Trade Policy Uncertainty and New Firm Entry: Evidence from China

Exploiting China’s WTO accession as a quasi-natural experiment, this study finds that reduced trade policy uncertainty (TPU) in a major destination market promotes domestic entrepreneurial activities in China. We explore a range of underlying mechanisms and regional heterogeneity effects, illustrating the important synchronization between external openness and internal reform for developing economies. We also show that reduction in TPU intensifies industry-level competition and induces better-quality entrants, and that new firm entry plays a non-negligible role in linking TPU alleviation to improved economic performance. Given the current state of global affairs, the results carry highly relevant practical implications.

After decades of international integration, the global economic order appears to have entered a new paradigm, characterized by deglobalization events such as the Brexit referendum and the US–China trade war. The evolving global economic landscape has elevated trade policy uncertainty (TPU) to a major source of economic instability, shaping the decision-making process of the economic agents and sparking renewed interest in the globalization-development nexus (Handley and Limão 2002).

The relationship between international trade and economic growth and development has long been a central research topic, carrying significant policy implications (e.g., Edwards 1993, Rodriguez and Rodrik 2000). Recent studies have examined how trade liberalization and TPU affect the productivity and investment behaviors of incumbent firms, i.e., exploring the intensive margin (e.g., Brandt et al. 2017, Caldara et al. 2020). One relatively overlooked dimension is how the external trade environment alters the dynamic process of firm entry and exit in the source country, which pertains to the extensive margin. It is well-documented that the entry-exit margin is pivotal for aggregate total factor productivity (TFP) growth (Foster, Haltiwanger, and Krizan 2001). In fact, entrepreneurial activities hold particular importance in developing economies. For instance, Brandt, Van Biesebroeck, and Zhang (2012) identified that 72% of the total manufacturing productivity growth in China between 1998 and 2007 can be attributed to the effect of net entrants. In a recent study (Cui and Li 2023), we try to unveil the link between globalization and domestic entrepreneurship by investigating how the elimination of TPU in a major destination market influenced the dynamics of new firm entry in China during its accession to the World Trade Organization (WTO).

Basic Findings

Our study exploits the quasi-natural experiment of TPU reduction for a difference-in-differences estimation strategy, as in Pierce and Schott (2016). After China was granted permanent normal trade relationship (PNTR) status in 2000 by the US Congress and permanently locked in the normal trade relationship (NTR) import tariff rates, industries with initially high non-NTR tariff rates experienced significant TPU reductions, while those with originally low non-NTR rates underwent moderate or minimal reductions. We can thus compare new firm entry rates in Chinese industries that were exposed to larger TPU reductions with those in industries that experienced only mild TPU mitigation before and after China’s WTO accession.

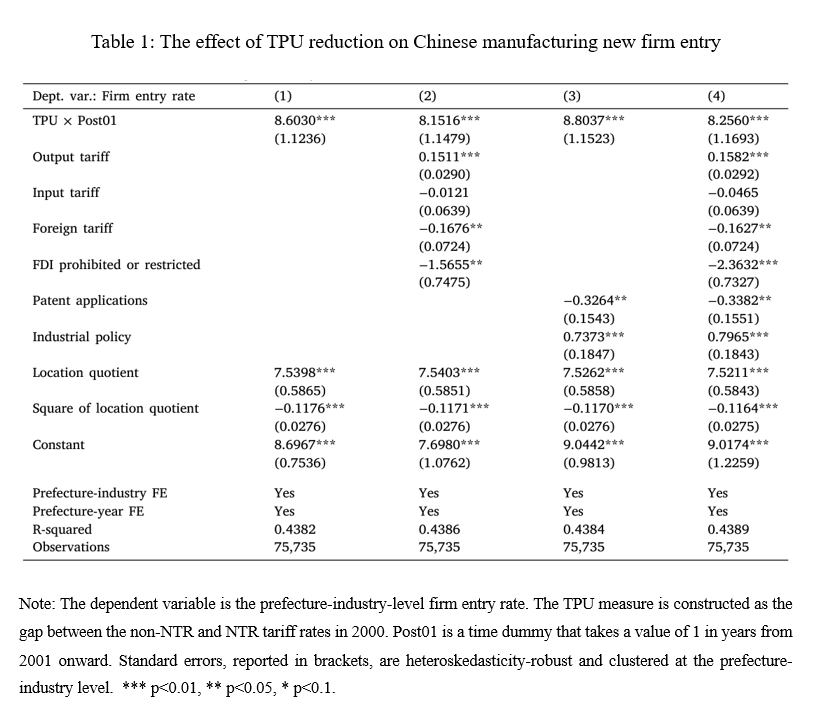

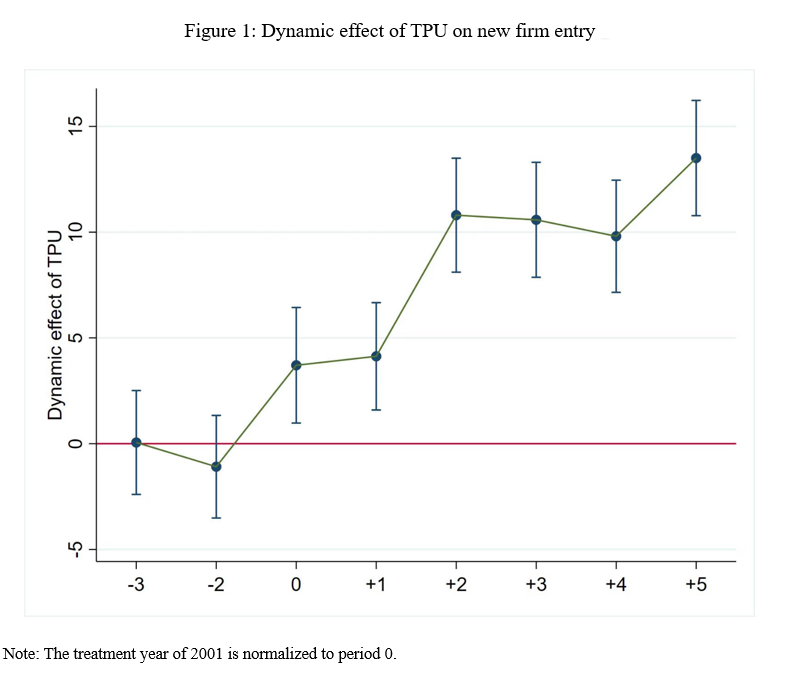

Overall, as demonstrated in Table 1, we find that reducing TPU significantly stimulates new firm entry in China. Specifically, based on column (4), shifting an industry’s TPU reduction from the 10th percentile to the 90th percentile increases its new firm entry rate by 3.31 percentage points, equivalent to about 16.2% of the average annual manufacturing entry rate in our sample period. As argued in Pierce and Schott (2016), the conferral of PNTR status was the subject of a fierce political debate with great uncertainty. The treatment is therefore plausibly exogenous. We verify the parallel-trend assumption in Figure 1, which shows that the entry rates of Chinese manufacturing firms were not significantly different between the treatment and control groups prior to 2001. Notably, in the dynamic setting, we also observe a growing magnitude of the estimated TPU effect after 2001. This dynamic and deepening impact of TPU reduction on domestic firm entry underscores the process by which potential entrepreneurial talents identify and capitalize on emerging opportunities (Parker 2018), and is aligned with the delayed capital adjustment process and gradual formation of the agglomeration forces as documented in Dix-Carneiro and Kovak (2017) in the context of Brazil’s trade liberalization.

Potential Mechanisms

We consider four potential mechanisms underlying the effect of TPU on new firm entry. First, a firm entry decision is made by comparing the present value of expected profits and the entry cost. When trade-induced uncertainty is alleviated and expected future market conditions improve, potential entrepreneurs might find starting a new business profitable. The extent of TPU’s impact on firm entry depends on the size and sunkness of the entry cost (Dixit and Pindyck 1994). In line with this, our analysis reveals that the WTO-associated TPU reduction has a greater impact on firm entry in industries facing lower entry barriers or undertaking higher levels of irreversible investments.

Second, export expansion and enhanced market access are likely to be key factors as TPU reduction has been accompanied by exceptional export growth in China (Feng, Li, and Swenson 2017). Interestingly, we find that the TPU effect is statistically significant for both exporting and non-exporting entrants, with the former's magnitude being 2.38 times that of the latter. Thus, our results validate the significance of export opportunities and market size expansion and hint at possible spillover effects on domestic non-exporting economic activities.

Third, by employing the location quotient measure as the dependent variable (Delgado, Porter, and Stern 2010) and re-estimating the baseline specification, we identify a positive role of TPU reduction in fostering regional agglomeration formation. Strengthening agglomeration forces can further lower the cost of entry and stimulate new business creation in the long run. This mechanism can be particularly important for developing economies in the early stage of industrialization.

Lastly, TPU reduction and export opportunities might depress entrepreneurial activities through an occupational choice mechanism (Díez and Ozdagli 2020). As productive incumbent firms expand their production and exporting, labor demand and wage rates are likely to increase, potentially deterring individuals from pursuing entrepreneurship. However, our firm-level analysis of employment and wages yielded no supporting evidence for an occupational trade-off channel. This lack of evidence could be attributed to specific labor market conditions in China during the early 2000s.

Regional Heterogeneity and Productivity Implications

We also delve into the effect of regional heterogeneity and find that the marginal impact of TPU is more pronounced in geographic areas characterized by better institutional quality, lower state-owned enterprise intensity, and the presence of established special economic zones. Hence, TPU reduction resulting from China’s WTO accession not only exhibits varying impacts across industries, but also reshapes the distribution of entrepreneurial activities within different regions of the country. Importantly, our study bolsters the argument for dismantling domestic entry barriers (Branstetter et al. 2014), and elucidates an important synchronization between external openness and internal reform for developing economies. If a country continues to enforce restrictive entry policies and erect high entry barriers, the pro-growth effect of export opportunities and access to foreign markets will be significantly discounted.

Finally, our findings suggest that reducing TPU can enhance the competitive environment within an industry. Also, in industries experiencing high TPU reductions, new entrants tend to be more productive upon entering the market. In our context, the entry decision is primarily prompted by an increase in expected future profit driven by US market potential. Consequently, attracted entrepreneurs are likely to possess more matching skill sets and are capable of serving relatively high-quality variants. Better-performing entrants result in a stronger selection effect and can induce stronger escape-competition effort, leading to higher aggregate TFP growth (Jiang, Zheng, and Zhu 2021). Empirically, after accounting for the entry margin, we discover that the positive TPU effect on incumbent TFP growth could be diminished by up to 45%. This illustrates that new firm entry plays a non-negligible role in linking TPU reduction to improved economic performance.

In summary, this work speaks to the dynamic gains from trade by presenting new evidence of how TPU reduction influences domestic entrepreneurial activities within the largest developing economy. Given the continued instability of the global economic situation and the unpredictability of the US–China relationship, our findings offer valuable insights into the potential ramifications of heightened uncertainty on long-term economic performance.

References

Brandt, Loren, Johannes Van Biesebroeck, and Yifan Zhang. 2012. “Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing.” Journal of Development Economics 97 (2): 339–51. https://doi.org/10.1016/j.jdeveco.2011.02.002.

Brandt, Loren, Johannes Van Biesebroeck, Luhang Wang, and Yifan Zhang. 2017. “WTO Accession and Performance of Chinese Manufacturing Firms.” American Economic Review 107 (9): 2784–2820. https://doi.org/10.1257/aer.20121266.

Branstetter, Lee, Francisco Lima, Lowell J. Taylor, and Ana Venâncio. 2014. “Do Entry Regulations Deter Entrepreneurship and Job Creation? Evidence from Recent Reforms in Portugal.” Economic Journal 124 (577): 805–32. https://doi.org/10.1111/ecoj.12044.

Caldara, Dario, Matteo Iacoviello, Patrick Molligo, Andrea Prestipino, and Andrea Raffo. 2020. “The Economic Effects of Trade Policy Uncertainty.” Journal of Monetary Economics 109: 38–59. https://doi.org/10.17016/IFDP.2019.1256.

Cui, Chuantao, and Leona Shao-Zhu Li. 2023. “Trade Policy Uncertainty and New Firm Entry: Evidence from China.” Journal of Development Economics 163: 103093. https://doi.org/10.1016/j.jdeveco.2023.103093.

Delgado, Mercedes, Michael E. Porter, and Scott Stern. 2010. “Clusters and Entrepreneurship.” Journal of Economic Geography 10 (4): 495–518. https://doi.org/10.1093/jeg/lbq010.

Díez, Federico J., and Ali K. Ozdagli. 2020. “Entrepreneurship and Occupational Choice in the Global Economy.” https://dx.doi.org/10.2139/ssrn.1799735.

Dix-Carneiro, Rafael, and Brian K. Kovak. 2017. “Trade Liberalization and Regional Dynamics.” American Economic Review 107 (10): 2908–46. https://doi.org/10.1257/aer.20161214.

Dixit, Avinash K., and Robert S. Pindyck. 1994. Investment under Uncertainty. Princeton, NJ: Princeton University Press.

Edwards, S. 1993. “Openness, Trade Liberalization, and Growth in Developing Countries.” Journal of Economic Literature 31(3): 1358–93. https://www.jstor.org/stable/2728244.

Feng, Ling, Zhiyuan Li, and Deborah L. Swenson. 2017. “Trade Policy Uncertainty and Exports: Evidence from China’s WTO Accession.” Journal of International Economics 106: 20–36. https://doi.org/10.1016/j.jinteco.2016.12.009.

Foster, Lucia, Thomas Haltiwanger, and C. J. Krizan. 2001. “Aggregate Productivity Growth: Lessons from Microeconomic Evidence.” In New Developments in Productivity Analysis, 303–72. Chicago: University of Chicago Press.

Handley, Kyle, and Nuno Limão. 2022. “Trade Policy Uncertainty.” Annual Review of Economics 14: 363–95. https://doi.org/10.1146/annurev-economics-021622-020416.

Jiang, Helu, Yu Zheng, and Lijun Zhu. 2021. Growing through Competition: The Reduction of Entry Barriers among Chinese Manufacturing Firms. London: Centre for Economic Policy Research.

Parker, Simon C. 2018. The Economics of Entrepreneurship. Cambridge, UK: Cambridge University Press.

Pierce, Justin R., and Peter K. Schott. 2016. “The Surprisingly Swift Decline of US Manufacturing Employment.” American Economic Review 106 (7): 1632–62. https://doi.org/10.1257/aer.20131578.

Rodriguez, Francisco, and Dani Rodrik. 2000. “Trade Policy and Economic Growth: A Skeptic’s Guide to the Cross-National Evidence.” NBER Macroeconomics Annual 15: 261–325. https://www.nber.org/system/files/chapters/c11058/c11058.pdf.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email