Higher Education and Corporate Innovation

This paper investigates the impact of higher education on corporate innovation using a difference-in-differences approach. We find that Chinese firms in skilled industries generate better innovation outcomes, especially firms headquartered in provinces with more science and engineering college graduates, young firms that are more likely to hire young graduates, and firms located near universities. Also, we show that technological innovation is a mechanism through which higher education affects productivity growth and thus the economy.

Higher education occurs after the completion of secondary education and is pursued at universities and colleges as the final stage of formal learning. It is verified that higher education can play a significant role in driving economic growth. However, the economic mechanisms underlying the growth effect of higher education are still unclear. Given that technological innovation is vital for economic growth (Solow 1956; Romer 1986), this study attempts to fill this gap by proposing such a mechanism and investigating the impact of higher education on corporate innovation.

We posit that a labor force consisting of many individuals with higher education enhances corporate innovation. According to endogenous growth theory, human capital is the engine of the innovation process (e.g., Romer 1990; Aghion and Howitt 1992; Acemoglu 1996; Aghion and Howitt 1998). However, such a positive role of human capital in innovation may differ between higher education and primary and secondary education. The primary- and secondary-educated workforce is considered to facilitate only the imitation of existing technology, whereas college-educated labor could promote the adoption of new technology that eventually leads to more sustainable economic growth (Vandenbussche, Aghion, and Meghir 2006; Aghion et al. 2009; Hunt and Gauthier-Loiselle 2010; Castelló-Climent and Mukhopadhyay 2013).

Institutional Background

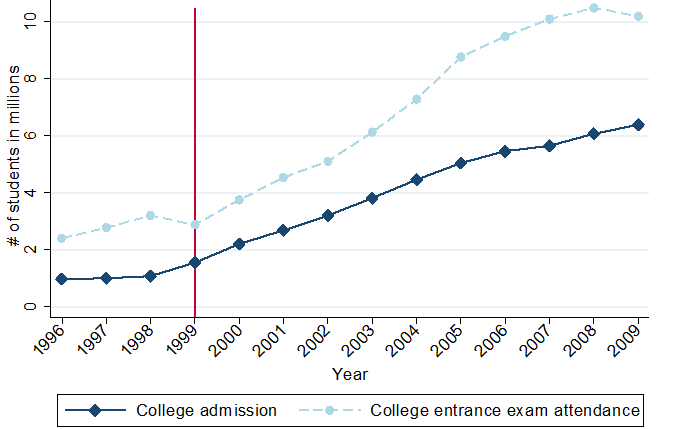

The education system in China is based on college admission policies, or gaokao, which is virtually the only gateway to top universities. In China, government plays a central role in developing higher education and setting education policies. In early 1999, the Ministry of Education proposed a 20% increase in admission for that year but soon revised it to an unprecedented 44% increase. This enrollment expansion was aimed at stimulating domestic spending on higher education and postponing high school graduates’ entry into the labor market (Wei and Li, 2000). We plot the time trend of college entrance exam attendance in Figure 1, which shows that the college admission rate has increased sharply since 1999.

Note: Time trend of college admissions and graduates in China from 1996 to 2009, based on college admission and graduation data from Chinese Educational Statistical Yearbook and Wind database (https://www.wind.com.cn/).

Empirical Strategy

The sudden increase in college admissions in 1999, in turn, generated an exogenous surge in the supply of highly skilled labor in 2003. Therefore, we adopt a difference-in-differences (DID) approach to investigate how the innovation output of firms in skilled industries changes relative to that of firms in unskilled industries after the surge in college-educated workers.

We use State Intellectual Property Office of China (SIPO) and Bureau van Dijk (BvD)’s Orbis patent database to proxy for the innovation output of firms. In terms of innovation quantity, we use the natural logarithm value of one plus the patent counts (LnPat). As for the innovation quality, we calculate the natural logarithm value of one plus the number of citations (LnCit), the natural logarithm value of one plus the number of non-self-citations (LnCitnonself), and the natural logarithm value of one plus the number of citations per patent (LnCitPat). In classifying skilled and unskilled industry, we use the human capital intensity in US industries as a proxy for the Chinese industry-level human capital intensity to alleviate self-selection issues.

We obtained 8,081 firm-year observations of 1,268 public non-financial firms from 1999 to 2009 for our regression. Specifically, to test whether the parallel trend assumption of the DID approach holds, we followed Bertrand and Mullainathan (2003) and examined the dynamics of innovation output surrounding the introduction of the higher education expansion policy. Our test reveals that there is no pretreatment trend in innovation output.

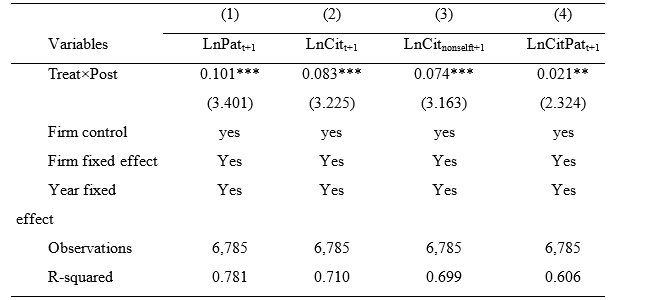

Having controlled for a vector of firm and industry characteristics that may affect outcomes, we find that higher education expansion exerts a positive effect on corporate innovation. Quantitative results are summarized in Table 1. Particularly, compared with the firms in unskilled industries, the exogenous surge in skilled labor leads to an 10.6% (=e0.101-1) increase in the number of patents, an 8.7% (=e0.083-1) increase in the number of citations, a 7.7% (=e0.074-1) increase in the number of non-self-citations, and a 2.1% (=e0.021-1) increase in the number of citations per patent among the firms in skilled industries. Overall, the results indicate that, compared with the firms in unskilled industries, the exogenous surge in skilled labor leads to a larger increase in both innovation quantity and quality among the firms in skilled industries.

Table 1: Qualitative effects of higher education expansion on corporate innovation

Note:Treati assumes a value of one for a firm in a skilled industry or a value of zero for a firm in an unskilled industry. Postt assumes a value of one for the 2003–9 period after the surge in the college-educated workforce caused by the higher education expansion policy in 1999, and zero for the 1999–2002 period. The coefficient of interest is the coefficient of the interaction term between Treat and Post, Treat×Post, which captures the innovation difference in treatment firms before and after the surge in skilled labor rather than the similar before-after difference in the control firms. Firm control is the vector of variables of firm and industry characteristics. All regressions include firm and year fixed effects. The t-statistics reported in parentheses are based on standard errors clustered at the firm level. ***, **, and * indicate significance of 1%, 5% and 10%, respectively.

Given that higher education expansion exerts a positive effect on corporate innovation, we further explore three plausible underlying economic channels through which the higher education expansion affects innovation output.

Hunt and Gauthier-Loiselle (2010) found that skilled immigrants in the US produce twice as many innovations as US natives, and one reason is that these immigrants disproportionately hold science and engineering (S&E) degrees. We thus hypothesize that the impact of the surge in skilled labor on corporate innovation should be more significant among firms headquartered in provinces with more college graduates in the S&E field.

Ouimet and Zarutskie (2014) find that young firms exhibit a higher average growth rate because they attract more young workers, who possess more current technological skills due to their recent education and are more willing to take on risky projects within a firm. Therefore, we expect the impact of the surge in skilled labor to be more significant among young firms, because the college expansion provides them with more educated young labor

Firms’ geographic proximity to universities may affect the effect of higher education on corporate innovation because college graduates may choose to work in local firms. Thus, we expect firms located close to universities to be more likely to take advantage of the increased supply of skilled labor because geographic proximity enables easier matching or convenient communication between firms and graduates.

All of the above hypotheses are verified and we find that the percentage of S&E students, the firm’s age, and the firm’s geographic proximity are underlying mechanisms through which higher education expansion promotes innovation output. In other words, the positive effect of human capital on innovation is more pronounced for firms headquartered in provinces with more S&E college graduates, young firms that are more likely to hire young graduates, and firms located near universities.

Contributions

This study (Kong, Zhang, and Zhang 2020) makes two major contributions to the existing literature. First, our paper provides evidence that innovation serves as an important mechanism underlying the growth effect of higher education. Specifically, we identify that higher education has a strong impact on firm innovation, and through this effect, we link higher education to economic growth. Our evidence also contributes to the debate regarding the role of human capital in innovation. Although human capital is regarded as the engine of innovation in endogenous growth theory (e.g., Romer 1990; Aghion and Howitt 1992; Acemoglu 1996; Aghion and Howitt 1998), previous studies have reached mixed conclusions concerning the heterogeneous effects of education on innovative human capital (Aghion et al. 2009; Hunt and Gauthier-Loiselle 2010; Castelló-Climent and Mukhopadhyay 2013; D’Acunto 2014).

Moreover, we contribute to the innovation literature investigating the drivers of firm innovation by identifying the role of corporate human capital. Our findings lend support to previous studies concerning the effect of managers’ human capital on corporate innovation (Custódio, Ferreira, and Matos 2019; Chemmanur et al. 2019). Moreover, our study adds to the growing literature concerning the determinants of corporate innovation at the employee level, including employee incentives, treatment, and efforts (Chang et al. 2015; Chen et al. 2016; Liu et al. 2017), tolerance for failure (Tian and Wang 2014), and labor law and unionization (Acharya, Baghai, and Subramanian 2013; Flammer and Kacperczyk 2015; Bradley, Kim, and Tian 2017; Gao and Zhang 2017).

(Dongmin Kong is a professor at the School of Finance, Zhongnan University of Economics and Law; Bohui Zhang is a professor at the School of Management and Economics and Shenzhen Finance Institute, Chinese University of Hong Kong, Shenzhen; Jian Zhang is a professor at the School of Business and Management, Shanghai International Studies University.)

References

Acemoglu, Daron. 1996. “A Microfoundation for Social Increasing Returns in Human Capital Accumulation.” Quarterly Journal of Economics 111, no. 3 (August): 779–804. https://doi.org/10.2307/2946672.

Aghion, Philippe, and Peter Howitt. 1992. “A Model of Growth through Creative Destruction.” Econometrica 60, no. 2 (March): 323–51. https://doi.org/10.2307/2951599.

Aghion, Philippe, and Peter Howitt. 1998. “Capital Accumulation and Innovation as Complementary Factors in Long-Run Growth.” Journal of Economic Growth 3: 111–30. https://doi.org/10.1023/A:1009769717601.

Aghion, Philippe, Leah Boustan, Caroline Hoxby, and Jerome Vandenbussche. 2009. “The Causal Impact of Education on Economic Growth: Evidence from the United States.” Brookings Papers on Economic Activity: 1–73. https://www.brookings.edu/wp-content/uploads/2016/07/2009_spring_bpea_aghion_etal.pdf.

Acharya, V. V., R. P. Baghai, and K. V. Subramanian, 2014, Wrongful discharge laws and innovation, Review of Financial Studies 27, 301-346. https://doi.org/10.1287/mnsc.2017.2828.

Barro, Robert J. 2001. “Human Capital and Growth.” American Economic Review 91, no 2 (May): 12–17. https://www.jstor.org/stable/2677725.

Becker, Gary S. 1964. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. New York: National Bureau of Economic Research.

Bertrand, Marianne, and Sendhil Mullainathan. 2003. “Enjoying the Quiet Life? Corporate Governance and Managerial Preferences.” Journal of Political Economy 111, no. 5 (October): 1043–75. https://doi.org/10.1086/376950.

Bowlus, Audra J., and Chris Robinson. 2012. “Human Capital Prices, Productivity, and Growth.” American Economic Review 102, no. 7 (December): 3483–3515. https://doi.org/10.1257/aer.102.7.3483.

Bradley, D., I. Kim, and X. Tian, 2017, Do Unions Affect Innovation?, Management Science 63, 2251-2271. https://doi.org/10.1287/mnsc.2015.2414.

Castelló-Climent, Amparo, and Abhiroop Mukhopadhyay. 2013. “Mass Education or a Minority Well Educated Elite in the Process of Growth: The Case of India,” Journal of Development Economics 105 (November), 303–20. https://doi.org/10.1016/j.jdeveco.2013.03.012.

Custodio, C., M. A. Ferreira, and P. Matos, 2019, Do General Managerial Skills Spur Innovation?, Management Science 65, 459-476. https://pubsonline.informs.org/doi/10.1287/mnsc.2017.2828.

Chemmanur, T. J., L. Kong, K. Krishnan, and Q. A. Yu, 2019, Top Management Human Capital, Inventor Mobility, and Corporate Innovation, Journal of Financial and Quantitative Analysis 54, 2383-2422. https://doi.org/10.1111/ajfs.12208.

Chang, X., K. K. Fu, A. Low, and W. R. Zhang, 2015, Non-executive Employee Stock Options and Corporate Innovation, Journal of Financial Economics 115, 168-188. https://doi.org/10.1016/j.jfineco.2014.09.002.

Chen, C., Y. Y. Chen, P. H. Hsu, and E. J. Podolski, 2016, Be Nice to Your Innovators: Employee Treatment and Corporate Innovation Performance, Journal of Corporate Finance 39, 78-98. https://doi.org/10.1016/j.jcorpfin.2016.06.001.

D’Acunto, Francesco. 2014. “Innovating to Invest: The Role of Basic Education.” Working paper. https://www.semanticscholar.org/paper/Innovating-to-Invest%3A-The-Role-of-Basic-Education-D’Acunto/0722dab4f0354420bf70961e68870ae85701d5e3.

Flammer, C., and A. Kacperczyk, 2016, The Impact of Stakeholder Orientation on Innovation: Evidence from a Natural Experiment, Management Science 62, 1982-2001. https://doi.org/10.2139/ssrn.2353076.

Gennaioli, Nicola, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2013. “Human Capital and Regional Development.” Quarterly Journal of Economics 128, no. 1 (February): 105–64. https://doi.org/10.1093/qje/qjs050.

Goldin, Claudia, and Lawrence F. Katz. 2001. “The Legacy of US Educational Leadership: Notes on Distribution and Economic Growth in the 20th Century.” American Economic Review 91, no. 2 (May): 18–23. https://doi.org/10.1257/aer.91.2.18.

Gradstein, Mark, and Moshe Justman. 2002. “Education, Social Cohesion, and Economic Growth.” American Economic Review 92, no. 4 (September): 1192–1204. https://doi.org/10.1257/00028280260344722.

Gao, H. S., and W. Zhang, 2017, Employment Nondiscrimination Acts and Corporate Innovation, Management Science 63, 2982-2999. https://doi.org/10.1287/mnsc.2016.2457.

Hunt, Jennifer, and Marjolaine Gauthier-Loiselle. 2010. “How Much Does Immigration Boost Innovation?” American Economic Journal: Macroeconomics 2, no. 2 (April): 31–56. https://doi.org/10.1257/mac.2.2.31.

Krebs, Tom. 2003. “Human Capital Risk and Economic Growth.” Quarterly Journal of Economics 118, no. 2 (May): 709–44. https://doi.org/10.1162/003355303321675491.

Lucas, Robert E. 2015. “Human Capital and Growth.” American Economic Review 105, no. 5 (May): 85–88. https://doi.org/10.1257/aer.p20151065.

Liu, T., Y. Mao, and X. Tian, 2017, The Role of Human Capital: Evidence from Patent Generation, Working paper, https://ssrn.com/abstract=2728924.

Nelson, Richard R., and Edmund S. Phelps. 1966. “Investment in Humans, Technological Diffusion, and Economic Growth.” American Economic Review 56, no. 1/2 (March 1): 69–75. https://www.jstor.org/stable/1821269.

Ouimet, Paige, and Rebecca Zarutskie. 2014. “Who Works for Startups? The Relation Between Firm Age, Employee Age, and Growth.” Journal of Financial Economics 112, no. 3 (June): 386–407. https://doi.org/10.1016/j.jfineco.2014.03.003.

Romer, Paul M. 1986. “Increasing Returns and Long-Run Growth.” Journal of Political Economy 94, no. 5 (October): 1002–37. https://doi.org/10.1086/261420.

Romer, Paul M. 1990. “Endogenous Technological Change.” Journal of Political Economy 98, no. 5, part 2 (October): 71–102. https://doi.org/10.1086/261725.

Shapiro, Jesse M. 2006. “Smart Cities: Quality of Life, Productivity, and the Growth Effects of Human Capital.” Review of Economics and Statistics 88, no. 2 (May): 324–35. https://doi.org/10.1162/rest.88.2.324.

Solow, Robert M. 1956. “A Contribution to the Theory of Economic Growth.” Quarterly Journal of Economics 70, no. 1 (February): 65–94. https://doi.org/10.2307/1884513.

Tian, X., and T. Y. Wang, 2014, Tolerance For Failure and Corporate Innovation, Review of Financial Studies 27, 211-255. https://doi.org/10.1093/rfs/hhr130.

Vandenbussche, Jérôme, Philippe Aghion, and Costas Meghir. 2006. “Growth, Distance to Frontier and Composition of Human Capital.” Journal of Economic Growth 11, no. 2 (June): 97–127. https://doi.org/10.1007/s10887-006-9002-y.

Wei, Xin, and Wenli Li. 2000. “Report on the Demand, Supply, Scale, and Growth Speed of Higher Education in China.” Beijing: Institute of Higher Education Research, Beijing University.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email