Competitive Effects of China’s Listing Suspensions

China’s suspensions of initial public offerings (IPOs) provide a unique opportunity to evaluate the competitive effects of IPO activity on listed firms, as existing studies are challenged by the influence of market conditions on IPO timing. We evaluate the stock returns of listed firms on the Shanghai and Shenzhen exchanges over the three most recent suspensions. We confirm adverse effects on listed firms from IPOs, both from direct competition and from the creation of close asset substitutes. We also find that weaker firms are more exposed to the adverse effects of IPO listings.

How do initial public offerings (IPOs) affect existing firms? One channel frequently cited is that firms going public threaten other firms in the same industry, either through direct competition (e.g. Akhigbe et al. 2003 and Hsu et al. 2010), or by adversely changing industry conditions (Spiegel and Tookes (2020)). Alternatively, assets generated by IPOs may be valuable to investors due to their risk characteristics, and their creation may leave assets with similar risk characteristics less scarce and hence less valuable (Braun and Larrain 2009).

However, the timing of individual equity issuances poses a challenge to research on IPO effects. Ritter (1991) shows that firms take advantage of “windows of opportunity” by issuing at times when investors are overly optimistic about industry prospects. Since then, other studies’ empirical findings have been consistent with this interpretation (e.g. Pagano et al. 1998; Boeh and Dunbar 2014).

This strategic timing problem implies that the negative relationship often identified between an IPO announcement and the valuation of similar listed firms cannot necessarily be taken as evidence of competitive effects. Since firm management is often more informed about a firm’s industry, IPOs may signal overly generous valuations of an industry. IPO announcements may then trigger price reversals independent of competitive effects.

The recent suspensions of IPO activity in China offers an opportunity for identification. Since 1994, the China Securities Regulatory Commission (CSRC), the regulator of China’s IPO markets, has implemented blanket IPO suspensions on nine separate occasions. These suspensions were largely unanticipated, and their blanket nature creates identifiable exogenous and unanticipated shocks to IPO activity for a large number of identifiable firms. These shocks have been used to examine the impact of suspensions on firms in the IPO process (Cong and Howell 2019), as well as the implications for aggregate market pricing (Shi et al. 2018).

In a recent paper, Packer and Spiegel (2020) construct a panel sample to examine the implications of CSRC IPO suspensions on individual listed firms by examining the returns of listed firms around the three episodes of blanket IPO suspension that have been imposed in China since 2008. Our panel specification allows us to condition for macroeconomic and market conditions at the time of the suspension announcements.

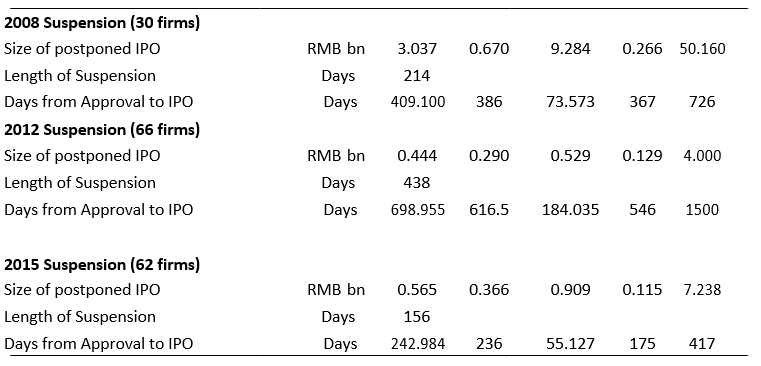

Importantly, the China IPO approval process allows us to identify unlisted firms whose IPOs were approved but had yet to issue at the time of the suspension announcement. Ahead of the 2008–2009, 2012–2014, and 2015 suspensions, 30, 66, and 62 firms, respectively, had been approved for an IPO and were waiting to list. The average size of the total 158 postponed IPOs, when they later occurred, was around one billion RMB, though the IPO size shows considerable variation, averaging more than 3 billion RMB in 2008, compared to 4 and 6 billion RMB in 2012 and 2015, respectively (Table 1).

Table 1 shows that the three suspensions lasted 214, 438, and 156 days, respectively. Variations in the lengths of time that IPOs have been in the queue ahead of the suspension and the time it subsequently takes to go public imply that the overall time from approval to the eventual IPO vary within each suspension as well.

Table 1. Postponed IPO Firm Characteristics

Source: Wind and authors’ calculations.

We identify direct competition by the percent of the existing industry market capitalization that the postponed IPO-queue firms would have represented. This variable is denoted by IPO, below. In addition, to measure the extent to which a listed firm is exposed to the increased supply of similar assets from prospective IPOs, we calculate the covariance of each individual listed security with a synthetic portfolio of listed firms whose industry composition matches that of the delayed IPO-queue portfolio. We call this variable COV, below.

We regress the one-day share price percentage return of listed firms on the suspension date on the key explanatory variables defined above along with a comprehensive array of control variables. In addition to firm and individual suspension fixed effects, we include measures of firm profitability, market capitalization, leverage, price-to book ratios, earnings volatility, an indicator of the exchange on which the firm is listed, and whether the listed firm is a state-owned enterprise.

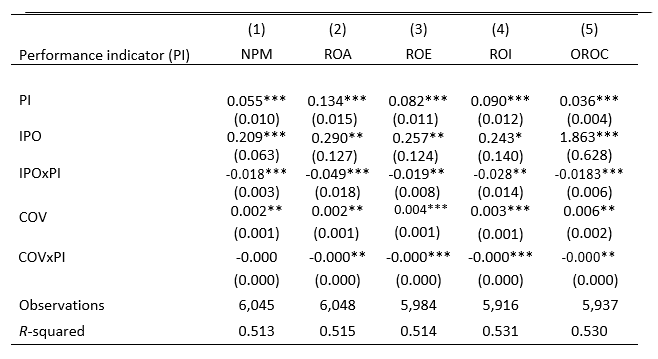

We expect that stronger firms would be less vulnerable to the competitive impact of IPOs. To check this, we examine the interaction of the competitive impact variables with alternative measures of listed firm profitability. The baseline results for our key variables are reported in Table 2, with each column using an alternative performance indicator (PI). Columns (1) through (5) use net profit margins (NPM), return on assets (ROA), return on equity (ROE), return on investment (ROI), and OROC, which measures operating revenue over operating cost, respectively. All PIs are measured as percentages. For space considerations, we do not report the results for the other conditioning variables in Table 2.

Table 2. Base Specification Results

Note: The dependent variable is one-day share price percentage return for listed firms at the time of each of the three suspensions. OLS with standard errors clustered by industry in parentheses. Conditioning variables coefficient estimates not reported. Models (1) through (5) alternate performance indicators, as indicated at top of each column. *** p<0.01, ** p<0.05, * p<0.1.

The key variables of interest, the proxy for potential direct IPO competition (IPO) in the second row, and that variable interacted with the profitability metric in the third row, both enter at statistically significant levels with the expected positive and negative point estimates, respectively. Our point estimates indicate that these channels are economically significant as well. For example, a one standard deviation increase in the IPO measure in the column (1) specification is estimated to raise one-day returns by 24.4 basis points, while our point estimate on the interactive term indicates that a one standard deviation increase in profitability for firms with average IPO values reduces those returns by 5.9 basis points.

Our proxy for potential asset-space IPO competition (COV) also enters at statistically significant levels with its expected positive sign. Again using column (1), our coefficient estimate indicates that a one standard deviation increase in COV results in a 42.8 basis point increase in one-day returns. Our interactive term misses statistical significance at conventional levels, but the point estimate indicates economically meaningful heterogeneity across firms in their sensitivity to this channel as well, with a one standard deviation increase in NPM for firms with average COV values reducing returns by 5.6 basis points.

Overall, our results are quite robust to the use of all the firm performance variables and confirm that the IPO suspensions were taken as better news for firms with greater exposure to the competitive impact of IPOs through either the direct or asset-space competition channels. Moreover, the sensitivity to the competitive impact of IPO activity was measurably related to firm performance, with less profitable firms exhibiting more sensitivity. IPO suspensions therefore appear to disproportionally benefit poorly performing firms.

(Bank for International Settlements and Federal Reserve Bank of San Francisco. Our views are our own and not those of the Bank for International Settlements, the Federal Reserve Board, or the Federal Reserve Bank of San Francisco.)

References

Akhigbe, A., S. Borde, and A. M. Whyte (2003). Does an industry effect exist for initial public offerings? The Financial Review 38 (4), 531–551.

Braun, M. and B. Larrain (2009). Do IPOs affect the prices of other stocks? Evidence from emerging markets. Review of Financial Studies 22 (4), 1505–1544.

Cong, L. W. and S. Howell (2019, December). Policy uncertainty and innovation: Evidence from IPO interventions in China. SSRN-ID 2911221.

Hsu, H.-C., A. Reed, and J. Rocholl (2010). The new game in town: Competitive effects of IPOs. Journal of Finance 65 (2), 495–528.

Packer, F. and M. Spiegel (2020). Competitive effects of IPOs: Evidence from Chinese listing suspensions. BIS Working Paper 888, September.

Pagano, M., F. Panetta, and L. Zingales (1998). Why do companies go public? An empirical analysis. Journal of Finance 53 (1), 27–64.

Ritter, J. (1991). The long-run performance of initial public offerings. Journal of Finance 46 (1), 3–27.

Shi, S., Q. Sun, and X. Zhang (2018). Do IPOs affect market price? Evidence from China. Journal of Financial and Quantitative Analysis 53 (3), 1391–1416.

Spiegel, M. and H. Tookes (2020). Why does an IPO affect rival firms? The Review of Financial Studies 33, 3205–3249.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email