Going Bankrupt in China

We use a new case-level dataset to document a set of stylized facts on bankruptcy in China and study how the introduction of specialized courts across Chinese cities affected insolvency resolution and the local economy. We find that specialized courts hire better-trained judges and are 35% faster at dealing with bankruptcy cases than civil courts within the same city. We also find evidence that their introduction benefited the local economy by fostering firm entry, increasing average capital productivity, and favoring the reallocation of employment out of “zombie” firm–intensive sectors.

The lack of an efficient and independent judicial system is a major obstacle to economic development. Several studies have shown that, especially in developing countries, courts are often slow at processing cases, lack specialized judges, and are subject to political interference (Djankov, Hart, McLiesh, and Shleifer, 2008; Dakolias, 1999; Rodriguez and Ehrichs, 2007). The effects of these frictions in contract enforcement can percolate through the financial system in the form of high interest rates and limited access to credit. These, in turn, affect firms’ ability to invest and innovate, and hinder the reallocation of capital towards more productive projects.

This issue is prominent in China, where local courts are traditionally slow and suffer from the interference of local politicians when dealing with bankruptcy cases (Fan, Huang, and Zhu, 2013; Henderson, 2007). Local politicians have strong incentives to keep in operation low-productivity and financially distressed state-owned firms, in order to contain unemployment, avoid social unrest, and promote their political careers. Despite its importance, we still know very little about how the judicial system deals with insolvency resolution in China and what are its effects on the real economy.

Bankruptcy in China: Uncovering new stylized facts

In a recent working paper, we collect new case-level data to shed light on how bankruptcy works in China (Li and Ponticelli, 2020). How the second largest economy in the world deals with corporate insolvency has important policy implications, especially in light of the recent increase in corporate defaults that followed a decade-long debt boom. Nevertheless, this question has been largely unexplored so far due to a lack of data.

To make progress on this front, we collect detailed information on 2,021 bankruptcy cases filed in China between 2011 and 2019. Our data source is a new online platform created by the Chinese Supreme Court that allows debtors and creditors to monitor the evolution of bankruptcy cases. The platform provides access to a digitized version of the court documents accompanying each case, from which we extract a large set of case and firm characteristics.

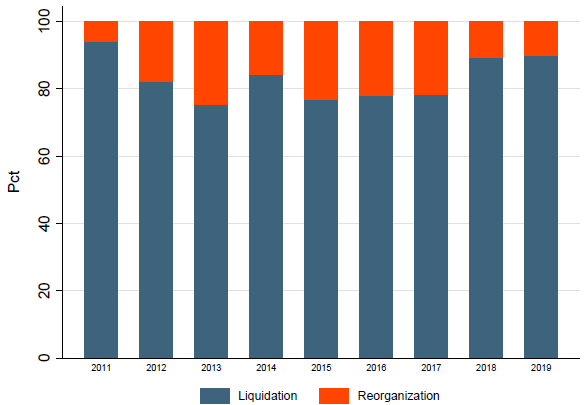

Figure 1: Number of bankruptcy cases by year, type of case, and sector

Notes: Number of bankruptcy cases by year of acceptance, 2011–2019. Source: authors’ calculations using data from the “National Corporate Bankruptcy Information Disclosure Platform.”

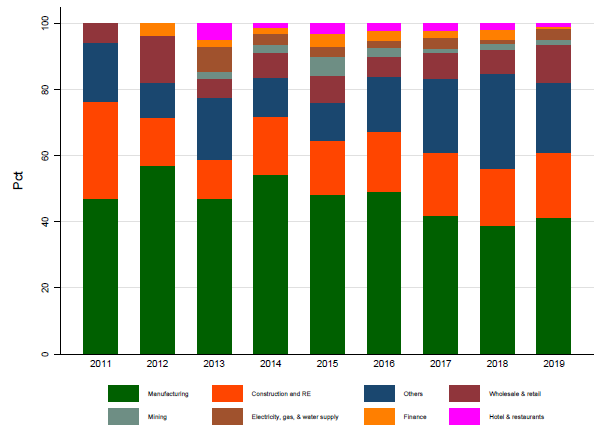

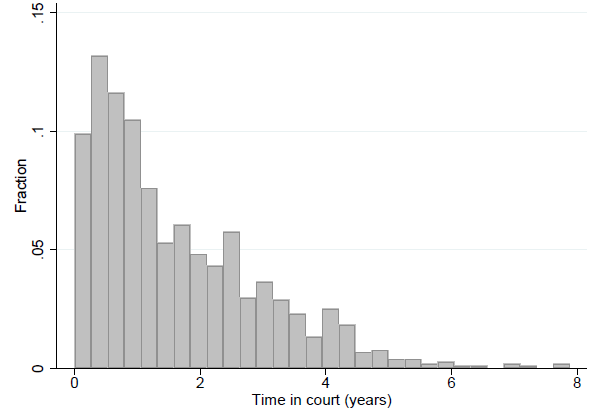

This new data allow us to uncover a set of stylized facts on bankruptcy in China. Similar to other emerging economies, the vast majority of Chinese bankruptcies are liquidations (77%). Over half of the cases in our sample involve firms operating in manufacturing, construction, and real estate. Liquidation cases are mostly initiated by unsecured creditors, while banks—whose claims tend to be secured by some form of collateral—initiate only 7.5% of cases. The average duration of bankruptcy cases we observe in the data is 1.6 years, around 60% longer than the average duration observed in the US during the same period according to World Bank data (see Note 1). However, as can be seen in Figure 2, there is large variation in case duration, which spans from a few months to around eight years. Reorganizations and cases involving small firms tend to be closed faster than liquidations and cases involving large firms respectively.

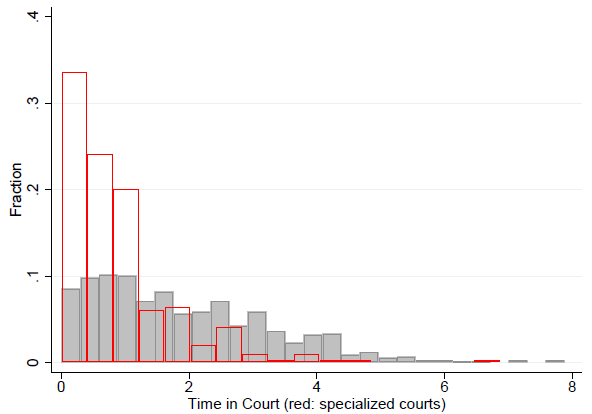

Figure 2: Distribution of case duration

Notes: The figure shows the distribution of the variable “time in court,” which captures the duration of each case in years. Panel (a) pools all closed cases in our sample. Panel (b) differentiates between cases initiated in traditional civil courts versus specialized courts.

The effects of introducing specialized courts on insolvency resolution

Our paper also provides a first attempt to estimate the effects of introducing specialized courts. As in many other emerging economies, until recently, the Chinese judicial system did not have courts specialized in bankruptcy cases. Despite being more time-consuming and complex than the average civil case, bankruptcy cases were filed in local civil courts, which lack specialized judges and tend to operate under the oversight of local party officials. Between 2007 and 2017, in an attempt to increase the legal protection of creditors, China introduced 97 specialized bankruptcy courts in different cities. Compared to traditional civil courts, specialized courts are run by better- trained judges and are part of an effort by the central government to limit local governments’ interventions in bankruptcy cases (INSOL, 2018). Thus, it is possible to exploit the introduction of specialized courts as a shock to judicial efficiency and independence.

From an identification standpoint, studying how the introduction of specialized courts has affected insolvency resolution in China is challenging. On the one hand, specialized courts were introduced at different times in different cities, offering the possibility of exploiting their staggered introduction as an identification device. However, cities that introduced specialized courts might be in a different economic cycle, which would also affect the type of firms going bankrupt. To deal with this challenge, we exploit the fact that, even after the introduction of specialized courts, bankruptcy cases were still handled by both traditional civil courts and specialized courts within the same city, in almost equal proportions. This feature of the Chinese judicial system allows us to compare cases initiated in different courts within the same city and year (see Note 2).

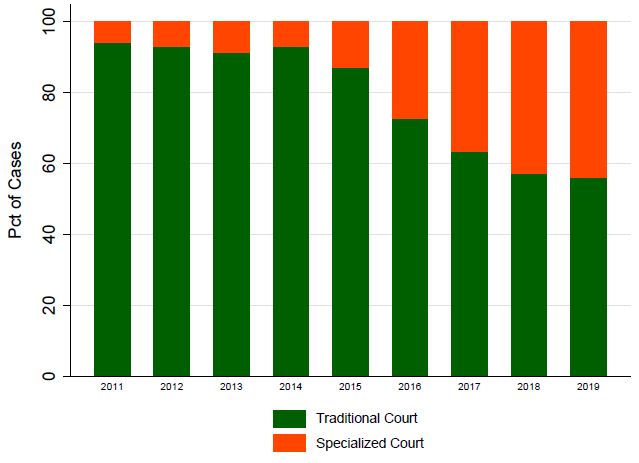

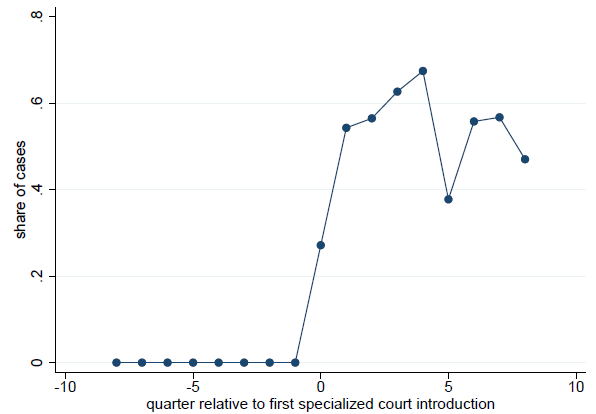

Figure 3: Allocation of cases in traditional vs. specialized courts

Notes: Panel (a) shows the percentage of total bankruptcy cases entering traditional civil courts versus specialized courts by year between 2011 and 2019. Panel (b) shows the average share of cases allocated to specialized courts in each city, by quarter relative to the introduction of the first specialized court in that city (which we set as t = 0).

We start by documenting how specialized courts affect the performance of local courts. We find that specialization leads to faster resolution. Case duration in specialized courts is 35% lower than in traditional civil courts when comparing similar cases initiated at the same time in the same city. This corresponds to a decline in case duration of around 210 days. To investigate the effect of specialization on judicial independence, we focus on the judicial treatment of state-owned versus private firms. According to the Chinese Supreme Court, one of the objectives of specialized courts is to facilitate an orderly and swift liquidation of unproductive state-owned firms and the reallocation of their resources to the rest of the economy. We find that the effect of specialization on case duration is significantly larger for cases regarding state-owned firms than privately owned firms. In particular, the magnitude of our estimates indicate that specialized courts reduce case duration for privately owned firms by around 198 days and for state-owned firms by 506 days.

How do faster and more independent courts affect the real economy

What effects do these specialized courts have on the local economy? By exploiting the staggered introduction of courts across cities, we study their effect on several measures of local economic development (see Note 3). A more efficient and independent bankruptcy system can promote local economic development in several ways. First, by facilitating the liquidation of low-productivity firms and favoring a quicker reallocation of their real assets, their labor force and their market shares to other firms in the economy (Bernstein et al. 2019). Second, by increasing the expected recovery rate of creditors and thus promoting lending to firms that operate under specialized courts (Visaria, 2009).

We focus on three indicators of local economic performance that are available in our data: entry of new firms, average firm productivity, and the share of local labor employed in industries with a higher concentration of “zombie” firms. We define zombie firms as low-productivity firms benefiting from financing conditions that are not justified by their fundamentals (following Caballero et al., 2009). Using data on publicly listed firms, we rank industries based on the concentration of zombie firms. We define industries above the median of this measure as zombie-intensive industries, or Z-industries.

We find that cities that introduced specialized bankruptcy courts experienced a 3 percent faster increase in the number of firms and a 4.5 percent larger increase in average product of capital of local firms relative to cities where insolvency is still resolved exclusively by civil courts. We also find that cities that introduced specialized courts experienced a 1.7 percentage points larger decline in the share of labor employed in zombie-intensive industries.

Increasing pressure on the institutions in charge of resolving insolvency

In the last decade, the Chinese economy experienced a massive increase in corporate debt. Several factors have contributed to this debt boom, including the stimulus policies of 2009–2010, the development of a corporate bond market, and the fast growth of shadow banking. Academics and policy makers have raised concerns about the risks associated with this credit boom. In addition, the Chinese central government expressed concerns about the large number of “zombie” firms and recognized the lack of efficient bankruptcy procedures to facilitate their liquidation or restructuring. Finally, the COVID-19 crisis will likely amplify the number of bankruptcy filings in the coming months and years.

Despite the increasing pressure on the Chinese insolvency resolution system, there has been, until now, virtually no academic research on how bankruptcy works in China. We believe that our paper can contribute to close this gap in the literature and inform policy makers. More research is necessary in this field, both on the functioning of the judicial system and on its effects on credit markets and the real economy.

Note 1: Doing Business, The World Bank Group (http://www.doingbusiness.org), for 2011–2019.

Note 2: Of course, even within a given city and year, cases are not randomly allocated across courts. However, we show that cases handled by traditional versus specialized courts within the same city and year are strongly balanced along both firm and case characteristics.

Note 3: This analysis exploits city-level variation, which does not allow us to exploit variation across courts facing the same city-level shocks. Thus, we rely solely on the staggered introduction of specialized courts across cities as a source of identification. To attenuate the concerns associated with the endogenous opening of specialized courts, we estimate a discrete time hazard model that studies whether differences in economic trends at the city level predict the timing of the introduction of specialized courts across cities. We find that the timing of their introduction is uncorrelated with different measures of local economic performance as captured by contemporaneous and lagged changes in GDP per capita, number of firms, average firm size, and share of manufacturing in local GDP.

(Bo Li is currently an Assistant Professor at PBC School of Finance, Tsinghua University; Jacopo Ponticelli, Northwestern University Kellogg School of Management and the Center for Economic Policy Research.)

References

Bernstein, S., E. Colonnelli, and B. Iverson (2019). “Asset Allocation in Bankruptcy.” Journal of Finance 74 (1), 5–53.

Caballero, R. J., T. Hoshi, and A. K. Kashyap (2008). “Zombie Lending and Depressed Restructuring in Japan.” American Economic Review 98 (5), 1943–1977.

Dakolias, M. (1999). “Court Performance around the World: A Comparative Perspective,” Volume 23. World Bank Publications.

Djankov, S., O. Hart, C. McLiesh, and A. Shleifer (2008). “Debt Enforcement around the World.” Journal of Political Economy 116 (6), 1105–1149.

Fan, J., J. Huang, and N. Zhu (2013). “Institutions, Ownership Structures, and Distress Resolution in China.” Journal of Corporate Finance 23 (1), 71–87.

Henderson, K. (2007). “The Rule of Law and Judicial Corruption in China: Half-Way Over the Great Wall.” In D. Rodriguez and L. Ehrichs (Eds.), Global Corruption Report: Corruption in Judicial Systems. Washington D.C.: Transparency International, Cambridge University Press.

Li, B. and J. Ponticelli (2020). “Going Bankrupt in China.” NBER Working paper w27501.

INSOL (2018). “PRC Enterprise Bankruptcy Law and Practice in China.” Technical report.

Rodriguez, D. and L. Ehrichs, eds. (2007). “Corruption in Judicial Systems. Global Corruption Report.” Washington D.C.: Transparency International, Cambridge University Press.

Visaria, S. (2009). “Legal Reform and Loan Repayment: The Microeconomic Impact of Debt Recovery Tribunals in India.” American Economic Journal: Applied Economics 1 (3), 59–81.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email