Unequal Transition: The Widening Wealth Gap amidst China’s Rapid Growth

We examine the drivers of rising wealth inequality in urban China since 1995. We highlight the intertwined nature of growth and equity during China’s transition toward a market-oriented economy: a small entrepreneurial class emerges to propel growth and accumulates substantial wealth in the meantime, whereas the majority working class, partly due to limited investment available from an underdeveloped financial sector, uses housing as the main vehicle of wealth accumulation over the course of a longtime housing boom.

Since its reform and opening up in 1978, China has transformed from one of the poorest countries to the second largest economy in the world. The growth process creates enormous income and wealth that do not benefit everyone equally. While the rising income inequality during the growth process is well documented (Khan and Riskin 2005; Benjamin, Brandt, Giles, and Wang 2008; Zhang 2021), the simultaneous rise in wealth inequality has become clear more recently following the empirical work of Piketty, Yang, and Zucman (2019): the top 10% income share, a widely used measure of income inequality, rose from 27% in 1978 to 40% in 2015, and the top 10% wealth share rose from 40% in 1995, the earliest year when household-level wealth data is available, to 67% in 2015. Faced with rising inequality, the Chinese central government has put “Common Prosperity” at the center of its new policy agenda since 2021.

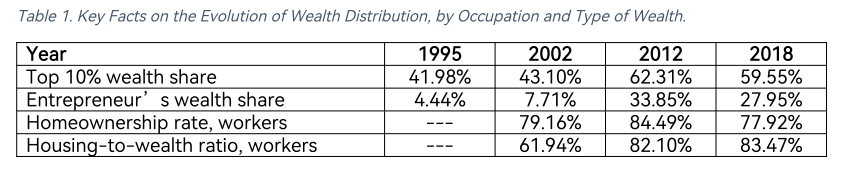

Tackling this rising inequality requires an understanding of it. In particular, the current level of wealth inequality has become alarmingly high, well above the European average, and approaching the US level (Piketty, Yang, and Zucman 2019). The emergence of such a large wealth gap over a relatively short period of time means that the wealth distribution is intricately intertwined with the country’s rapid growth. In a recent working paper, we propose a quantitative theory of China’s economic transition that explains the increase of the wealth inequality observed for its urban population since 1995 (Jiang, Zheng, and Zhu 2023). At the heart of our theory is rational agents making economic decisions in response to a set of transition policies that lower the barriers to private ownership of capital, including both productive and housing capital. A small fraction of more entrepreneurial households takes the opportunity to start a private business. In the presence of financial frictions, they maintain high investment rates at high returns, which creates massive wealth accrued to this small group at the top of the wealth distribution. Identifying entrepreneurs in survey data by those reported to operate individual businesses or private enterprises or those whose primary occupation is private enterprise employers or self-employed, we document a substantial increase in entrepreneurs’ wealth share from 1995 to mid-2010 in urban China (Table 1). The overwhelming majority, the working class, who are faced with increasing wage income risks, engage in precautionary saving. But as they are precluded from investing in the lucrative private business sector due to underdeveloped financial markets, they store their wealth in houses over a decades-long housing market boom (Table 1).

Notes: Authors’ calculations from China Household Income Project (CHIP) 1995 and 2002 and China Family Panel Studies (CFPS) 2012 and 2018. In CHIP, we define a household as an entrepreneurial household if they answer yes to the question, “Over the past year, is there any family member in your household who operates individual businesses or private enterprises?” In CFPS, entrepreneurial households are defined as those with at least one household member whose primary occupation is private enterprise employers or self-employed (siying qiye guzhu huo geti huzhu).

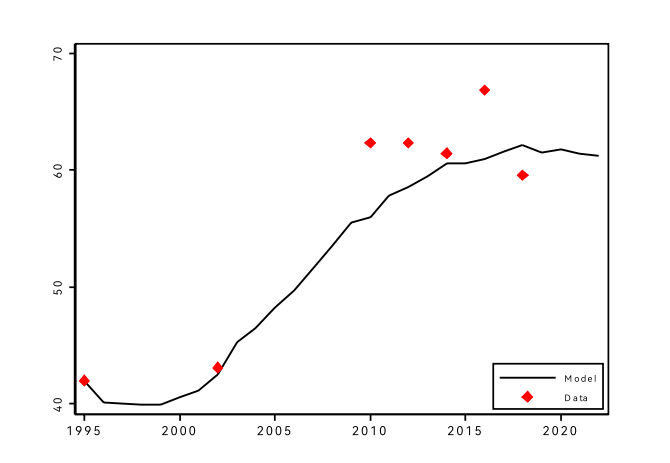

More specifically, we build an open-economy dynamic equilibrium incomplete markets model in the tradition of Aiyagari (1994), which is expanded to two sectors (rural/agriculture and urban/manufacturing), two occupations in urban areas (workers and entrepreneurs), and two goods (non-durable consumption and housing consumption). Along the transition path, in each period, hand-to-mouth rural residents working in agriculture choose whether to move to urban areas. Meanwhile, urban residents decide between being employed in a manufacturing firm, be it state-owned or private, and becoming an entrepreneur in the private manufacturing sector subject to financing constraints. Urban residents, after the establishment of the housing market, can store wealth by purchasing housing units as a form of durable consumption good in addition to bank deposits. We interpret the data in 1995 as reflecting a pre-reform steady state. Subsequently, alongside the exogenous total factor productivity (TFP) growth, the housing reform removes the housing trading restriction, the migration reform reduces the rural-to-urban migration barrier, and the state-owned enterprise (SOE) reform reduces the barrier to entry to the private manufacturing sector, until the model settles down to a new steady state in the distant future. We calibrate the initial steady state as well as the transitional dynamics jointly, targeting data moments describing growth and structural changes such as the urban population share, the size of the entrepreneurial sector, and the housing-to-wealth ratio, at two points in time: 1995, before the transition, and 2012, in mid-transition. Though not directly targeted, the model predicts a 19.30 percentage point increase in the top 10% wealth share over the transition that almost exactly matches the data counterpart (Figure 1).

Figure 1. Wealth inequality in model and in data.

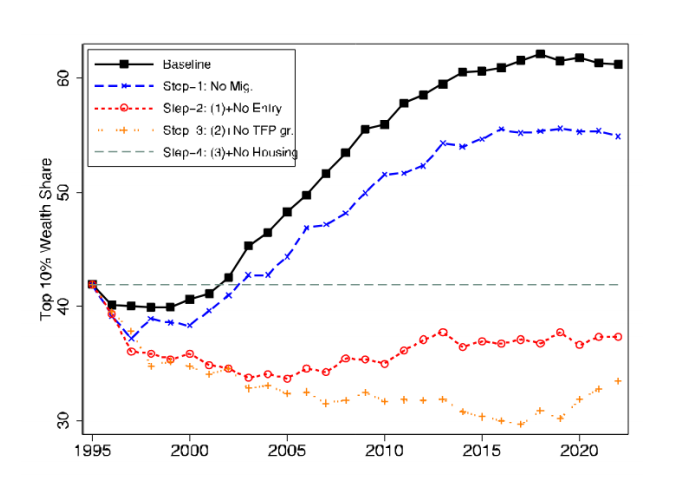

An advantage of our structural framework is that it explains the contribution of different reform measures to rising wealth inequality, taking into account equilibrium forces. Figure 2 shows the results of a series of counterfactual exercises that decompose the increase in wealth inequality into different drivers. We start from the calibrated model and successively shut down migration reform, SOE reform, exogenous TFP growth, and housing reform. We find that shutting down migration reduces the magnitude of the increase in the top 10% wealth share to 12.96 percentage points, accounting for 32.85% of the rise in wealth inequality. Keeping the entry barrier to the private sector at the pre-reform level reduces inequality to below the pre-reform level and accounts for a staggering 91.03% of the rise in inequality. Eliminating productivity growth brings inequality further down and accounts for 19.90% of the rise of inequality. Finally, removing the housing market exacerbates inequality and accounts for 43.78% of the rise of wealth inequality. Hence, entry barrier reform contributes the most to the rising wealth inequality according to our quantitative analysis. Housing reform, i.e., from public to private housing tradable in markets, mitigates inequality as it enables the middle class to accumulate wealth.

Figure 2. Decomposition results.

Another advantage of our structural framework is that it allows us to evaluate the welfare consequences of each of these drivers, taking into account the growth-equity trade-off, from the point of view of a utilitarian social planner who assigns equal weight to each household. The broad lesson from such welfare analysis is that the relatively moderate TFP growth of 3.5% per year is still the most important driver of the welfare gain during the transition. However, for urban households, the reduction of entry barriers to entrepreneurship is a close second, which means that despite the high degree of inequality it generates, “letting some people get rich first” on balance produces substantial welfare gain for urban households.

The Chinese economy is characterized by severe financial frictions. Even today the financial sector is largely dominated by a few state-owned banks. As the growing financially constrained entrepreneurship plays a major role in driving wealth inequality, the last question we ask is what would happen if the same set of reforms and TFP growth happened in an economy with a perfect credit market. The striking result is not only that output growth would be higher, but also the wealth inequality would actually decline during the transition. In other words, the growth-equity trade-off in the Chinese case emerges only in the context of an underdeveloped financial market. The perfect credit market moderates the savings motive by reducing the average household saving rate from 60% in the calibrated model to around 45%. At the same time, a perfect credit market allows entrepreneurs to operate at their optimal size, which speeds the growth rates of output as well as the wage rate workers receive. These factors combined lead to a more equal distribution of wealth.

This last result highlights the critical role of financial friction in enabling China’s tremendous rise of wealth inequality and the resulting growth-equity trade-off. Capital accumulation per se does not necessarily lead to a more unequal distribution. In the case of a perfect credit market, there is actually more capital employed in production. It is the fact that entrepreneurs need to finance these investments through their own pockets that drives the increase in wealth inequality. For other transition economies, our findings potentially point to the importance of developing a well-functioning financial market alongside reforms in industrial or agricultural sectors.

References

Aiyagari, S. Rao. 1994. “Uninsured Idiosyncratic Risk and Aggregate Saving.” Quarterly

Journal of Economics 109 (3): 659–84. https://doi.org/10.2307/2118417.

Benjamin, Dwayne, Loren Brandt, John Giles, and Sangui Wang. 2008. “Income Inequality during China’s Economic Transition.” In China’s Great Economic Transformation, edited by Loren Brandt and Thomas G. Rawski, 729–75. Cambridge, UK: Cambridge University Press. https://doi.org/10.1017/CBO9780511754234.019.

Jiang, Yangtian, Yu Zheng, and Lijun Zhu. 2023. “Unequal Transition: The Widening Wealth Gap amidst China’s Rapid Growth.” SSRN Working Paper No. 4485013. https://dx.doi.org/10.2139/ssrn.4485013.

Khan, Azizur Rahman, and Carl Riskin. 2005. “China’s Household Income and Its Distribution, 1995 and 2002.” China Quarterly 182: 356–84. https://www.jstor.org/stable/20192479.

Piketty, Thomas, Li Yang, and Gabriel Zucman. 2019. “Capital Accumulation, Private Property, and Rising Inequality in China, 1978–2015.” American Economic Review 109 (7): 2469–96. https://doi.org/10.1257/aer.20170973.

Zhang, Junsen. 2021. “A Survey on Income Inequality in China.” Journal of Economic Literature 59 (4): 1191–1239. https://doi.org/10.1257/jel.20201495.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email