Why Does China Need a New Breed of Companies?

Understanding corporate China and its future dynamics is the key to understanding the Chinese economy and its undergoing transformation. The intellectual framework proposed in this work can be summarized by a simple identity: Growth Rate = Return on Invested Capital (ROIC) X Investment Rate. To successfully achieve China’s economic transition without losing a lot of growth at the same time, China needs to improve ROIC at the aggregate level. In doing so, China needs to foster a large number of companies that can maintain a high ROIC for a long period of time. Only with a large number of such companies in existence can the micro-foundations of the Chinese economy be fixed and an enduring growth be achieved.

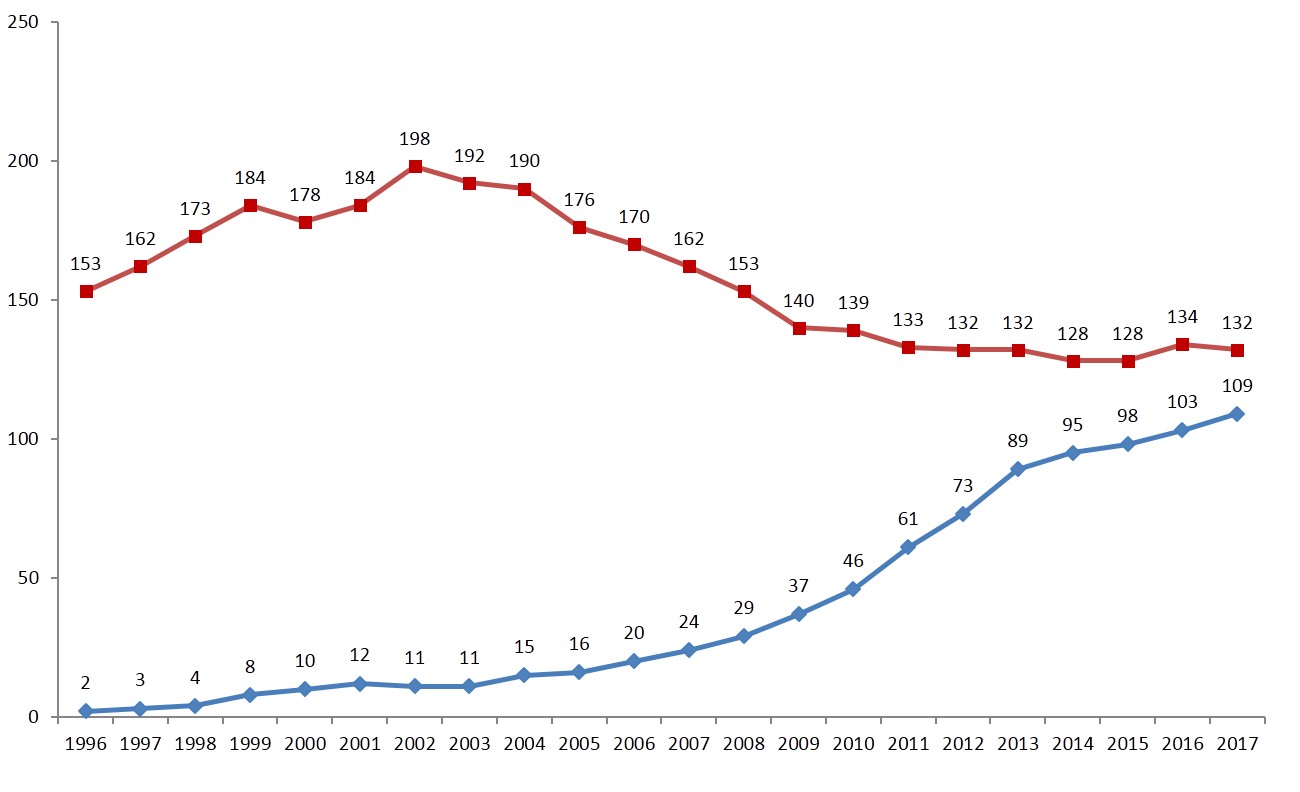

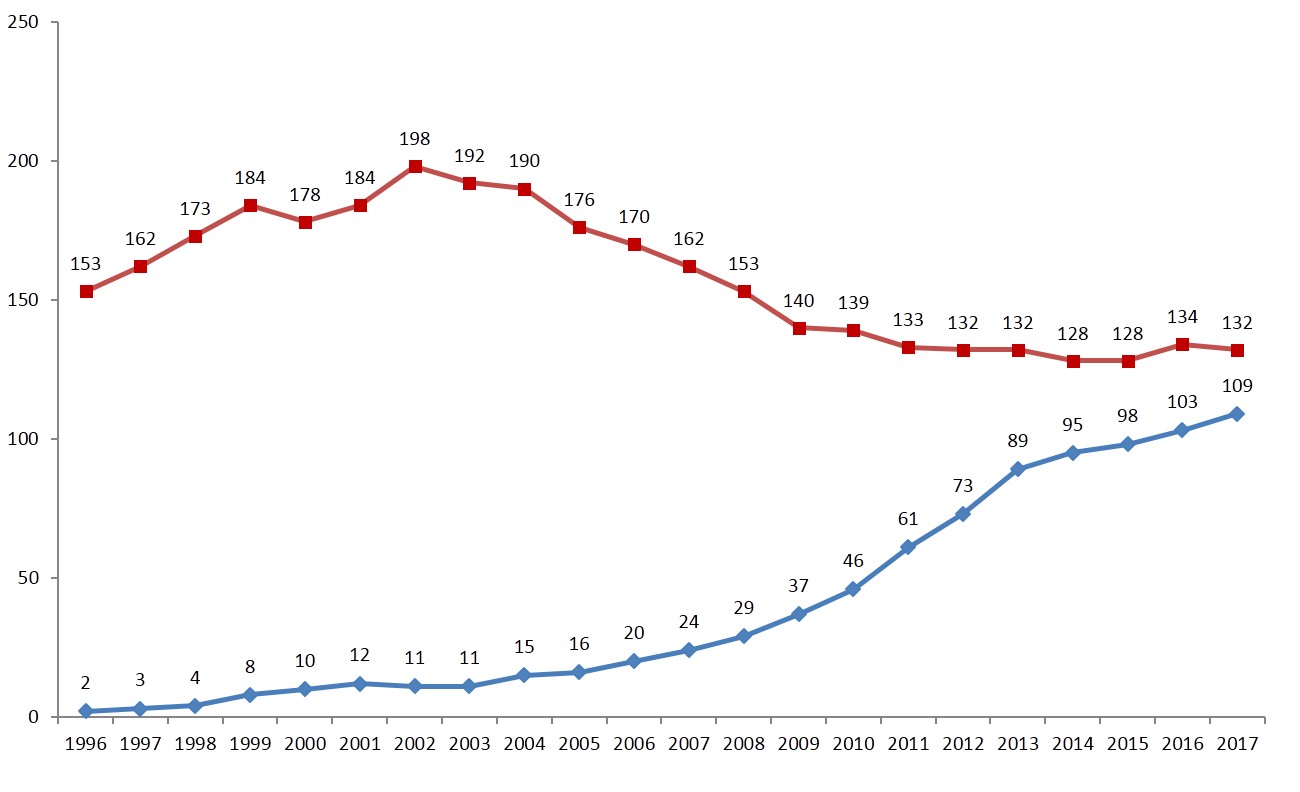

Accompanying China’s rapid economic growth has been growth of another kind: the surge of large companies in China. On July 20, 2017, Fortune magazine released its 2017 Global 500 list, which ranks the world’s largest firms by sales. On the list, Chinese firms continue to ascend global rankings — there are an unprecedented 115 Chinese firms (including six Taiwanese firms), which is only seventeen less than the number of American firms on the list. The 2017 list is the fourteenth time that China has increased its share of largest companies. Given the strong momentum, China will likely have more Fortune Global 500 companies than the United State in three to five years (see Figure 1, where Taiwanese firms are not included). Strikingly different from their Western counterparts, most of China’s large companies are state-owned and are concentrated in the commodities, energy, and financial sectors.

Note:China is blue and the U.S. is red.

Source:Various issues of Fortune magazine.

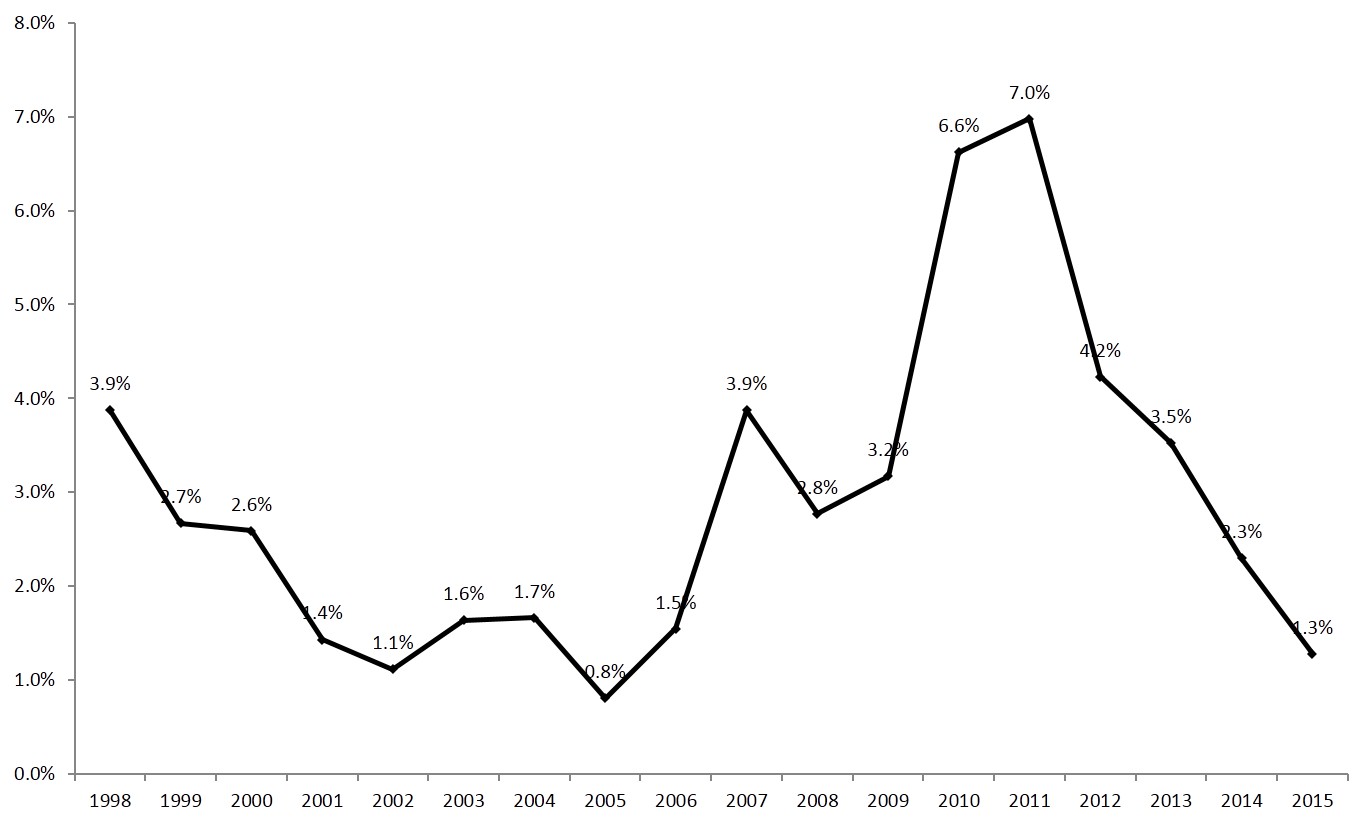

While these giant companies contribute significantly to China’s GDP, many do not generate much value. For example, Aluminum Corp. of China, also known as Chalco, reported in March 2015 a net loss for the previous year of 16.2 billion yuan ($2.4 billion). Also in 2015, Sinosteel missed a payment on its debt. Overall, China’s listed companies have a reported average returns on invested capital (ROIC) of 3 percent over the past eighteen years (see Figure 2), compared with over 10 percent of ROIC for U.S. companies over the past 100 years. To successfully transition China’s economy without losing much growth, the country must shift its primary growth driver from an investment rate to ROIC. The micro-units of the economy — Chinese companies — must put value creation far ahead of the aggressive pursuit of operational scale.

Note: Financial institutions and utilities firms are excluded from the sample. Equal-weighted average ROICs are reported. Using a value-weighted average yields similar results.

The Improbable Surge of Corporate China

The surge of the number of large Chinese companies largely results from the growth strategy adopted by China during its reform era. Since the reform and the opening of its economy, China has followed an investment-led growth strategy accompanied by strong demand for capital and other production factors, such as energy and raw materials. Many companies, however, are still monopolized by the state. Furthermore, strong demand combined with the persistence of state monopolies yields big state-owned companies in the resource and other sectors (i.e., finance). For example, except for China State Construction Engineering and SAIC Motors, the ten largest Chinese companies on the 2017 Fortune Global 500 list are all in the resource and financial sectors. Notably, except for Ping An Insurance, these ten largest Chinese companies are all owned by the central government.

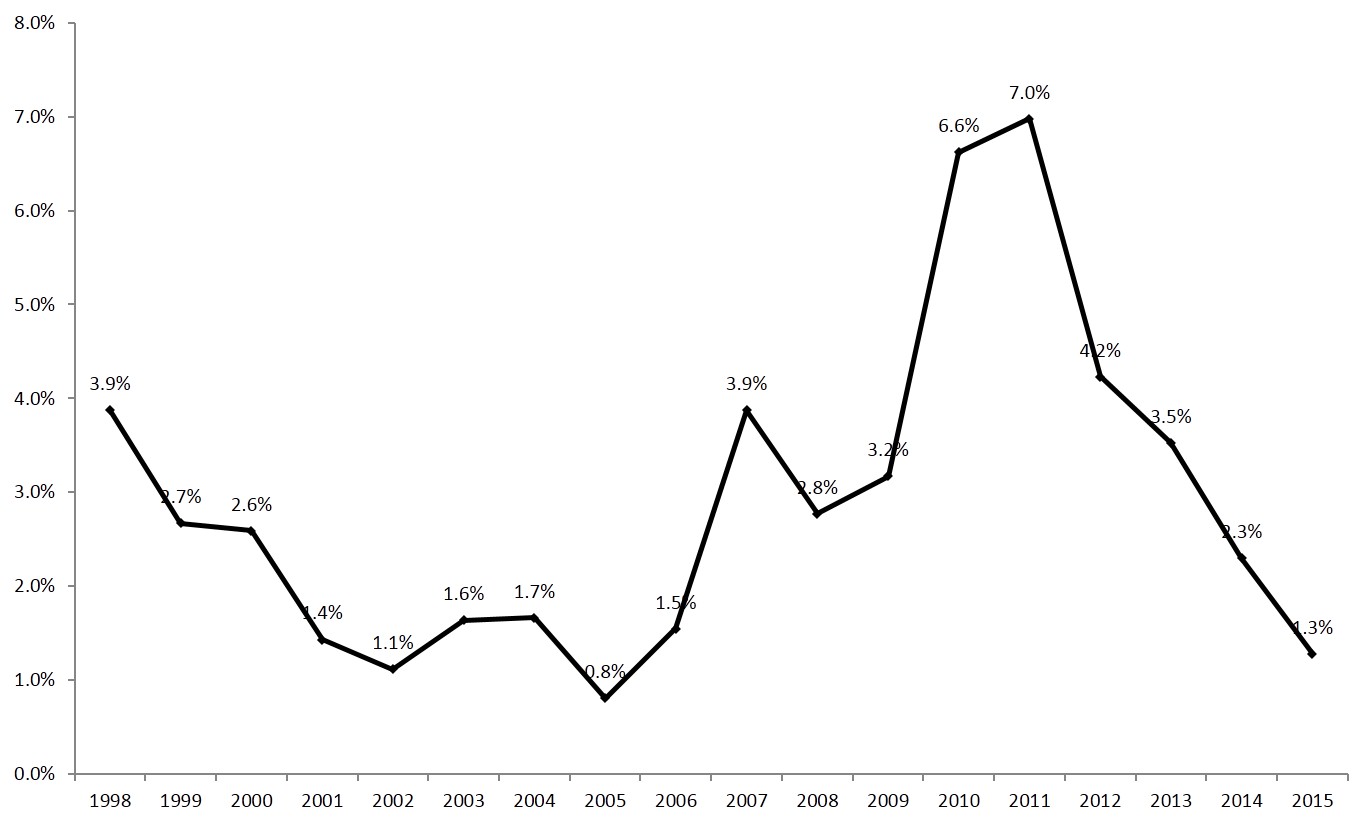

Note: State firms are in red and non-state firms are in blue.

The terms “big” and “brilliant” are not synonymous when looking at these large firms. These state-owned enterprises (SOEs) have been plagued by moral hazard issues and soft budget restraints, resulting in inefficiency. As shown in Figure 3, the ROIC analysis of the Chinese firms listed over the 1998–2015 period shows that the SOEs on average report an ROIC lower than that of non-state companies, with 2011 being the only exception. In 2017, out of mainland China’s 109 Fortune Global 500 companies, eleven are loss-making.

In addition to the investment-led growth strategy, the lack of an open and integrated domestic market is also to blame. As a result of reform and market liberalization, China has become a global business hub; however, the domestic market is segmented. Fierce competition among local officials who are judged on their areas’ economic performance has led to regional protectionism. This significantly increases the cost of cross-regional transactions. Without a level playing field, market competition creates winners who are better at rent-seeking than creating value.

Poor corporate governance practices and the diversification myth also explain the lack of great Chinese companies. Due to ineffective corporate governance mechanisms, many Chinese companies are unable to resolve their agency problems, such as the strong incentive for senior executives to build corporate empires through debt financing. The obsession with building empires may be very effective in creating colossal entities, but does nothing to improve ROIC.

Diversification has also been a persistent myth for corporate China. Chinese companies, whether state-owned or privately held, end up diversifying their portfolios over time. However, the data on China’s listed companies shows that there is a negative correlation between ROIC and the extent of diversification. Diversification in general leads to large companies but not necessarily successful companies. On the contrary, staying focused on what works well helps improve a firm’s value. The aggressive pursuit of an expanding business portfolio, to a certain extent, may account for the lack of great companies in China.

Value Creation Must be Put Ahead of the Pursuit of Scale

After nearly forty years of strong economic growth, many of the factors that led to China’s economic rise are no longer working their magic. The once-abundant labor force is aging and is increasingly expensive, the forces of globalization are in retreat, credit-fueled investment has resulted in a pile-up of corporate debt, and overcapacity is endemic. The once strong faith in China’s long-term prosperity held by entrepreneurs and corporate founders is eroding. The ongoing economic transition poses many challenges for those national champions, many of which are debt-laden and failing to deliver reasonable returns.

How can Chinese companies transform themselves into value creators? Facilitating the emergence of strong companies in China is more a marathon than a sprint. It calls for a more pro-market institutional foundation involving a redefinition of the economic role of the government, enhancing the efficiency of financial intermediation, and seeding a culture of innovation and entrepreneurship.

The visible hand of the government in economic affairs has been a crucial factor in China’s economic success. State-planning and government spending have built an indispensable infrastructure for industrialization and economic growth. State involvement has even set the stage for innovation. For example, the rise of Chinese e-commerce has benefited tremendously from the telecommunication network, highway system, and high-speed railways built by the state. The state has committed large amounts of resources to drive innovation in many crucial areas — a feat impossible for private companies alone. However, in the next stage of economic development, capital efficiency and innovation will be much more important. All levels of government need to adjust their roles and strive to transform themselves from participants in economic activities to rule-setters and public service providers.

In addition, deregulating interest rates and allowing private capital to enter the financial services sector will be key to rejuvenating China’s financial system. Only when capital can be allocated more efficiently can company-level ROIC be improved. As such, China needs “Finance 2.0,” a new-generation financial system that can channel funds from savers to end-users through simple, direct, and effective channels.

The Chinese economy has benefited tremendously from unleashing individual creativity, as evidenced by the reform experiences of the 1980s and 1990s. The most feasible source of future economic growth is the improvement of total factor productivity. To make this possible, China must create a fair, equitable, and transparent business atmosphere, seed a culture of innovation, and inspire entrepreneurship.

Great minds create great companies. China’s new breed of companies will be run by those individuals who are brave enough to disrupt incumbents through technology and business model innovation, hold deep respect for the market and customers, and aim at creating long-term value rather than short-term gains. On this point, Huawei Technologies, Alibaba Group Holding, Tencent Holdings, Xiaomi, and SF Express are front-runners that may herald the coming of a breakthrough. Only with more companies like them can the Chinese economy accomplish its long overdue metamorphosis from quantity growth to quality growth.

Note: This paper is a synopsis of Corporate China 2.0: The Great Shakeup, authored by Qiao Liu and published by Palgrave Macmillan in December 2016. The analysis reported here is based on the most recently available data.

Accompanying China’s rapid economic growth has been growth of another kind: the surge of large companies in China. On July 20, 2017, Fortune magazine released its 2017 Global 500 list, which ranks the world’s largest firms by sales. On the list, Chinese firms continue to ascend global rankings — there are an unprecedented 115 Chinese firms (including six Taiwanese firms), which is only seventeen less than the number of American firms on the list. The 2017 list is the fourteenth time that China has increased its share of largest companies. Given the strong momentum, China will likely have more Fortune Global 500 companies than the United State in three to five years (see Figure 1, where Taiwanese firms are not included). Strikingly different from their Western counterparts, most of China’s large companies are state-owned and are concentrated in the commodities, energy, and financial sectors.

Figure 1: Fortune Global 500 Companies: China versus the United States

Source:Various issues of Fortune magazine.

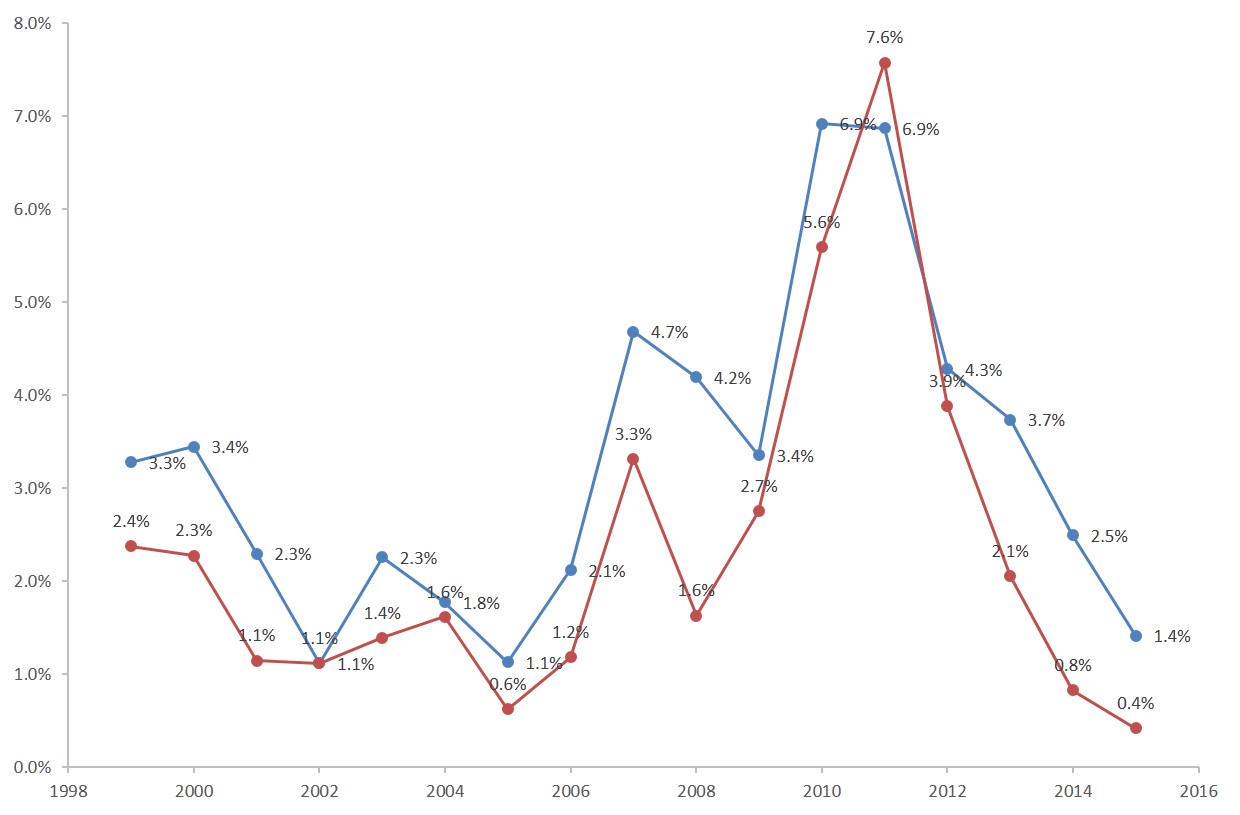

While these giant companies contribute significantly to China’s GDP, many do not generate much value. For example, Aluminum Corp. of China, also known as Chalco, reported in March 2015 a net loss for the previous year of 16.2 billion yuan ($2.4 billion). Also in 2015, Sinosteel missed a payment on its debt. Overall, China’s listed companies have a reported average returns on invested capital (ROIC) of 3 percent over the past eighteen years (see Figure 2), compared with over 10 percent of ROIC for U.S. companies over the past 100 years. To successfully transition China’s economy without losing much growth, the country must shift its primary growth driver from an investment rate to ROIC. The micro-units of the economy — Chinese companies — must put value creation far ahead of the aggressive pursuit of operational scale.

Figure 2: The Average ROIC of China’s Listed Companies: 1998–2015

The Improbable Surge of Corporate China

The surge of the number of large Chinese companies largely results from the growth strategy adopted by China during its reform era. Since the reform and the opening of its economy, China has followed an investment-led growth strategy accompanied by strong demand for capital and other production factors, such as energy and raw materials. Many companies, however, are still monopolized by the state. Furthermore, strong demand combined with the persistence of state monopolies yields big state-owned companies in the resource and other sectors (i.e., finance). For example, except for China State Construction Engineering and SAIC Motors, the ten largest Chinese companies on the 2017 Fortune Global 500 list are all in the resource and financial sectors. Notably, except for Ping An Insurance, these ten largest Chinese companies are all owned by the central government.

Figure 3: Average ROIC from 1998 to 2015: Non-state Firms versus State Firms

The terms “big” and “brilliant” are not synonymous when looking at these large firms. These state-owned enterprises (SOEs) have been plagued by moral hazard issues and soft budget restraints, resulting in inefficiency. As shown in Figure 3, the ROIC analysis of the Chinese firms listed over the 1998–2015 period shows that the SOEs on average report an ROIC lower than that of non-state companies, with 2011 being the only exception. In 2017, out of mainland China’s 109 Fortune Global 500 companies, eleven are loss-making.

In addition to the investment-led growth strategy, the lack of an open and integrated domestic market is also to blame. As a result of reform and market liberalization, China has become a global business hub; however, the domestic market is segmented. Fierce competition among local officials who are judged on their areas’ economic performance has led to regional protectionism. This significantly increases the cost of cross-regional transactions. Without a level playing field, market competition creates winners who are better at rent-seeking than creating value.

Poor corporate governance practices and the diversification myth also explain the lack of great Chinese companies. Due to ineffective corporate governance mechanisms, many Chinese companies are unable to resolve their agency problems, such as the strong incentive for senior executives to build corporate empires through debt financing. The obsession with building empires may be very effective in creating colossal entities, but does nothing to improve ROIC.

Diversification has also been a persistent myth for corporate China. Chinese companies, whether state-owned or privately held, end up diversifying their portfolios over time. However, the data on China’s listed companies shows that there is a negative correlation between ROIC and the extent of diversification. Diversification in general leads to large companies but not necessarily successful companies. On the contrary, staying focused on what works well helps improve a firm’s value. The aggressive pursuit of an expanding business portfolio, to a certain extent, may account for the lack of great companies in China.

Value Creation Must be Put Ahead of the Pursuit of Scale

After nearly forty years of strong economic growth, many of the factors that led to China’s economic rise are no longer working their magic. The once-abundant labor force is aging and is increasingly expensive, the forces of globalization are in retreat, credit-fueled investment has resulted in a pile-up of corporate debt, and overcapacity is endemic. The once strong faith in China’s long-term prosperity held by entrepreneurs and corporate founders is eroding. The ongoing economic transition poses many challenges for those national champions, many of which are debt-laden and failing to deliver reasonable returns.

How can Chinese companies transform themselves into value creators? Facilitating the emergence of strong companies in China is more a marathon than a sprint. It calls for a more pro-market institutional foundation involving a redefinition of the economic role of the government, enhancing the efficiency of financial intermediation, and seeding a culture of innovation and entrepreneurship.

The visible hand of the government in economic affairs has been a crucial factor in China’s economic success. State-planning and government spending have built an indispensable infrastructure for industrialization and economic growth. State involvement has even set the stage for innovation. For example, the rise of Chinese e-commerce has benefited tremendously from the telecommunication network, highway system, and high-speed railways built by the state. The state has committed large amounts of resources to drive innovation in many crucial areas — a feat impossible for private companies alone. However, in the next stage of economic development, capital efficiency and innovation will be much more important. All levels of government need to adjust their roles and strive to transform themselves from participants in economic activities to rule-setters and public service providers.

In addition, deregulating interest rates and allowing private capital to enter the financial services sector will be key to rejuvenating China’s financial system. Only when capital can be allocated more efficiently can company-level ROIC be improved. As such, China needs “Finance 2.0,” a new-generation financial system that can channel funds from savers to end-users through simple, direct, and effective channels.

The Chinese economy has benefited tremendously from unleashing individual creativity, as evidenced by the reform experiences of the 1980s and 1990s. The most feasible source of future economic growth is the improvement of total factor productivity. To make this possible, China must create a fair, equitable, and transparent business atmosphere, seed a culture of innovation, and inspire entrepreneurship.

Great minds create great companies. China’s new breed of companies will be run by those individuals who are brave enough to disrupt incumbents through technology and business model innovation, hold deep respect for the market and customers, and aim at creating long-term value rather than short-term gains. On this point, Huawei Technologies, Alibaba Group Holding, Tencent Holdings, Xiaomi, and SF Express are front-runners that may herald the coming of a breakthrough. Only with more companies like them can the Chinese economy accomplish its long overdue metamorphosis from quantity growth to quality growth.

Note: This paper is a synopsis of Corporate China 2.0: The Great Shakeup, authored by Qiao Liu and published by Palgrave Macmillan in December 2016. The analysis reported here is based on the most recently available data.

(Qiao Liu, Guanghua School of Management, Peking University.)

Qiao Liu, 2016, Corporate China 2.0: The Great Shakeup, London and New York: Palgrave Macmillan.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email