Improving Regulation for Innovation: Evidence from China’s Pharmaceutical Industry

In 2015, China revamped its pharmaceutical regulations, drawing inspiration from the US, to accelerate drug approvals. Using data at the drug and firm levels during 2011–2021, this study reveals three key outcomes: a spike in new drug trials due to faster approval processes, an influx of innovative companies enhancing overall drug creativity, and a positive stock market response to these advancements. These findings highlight how streamlined regulations can invigorate the pharmaceutical sector, attracting cutting-edge firms and fostering innovation, illustrating the significant impact of adopting efficient regulatory practices from leading countries.

Medical innovation is crucial for improving health outcomes and extending life expectancy.Yet, the majority of scholarly work on this subject focuses on developed economies, the pioneers in medical innovation. Developing and emerging economies, on the other hand, often lag in this area. How can latecomers improve their potential in medical innovation? In our recent study (Jia, Ma, Yang, and Zhang 2023), we emphasize the potential effectiveness of overhauling regulatory practices that have fallen behind as a viable pathway to improving medical innovation in emerging markets.

A critical aspect of medical regulation is the time taken to approve various stages of new drug development, which varies significantly worldwide. Developed regions like Australia, Canada, Europe, Japan, and the US typically have swifter approval processes. However, emerging markets such as China and South Africa might experience approval processes that are up to four times lengthier than those in developed nations. To what extent can enhanced regulation foster medical innovation in emerging markets? We address this question by studying the substantial regulatory reform introduced in China in 2015.

As in other emerging markets, the China Food and Drug Administration (CFDA) confronted a critical shortage of proficient personnel and limited regulatory expertise. This subsequently caused delays and backlogs in the processing of drug approval applications. In response, in 2015, CFDA adopted a strategy reminiscent of the Prescription Drug User Fee Act enacted in the US. This strategy involved the collection of user fees from applicants to facilitate the recruitment of personnel and the enhancement of systems, resulting in a significant reduction in the approval time for investigational new drugs (INDs), the critical first stage in the new drug development process. This reform presents an apt context to illuminate the impact on innovation when an emerging market adopts regulatory approaches employed by frontier countries such as the US.

Shorter Waiting Periods Lead to Greater Innovation Volume

We leverage the difference in the reduction of approval time across drug categories to identify the effect of regulatory reform on innovation quantity. To measure the drug-level change in approval time, we use China’s medical registration data from 2011 to 2021 and the Anatomical Therapeutic Chemical (ATC) drug classification system to group drugs into categories. We measure the decline in approval time within three years (2015–2017) in the post-reform period relative to that within three years (2012–2014) in the pre-reform period to measure the magnitude of the reform, assuming that firms observe these changes and make decisions regarding innovation. As our primary indicator of innovation, we focus on applications for INDs, which are submissions mandated by regulatory authorities prior to initiating clinical trials, and examine whether these INDs have translated into clinical trials.

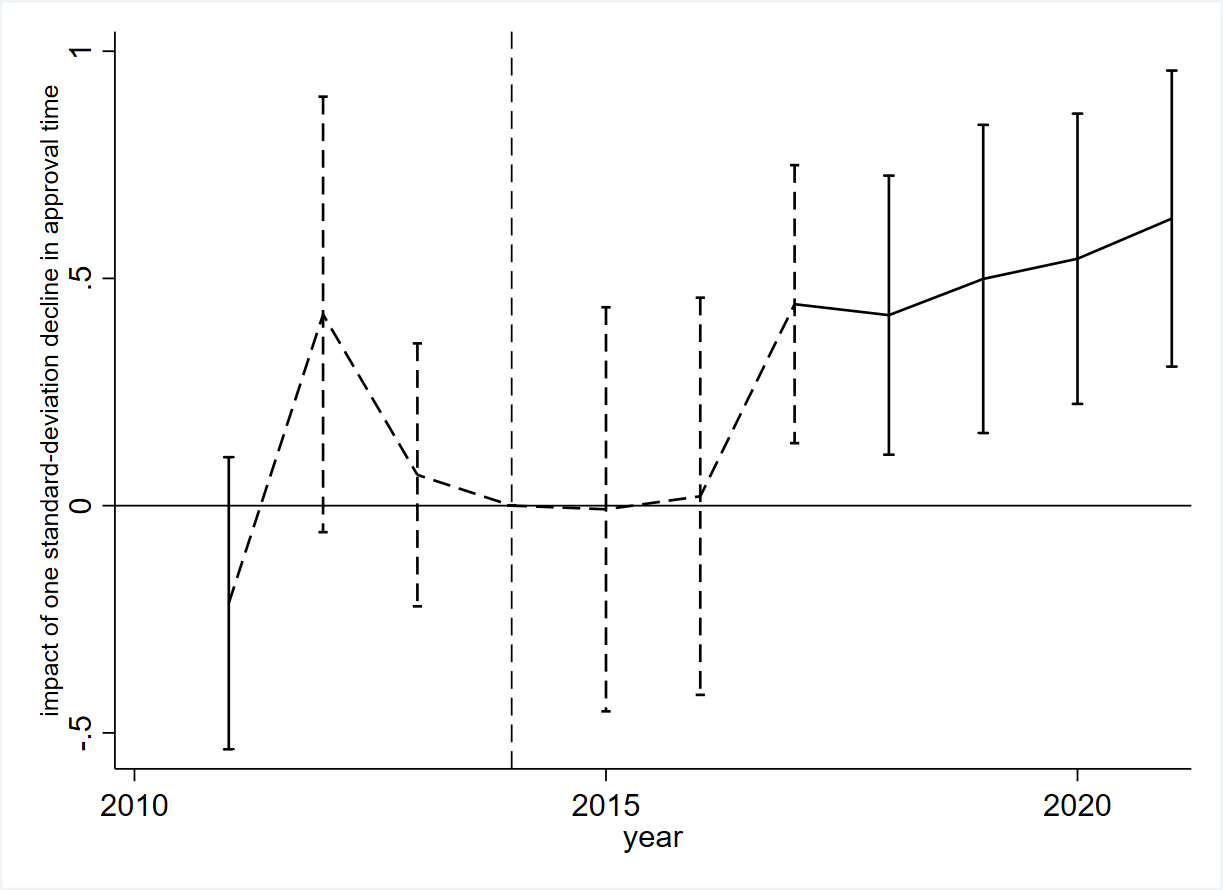

Through a standard difference-in-differences approach across 109 drug categories, we first examine how a decline in approval time affects the quantity of innovation, measured by IND applications and their associated clinical trials. Figure 1 presents the estimation results, indicating a positive association between the decrease in approval time and an increase in the number of IND applications. It appears that this effect is delayed by a few years, which is likely due to the time required for firms and entrepreneurs to observe these changes and subsequently make decisions regarding R&D and market entry. Specifically, after 2017, a one-standard-deviation decrease in approval time led to a more than 50% increase in the number of IND applications, indicating the substantial impact of regulatory reform on medical innovations. Importantly, the analysis shows no systematic correlation between the decline in approval time and the number of IND applications before the regulatory reform in 2015. The finding is robust to considering a variety of drug characteristics. This rise in INDs is also reflected in an increase in clinical trials across Phases I, II, and III. We demonstrate that our findings are unaffected by other policy changes in the era, namely the bioequivalence evaluation for generic drugs and the modification of the drug reimbursement list for public health insurance.

Figure 1: Impact of Decline in Approval Time on Number of IND Applications

We further investigate whether the change in IND applications after the reform was driven by new firms or incumbent firms. We find that incumbent firms are accountable for half of this upswing in INDs, with the remaining half attributed to new firms.

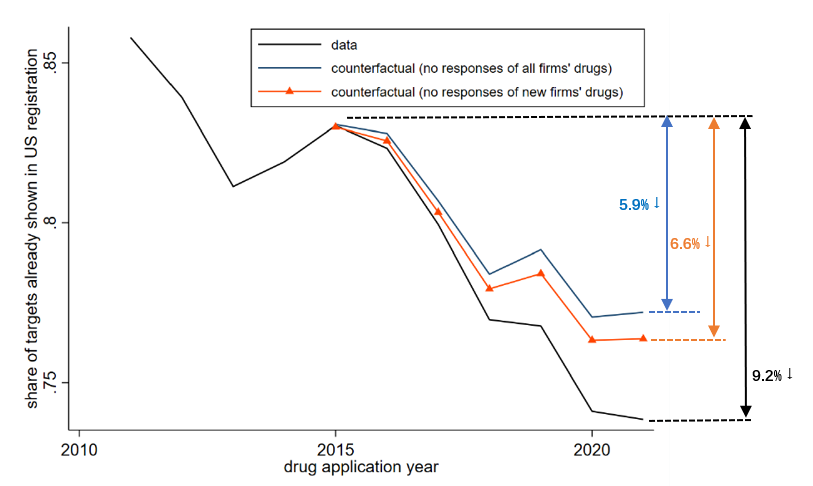

Improvement in Innovativeness of the Drug Industry Fueled by Entry of New Firms

Motivated by the long-standing discussion on imitation and innovation in our context, we introduce a novel metric for innovativeness, focusing on whether drug applications adopt targets already established in the US (or Europe). It is noteworthy that innovativeness can be influenced through two avenues: within-drug innovation and firm composition due to firm entry. We discover no substantiating evidence for a change in novelty within drug categories following the reform. To explore the firm composition channel, we conduct a counterfactual exercise based on the estimation results from the previous part, assuming either no response from all firms, or no response from new firms only. Figure 2 shows the findings. The black line depicts patterns from the actual data and indicates that there is a sizable enhancement in drug novelty during this period (a reduction in the share of drugs exploring existing targets by 9.2pp). The accounting exercise reveals that regulatory reform contributes to 38% of the increase in new targets observed in the post-reform period, with new firms playing a significant role in elevating aggregate innovativeness. Specifically, new firms account for 74% of the contribution to aggregate innovativeness, given their inclination for innovation and propensity to explore novel targets.

Figure 2: Impact of Changes in Approval Time on Drug Applications’ Innovativeness through Changes in Composition

Market Acknowledges Enhancements Resulting from Regulatory Reform

Our main analysis centers around INDs, a critical initial stage in new drug approvals. Notably, only a few post-reform INDs have progressed to the final approval stage of new drug applications (NDAs). To assess market reactions as an indicator of the reform’s impact, we further explore stock market responses to NDAs before and after the reform. It’s important to note that some INDs for post-reform NDAs may have been filed before the reform. Therefore, this analysis aims not to evaluate the market value of post-reform INDs directly, but rather to assess market reactions to the regulatory reform. By comparing stock market reactions to the approval of new drugs with those of generic drugs, both before and after the regulatory reform, we find a notably positive stock market response to the final approvals of NDAs following the reform, a contrast to the limited response observed prior to the reform. This supports our interpretation that the reform has led to increased expected returns, reflecting a positive market perception of the reform’s impact on drug innovation.

Conclusion

Our findings deepen our understanding of the relationship between regulation and innovation, especially medical innovation in emerging economies. Most of the existing work on regulation in medical innovation focuses on evaluating the speed and safety trade-off of FDA review times (Grabowski and Wang 2008; Chandra et al. 2022; Rogers 2022). Though this is crucial in emerging nations like China, there’s an added dimension: the authenticity of the innovation’s novelty. This raises inquiries such as whether these firms are truly innovating or merely imitating their US counterparts. Our study sheds light on this vital, relatively untapped domain of medical innovation in emerging markets.

Our study reveals an important link between quantity and novelty in innovation, due to firm entry. In our setting, quantity improvement leads to composition change, which implies novelty improvement at the aggregate level, while the literature commonly tends to analyze quantity and quality separately (Romer 1990, Grossman and Helpman 1991). Our findings document that new firms play a considerable role in medical innovation, consistent with recent literature on the role of new firms in China’s economic growth (Khandelwal, Schott, and Wei 2013; Brandt and Lim 2019). It also highlights the costs associated with ineffective regulation, specifically how it can deter more innovative firms from entering the market.

Broadly speaking, our study emphasizes that regulatory practices can hinder or foster innovation. It does not center around the impact of more or fewer regulations or wholesale adoption of regulatory approaches; rather, it reveals the value of pinpointing specific regulatory practices that have demonstrated efficacy in frontier countries.

References

Brandt, Loren, and Kevin Lim. 2019. “Accounting for Chinese Exports.” University of Toronto Working Paper 680. https://brandt.economics.utoronto.ca/wp-content/uploads/2020/12/working_account_for_chinese_exports.pdf

Chandra, Amitabh, Jennifer Kao, Kathleen L. Miller, and Ariel D. Stern. 2022. “Regulatory Incentives for Innovation: The FDA’s Breakthrough Therapy Designation.” National Bureau of Economic Research Working Paper 30712. https://doi.org/10.3386/w30712.

Grabowski, Henry, and Y. Richard Wang. 2008. “Do Faster Food and Drug Administration Drug Reviews Adversely Affect Patient Safety? An Analysis of the 1992 Prescription Drug User Fee Act.” Journal of Law and Economics 51 (2): 377–406. https://doi.org/10.1086/589934.

Grossman, Gene M., and Elhanan Helpman. 1991. “Quality Ladders in the Theory of Growth.” Review of Economic Studies 58 (1): 43–61. https://doi.org/10.2307/2298044.

Jia, Ruixue, Xiao Ma, Jianan Yang, and Yiran Zhang. 2023. “Improving Regulation for Innovation: Evidence from China’s Pharmaceutical Industry.” National Bureau of Economic Research Working Paper 31976. https://doi.org/10.3386/w31976.

Khandelwal, Amit K., Peter K. Schott, and Shang-Jin Wei. 2013. “Trade Liberalization and Embedded Institutional Reform: Evidence from Chinese Exporters.” American Economic Review 103 (6): 2169–95. https://doi.org/10.1257/aer.103.6.2169.

Rogers, Parker. 2022. “Regulating the Innovators: Approval Costs and Innovation in Medical Technologies.” Center for Open Science SocArXiv Paper. https://doi.org/10.31235/osf.io/c8s3m.

Romer, Paul M. 1990. “Endogenous Technological Change.” Journal of Political Economy 98 (5): S71–S102. https://www.jstor.org/stable/2937632.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email