiscal and Financial Clauses, the Tax Clause, and the Firm Right Clause, all of which have been found to positively support private firms and thus enhance firms’ productivity gains from infrastructure investment. Conversely, the Worker Right Clause and the Social Right Clause, which tend to increase operational costs for firms, did not yield significant effects on productivity enhancements derived from infrastructure investments in our DID analysis.

Collectively, our findings underscore the complementary roles of state-driven infrastructure investments and a conducive market environment in boosting the productivity of private firms, affirming our central hypothesis. Our results demonstrate that government interventions, through infrastructure investments, and the enhancement of marketization levels, as evidenced by a more favorable business environment for the private sector, act in a complementary fashion. This complementary interaction substantially boosts firm productivity and performance, highlighting the comprehensive advantages of synchronized policy measures in fostering economic development. This analysis becomes especially pertinent given China’s recent policy shift from prioritizing market mechanisms to a stronger emphasis on assertive state interventions.

References

Acemoglu, Daron, and James A. Robinson. 2012. “Why Nations Fail: The Origins of Power, Prosperity, and Poverty.” Finance and Development (English edition) 49 (1): 53.

Allen, Franklin, Jun Qian, and Meijun Qian. 2005. “Law, Finance, and Economic Growth in China.” Journal of Financial Economics 77 (1): 57–116. https://doi.org/10.1016/j.jfineco.2004.06.010.

Aschauer, David Alan. 1989. “Is Public Expenditure Productive?” Journal of Monetary Economics 23 (2): 177–200. https://doi.org/10.1016/0304-3932(89)90047-0.

Calderón, César, and Luis Servén. 2010. “Infrastructure and Economic Development in Sub-Saharan Africa.” Journal of African Economies 19 (suppl_1): i13–i87. https://doi.org/10.1093/jae/ejp022.

Démurger, Sylvie. 2001. “Infrastructure Development and Economic Growth: An Explanation for Regional Disparities in China?” Journal of Comparative Economics 29 (1): 95–117. https://doi.org/10.1006/jcec.2000.1693.

Hsieh, Chang-Tai, and Peter J. Klenow. 2009. “Misallocation and Manufacturing TFP in China and India.” Quarterly Journal of Economics 124 (4): 1403–48. https://doi.org/10.1162/qjec.2009.124.4.1403.

Juhász, Réka, Nathan J. Lane, and Dani Rodrik. 2023. “The New Economics of Industrial Policy.” National Bureau of Economic Research Working Paper No. 31538. https://doi.org/10.3386/w31538.

Kodongo, Odongo, and Kalu Ojah. 2016. “Does Infrastructure Really Explain Economic Growth in Sub-Saharan Africa?” Review of Development Finance 6 (2): 105–25. https://doi.org/10.1016/j.rdf.2016.12.001.

Mitra, Pritha. 2006. “Has Government Investment Crowded out Private Investment in India?” American Economic Review 96 (2): 337–41. https://doi.org/10.1257/000282806777211621.

Nazmi, Nader, and Miguel D. Ramirez. 1997. “Public and Private Investment and Economic Growth in Mexico.” Contemporary Economic Policy 15 (1): 65–75. https://doi.org/10.1111/j.1465-7287.1997.tb00455.x.

North, Douglass C. 1991. Institutions, Institutional Change, and Economic Performance. Cambridge, UK: Cambridge University Press.

Qian, Shuoge, Hong Ru, and Wei Xiong. 2024. “State Versus Market: China’s Infrastructure Investment.” Princeton University Working Paper. http://wxiong.mycpanel.princeton.edu/papers/Infrastructure.pdf.

Ramirez, Miguel D., and Nader Nazmi. 2003. “Public Investment and Economic Growth in Latin America: An Empirical Test.” Review of Development Economics 7 (1): 115–26. https://doi.org/10.1111/1467-9361.00179.

Rodrik, Dani. 1999. “Where Did All the Growth Go? External Shocks, Social Conflict, and Growth Collapses.” Journal of Economic Growth 4: 385–412. https://doi.org/10.1023/A:1009863208706.

Sahoo, Pravakar, and Ranjan Kumar Dash. 2012. “Economic Growth in South Asia: Role of Infrastructure.” Journal of International Trade and Economic Development 21(2): 217–52. https://doi.org/10.1080/09638191003596994.

Sanchez-Robles, Blanca. 1998. “Infrastructure Investment and Growth: Some Empirical Evidence.” Contemporary Economic Policy 16 (1): 98–108. https://doi.org/10.1111/j.1465-7287.1998.tb00504.x.

Song, Zheng, Kjetil Storesletten, and Fabrizio Zilibotti. 2011. “Growing Like China.” American Economic Review 101 (1): 196–233. https://doi.org/10.1257/aer.101.1.196.

Stiglitz, Joseph E. 1993. “The Role of the State in Financial Markets.” World Bank Economic Review 7 (suppl_1): 19–52. https://academic.oup.com/wber/issue/7/suppl_1.

Williamson, Oliver E. 1985. The Economic Institutions of Capitalism. New York: Free Press.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email