A Summary of Retail Investors and Momentum

We explore the link between momentum and retail investing via an identification strategy in China, where retail investors dominate. We propose that due to a round lot restriction, small retail investors are less likely to hold and trade stocks with high nominal prices, and find supporting evidence. We then show that while there is no momentum in the Chinese market on aggregate, there is indeed strong momentum in high-priced stocks. Short-term reversals are stronger in low-priced stocks even after controlling for illiquidity. Mutual fund holdings enhance momentum. Small investor participation increases and momentum weakens following splits in high-priced stocks. Taken together, the results support the notion that short-horizon retail trades contribute to short-term reversals, and attenuate momentum arising from institutional underreaction to long-lived information.

S ince the discovery of momentum by Jegadeesh and Titman (1993), the profitability of this simple strategy that buys past winners and shorts past losers has continued to puzzle researchers. Chui, Titman, and Wei (2010), and, more recently, Liu, Stambaugh, and Yuan (2019) find that whereas momentum is significantly present in the U.S. market, it is absent in the Chinese market. This difference in return patterns between two of the world’s top equity markets by capitalization is intriguing. Is momentum really absent in China, or is it present in a subset of firms? What can we learn about momentum from the contrast in the success of the strategy within the U.S. versus China?

To understand the above issues, our starting point is the observation that the Chinese market has a much stronger presence of retail investors. In general, such investors are considered to be unsophisticated traders, who might naïvely conduct short-horizon trades (Jones et al. 2022), and whose demands can cause inventory-based return reversals (Nagel 2012; Peress and Schmidt 2020). On the other hand, theoretical work suggests that better informed (i.e., institutional) investors' underreaction to cash flow signals contributes to return momentum (Hong and Stein 1999). These observations imply that the absence of momentum can arise from a different clientele in China: the greater presence of short-horizon retail investors promotes short-term reversals, as opposed to longer-term momentum.

In this study, we test whether differences in clientele do indeed cause differences in the success of the momentum strategy via a two-prong identification approach within the Chinese market. In our first method, we identify firms in which retail investors are less (more) active for reasons other than firms’ fundamentals, and examine whether there is in fact more (less) momentum in these shares. Our second approach exploits a corporate event that increases retail investor participation, and examines whether the profitability of momentum strategies decreases as a result.

Specifically, our initial approach exploits a Chinese market rule that makes retail investors less prone to investing in stocks with high nominal prices. The rule sets the minimum trading unit at a round lot of 100 shares. Such a requirement induces financial constraints on investors. Because these constraints are related to investors’ capital and nominal prices, but unrelated to firms’ fundamentals, nominal prices can affect the participation of small investors in a manner independent of underlying cash flows.

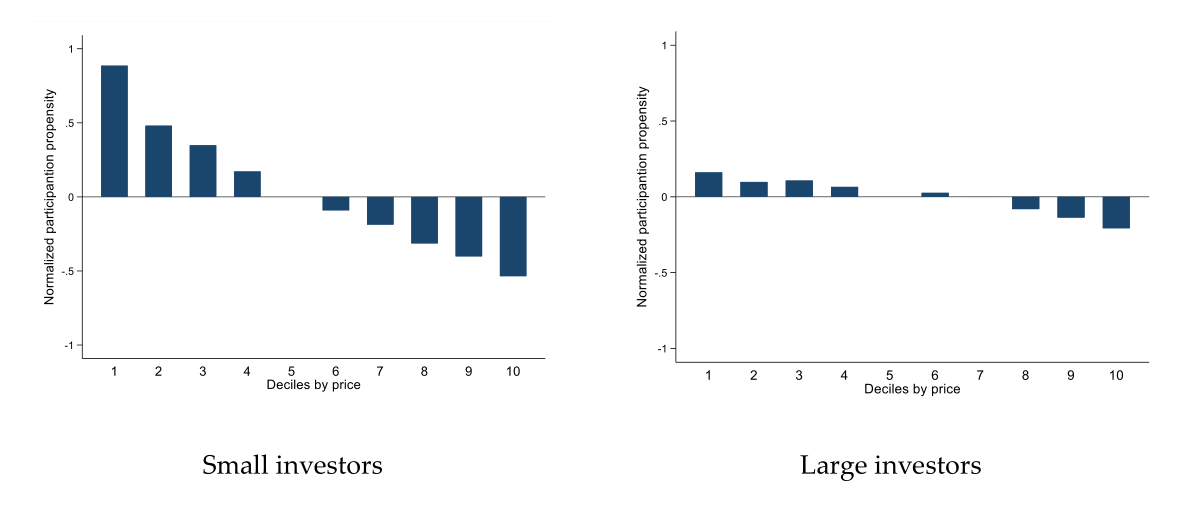

We use account-level data to directly measure investors’ participation propensity across deciles based on nominal prices. We designate retail investors whose average portfolio size is below 200K (above 500K) yuan as “small” (“large”). We find that investor participation propensity is negatively related to stock prices. The downward slope is much steeper for small investors than for large investors. Figure 1 shows that, compared to the stocks in the fifth decile, the participation propensity in the tenth decile (highest-priced group) drops by 53.5% for small investors, whereas the corresponding reduction for large investors is just 20.7%. We also document that small investors have shorter average holding periods and exhibit greater turnover than larger investors, supporting the conjecture that the former are short-horizon traders.

Fig.

1 Participation propensity of small and large investors across price-based

deciles

We use two other tests to show that high prices deter small investors via the financial constraint channel. First, we show that as the prices of high-priced stocks rise, their direct holdings among small investors decrease, whereas their indirect holdings via mutual funds continue to increase. Second, we show that when stocks held by small investors experience long-lived trading halts, thus effectively locking up wealth, such investors reduce their propensity to buy high-priced stocks (but not low-priced stocks). These two findings indicate that small investors eschew high-priced stocks because of the tighter financial constraints imposed by the round lot restriction.

We then test our main hypothesis that momentum is stronger in stocks with less ownership by small retail traders. We examine the returns of momentum strategies across stock groups sorted on nominal prices and report the results in Figure 2. For this purpose, we are able to use a longer time series of returns data from January 2000 to December 2020, relative to the 2016–2020 time series for the trading account data. Consistent with Griffin, Ji, and Martin (2003), Chui, Titman, and Wei (2010), and Docherty and Hurst (2018), the 12-month momentum strategy based on going long-short in the extreme winner-loser quintiles generates insignificant monthly returns on aggregate (estimate = 0.198% and t-value = 0.71). In a novel result, however, among the highest-priced stocks (tenth decile), the momentum strategy generates significantly positive monthly returns (estimate = 1.643% and t-value = 3.73). This monthly return estimate translates to an annual return of 19.72%. If one yuan is invested in the momentum strategy among the highest-priced stocks, it multiplies to approximately 30 yuan over the sample period, which is five times greater than the momentum strategy that applies to all stocks. Our qualitative results are robust to controlling for risk factors, using double-sorted portfolios, and using Fama and MacBeth (1973)-type regressions.

Fig. 2 Monmentum return across price-based deciles

The dampening effect of small retail investors on a baseline level of momentum suggests that the marginal impact of such investors should diminish as their presence increases, but the momentum returns should not turn negative. We find evidence to support this notion. Specifically, the returns of momentum strategies halve from the highest-price decile (1.643% per month) to the second-highest decile (0.745% per month and still statistically significant). The average return further declines to 0.236% (t-value = 0.51) in the lowest-price decile. Thus, the momentum strategy yields positive returns in general, but its economic and statistical significance diminish as we move to progressively lower-price deciles.

We also demonstrate two other findings. First, we find that monthly reversals are more pronounced in low-priced stocks, a pattern that is the opposite of that for six to 12 month momentum. Second, for the high-priced stocks, where we do find momentum, it is more pronounced for stocks with higher levels of mutual fund holdings. We also find that return volatility, a proxy for real options, is negatively related to momentum in high-priced stocks, which runs counter to the notion that the higher returns to winners arise due to higher risk induced by greater availability of real options. The overall picture thus conforms to the notion that retail noise trading exacerbates short-term reversals and attenuates momentum caused by institutional underreaction to information.

Furthermore, we use a corporate event, namely, stock splits, to corroborate that financial constraints cause low participation of small investors among high-priced stocks, thus resulting in lower momentum in these stocks. Since splits mechanically lower nominal prices, they make the stocks more affordable to small investors. As a result, we expect a net increase in the fraction of small investors and, in turn, a decrease in the momentum effect. In a standard event-study approach, we find that for the high-priced stock groups, stock splits lead to a 25.7% increase in investor participation among small investors and only a 10.6% increase in large investor participation. These results are consistent with our financial constraint hypothesis because small investors face tighter financial constraints than large investors.

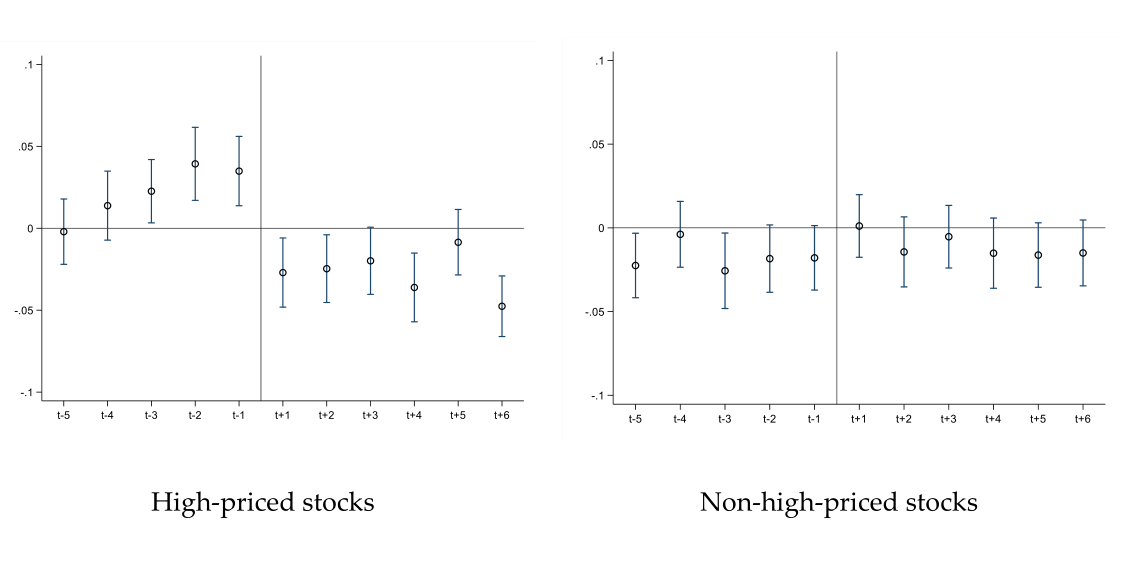

We next examine how stock split events affect stock-level momentum. We show that, in Figure 3, for the high-priced stock group, stock splits dampen stock-level momentum by 7.0% post-split, and the dampening effect is strengthened with higher split ratios. Further, the estimate of the after-split effect is close to zero and statistically insignificant for the remaining stocks. Overall, these results confirm our hypothesis that small retail investors attenuate momentum profits.

Fig.3 Stock momentum around stock splits

The question naturally arises as to what is novel about our Chinese setting relative to the U.S. The answer lies in the special features of our data. In general, establishing a causal relationship between retail investors and asset prices is difficult, because it is hard to create a treatment market with retail investors and a control market without such investors, ceteris paribus. Our paper exploits a market friction derived from the round lot rule to establish such a causal link. Our identification schemes related to direct stockholdings versus indirect holdings via mutual funds, the effect of long-lived trading halts on retail investment, and the effect of splits on retail investment are uniquely facilitated via access to detailed Chinese data on retail holdings and trading activity. Through these identification schemes that establish nominal stock prices as an inverse proxy for retail investment, we shed light on the link between momentum and retail investors.

Many theoretical papers on momentum focus on investors’ biased beliefs (Daniel, Hirshleifer, and Subrahmanyam 1998; Barberis, Shleifer, and Vishny 1998; Hong and Stein 1999; Da, Gurun, and Warachka 2014; Andrei and Cujean 2017). We believe that biases play an important role in generating momentum. However, it is tempting to conclude that if a return anomaly is caused by biased belief updating, then the absence of such an anomaly suggests rationality. Our results propose instead that retail noise trading could obscure the effect of underreaction to information signals. Thus, the absence of momentum in a market does not necessarily imply the predominance of rational investors in that market.

References

Andrei, Daniel, and Julien Cujean. 2017. “Information Percolation, Momentum, and Reversal.” Journal of Financial Economics 123 (3): 617–45. https://doi.org/10.1016/j.jfineco.2016.05.012.

Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. “A Model of Investor Sentiment.” Journal of Financial Economics 49 (3): 307–43. https://doi.org/10.1016/S0304-405X(98)00027-0.

Chui, Andy C. W., Sheridan Titman, and K. C. John Wei. 2010. “Individualism and Momentum around the World.” Journal of Finance 65 (1): 361–92. https://doi.org/10.1111/j.1540-6261.2009.01532.x.

Da, Zhi, Umit G. Gurun, and Mitch Warachka. 2014. “Frog in the Pan: Continuous Information and Momentum.” Review of Financial Studies 27 (7): 2171–2218. https://doi.org/10.1093/rfs/hhu003.

Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1998. “Investor Psychology and Security Market Under‐ and Overreactions.” Journal of Finance 53 (6): 1839–85. https://doi.org/10.1111/0022-1082.00077.

Docherty, Paul, and Gareth Hurst. 2018. “Investor Myopia and the Momentum Premium across International Equity Markets.” Journal of Financial and Quantitative Analysis 53 (6): 2465–90. https://doi.org/10.1017/S0022109018000431.

Fama, Eugene F., and James D. MacBeth. 1973. “Risk, Return, and Equilibrium: Empirical Tests.” Journal of Political Economy 81 (3): 607–36. https://www.jstor.org/stable/1831028.

Griffin, John M., Xiuqing Ji, and J. Spencer Martin. 2003. “Momentum Investing and Business Cycle Risk: Evidence from Pole to Pole.” Journal of Finance 58 (6): 2515–47. https://doi.org/10.1046/j.1540-6261.2003.00614.x.

Hong, Harrison, and Jeremy C. Stein. 1999. “A Unified Theory of Underreaction, Momentum Trading, and Overreaction in Asset Markets.” Journal of Finance 54 (6): 2143–84. https://www.jstor.org/stable/797990.

Jegadeesh, Narasimhan, and Sheridan Titman. 1993. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance 48 (1): 65–91. https://doi.org/10.2307/2328882.

Jones, Charles M., Donghui Shi, Xiaoyan Zhang, and Xinran Zhang. 2022. “Understanding Retail Investors: Evidence from China.” SSRN Working Paper. http://dx.doi.org/10.2139/ssrn.3628809.

Liu, Jianan, Robert F. Stambaugh, and Yu Yuan. 2019. “Size and Value in China.” Journal of Financial Economics 134 (1): 48–69. https://doi.org/10.1016/j.jfineco.2019.03.008.

Nagel, Stefan. 2012. “Evaporating Liquidity.” Review of Financial Studies 25 (7): 2005–2039. https://doi.org/10.1093/rfs/hhs066.

Peress, Joel, and Daniel Schmidt. 2020. “Glued to the TV: Distracted Noise Traders and Stock Market Liquidity.” Journal of Finance 75 (2): 1083–1133. https://doi.org/10.1111/jofi.12863.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email