E-Commerce Development and Household Consumption Growth in China

China has quickly become the largest e-commerce market in the world. E-commerce has reshaped consumption patterns in recent years. This paper examines how e-commerce development has shaped household consumption growth in China. It finds that e-commerce development is associated with higher consumption growth, that the link is stronger for the rural sample, inland regions, and poor households, and that the consumption of durable goods, in-style goods, and goods of high income elasticity have grown faster than the consumption of local services.

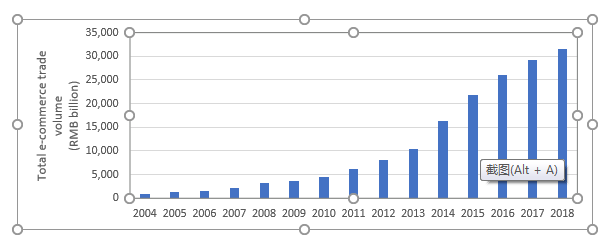

China has quickly become the largest e-commerce market in the world. The annual total e-commerce trade volume in China increased thirtyfold from RMB 930 billion in 2004 to RMB 29,160 billion in 2017—a compound annual growth rate of 30 percent (see Note 1). Annual e-commerce trade volume in China increased rapidly from 2004 to 2018, growing from RMB 930 billion (US$112 billion) to RMB 32 trillion (US$5 trillion) (Figure 1). The number of internet users in China reached 772 million in 2017, of which 533 million made purchases online (see Note 2). Express mail service exceeded 30 billion pieces in 2016, of which some 60 percent is related to e-commerce (see Note 3).

Figure 1. Total E-Commerce Trade Volume in China

Source: Ministry of Commerce of China

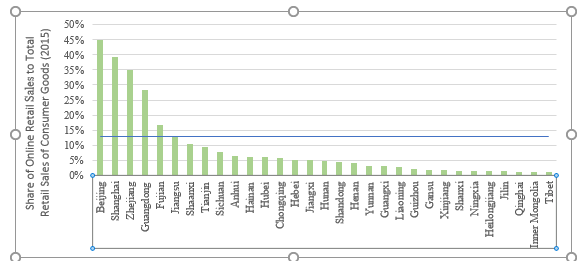

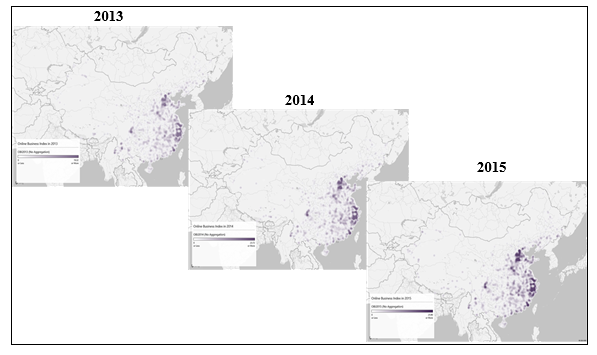

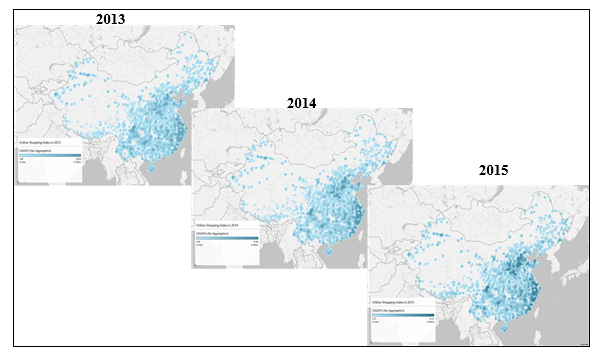

The development of online retailing, however, remained uneven across Chinese provinces, as measured by the Online Business Index (OBI) and the Online Shopping Index (OSI) developed by AliResearch (Map 1 and Map 2) (See Note 4). In 2015, in Beijing, 45 percent of the total retail sales of consumer goods was purchased online, followed by nearly 40 percent in Shanghai, 35 percent in Zhejiang, and 28 percent in Guangdong. However, the share was much lower (less than 2 percent) in nine inland provinces (Figure 2).

Figure 2. Share of online retail sales to total retail sales of consumer goods in provinces (2015)

Map 1. Online Business Index (county level)

Data source: AliResearch

Map 2. Online Shopping Index (county level)

Data source: AliResearch

In developing countries, where a large proportion of people live in remote areas with limited access to offline retail stores, e-commerce may has the potential to reach a wide range of consumers who are constrained by limited access to markets. Fan et al. (2016) show that e-commerce development in China disproportionately improves consumer welfare in remote cities as compared to major cities. Couture et al. (2017) finds that e-commerce expansion reduces the cost of living for certain groups of the rural population who use it, though the average effect is muted.

Methodologically, our study advances the existing research in three ways by matching a nationally representative China Family Panel Studies (CFPS) survey with county-level e-commerce information obtained from Alibaba. First, our study directly investigates the impact of e-commerce on consumption growth at the household level rather than at the aggregate city level as in Fan et al. (2016). Second, our results are likely more representative because CFPS covers many more counties than the sample of eight counties in three provinces used in Couture et al. (2017). Third, our analysis examines the heterogenous associations between e-commerce development and various categories of consumption (see Note 5), which were not discussed in other studies.

Our empirical results offer three major findings:

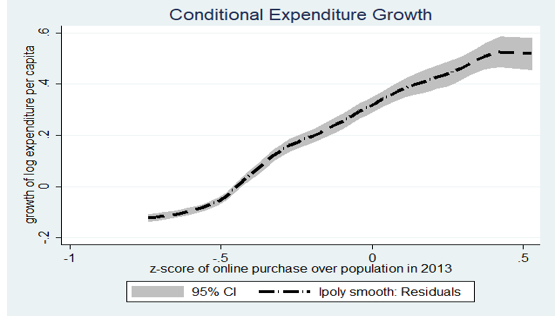

First, e-commerce development is associated with higher consumption growth (see Figure 3). A one standard deviation above the mean of e-commerce development indicator, measured by online purchases over census population, is associated with about 30% annual household expenditure per capita growth in China. The relationship holds for both urban and rural households and across all regions for ten categories (see Note 6) that are regularly consumed by most households. Lower search and transaction costs, a key feature of e-commerce, makes price discovery easier, bringing the law of one price closer to reality (Gorodnichenko and Talavera 2017), and creates more trad, enabling higher specialization in the long-tail market. More- competitive prices tend to reduce the cost of living for residents. The findings are consistent with the literature. Couture et al. (2017) show that the expansion of e-commerce to the Chinese countryside is associated with lower cost of living, and, for the goods that are available at both the Rural Taobao online terminal and in the village, the median price from the online terminal is cheaper by 15 percent. According to a McKinsey report (McKinsey, 2013), e-tailing may have lowered China’s average retail price by 0.2 percent to 0.4 percent in 2011 and by 0.3 percent to 0.6 percent in 2012. Holding disposable income constant, a lower cost of living means more discretionary spending power, which implies higher consumption.

Figure 3. Growth rate of household consumption per capita and e-commerce intensity level in China

Note: Extreme value dropped at 5 percent.

Second, the impact of e-commerce development on household consumption is conspicuously larger for rural residents, inland regions, and poor households. The magnitude of the impact is more than twice as large for rural households than for urban households, twice as large in the west than in the coastal regions, and twice as large for the poorest quartile of households than for the richest quartile. This suggests e-commerce development helps reduce rural/urban inequality in consumption (see Note 7).

Third, the consumption of durable goods, and in-style goods (such as cosmetics and beauty, travel, and entertainment) and high-income elasticity goods (travel, automobiles, and dining out) exhibit stronger growth than the consumption of local services (such as education, medical services, expenditure on vehicles other than purchasing automobiles, and home repair). By enabling traders to locate nearby producers and sell products directly to consumers, e-commerce can lower transportation and contracting costs associated with remote ordering. They can also save traders’ storage costs and allow them to keep a small inventory. Thanks to the lower costs of transportation, contracting, and storage, sellers can source more frequently, can provide more fashionable products, and offer greater variety to consumers (Startz 2018). If the cost savings are passed through, consumers will obtain lower prices.

China has been on a fast track of e-commerce development. Developing e-commerce requires not only internet, but many other factors, such as infrastructure and logistics services, skills, entrepreneurship, and an overarching business environment that facilitates online and offline business. With the right policies, further development of e-commerce can help accelerate consumption growth and narrow the regional gaps in e-commerce development, which in turn can lead to a more inclusive spatial development pattern.

Note 1: Ministry of Commerce of China. E-Commerce in China (2015, 2016, and 2017).

Note 2: Ministry of Commerce (2017). E-commerce in China 2017.

Note 3: Source: State Post Bureau of the People’s Republic of China, http://www.spb.gov.cn/zy/xxgg/201706/t20170624_1196398.html

Note 4: The OBI and OSI data are obtained from the AliResearch team. OBI is a constructed index measuring the density of online stores and the percentage of online stores with annual online sales above RMB 240,000. The value of the index ranges from 0 to 100. The higher the value, the more-developed the online sales. OSI is a constructed index measuring the density of online buyers and the percent of online buyers with annual online consumption above RMB 10,000. The value of the index ranges from 0 to 100. The higher the value, the more-developed the online purchases. The online transaction numbers are from the Alibaba platform, which accounts for the majority of online transactions in China. The values of the OBI and OSI are not comparable over time due to changes in the methodologies.Note 5: There are 18 categories in our study: cosmetics and beauty, foods, foods at home, dining out, clothes, utilities, communications, local transport, travel, entertainment, automobile, expenditure on vehicles other than automobile purchase, durable goods, medical, health and fitness, education, home repair, and gifts.

Note 6: These categories include expenditures on cosmetics and beauty, food (foods at home and dining out), clothes, utilities, communication, local transportation, and entertainment.

Note 7: Several papers suggest that e-tailing is not just a replacement of purchases that would otherwise be made but could spur incremental consumption, particularly in small cities and towns where there is pent-up demand for goods that local physical stores cannot deliver (McKinsey 2013). Couture et al. (2017) show that 62 percent of goods bought through Alibaba’s Rural Taobao online terminal were not available in the village. For durable goods, this number rises to 84 percent.

Note 8: While we have tried to control for as many factors as possible, some variables correlated with both the outcome variable and the e-commerce indicator may have been omitted, which may bias the estimates of the e-commerce variable. Our findings imply only associations and not causality. More studies are needed to tease out the causal relationship between e-commerce development and consumption growth.

Disclaimer: The views expressed in this

paper are those of the authors and do not reflect the views of the World

Bank or its affiliated organizations.

[Xubei Luo is a senior economist of the World Bank; Yue Wang is a Ph.D. candidate at Cornell University; and Xiaobo Zhang is a distinguished chair professor of economics at the National School of Development, Peking University in China, and senior research fellow of International Food Policy Research Institute. The blog is written based on Luo, Wang, and Zhang (2019)]

References:

Couture, Victor, Benjamin Faber, Yizhen Gu, and Lizhi Liu, “E-Commerce Integration and Economic Development: Evidence from China,” NBER Working Paper No. 24384 (2018).

McKinsey (2013), China’s e-tail revolution: Online as a catalyst for growth. McKinsey & Company.

Startz, Meredith, The Value of Face-to-Face: Search and Contracting Problems in Nigerian Trade (November 27, 2016). Available at SSRN: https://ssrn.com/abstract=3096685 or http://dx.doi.org/10.2139/ssrn.3096685.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email