Does External Monitoring from the Government Improve the Performance of State-Owned Enterprises?

We investigate the impact of external monitoring from the government on state-owned enterprise performance, using the variation in monitoring strength arising from a nationwide policy change and firms’ geographic location in China. We utilize a structural approach to estimate input prices and productivity separately at the firm level using commonly available production data. We show that enhanced external monitoring, as a key component of corporate governance, can substantially reduce managerial expropriation in procurement and shirking in production management. The results suggest that government monitoring can be an effective policy instrument to improve state-owned enterprise performance.

In October 2017, the Supervision Law of the People’s Republic of China first involved the management team of state-owned enterprises (SOEs), following the decisions in the 19th National Congress of the Communist Party of China. In 2021, the 14th Five-Year Plan further proposed to use digital technology to enhance external monitoring of the operation and management of SOEs. The purpose was to establish an effective “Sunshine Procurement System” for SOEs. These measures aimed to strengthen the previously weak monitoring of the management of SOEs, which potentially led to the weak performance of SOEs. In fact, while playing an important role in the global economy and accounting for 24% of total sales in the Fortune Global 500 in 2014, SOEs were usually outperformed by their private counterparts in terms of profitability, total factor productivity, and capital productivity (Xu 2011; Brandt, Van Biesebroeck, and Zhang 2012). Are these policies to strengthen external monitoring of SOEs likely to improve SOE performance?

While previous studies of SOEs’ performance emphasized internal incentivization and privatization (Groves et al. 1994, Li 1997, Estrin et al. 2009, Chen et al. forthcoming), the differences in external monitoring, due to SOEs’ property rights arrangement and weak legal enforcement arising from strong political connections, have been largely ignored. When external monitoring is strengthened, SOE managers may be less likely to engage in corrupt material procurement, such as taking kickbacks, self-dealing, and engaging in secret transactions with relational firms. This directly decreases the prices of the material inputs paid by SOEs and, consequently, increases profits. Beyond that, strengthened external monitoring may improve productivity, because it can decrease managerial shirking either directly or indirectly if (higher) productivity and (lower) input prices are complementary in promoting profits. From these perspectives, in Li and Zhang (2021), we investigate the impact of external government monitoring on SOE performance, using variation in monitoring strength arising from the nationwide policy change and firms’ geographic locations in China.

Data, Challenges, and Methodological Contribution

We distinguish the impact of external monitoring on managerial expropriation in procurement (as proxied by material input prices) and shirking in production management (as proxied by productivity) and investigate the impact using a difference-in-differences analysis. One challenge is that our dataset (Annual Surveys of Industrial Production in China, 1998–2007), like many other production surveys, does not include firm-level input prices or productivity. To address this challenge, we estimate firm-level measures of input prices and productivity using the structural approach of production function estimation initially developed by Grieco, Li, and Zhang (2016) and extended in Grieco, Li, and Zhang (2020). Our new method emphasizes input prices as an independent firm heterogeneity besides productivity and recovers firm-level input prices and productivity using commonly available production datasets, overcoming a common data limitation in the literature on firm studies. The main idea is to use firms’ optimality conditions on input choices together with information on wages and input expenditures to infer and control for unobserved material input prices when estimating production function. This approach also allows for a wide range of distortions (e.g., capital market distortions/misallocations, differences in firm productivity management, and corruption in input procurement), which is crucial in performance comparison across firms.

Result 1: Underperformance of SOEs

We use our estimates to document performance gaps between SOEs and non-SOEs in terms of productivity and the ability to secure better input prices. The productivity of SOEs is about 20% lower and they face 6.4% higher input prices compared with their private counterparts on average, after controlling for observable characteristics such as size, industry, and location. This is despite SOEs’ market power in output markets and bargaining power in input markets to access discounted input prices, arising from their connections to government. The higher input prices, as a result, are consistent with the existence of corruption and/or shirking in the material procurement process arising from weak external monitoring faced by SOEs. When using the traditional total factor productivity measure without separating input price heterogeneity from productivity, we find a qualitatively similar result.

Result 2: Impact of Strengthened Government Monitoring after SASAC

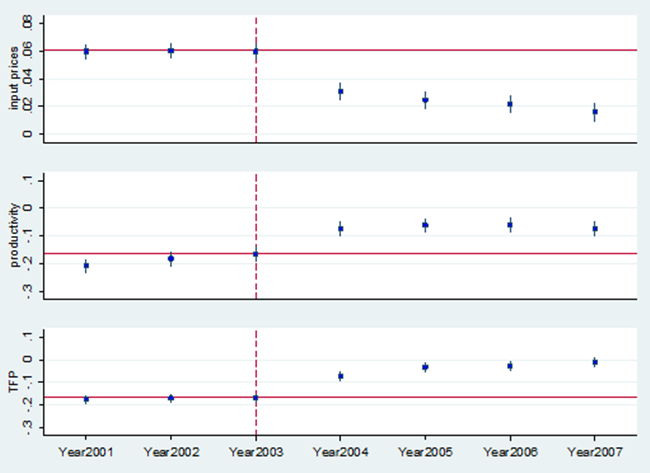

To explore the causality, we first examine the effect of the State-Owned Assets Supervision and Administration Commission (SASAC) on SOE performance in China. SASAC was established in 2003 as the legal owner of state-owned assets under the leadership of the State Council. It directly enhanced external monitoring of the management of SOEs (but not private firms) nationwide, through a combination of measures such as designating a board of supervisors to SOEs and imposing more accurate performance evaluations for top SOE executives. In the data, we observe a quick catch-up of SOEs’ profitability compared with that of non-SOEs after the establishment of SASAC. Notably, this catch-up was mainly driven by the improved performance of SOEs. Consistently, our estimates show that SASAC reduced the input prices paid by SOEs by 3.9%, closing the gap between SOEs and non-SOEs by half. The establishment of SASAC also increased the productivity of SOEs by 12.6% relative to their private counterparts, closing the gap by about 53%. Figure 1 further shows the dynamic impact of SASAC on SOE performance.

Figure 1: Dynamic Effect of SASAC on SOE Performance, Relative to non-SOEs

Point estimates and the 95% confidence interval are reported.

Result 3: Impact of Monitoring Costs

We next exploit the spatial variation in monitoring costs and evaluate how it influences SOE performance. Higher costs of external monitoring reduce monitoring strength and consequently lead to more managerial expropriation and shirking. Because monitoring costs are unobservable, we approximate them using SOEs’ direct spherical distance to their oversight government agency, following Huang et al. (2017). Intuitively, greater distance increases information asymmetry and monitoring difficulties, leading to higher monitoring costs. In our empirical analysis, we find that SOEs at greater distances from their oversight government pay higher input prices and have lower productivity, relative to non-SOEs. We further find that, given travel distance, increased travel difficulty—as proxied by the ruggedness of the landscape—leads to higher input prices and lower productivity, all other things being equal.

Interestingly, as a reinforcement for monitoring SOEs, SASAC largely alleviates such negative influence of oversight distance on SOE performance. It reduces performance gaps in terms of input prices and productivity between SOEs that are far from their oversight government and those that are close. Overall, the costs of monitoring SOEs due to geographic distance raise the aggregate input price by 1.09% for SOEs and reduce aggregate productivity by 2.61%.

Implications

Our analysis contributes to the long-standing debate on how to improve SOE performance through public policy, by providing firm-level evidence using large-scale data in the Chinese manufacturing sector. The results imply that, if effectively implemented, the measures to strengthen external monitoring of SOEs in China as specified in the Supervision Law and the 14th Five-Year Plan are likely to have a positive effect on SOE performance, by reducing managerial expropriation in procurement and shirking in production management.

More generally, our results suggest that enhanced government monitoring and credible punishment can be effective policy instruments to improve SOE performance, even without ownership change (privatization), massive capital investment, or layoffs of redundant workers. This implication is important for policymaking, especially in industries that cannot be privatized for economic or political reasons.

Methodologically, our approach of estimating input prices and productivity as two distinct aspects of firm heterogeneity could be applied to many economic fields related to firm analysis. The computer code is publicly available on the journal’s website (see, Supplementary Data, https://doi.org/10.1093/ej/ueab048).

[Shengyu Li is a Senior Lecturer of Economics at the University of New South Wales, Sydney; Hongsong Zhang is an Associate Professor of economics in the HKU Business School and the Associate Director of the Institute for China and Global Development (ICGD) at the University of Hong Kong.]

References

Brandt, Loren, Johannes Van Biesebroeck, and Yifan Zhang. 2012. “Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing,” Journal of Development Economics 97 (2): 339–51. https://doi.org/10.1016/j.jdeveco.2011.02.002.

Chen, Yuyu, Mitsuru Igami, Masayuki Sawada, and Mo Xiao. “Privatization and Productivity in China,” RAND Journal of Economics (forthcoming). https://ssrn.com/abstract=2695933.

Estrin, Saul, Jan Hanousek, Evzen Kocenda, and Jan Svejnar. 2009. “The Effects of Privatization and Ownership in Transition Economies,” Journal of Economic Literature 47 (3): 699–728. https://doi.org/10.1257/jel.47.3.699.

Grieco, Paul, Shengyu Li, and Hongsong Zhang. 2016. “Production Function Estimation with Unobserved Input Price Dispersion,” International Economic Review 57 (2): 665–90. https://doi.org/10.1111/iere.12172.

Grieco, Paul, Shengyu Li, and Hongsong Zhang. 2020. “Input Prices, Productivity, and Trade Dynamics: Long-Run Effects of Liberalization on Chinese Paint Manufacturers,” https://ssrn.com/abstract=3521720.

Groves, Theodore, Yongmiao Hong, John McMillan, and Barry Naughton. 1994. “Autonomy and Incentives in Chinese State Enterprises,” Quarterly Journal of Economics 109 (1): 183–209. https://doi.org/10.2307/2118432.

Huang, Zhangkai, Lixing Li, Guangrong Ma, and Lixin Colin Xu. 2017. “Hayek, Local Information, and Commanding Heights: Decentralizing State-Owned Enterprises in China,” American Economic Review 107 (8): 2455–78. https://doi.org/10.1257/aer.20150592.

Li, Shengyu, and Hongsong Zhang. 2021. “Does External Monitoring from the Government Improve the Performance of State-Owned Enterprises?” Economic Journal. http://dx.doi.org/10.1093/ej/ueab048.

Li, Wei. 1997. “The Impact of Economic Reform on the Performance of Chinese State Enterprises, 1980–1989,” Journal of Political Economy 105 (5): 1080–1106. https://doi.org/10.1086/262106.

Xu, Chenggang. 2011. “The Fundamental Institutions of China’s Reforms and Development,” Journal of Economic Literature 49 (4): 1076–1151. https://doi.org/10.1257/jel.49.4.1076.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email