Internal Capital Markets in Business Groups and the Propagation of Credit Supply Shocks

Using business registry data from China, we show that internal capital markets in business groups can propagate corporate shareholders' credit supply shocks to their subsidiaries. An average of 16.7% local bank credit growth where corporate shareholders are located would increase subsidiaries investment by 1% of their tangible fixed asset value, which accounts for 71% (7%) of the median (average) investment rate among these firms. We argue that equity-exchange is one channel through which corporate shareholders transmit bank credit supply shocks to the subsidiaries and provide empirical evidence to support the channel. We also find that subsidiaries who are more financially constrained or productive benefit more from such shocks. Finally, the propagation effect becomes much stronger when the corporate shareholders are controlling holders or Non-SOE.

China has witnessed tremendous growth in the past few decades despite a surprisingly underdeveloped financial system. Many small- and medium-sized firms have limited access to bank credit, which fostered the recent development of other financing options including shadow banks and Fintech (Frost, Huang, Shin, and Zbinden, 2019). While these non-bank financing options might attract credit from other sources, they could also help better intermediate bank credit. Our paper shows that inter-business-group financing among non-financial firms helps propagate bank credit in the non-financial corporate sector.

Using Chinese business registry data from the State Administration of Industries and Commerce, we show that business groups, which connect firms through equity holdings, are common in the Chinese economy. Internal capital markets within these business groups can propagate bank credit from corporate shareholders to their subsidiaries. An average of 16.7% local bank credit growth where corporate shareholders are located would increase subsidiary investment by 1% of their tangible fixed asset value. The estimate is reasonably large compared to the median subsidiary investment rate of 1.4%. We also present evidence that equity exchanges between shareholders and subsidiaries is one effective channel of the inter-business-group financing.

The Popularity of Business Groups in China

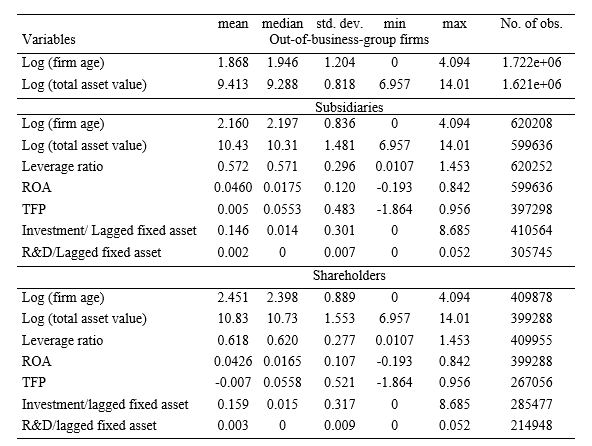

We first document that a significantly large number of Chinese firms are connected with each other in business groups. Our business registry data, unlike public firm disclosure data, identify business groups among all registered firms in China (Bai, Hsieh, Song, and Wang, 2018). As of 2017, 16% of over 35 million Chinese firms were part of business groups. After merging the business registry data with the Annual Survey of Chinese Industrial Enterprises (ASCIE), we find that firms in business groups contribute to 60% of output, 70% of total fixed assets, and 60% of employment in our sample. Shareholders tend to be much larger compared to subsidiaries and out-of-business-group firms. The average value of total assets for shareholders, subsidiaries, and out-of-business-group firms, are 712 million, 512 million, and 134 million RMB, respectively. Subsidiary firms, relative to the shareholders, have higher total factor productivity (TFP) and return on assets (ROA), but lower leverage ratios (Table 1).

Data source: Annual Survey of Chinese Industrial Enterprises (ASCIE)

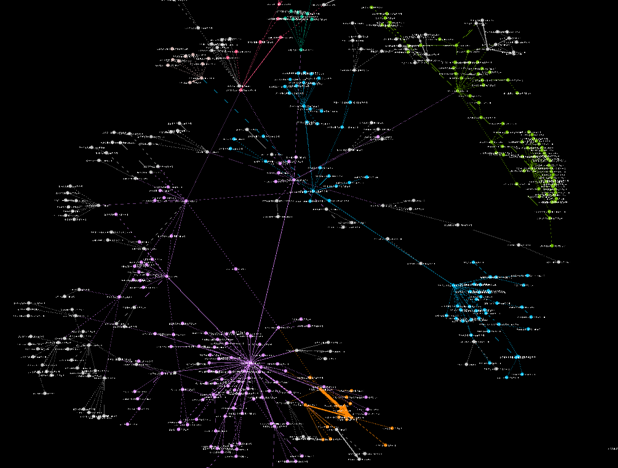

Finally, business groups tend to have complicate structures. A large business group usually consists of various subgroups. Different subgroups do not overlap with each other, but are connected via one or two pivotal firms. Within each subgroup, firms are connected more densely, i.e. the equity-holding linkages exist more often and appear to be stronger compared to a randomly generated network. Figure 1 provides an example of the part of business groups that can be traced to the “Haier Group” (Allen, Cai, Gu, Qian, Zhao, and Zhu, 2019). Unlike the experience of some other countries, cross-holdings are rare.

Note: This figure is from Allen et al. (2019), which shows part of a typical business group that can be traced to the Haier Group. Each dot in the figure represents a firm; firms within the same subbusiness groups are labeled with the same color. Subbusiness groups are identified using the K-clustering approach by maximizing the weighted degree of modularity.

Geographical Diversification of the Business Groups and Identification

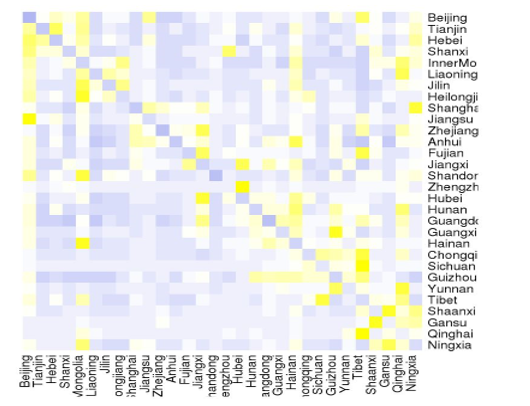

We show that in business groups, bank credit supply shocks to a corporate shareholder benefit its subsidiary firms. Our identification takes advantage of the geographical diversification of the business-group network and the regional segmentation of the Chinese banking sector. According to our business registry data, until 2017, the shareholder and the subsidiary were located in two different municipal cities, accounting for 38% of the shareholding relationships. The network spans the entire country without following a particular pattern (Figure 2). The regional segmentation of the banking sector is a result of the localized business model of Chinese banks and inefficiency in the inter-bank market. Local bank branches have substantial decision-making power, and thus, even large commercial banks conduct business on a regional basis (Huang, Pagano, and Panizza, 2019).

Note: This figure shows the equity-holding linkages between firms across different provinces in China. Yellow indicates more frequent connections between firms; purple implies few identified equity-holding linkages.

Data Source: Business registry data from the State Administration of Industries and CommerceWe implement our identification strategy using variation in local bank credit growth and corporate balance sheet data of the subsidiary firms (2000–2008). Taking business groups in 2000 as given, we compare similar subsidiary firms with shareholders located in different other cities where bank credit also grew differently. As long as idiosyncratic shocks to bank credit are uncorrelated across cities, we identify the transmission of these shocks along the business-group network through differential subsidiary firms’ responses. Our main identification challenge comes from the possibly correlated credit demand across cities. To mitigate the concern, we construct a Bartik-type instrument for local bank credit supply shocks. We track the expansion of commercial banks all over the country, which should be correlated with bank business decisions but uncorrelated with local credit demand of individual cities. A commercial bank that quickly expanded in China is considered as being more ambitious in providing new credit to firms. If this bank also controlled a significant fraction of the credit market in a city, we would consider the city as having experienced a more substantial bank credit supply shock. The estimates using this Bartik-type instrument support our hypothesis that corporate shareholders would pass along a positive credit supply shock from banks to their subsidiaries.

Other Business Networks

Another challenge is that other business networks, including the input-output network and the geographical overlay of industries, may overlap with the formation of business groups. To deal with this concern, we control for other networks in our robustness tests. We include the estimates of upstream supply shocks and downstream demand shocks to proxy for shocks from supply linkages, trade credit measures (accounts payable and receivable) as a proxy for credit from trading partners, shareholder industry cross subsidiary industry fixed effects and shareholder city cross subsidiary city fixed effects to control for any geographical overlay of industries, and a common shareholder dummy to control for the tunneling effects. Our results are robust to controlling for various additional business networks.

The Equity Transfer Mechanism

Last but not least, we turn to the question of the transmission mechanism within business groups. We provide new empirical evidence arguing that equity transfers among shareholders and subsidiaries could be an effective channel. Subsidiaries transfer or issue new equity stakes to holding firms in exchange for more cash. We establish this channel using the same identification strategy. We find that for an average subsidiary firm, total equity shares held by corporate shareholders increase following a positive credit supply shock to these shareholders. The equity transfer channel is also discussed in Almeida et al. (2015), which finds that cross-firm equity investments are frequently used by chaebol (business groups in Korea) to transfer cash from low-growth to high-growth member firms.

The Effectiveness of Internal Capital Markets in Propagating Credit Shocks

A natural but important question for policymakers is whether this channel is efficient for resource reallocation. The effectiveness of internal capital markets in propagating credit supply shocks depends on two elements: the subsidiary firm's financial constraints and investment opportunities. We follow the literature (Manova, Wei, and Zhang, 2015; Giroud and Mueller, 2015) and construct proxies for firm financial constraints and investment opportunities. Our findings indicate that subsidiary firms with larger long-term financial constraints (high external finance dependence) tend to invest more following a credit supply shock to their shareholders, while the short-term liquidity constraints matter less. Among the group of financially constrained subsidiaries, the ones with good investment opportunities also invest more following a credit supply shock to their shareholders. Additionally, domestic private firms are more responsive to the credit supply shocks exposure to holding firms, while foreign and SOE firms are not. Finally, the incentive for corporate shareholders matters. We find that non-SOE corporate shareholders and controlling corporate shareholders are more active in propagating the credit shocks, while SOE shareholders have no incentive at all.

Conclusion

In this paper, we document a new channel that helps facilitate bank credit to a large number of non-financial firms through their equity shareholding linkages. Our study sheds new light on the bank lending channel, which not only affects firms borrowing directly from banks, but also to those indirectly connected to the banking sector through their corporate shareholders. Our findings also provide important implications for targeted monetary policy. Depending on the financial market structure, to inject liquidity into the economy more effectively, authorities should consider the structure of existing business groups.

(Yu Shi, Economist in the IMF’s Research Department; Robert Townsend, Department of Economics, MIT; Wu Zhu, Ph.D. in Economics, the University of Pennsylvania.)

References

Allen Franklin, Junhui Cai, Xian Gu, Jun “QJ” Qian, Linda Zhao and Wu Zhu (2019), Networks structure and firm growth. Unpublished manuscripts.

Bai, C., Hsieh, C., Song, Z., Wang, X. (2018). Conglomerate formation in China. Unpublished manuscripts.

Chen, Long. "From fintech to finlife: The case of fintech development in China." China Economic Journal 9.3 (2016): 225–239. https://www.tandfonline.com/doi/abs/10.1080/17538963.2016.1215057

Giroud, X., & Mueller, H. M. (2015). Capital and labor reallocation within firms. The Journal of Finance, 70(4), 1767–1804. https://onlinelibrary.wiley.com/doi/full/10.1111/jofi.12254

Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., & Zbinden, P. (2019). BigTech and the changing structure of financial intermediation. https://www.bis.org/publ/work779.pdf

Huang, Y., Pagano, M., & Panizza, U. (2019). Local crowding out in China. Available at SSRN 2820682. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2820682

Manova, K., Wei, S. J., & Zhang, Z. (2015). Firm exports and multinational activity under credit constraints. Review of Economics and Statistics, 97(3), 574–588. https://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00480

Shi, Yu, Townsend, Robert M. and Zhu, Wu, Internal Capital Markets in Business Groups and the Propagation of Credit Supply Shocks (May 2019). IMF Working Paper No. 19/111. https://ssrn.com/abstract=3405978

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email