The Two-Pillar Policy for the RMB from December 2015 to May 2017

We document that since December 2015 the People’s Bank of China (PBC) has followed a “two-pillar” exchange rate policy that aims to achieve both stability and flexibility. Based on a no-arbitrage model and options price data we estimate the credibility of the policy as well as its impact on the RMB/USD exchange rate. The model was able to correctly forecast the end of the two-pillar policy in May 2017.

Since December 2015, the People’s Bank of China (PBC) has followed a “two-pillar” exchange rate policy that aims to achieve both stability and flexibility. Based on a no-arbitrage model and options price data, we estimate the credibility of the policy as well as its impact on the RMB/USD exchange rate. Our model was able to correctly forecast the end of the two-pillar policy in May 2017.

Managed floating regime for the RMBThe Chinese currency, Renminbi or RMB, is currently in a “managed floating” regime. Every morning the PBC announces the “central parity rate” (also known as the midpoint price) and permits the RMB/USD exchange rate to fluctuate within a band around the central parity rate. Currently, the width of the band is officially 2% on either side. Recently, however, this has effectively been limited to 0.5%. To make the RMB more “market-determined,” the PBC reformed the formation mechanism of the central parity on August 11, 2015, such that the midpoint would be primarily based on the previous day’s closing rate in the spot market. Due to possible rate hikes by the Federal Reserve and the slowing Chinese economy, the RMB was subsequently expected to depreciate. To mitigate depreciation expectations, the PBC modified the policy on December 11, 2015, and introduced three trade-weighted RMB baskets or indices (i.e., CFETS, BIS, and SDR). As stated in “China Monetary Policy Report” (2016Q1), under the modified policy, “market makers must consider both factors when quoting the central parity of the RMB to the USD, namely the ‘previous closing rate’ and the ‘changes in the currency basket’.”

Two-pillar policy formulation

Several studies of the managed floating regime prior to 2015 focused on uncovering the unknown weights of the currencies in the PBC’s currency basket (see, for instance, Frankel 2009). Our own recent work (Jermann, Wei, and Yue 2017) has focused on formalizing the PBC’s modified approach since the end of 2015. We label this modified approach the two-pillar policy: one pillar refers to the “previous closing rate” that “reflects the market demand and supply situation,” while the other refers to “changes in the currency basket” that “maintains the overall stability of the RMB to the currency basket.”

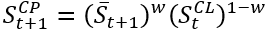

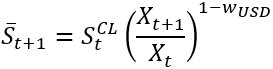

We can formulate the two-pillar policy for the central parity as follows

Empirical analysis of the two-pillar policy

Our empirical analysis suggests a 50-50 equal weighting scheme. The exact choice of the basket does not seem to matter much. Table 1 reports the results from regressing the changes in the central parity on the two pillars between December 11, 2015 and May 23, 2017. As shown in Table 1, across all three indices, the regression has a high R-squared of around 0.8 and its coefficients sum to essentially one. These results suggest a tight adherence to the two-pillar policy and that the weights on both pillars are roughly equal.

A no-arbitrage model for the RMB and two-pillar policy credibility

For the past one and a half years, the two-pillar policy—combined with an effective 0.5% trading band—has restricted the exchange rate dynamics. Expectations about further RMB depreciations and a possible change in policy have also affected exchange rates during that time. We build a no-arbitrage model to quantify these expectations.

We combine the documented properties of the two-pillar policy with the tractable no-arbitrage model from Jermann (2017). The model is very parsimonious and allows for an occasionally binding band around the central parity. In the model, we assume that the two-pillar policy may or may not continue in the future. In the latter case it would be replaced by an alternative policy with an exchange rate we label the fundamental exchange rate.

Fitting the model to spot rate and RMB option price data, we estimate the fundamental exchange rate and the continuation probability of the two-pillar policy. These estimations are possible because options are forward-looking. In particular, the option price can be decomposed into two parts that correspond to the two regimes, helping to identify the regime survival probability.

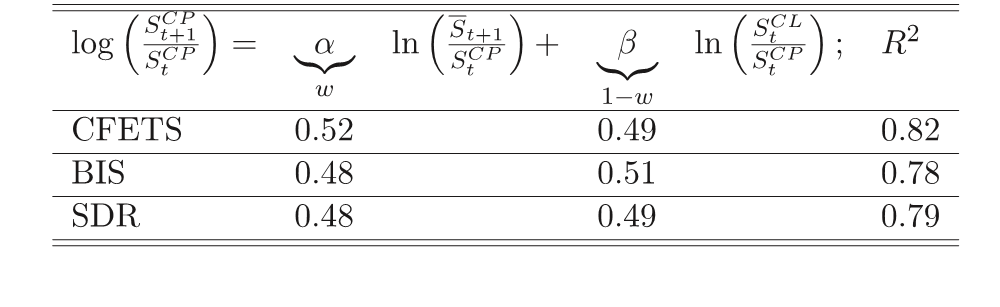

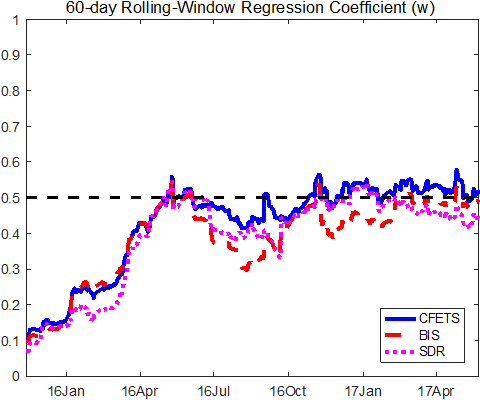

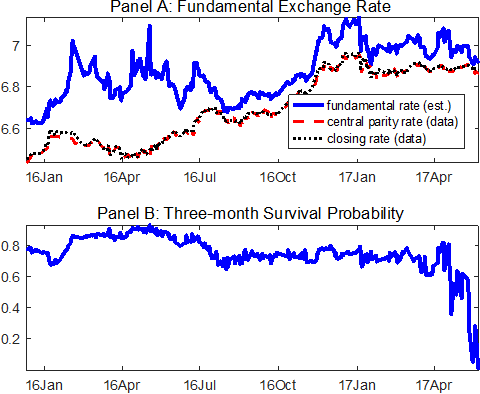

The model is estimated for the period between December 11, 2015, and May 23, 2017. We choose December 11, 2015 because it is the starting date of the two-pillar policy following the introduction of the RMB indices. We choose May 23, 2017 as the ending date of the sample because our model implies an essentially zero probability that the two-pillar policy would continue in the near future. This is consistent with the PBC’s statement on May 26, 2017, confirming that it had recently changed its policy and added a countercyclical factor to the formation mechanism of the central parity. Figure 2 plots the estimation results.

We find that during the sample period the RMB has been valued on average about 3% higher than its fundamental value (see Panel A of Figure 2), which is consistent with recent expectations of further depreciation of the RMB. The two-pillar policy had mostly high credibility over the sample. During May 2017, the probability dropped from about 60% to essentially zero (see Panel B of Figure 2), as the model correctly forecasts the approaching end of the two-pillar policy.

Author’s note: The views expressed herein are those of the author and do not necessarily reflect the views of the Federal Reserve Bank of Atlanta or the Federal Reserve System.

(Urban J. Jermann, the Wharton School of University of Pennsylvania and NBER; Bin Wei, the Federal Reserve Bank of Atlanta; Vivian Z. Yue, Emory University, the Federal Reserve Bank of Atlanta and NBER.)

Frankel, Jeffrey (2009), “New estimation of China’s exchange rate regime,” Pacific Economic Review, 14 (3): 346-360. http://onlinelibrary.wiley.com/doi/10.1111/j.1468-0106.2009.00454.x/abstract

Jermann, Urban J., Bin Wei, and Vivian Z. Yue (2017), “The two-pillar policy for the RMB,” unpublished manuscript. https://www.dropbox.com/s/epspp72ws36gyuf/TwoPillar.pdf?dl=0

Jermann, Urban J. (2017), “Financial markets’ views about the euro-swiss franc floor,” Journal of Money, Credit and Banking, 49 (2-3): 553-565. http://onlinelibrary.wiley.com/doi/10.1111/jmcb.12389/abstract

People’s Bank of China (2016), China Monetary Policy Report, Quarter One.

http://www.pbc.gov.cn/english/resource/cms/2017/03/2017031316550822382.doc

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email