What You Import Matters for Productivity Growth: Experience from Chinese Manufacturing Firms

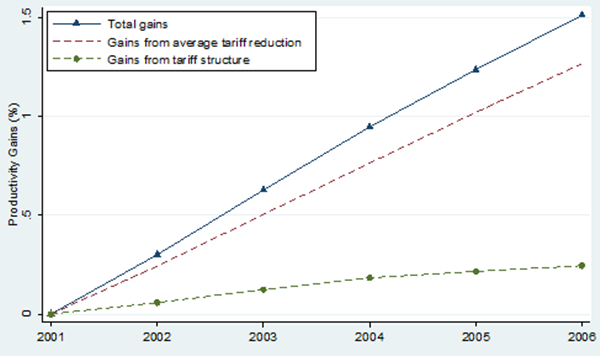

We find that capital import has a substantially larger productivity effect than intermediates import, by generating significant long-term productivity gains through R&D-capital synergy, R&D-inducing, and direct dynamic productivity effects. Our findings highlight the importance of tariff structure in tariff liberalization: the change in tariff structure explains 18% of the productivity gains following China’s WTO accession.

The 4th China International Import Expo (CIIE) was held in Shanghai from November 5 to 10, 2021. The CIIE is the world’s first national-level exhibition with import as its theme, which aims at facilitating countries and regions all over the world to strengthen economic cooperation and trade.

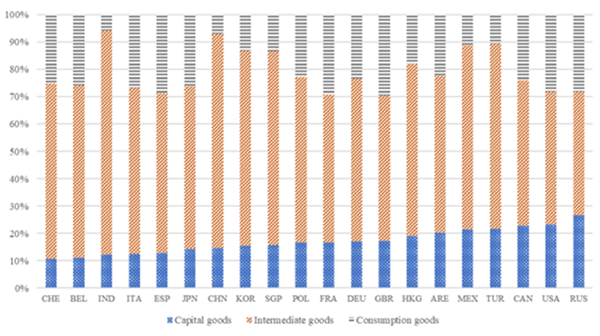

Large import expos are rare because most countries are more likely to promote export than import. Nonetheless, import may play important roles in promoting firm performance and industry upgrading. Figure 1 depicts the import structures across the top 20 largest importing countries/regions in 2016. The share of capital goods in total imports is between 10% and 24% and the share of intermediate goods imports is substantially larger than that of capital goods imports, while consumption goods account for a small share of total imports.

Figure 1: Import Structure across Countries/Regions, 2016

Source: UN Comtrade.

A large body of literature has found evidence that imported inputs in general—without distinguishing capital from intermediate goods—improves the productivity of imported firms due to more varieties, better quality, and learning (Amiti and Konings 2007; Halpern, Koren, and Szeidl 2015). The literature has also shown that imported capital goods from developed economies improve productivity in less developed countries through international technology diffusion (Lee 1995, Mazumdar 2001, Keller 2004).

In Mo, Qiu, Zhang, and Dong (2021), we investigate the distinct effects of capital and intermediates imports on productivity growth at the firm level. Compared to intermediate goods, capital goods can typically be used for multiple periods. Capital goods import is also regarded as a channel for international technology diffusion, since capital goods production is highly concentrated in a few R&D-intensive countries (Eaton and Kortum 2001). As a result, capital goods import may generate an augmented immediate productivity effect via an import-R&D synergy effect when the importer is also conducting R&D investment, or induce more R&D investment, which further enhances productivity growth in the long run. This is consistent with the observations in the data: capital importers are larger, more productive, and invest more in R&D, compared with intermediates importers and firms that do not import. Capital importers also have higher growth rates of sales, labor productivity, and R&D investment.

To explain these stylized facts, we build a structural model that allows capital and intermediates imports to have differential effects on firm production and productivity evolution process in a dynamic setting. We then quantify the empirical importance of the productivity effects from capital and intermediates imports, by estimating the model using the standard production estimation approach developed by Olley and Pakes (1996) and Levinsohn and Petrin (2003).

Results

We have three key findings. First, while both capital and intermediates imports have strong immediate productivity effects, only capital import has R&D-capital synergy effect, that is, importers obtain additional productivity gains when simultaneously making R&D investment and importing capital. Second, capital import has strong direct dynamic effects from learning and long-term usage of capital goods. Third, capital import increases firms’ probability of conducting R&D, which we refer to as the R&D-inducing effect. We find no evidence on the R&D-synergy and R&D-inducing effects for intermediates import.

Based on our empirical results, we conduct quantitative exercises to show that international sourcing improved the average productivity of importing firms by 2.43% in China’s manufacturing sector during 2000–2006, of which 52% was contributed by capital import. This large share of gains from capital import is striking because capital import accounts for only one-sixth of the total value of input imports. Importantly, about 43% of the productivity gains from capital import came from the R&D-capital synergy and dynamic productivity effects. Almost all of the productivity gains from intermediates import were from the quality-and-variety effect.

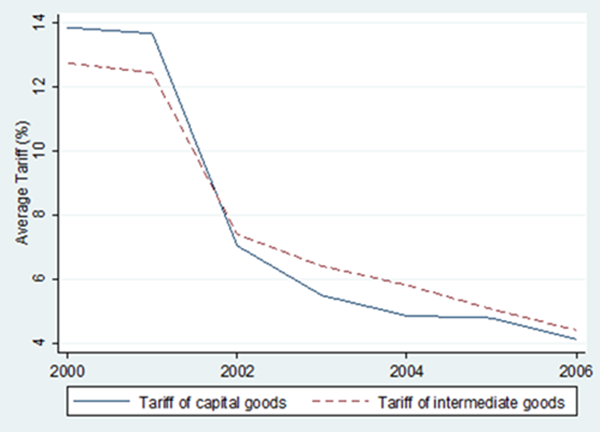

We apply the model to quantify the impact of China’s input tariff liberalization (especially changes in tariff structure) on firm productivity following the country’s accession to the WTO at the end of 2001. After the WTO accession, China reduced the tariffs of capital imports more than those of intermediates imports, by approximately two percentage points (Figure 2). The differential productivity effects of capital and intermediates imports directly highlight the importance of tariff structure in liberalization. Simulation based on our structural model demonstrates that the tariff reduction increased the average productivity of marginal importers by approximately 1.5% from 2002 to 2006, of which 18% was contributed by the change in tariff structure (Figure 3).

Figure 2: Average Import Tariff Rates by Product Category

Note: The average tariff rates are calculated using the import value of corresponding products as the weights.

Figure 3: Productivity Gains from Tariff Reduction: Average Tariff Reduction versus Tariff Structure

Implications

Based on China’s experience, our study has clear policy implications for other low-income countries. First, our study shows that the structure of tariff liberalization is important because what a country imports matters: manufacturing firms benefit more from capital import than from intermediates import. That is, we need trade policies to remove capital import frictions in low-income countries. Second, our finding of the strong R&D-capital synergy and R&D-inducing effects suggests the importance of aligning the import policy and R&D policy in developing countries.

(Jiawei Mo, School of Economics, Peking University; Larry D. Qiu, Department of Economics, Lingnan University; Hongsong Zhang, Faculty of Business and Economics, University of Hong Kong; Xiaoyu Dong, Hong Kong Monetary Authority.)

References

Amiti, Mary, and Jozef Konings. 2007. “Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia.” American Economic Review 97 (5): 1611–38. https://doi.org/10.1257/aer.97.5.1611.

Eaton, Jonathan, and Samuel Kortum. 2001. “Trade in Capital Goods.” European Economic Review 45 (7): 1195–1235. https://doi.org/10.1016/S0014-2921(00)00103-3.

Halpern, László, Miklós Koren, and Adam Szeidl. 2015. “Imported Inputs and Productivity.” American Economic Review 105 (12): 3660–703. https://doi.org/10.1257/aer.20150443.

Keller, Wolfgang. 2004. “International Technology Diffusion.” Journal of Economic Literature 42 (3): 752–82. https://doi.org/10.1257/0022051042177685.

Lee, Jong-Wha. 1995. “Capital Goods Imports and Long-Run Growth.” Journal of Development Economics 48 (1): 91–110. https://doi.org/10.1016/0304-3878(95)00015-1.

Levinsohn, James, and Amil Petrin. 2003. “Estimating Production Functions Using Inputs to Control for Unobservables.” Review of Economic Studies 70 (2): 317–41. https://doi.org/10.1111/1467-937X.00246.

Mazumdar, Joy. 2001. “Imported Machinery and Growth in LDCs.” Journal of Development Economics 65 (1): 209–24. https://doi.org/10.1016/S0304-3878(01)00134-1.

Mo, Jiawei, Larry D. Qiu, Hongsong Zhang, and Xiaoyu Dong. 2021. “What You Import Matters for Productivity Growth: Experience from Chinese Manufacturing Firms.” Journal of Development Economics 152, 102677. https://doi.org/10.1016/j.jdeveco.2021.102677.

Olley, G. Steven, and Ariel Pakes. 1996. “The Dynamics of Productivity in the Telecommunications Equipment Industry.” Econometrica 64 (6): 1263–97. https://doi.org/10.2307/2171831.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email