Implicit Guarantees and the Rise of Shadow Banking: the Case of Trust Products

The prevalent implicit guarantees provided by financial intermediaries have been a central feature of shadow banking products in China. Our theoretical investigation shows that providing implicit guarantees can be the second-best arrangement and mitigate capital misallocation. Empirically, we find the ex ante yields reflect borrower risks and guarantee strength. Regulations enacted in 2018 to restrict implicit guarantees led to a weaker relationship between yield spreads and guarantee strength and more credit rationing of non-SOEs.

Shadow banking has experienced exponential growth in China during the last two decades. A key feature of China’s shadow banking sector is that investors expect implicit guarantees on the returns of risky investment, even though the product prospectuses clearly state that returns are contingent on the investment payoffs and not guaranteed. The ongoing debate has focused on the net benefits of implicit guarantees in China’s financial system (e.g., Zhu 2016). Critics argue that guarantees can induce moral hazard problems, i.e., investors will lack incentives to collect information and price the products efficiently. Meanwhile, implicit guarantees provided to financial institutions may encourage them to take excessive risks, which can increase the overall risks of the financial system. However, shadow banking accompanied by implicit guarantees has played an important role in funding non-state-owned-enterprises (non-SOEs), which have been the engine of China’s economic growth (Allen et al. 2019), but are less favored by the traditional banking sector and the security markets (e.g., Allen, Qian, and Gu 2017; Cong et al. 2019).

In our recent paper, Allen et al. (2023), we develop a theoretical model to understand the potential optimality of implicit guarantees in shadow banking. We then empirically examine the predictions of the model using investment products sponsored by trust companies (an important component of shadow banking in China). Our theoretical model shows that when investors rely on a financial intermediary to screen projects, it is a second-best solution for the intermediary to provide implicit guarantees for the investors under reasonable conditions. On the one hand, an implicit guarantee incentivizes the intermediary to screen projects by making it bear the project risk. On the other hand, it gives the intermediary the flexibility of not paying in bad economic states when the cost of paying is particularly high. Thus, an implicit guarantee is preferred to an explicit guarantee or no guarantee when the social benefit of screening is high relative to the costs.

Under the framework of our model, we further investigate the efficiency of capital allocation with and without implicit guarantees. We examine a traditional banking system with explicit guarantees to investors and an extended banking system that also includes shadow banking with implicit guarantees. Consistent with the literature, there is capital misallocation between SOEs and private sectors due to the systematic favoritism toward SOEs. While misallocation exists in both banking systems, more private projects will be funded, and allocation efficiency will improve when shadow banking with implicit guarantees is allowed. As a result, total output will also be higher.

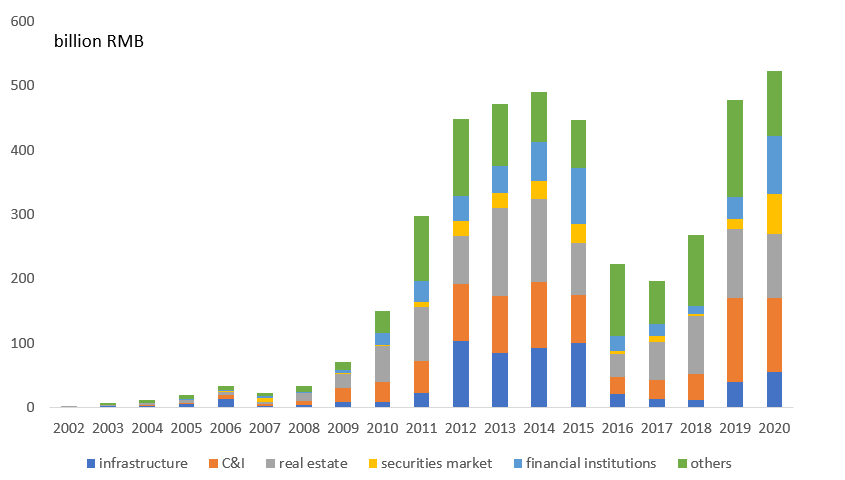

We also derive several empirical predictions from the model, which we empirically test using a comprehensive sample of investment products sponsored by all licensed trust companies (Figure 1). Our empirical investigation reveals three main findings consistent with the model’s prediction. First, we find that product yield spread depends on the underlying investment risk as well as the strength of the implicit guarantee. Specifically, the yield spread is higher if the borrower is smaller, or from the risky real estate industry, or located in a province with lower GDP growth. Yield spreads are lower if the sponsoring trust firm is larger or controlled by an SOE, or if the product is sold via one of the largest five banks. The yield depends on each of these variables as well as an implicit guarantee index (IG index) aggregated over these three dimensions.

Second, we find that strong implicit guarantees reduce the sensitivity of yield spread to underlying investment risk. We show that yield spread is less sensitive to investment risk (as measured by borrower size, its provincial GDP growth, and whether it is in the real estate industry) when the guarantee is perceived to be stronger (i.e., when the IG index is higher). The first high-profile default case of an investment product is a shock to the market perception of the risk of all trust products. We find that the spreads increase after this default case, but the effect is largely mitigated if the implicit guarantee is strong.

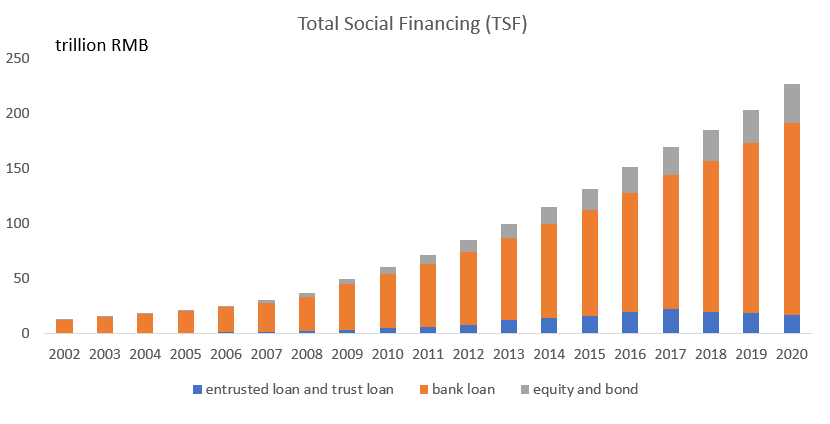

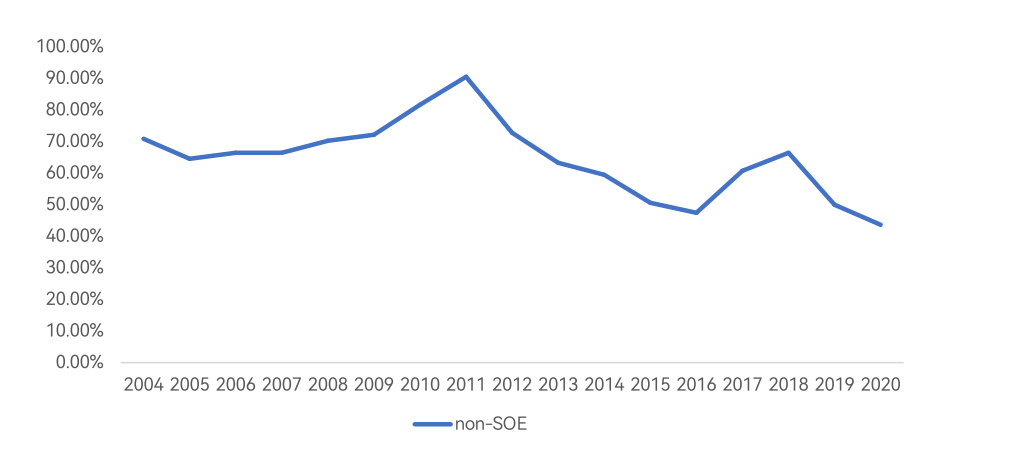

Third, we find the relationship between yield spreads and guarantee strength was weakened after a regulatory shock in 2018 that restricted implicit guarantees, reflecting lower expectations on the delivery of guarantees. In March 2018, the central government announced guidelines for regulating the asset management business of financial institutions, and prohibited implicit guarantees on newly issued products. These new regulations imposed costs on the provision of implicit guarantees for trust companies. Case studies show that trust firms continue to cover losses for investors in the post-2018 period, although the frequency is much lower and the reasons and process for such coverage have changed. At the aggregate level, we find that shadow banking in general, and the trust industry in particular, have declined in size since the announcement of the new regulations (Figure 2), as has funding to the non-SOE sector (Figure 3).

We further obtain information on loan contracts between borrower firms/projects and the issuing trusts on a subsample of products and find that the size of products financing risky projects (in real estate, and commercial and industrial firms) fell more in the post-2018 period when the trust company’s strength in providing guarantees was weaker, and when the borrower firm was privately owned. In particular, when a trust firm’s guarantee strength was weak, the size of its loans to non-SOE borrowers was reduced by more than half after 2018. This transaction-level result, together with the aggregate-level reduction of shadow banking funding to non-SOEs since the advent of the new regulation, supports our theoretical prediction that implicit guarantees facilitate shadow banking in funding more private projects and mitigate over-allocating resources to SOEs.

Figure 1. Total issuance of the trust product sample: by industry and year

This figure plots the total issuance of our sample products by year and by industry, from 2002 to 2020. We omit products without yield or issuance volume information.

Figure 2. Components of total social financing in China

This figure plots the breakdown of total social financing in China from 2002 to 2020.

Figure 3. Percentage of trust loans for non-SOEs

This figure plots the percentage of capital funded by our sample trust products going to non-SOE borrowers from 2004 to 2020. To identify whether the borrower of trust products is an SOE, we match registration data originated from the State Administration for Industry and Commerce and China Economic Census data.

References

Allen, Franklin, Xian Gu, C. Wei Li, Jun “QJ” Qian, and Yiming Qian. 2023. “Implicit Guarantees and the Rise of Shadow Banking: The Case of Trust Products.” Journal of Financial Economics: 149 (2), 115–41. https://doi.org/10.1016/j.jfineco.2023.04.012.

Allen, Franklin, Jun “QJ” Qian, and Xian Gu. 2017. “An Overview of China’s Financial System,” Annual Review of Financial Economics 9, 191–231. https://doi.org/10.1146/annurev-financial-112116-025652.

Allen, Franklin, Yiming Qian, Guoqian Tu, and Frank Yu. 2019. “Entrusted Loans: A Close Look at China’s Shadow Banking System.” Journal of Financial Economics 133(1): 18–41. https://doi.org/10.1016/j.jfineco.2019.01.006.

Chen, Kaiji, Jue Ren, and Tao Zha. 2018. “The Nexus of Monetary Policy and Shadow Banking in China.” American Economic Review 108 (12): 3891–3936. https://doi.org/10.1257/aer.20170133.

Chen, Zhuo, Zhiguo He, and Chun Liu. 2020. “The Financing of Local Government in China: Stimulus Loan Wanes and Shadow Banking Waxes.” Journal of Financial Economics 137 (1): 42–71. https://doi.org/10.1016/j.jfineco.2019.07.009.

Cong, Lin William, Haoyu Gao, Jacopo Ponticelli, and Xiaoguang Yang. 2019. “Credit Allocation Under Economic Stimulus: Evidence from China.” Review of Financial Studies 32 (9): 3412–60. https://doi.org/10.1093/rfs/hhz008.

Hachem, Kinda, and Zheng Song. 2021. “Liquidity Rules and Credit Booms.” Journal of Political Economy 129 (1): 2721–65. https://doi.org/10.1086/715074.

Zhu, Ning. 2016. China’s Guaranteed Bubble: How Implicit Government Support Has Propelled China’s Economy While Creating Systemic Risk. New York: McGraw-Hill Education.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email