Dollar Appreciation and Asian Economies

The sharp appreciation of the U.S. dollar between mid-2014 and mid-2015 raised concerns in the U.S. and its major trading partners. Zheng Liu, Mark Spiegel, and Andrew Tai from the San Francisco Fed evaluate the impact of dollar appreciation on economic conditions in the United States and its three major Asian trading partners: South Korea, Japan, and China.

The onset of U.S. monetary policy normalization has led to significant appreciation of the dollar. Between mid-2014 and mid-2015, the real effective exchange rate of the dollar increased by about 10%.

In theory, dollar appreciation reduces the relative price of foreign goods sold in the U.S. market and therefore stimulates foreign exports to the United States (Mendoza 1995). Appreciation also can act as a drag on U.S. economic activity, however, as U.S. exports become more expensive in foreign currencies. All else equal, the decline in U.S. activity reduces U.S. household income and lowers overall U.S. demand for foreign goods. If this demand spillover effect is sufficiently large, it may lower (rather than raise) a foreign country's exports to the U.S., limiting that country’s overall economic activity.U.S. monetary policymakers have frequently emphasized the demand spillover effect in their assessments of the global implications of U.S. monetary policy, both during the global financial crisis and in the subsequent recovery period. For example, in a 2012 speech, Federal Reserve Chairman Ben Bernanke recognized the possibility that U.S. monetary policy easing may have undesirable consequences for its trading partners, particularly for emerging market economies (EMEs) that are vulnerable to abrupt changes in the pace of international capital flows. He stressed, however, that there are potential benefits for EMEs from supporting recovery in the advanced economies (Bernanke 2012). More recently, current Federal Reserve Vice Chair Stanley Fischer noted that, while the onset of policy tightening in the United States may have put pressure on capital movements for some EMEs, one reason for optimism was that this tightening was taking place “against the backdrop of a strengthening U.S. economy and in an environment of improved household and business confidence” (Fischer 2014).

Ambiguity in the effects of dollar appreciation may also stem from the well-known Harberger-Laursen-Metzler effect, which suggests that if a foreign currency depreciates against the dollar, the relative price of its exported goods falls and its terms of trade deteriorate. If this deterioration were transitory, then domestic households would reduce savings to smooth consumption, lowering the country’s current account balance (Svensson and Razin 1983). But if the deterioration in the terms of trade were perceived to be permanent, Obstfeld (1982) shows that the negative wealth effect may increase domestic savings, improving the current account balance.

The sensitivity of a country’s economic activity to dollar appreciation can further depend on the country's domestic policy regime, particularly its exchange rate regime. For a country that tightly manages its exchange rate against the dollar, a dollar appreciation shock would result in an overall real currency appreciation for the country, reducing its global competitiveness. One notable example of such a managed exchange rate regime is China. Although China's currency (RMB) has shown more flexibility recently, it closely followed the dollar during the period of significant dollar appreciation in 2014-15.

In a recent paper, we evaluate the impact of dollar appreciation on economic conditions in the United States and its three major Asian trading partners: South Korea, Japan, and China (Liu, Spiegel, and Tai 2017). This is a challenging task, not only because of the theoretical ambiguity of the dollar appreciation effects on foreign economies, but also because measuring economic activity in these Asian economies is inherently difficult.

To examine the impact of dollar appreciation on the three Asian economies, we use the factor-augmented vector auto-regression (FAVAR) framework introduced by Bernanke and Boivin (2003) and Bernanke, Boivin and Elias (2005) to gauge the impact of monetary policy shocks for the U.S. economy. This approach addresses the issue that observed individual data sources, such as industrial production and the unemployment rate, are generally imperfect measures of economic activity. This concern is particularly relevant for a country like China, where data availability is limited and official data are not completely reliable (Fernald, Spiegel, and Swanson 2014). The FAVAR framework summarizes economic activity through a small number of estimated indices.

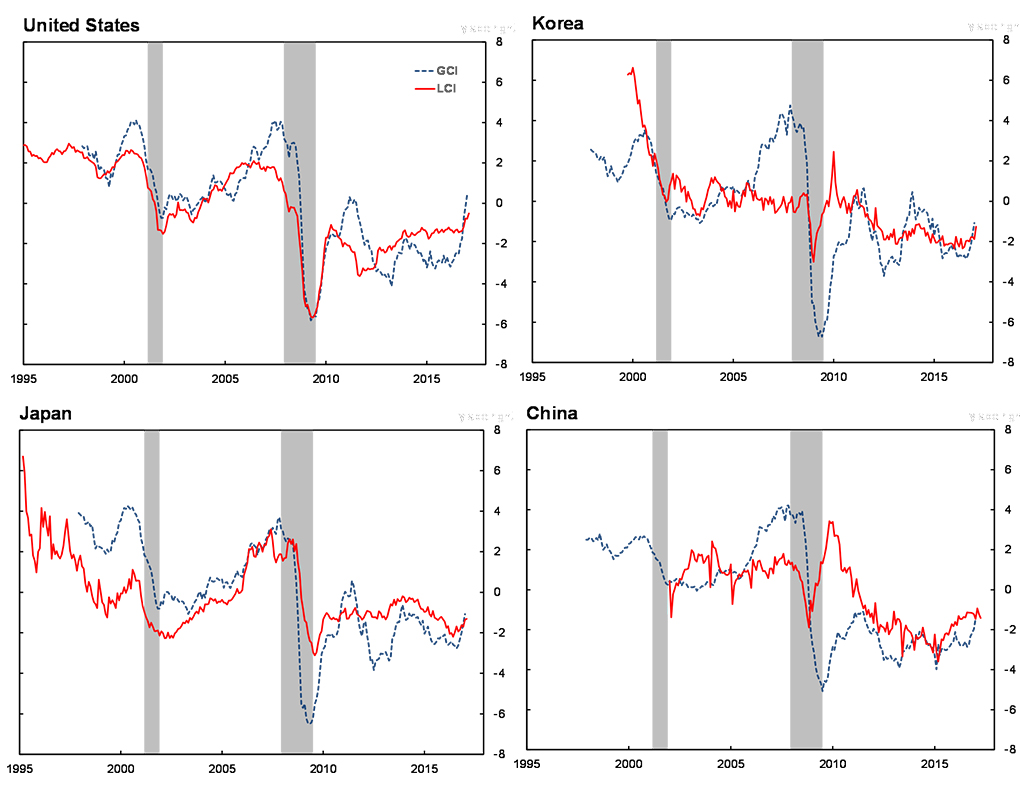

We extend the FAVAR framework to study the impact of dollar appreciation on four countries: South Korea, Japan, China, and the United States. For each country, we construct a local conditions index (LCI) that summarizes changes in a number of domestic economic indicators, such as industrial production, unemployment, housing activity, and asset market indicators. To control for changes in external economic conditions for a specific country, we also construct a latent index of foreign activity, which summarizes the economic activity in which the country engages with its nine largest trading partners (weighted by trade shares). This country-specific global conditions index (GCI) provides a novel way of conditioning for changes in relevant foreign activity and helps isolate the dollar appreciation effects in the estimated FAVAR framework. Both the LCI and GCI are plausible, as they sufficiently capture the four countries’ domestic business cycles as well as global cyclical fluctuations (see Figure 1).

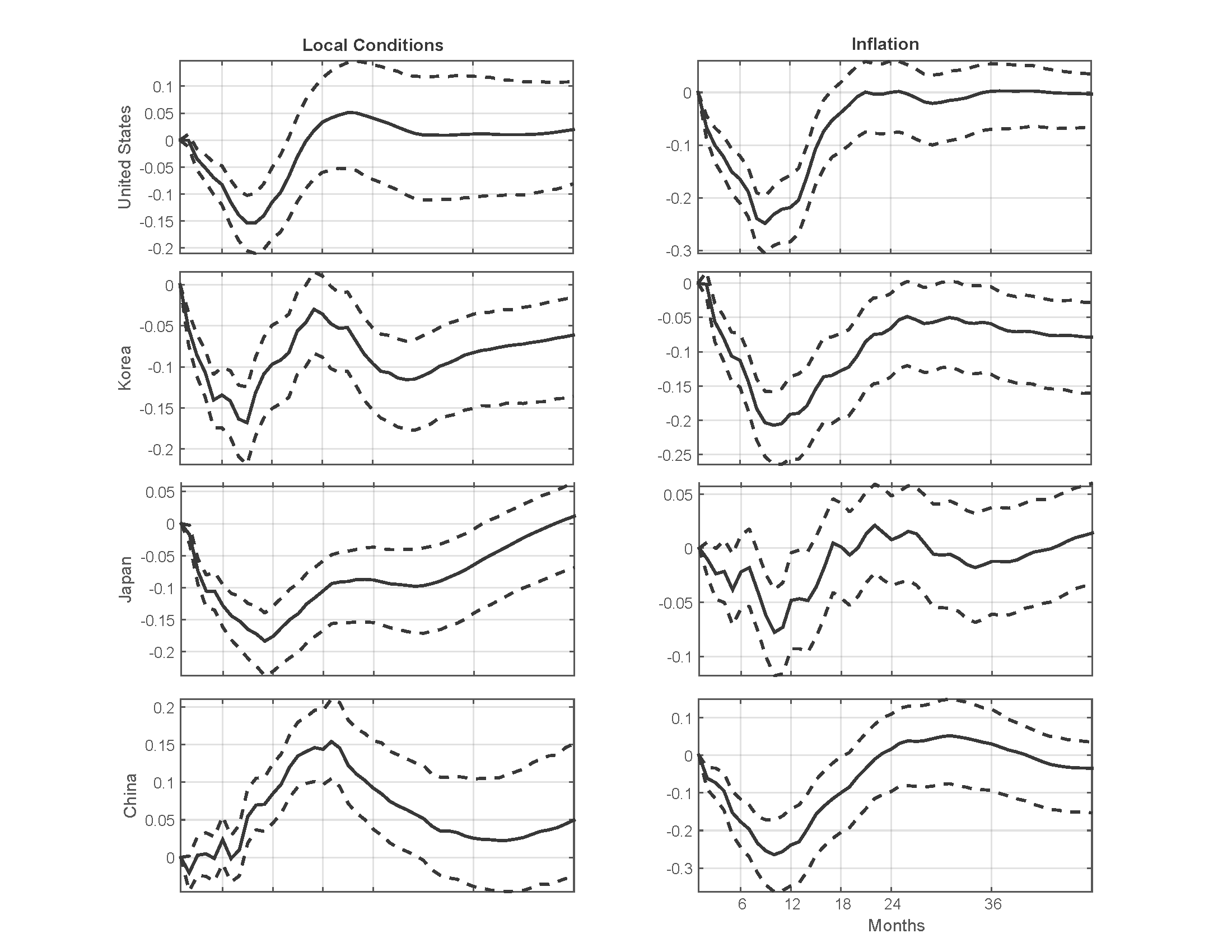

Figure 2: Impulse responses of the local conditions index and inflation for each country

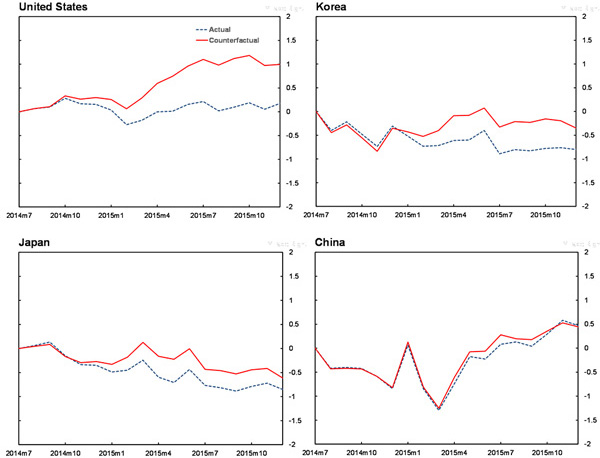

Finally, we use the estimated model to assess the quantitative importance of the dollar appreciation from July 2014 through December 2015. We conduct a counterfactual experiment that compares the actual path of the LCI in each country to the counterfactual path generated when the broad dollar index is fixed at its June 2014 value for the remainder of the sample period. The actual and counterfactual paths of the LCIs are shown in Figure 3. The actual dollar appreciation from mid-2014 to mid-2015 imposed a significant drag on U.S. economic activity. Absent the dollar appreciation, the U.S. LCI during this period would have been one standard deviation higher than observed. The dollar appreciation has also substantially reduced economic activity in South Korea, despite that country’s floating exchange rate regime and globally integrated capital markets. The effects of dollar appreciation on Japan's and China's LCIs are more muted.

Note: Both the actual and counterfactual LCIs are normalized to zero in July 2014.

Note: Both the actual and counterfactual LCIs are normalized to zero in July 2014.These findings suggest that Asian economic conditions are closely tied to U.S. monetary policy, despite the apparent differences in economic structures and policy regimes in those countries. The evidence favors the argument made by U.S. monetary policymakers that the recovery of the advanced economies was in the best interests of EMEs during the crisis period.

The views expressed herein do not necessarily reflect the views of the Federal Reserve Bank of San Francisco or the Federal Reserve System.

(Zheng Liu, Economic Research Department of the Federal Reserve Bank of San Francisco; Mark M. Spiegel, Economic Research Department of the Federal Reserve Bank of San Francisco; Andrew Tai, Economic Research Department of the Federal Reserve Bank of San Francisco.)

Bernanke, Ben S. (2012), “U.S. Monetary Policy and International Implications.” Speech at the “Challenges of the Global Financial System: Risks and Governance under Evolving Globalization,” A High-Level Seminar sponsonered by Bank of Japan-International Monetary Fund, Tokyo, Japan.

Bernanke, Ben S. and Jean Boivin (2003), “Monetary Policy in a Data Rich Environment, Journal of Monetary Economics, 50, pp. 525-546.”

Bernanke, Ben S., Jean Boivin, and Piotr Eliasz (2005), “Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach,” Quarterly Journal of Economics, 50, pp. 387-422.

Fernald, John G., Mark M. Spiegel, and Eric T. Swanson (2014), “Monetary Policy Effectiveness in China: Evidence from a FAVAR Model," Journal of International Money and Finance, 49, pp. 83-103.

Fischer, Stanley (2014), “The Federal Reserve and the Global Economy,” Per Jacobsson Foundation Lecture, 2014 Annual Meetings of the International Monetary Fund and the World Bank Group, Washington, D.C..

Liu, Zheng, Mark M. Spiegel, and Andrew Tai (2017), “Measuring the Effects of Dollar Appreciation on Asia: A FAVAR Approach,” Journal of International Money and Finance, 74, pp. 353-370.Mendoza, Enrique (1995), “The Terms of Trade, the Real Exchange Rate, and Economic Fluctuations,” International Economic Review, 36, pp. 101-137.

Obstfeld, Maurice (1982), “Aggregate Spending and the Terms of Trade: Is There a LaursenMetzler Effect?” Quarterly Journal of Economics, 97, pp. 251–270.

Svensson, Lars E. O. and Assaf Razin (1983), “The Terms of Trade and the Current Account: The Harberger-Laursen-Metzler Effect,” Journal of Political Economy, 91, pp. 97–125.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email