Foreign-Invested Enterprises and the Transmission of Global Financial Uncertainty: Evidence from China

How are global financial uncertainty shocks transmitted across borders? What is the role of nonfinancial multinational companies in the cross-border shock transmission? Using Chinese firm-level data, we find that rising global financial uncertainty has a significantly larger contractionary effect on real investment for foreign-invested enterprises (FIEs) than their local counterparts. The differential responses to global financial uncertainty are more pronounced for firms with greater investment irreversibility or higher external finance dependence. Furthermore, the contractionary effect is mainly driven by downside uncertainty, while upside uncertainty is modestly expansionary. In addition, the contractionary effect of global financial uncertainty can be spilled over from FIEs to local firms through production networks.

Amid the rising uncertainty over the outlook of global financial markets in the wake of the global financial crisis, academics and policy makers have paid a great deal of attention to the economic consequences of the uncertainty shock, especially the cross-border spillover of uncertainty shocks to developing countries. Recent studies (e.g., Carrrière-Swallow and Céspedes, 2013; Bhattarai et al., 2020) have provided macro-level evidence for the cross-border spillover effect of global financial uncertainty. However, micro-level evidence on the international transmission of global financial uncertainty and its underlying channels remains quite limited.

Meanwhile, previous studies in the broad international shock transmission literature have largely centered on cross-border portfolio flows or banking flows facilitated by financial institutions (e.g., Obstfeld et al., 2005; Cetorelli and Goldberg, 2012). Less attention has been paid to the role of nonfinancial multinational companies in the cross-border transmission of shocks. Given that many developing countries impose strict restrictions on portfolio flows but are highly open to inward foreign direct investment flows, understanding how foreign-invested enterprises (FIEs) propagate global shocks to the host economies is thus of great importance to safeguard local economy against external shocks.

In our recent working paper (Wu and Ye, 2021), we use the Chinese firm-level data to investigate the role of nonfinancial FIEs in transmitting global financial uncertainty to local economy, despite China’s tight controls on cross-border portfolio flows. The institutional and economic environment in China provide an ideal setting for us to uncover the FIE-based transmission channel. On the one hand, there is a substantial difference in accessing international credit markets between FIEs and their local counterparts in China. While local private firms are restricted from foreign borrowing due to capital control policies, FIEs in China enjoy preferential policy treatment in accessing international credit markets. As such, FIEs tend to have a greater exposure to global shocks than their local counterparts in China. We thus leverage on the differential real responses to global uncertainty shocks across firms to shed light on the role of FIEs in transmitting shocks to the host economy.

On the other hand, like many developing countries China has been tirelessly attracting foreign direct investment to promote growth over the past several decades. So far, FIEs have played an indispensable role in Chinese real economy. The data from the National Bureau of Statistics of China reveal that FIEs have, on average, contributed to over 26% of the above-scale industrial production and sales revenue in China between 2003 and 2015. Therefore, disturbances to FIEs’ real operation originating from global shocks can have potentially serious knock-on effects on the local economy in China.

We follow the literature to use the VIX as our primary measure of global financial uncertainty. To distinguish the effect of global financial uncertainty shocks from the confounding effects associated with contemporaneous movements in global and local conditions, we pursue three strategies. The first strategy is to explicitly control for FIEs’ differential responses to variations in realized volatility of stock market returns and changes in the U.S. monetary policy in the baseline specification. Secondly, we measure global financial uncertainty as the structural shocks that are identified from a VAR model and orthogonal to various global economic and financial variables. The third strategy is to further verify the robustness of our results to the inclusion of additional interaction effects with a rich set of global and domestic economic and financial factors.

To ensure that the differential real responses to global financial uncertainty shocks across firms are indeed driven by foreign ownership rather than other firm-level characteristics, we not only control for the interactions between firm-level characteristics and uncertainty but also apply propensity score matching methods to match FIEs with their comparable local counterparts, and re-estimate the baseline specification in matched samples.

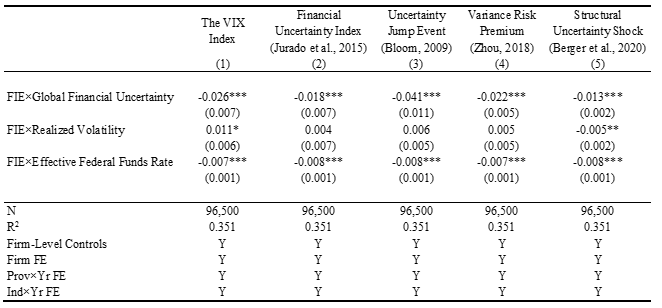

Using a large data set of Chinese manufacturing firms over the 2006-2015 period obtained from the Bureau van Dijk’s Oriana database, we find strong and robust evidence that an increase in global financial uncertainty causes a substantially larger contractionary effect on real investment for FIEs over local private firms. As shown in Table 1, regardless of the uncertainty measure used, the estimated coefficient on FIEs’ interaction with the uncertainty measure is always negative and statistically significant, indicating that greater global financial uncertainty is associated with a sharper decline in investment for FIEs than for their local counterparts in China. Moreover, the differential investment response to global financial uncertainty is also economically sizable. A one-standard-deviation increase in log VIX would lower FIEs’ investment by 2.6 percentage points more than that of their local counterparts, equivalent to about a 40-percent decrease relative to the average investment rate in the sample.

Table 1. Basic Results

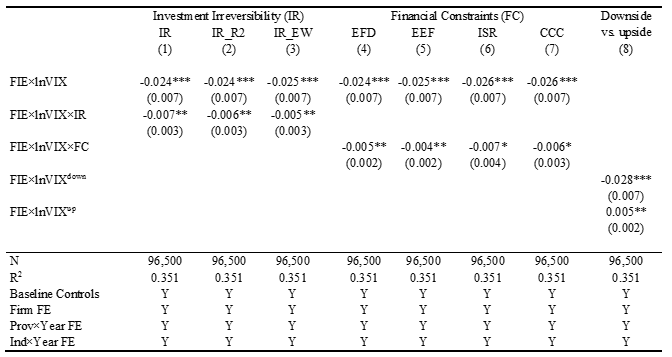

Next, we rely on cross-industry variations to explore two potential channels through which global financial uncertainty affects the differential investment responses of FIEs relative to their local counterparts. One is the “real option” channel associated with investment irreversibility. The other is the credit channel associated with financial frictions. Table 2 shows that the differential investment response to global financial uncertainty is more pronounced for firms that are faced with greater investment irreversibility or rely more heavily on external finance. Furthermore, when distinguishing downside uncertainty from upside uncertainty, we find that the downside uncertainty is the main driving force behind the contractionary effect on investment, while the upside uncertainty is mildly expansionary.

Table 2. Underlying Mechanisms

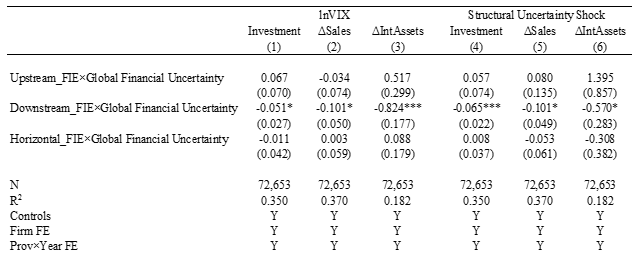

Finally, we also extend our analysis to other aspects of firm performance and explore potential spillover effects to local private firms via production networks. Our estimates suggest that heightened global financial uncertainty leads to significantly worse performance in sales growth, employment growth, liquidity conditions, and intangible asset growth for FIEs relative to their local counterparts. Moreover, following Javorcik (2004), we show in Table 3 that the negative effects of global uncertainty shock can propagate to local private firms along the production chain. Specifically, at times of rising global financial uncertainty, local private firms are more likely to suffer from declines in investment, sales growth and intangible asset growth when their downstream is characterized by a higher concentration of FIEs.

Table 3. Propagation Through Production Networks

From the policy perspective, our evidence indicates that global financial uncertainty shocks can be propagated even to countries that have managed to insulate their local financial systems from external shocks by imposing capital controls on portfolio flows. Particularly, our findings reveal that the presence of FIEs can be a backdoor through which financially isolated countries like China remain directly vulnerable to external shocks. Furthermore, our results also suggest that domestic policy measures for reducing capital adjustment frictions and financial market frictions can help enhance local economic resilience to external shocks and threats.

(Shujie Wu, Chinese University of Hong Kong; Haichun Ye, Chinese University of Hong Kong, Shenzhen.)

References

Berger, D., I. Dew-Becker, S. Giglio, 2020. Uncertainty shocks as second-moment news shocks, Review of Economic Studies 87(1): 40–76.

Bhattaraia, S., A. Chatterjee, and W. Y. Park, 2020. Global spillover effects of U.S. uncertainty, Journal of Monetary Economics 114: 71–89.

Bloom, N., 2009. The impact of uncertainty shocks, Econometrica 77(3): 623–685.

Carrière-Swallow, Y., and L. Cespedes, 2013. The impact of uncertainty shocks in emerging economies, Journal of International Economics 90(2): 316–325.

Cetorelli, N., and L. Goldberg, 2012. Bank globalization and monetary transmission, Journal of Finance 67(5): 1811–1843.

Javorcik, B.S., 2004. Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward and forward linkages, American Economic Review 94(3): 605–627.

Jurado, K., S. C. Ludvigson, and S. Ng., 2015. Measuring uncertainty, American Economic Review 105 (3): 1177–1216.

Obstfeld, M., J. Shambaugh, and A. Taylor, 2005. The trilemma in history: Tradeoffs among exchange rates, monetary policies, and capital mobility, Review of Economics and Statistics 3: 423–438.

Wu, S. J., and H. Ye, 2021. FIEs and the Transmission of Global Financial Uncertainty: Evidence from China, Working Paper.

Zhou, H., 2018. Variance risk premia, asset predictability puzzles, and macroeconomic uncertainty, Annual Review of Financial Economics 10: 481–97.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email