Cash in the Darkness

Relying on a large dataset on cash withdrawals of over 165 million bank cards from China, we find a higher ratio of cash withdrawals late at night is associated with criminal activity. The effect is stronger for crimes that involve cash transactions but is muted for cash withdrawals during the day or for civil disputes and daytime cash-intensive criminal cases. Moreover, the proportion of cash withdrawals at night significantly dropped during exogenous anti-crime campaigns, but increased after the ban of cryptocurrencies. Overall, our study suggests that the use of cash at night plays an important role in fueling criminal activity.

It has been widely recognized that cash plays a key role in fueling the underground economy, favored by its real-time clearing of transactions and anonymity (Baddeley 2004, McAndrews 2020, Borgonovo et al. 2021). Such an economy includes a great deal of criminal activity, such as tax evasion, money laundering, drug dealing, human trafficking, terrorism, counterfeiting, and illegal immigration (Rogoff 2017). For instance, Europol, the law enforcement agency of the European Union, estimates that more than 30% of the suspicious transaction reports within the financial system involve the use of cash in the EU. Despite the intuitive link between cash and crime, there is a lack of direct evidence identifying whether and how cash is related to criminal activity.

In Ren, Wang, Zhang, and Zhang (2023), we utilize a large, high-frequency dataset on cash withdrawal of 222 Chinese cities from 2016 to 2019 to examine the relationship between the use of cash late at night (00:00 to 05:59) and criminal activity. In particular, we consider the different economic implications of the use of cash over a day, by decomposing the use of cash late at night (00:00 to 05:59) and during the day (06:00 to 17:59), and propose a measure to gauge the dark side of cash. We do not include the time period between 18:00 and 23:59 in the nighttime period because we are interested in late-night cash withdrawals, which are more suspicious than those cash withdrawals at other times of night. Cash withdrawals between 18:00 and 23:59 are not so “dark” and may be used more for legitimate nighttime consumption purposes. We also manually collect data on criminal cases from China Judgments Online (CJO), an official database maintained by the Supreme People’s Court of China. We measure a city’s criminal activity by counting the total number of first-instance court judgments of criminal cases in the city in a given year.

Main Findings

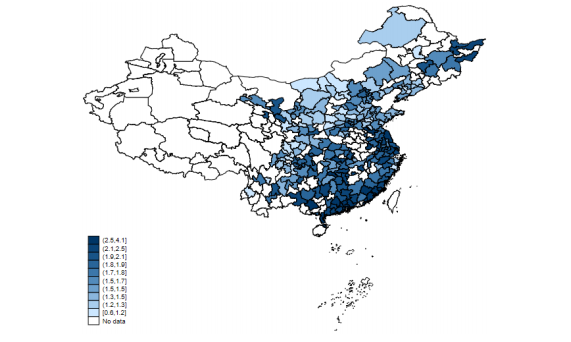

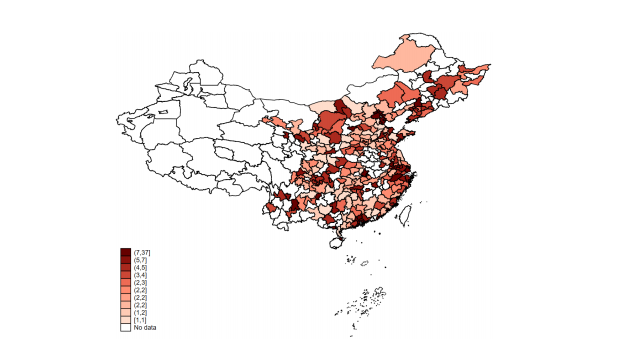

Figure 1 presents the geographic heatmaps of the nighttime cash ratio and the number of crimes. We divide the cities into ten equal-sized subsamples by the mean of night cash ratio (in percentage) and by the annual average crime cases per 10,000 people in panels A and B, respectively. We assign darker colors to cities with higher values. The two heatmaps show that cities with many criminal cases are also likely to have a high number of nighttime cash withdrawals. This finding points to a positive correlation between nighttime cash withdrawals and criminal activity.

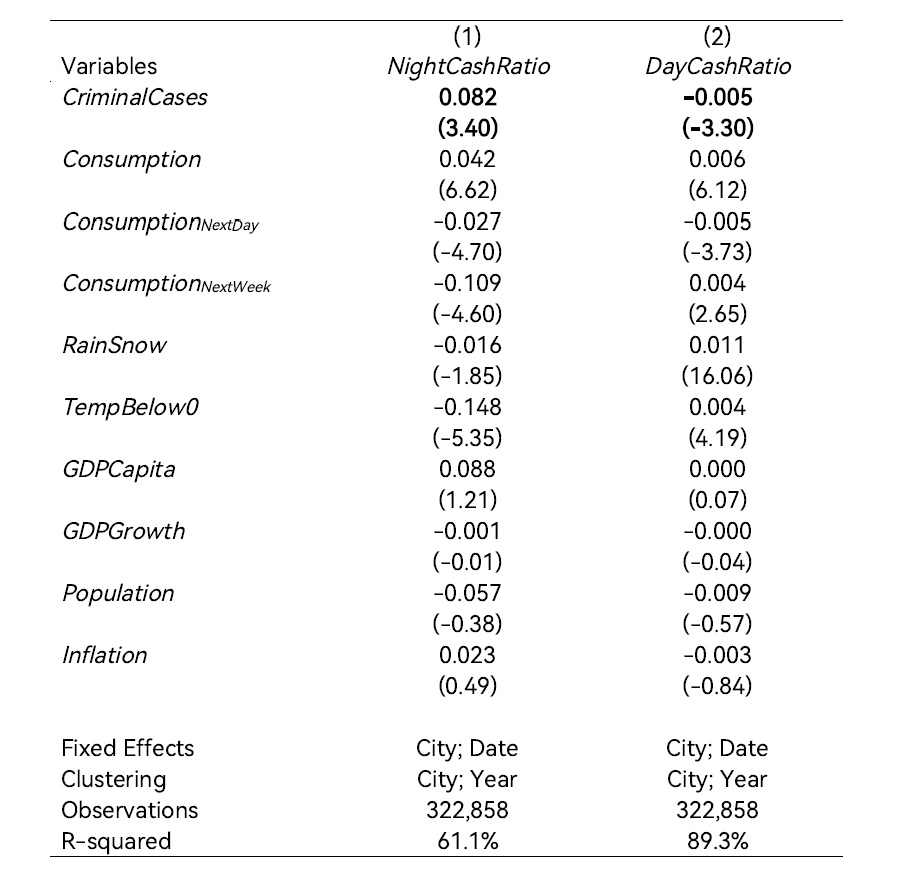

We then confirm this positive relationship using formal regressions. The results in Table 1 suggest that a 1-standard-deviation increase in criminal cases is associated with a 16.8%-standard-deviation increase in the ratio of nighttime cash withdrawals. The evidence implies that cities with more nighttime cash withdrawals are likely to also have a higher number of criminal events, which points to a “dark” side of nighttime cash withdrawals. In contrast, such a relationship is found to be negative when we use the ratio of day cash to total cash withdrawals as the outcome variable. Moreover, in a placebo test, we do not find the result to hold when we consider the number of civil disputes as the variable of main interest.

Panel A. Night Cash Ratio (in percentage) by City

Panel B. Criminal Cases per 10,000 People by City

Figure 1. Night Cash Ratio and Criminal Cases by City

This figure shows the geographical distribution of the night cash ratios and the number of crimes across cities in China. Panel A plots a heatmap for the distribution of night cash ratio (in percentage), and Panel B plots a heatmap for the distribution of annual average crime cases as per 10,000 people. We divide the cities into ten equal-sized subsamples by the mean of night cash ratio and by the annual average crime cases per 10,000 people in Panels A and B, respectively. We assign darker colors to cities with higher values. The legends of Panels A and B show the intervals of night cash ratio and average crime cases for each of the ten subsamples, respectively.

Table 1. Crime and the Use of Cash

This table reports the results of the regression of the use of cash on the number of crime cases. CriminalCasesi,T is the natural logarithm of the number of criminal cases of city i in year T. NightCashRatioi,t is the natural logarithm of the ratio of night cash (00:00 to 05:59) to total cash withdrawals in city i on day t. DayCashRatioi,t is the natural logarithm of the ratio of day cash (06:00 to 17:59) to total cash withdrawals in city i on day t. We also control for individual consumption, local weather conditions, and local economic conditions. The sample period is from January 1, 2016, to December 31, 2019. We control for fixed effects at the city and day levels. The t-statistics reported in parentheses are based on standard errors double clustered at both the city and year levels.

Potential Mechanisms

We carry out a set of cross-sectional analyses to examine two possible channels through which nighttime cash withdrawals are related to criminal activity.

First, the use of cash late at night can meet the real-time demand for cash for criminal activity that is likely to both occur at night and rely heavily on cash. This channel essentially predicts that the baseline positive relation between night cash and crime is due mainly to those crimes that are extensively involved with the use of cash late at night. Following Rogoff (2017), we divide the nine broad types of crimes listed in the CJO database into a night-cash-intensive group and a daytime-cash-intensive group based on the probability of such crimes requiring cash for illegal transactions. For example, “Crimes of Encroaching on Property,” such as robbery or theft, fall into the cash-intensive group, while “Crimes of Dereliction of Duty” fall into the daytime-cash-intensive group. Consistent with this nighttime crime channel, we find that the baseline results are indeed concentrated on cash-intensive crimes but become nonsignificant for daytime-cash-intensive crimes.

Second, the use of cash is more difficult to track under the cover of darkness, which lowers the expected costs of committing crimes and thus fosters more crimes (Allen 2011, Pyne 2016). To test this intuition, we construct two proxies for public security, with the first measure being the number of CCTV cameras per capita in the city, and the second being the number of police stations per capita. Consistent with this monitoring cost channel, we find that the baseline positive relation is weaker in cities ranking in the top 10 (20 or 30) in terms of the number of CCTV cameras per capita and in those with a higher number of police stations per capita.

Establishing Causality

The positive relation between nighttime cash withdrawals and criminal events could be endogenous. For instance, some omitted variables, such as the bustling nightlife of a city, may lead to both a higher number of nighttime cash withdrawals and a higher amount of criminal activity. To alleviate such concerns, we perform three difference-in-differences (DiD) analyses based on two exogenous shocks to criminal activity and one shock to the alternative payment channel.

The first event we exploit is the anti-gang campaign between 2018 and 2020. The campaign led to a massive crackdown on gang-related crimes. Nearly 32,000 gang-related organizations were dismantled during the campaign. The campaign had three rounds, starting in July 2018. In each round, the CPC’s Central Committee sent steering groups to one-third of 31 provinces in mainland China to supervise the campaign and crack down on gang-related crimes and corruption within local governments. Each round lasted for one month and did not overlap with the other two rounds, which enabled us to perform a standard staggered DiD analysis. We find that the affected cities experienced a 2.4% greater reduction in nighttime cash withdrawals relative to the control cities after the campaign.

The second event we examine is anti-drug day, which is marked on June 26 of each year. Around that day, governments at all levels in China organize large-scale campaigns and various programs to publicize the dangers of narcotics, carry out drug prevention education, and crack down on drug-related crimes. We conjecture that cash withdrawals at night, if related to crime, would experience a substantial decline on anti-drug day. Consistent with this prediction, we find that the proportion of cash withdrawals at night declines by a significant margin, 8.9%, on anti-drug day for cities with a higher number of drug crimes compared to cities with fewer drug crimes.

The third event we examine is China’s crackdown on cryptocurrencies in 2017. On September 4, 2017, the People’s Bank of China and six other central government administrations issued a joint statement to ban initial coin offerings (ICOs) of cryptocurrencies and prohibit financial and payment institutions from providing any services for cryptocurrency transactions. Because cryptocurrencies are widely used in illegal activities for their high levels of anonymity (Foley, Karlsen, and Putniņš 2019), we consider this ban to be a salient shock to crimes that have strong demand for anonymous transactions. We find that following the ban on cryptocurrencies, the use of cash at night is even more positively related to the number of crimes, especially for cities with more crimes. Given that cryptocurrencies are widely used for criminal purposes (Foley Karlsen, and Putniņš 2019; Sokolov 2021; Amiram et al. 2022), this finding suggests that the use of cash at night likely serves as the remaining channel of capital flows for illegal activities after cryptocurrency transactions were banned in China.

Policy Implications

Overall, we find that late-night cash withdrawals are positively associated with criminal activity. An important implication of this study is that we reveal the possibility of using nighttime cash withdrawals as an ex-ante indicator for crime activities. Regulatory authorities could consider alternative data like cash withdrawals as a potential source of information about illegal activities in the future.

References

Amiram, Dan, Bjørn N. Jørgensen, and Daniel Rabetti. 2022. “Coins for bombs: The predictive ability of on‐chain transfers for terrorist attacks.” Journal of Accounting Research 60 (2): 427-466. https://doi.org/10.1111/1475-679X.12430.

Allen, W. David. 2011.Criminals and Victims. Redwood City, CA: Stanford University Press.

Baddeley, Michelle. 2004. “Using E-cash in the New Economy: An Economic Analysis of Micropayment Systems.” Journal of Electronic Commerce Research 5 (4): 239–53. http://ojs.jecr.org/jecr/sites/default/files/05_4_p03_0.pdf.

Borgonovo, Emanuele, Stefano Caselli, Alessandra Cillo, Donato Masciandaro, and Giovanni Rabitti. 2021. “Money, Privacy, Anonymity: What Do Experiments Tell Us?” Journal of Financial Stability 56: 100934. https://doi.org/10.1016/j.jfs.2021.100934.

Foley, Sean, Jonathan R. Karlsen, and Tālis J. Putniņš. 2019. “Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed through Cryptocurrencies?” Review of Financial Studies 32 (5): 1798–1853. https://doi.org/10.1093/rfs/hhz015.

McAndrews, James J. 2020. “The Case for Cash.” Latin American Journal of Central Banking 1 (1–4): 100004. https://doi.org/10.1016/j.latcb.2020.100004.

Pyne, Derek. 2016. “Crime (Incentive to).” In Encyclopedia of Law and Economics, edited by Alain Marciano and Giovanni Battista Ramello. New York: Springer.

Ren, Haohan, Kemin Wang, Bohui Zhang, and Fan Zhang. 2023. “Cash in the Darkness.” SSRN Working Paper No. 4497793. https://dx.doi.org/10.2139/ssrn.4497793.

Rogoff, Kenneth S. 2017. The Curse of Cash. Princeton, NJ: Princeton University Press.

Sokolov, Konstantin. 2021. “Ransomware activity and blockchain congestion.” Journal of Financial Economics 141 (2): 771-782. https://doi.org/10.1016/j.jfineco.2021.04.015.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email