The Natural Interest Rate in China

The growth of China’s economy and development of its financial markets has created a need for tools to evaluate the stance of monetary policy in China. We contribute to this effort by providing estimates of China’s natural interest rate. We find that China’s natural interest rate averaged between 3–5 per cent between the late 1990s and 2010s, but declined over the next decade to around 2 per cent at the end of 2019. We attribute slightly more than half of the decline in China’s natural interest rate to a lower rate of potential output growth. Our results also suggest that real policy interest rates in China have closely tracked the natural rate over our sample.

Over the past few decades, China’s economy has experienced an extraordinary transformation. As the economy has grown and financial markets have developed, the conduct of monetary policy has evolved from a quantity-based framework based on controls of monetary and credit aggregates to a market-based system where short- and medium-term policy interest rates increasingly serve as the main policy instruments. This has created a need for tools to evaluate the stance of monetary policy in China. In Sun and Rees (2021), we contribute to this effort by providing estimates of China’s natural interest rate.

We define the natural interest rate as the real interest rate that would be consistent with a closed output gap and stable inflation over the medium run. According to this definition, the natural interest rate is not an “optimal” rate. Nor is it the one that would stabilise output and inflation at any point in time. Instead, it provides a benchmark for whether monetary policy is expanding or contracting the economy. It also indicates where we might expect real interest rates to settle after temporary cyclical factors have abated.

Because the natural interest rate is not directly observable, we must infer its value from the behaviour of market interest rates and other economic variables. We follow the approach proposed by Laubach and Williams (2003). The idea behind this approach is that if inflation is increasing and output is above its trend level, the policy interest rate is likely to be below the natural rate. Similarly, if inflation is decreasing and output is below trend, the policy interest rate is likely to be above the natural rate. One can then use a small semi-structural model of output and inflation, alongside data on the central bank’s policy rate, to identify the level of the natural rate at each point in time.

Tailoring the approach to Chinese conditions

There are a number of challenges when applying the Laubach and Williams framework to Chinese data. Chinese GDP growth varies little from quarter to quarter (see Note 1), and some key variables have relatively short data samples. For example, the one-year loan prime rate (LPR), a core policy instrument, did not exist until late 2013. Short samples and uninformative data make it hard to pin down variables such as the output gap, potential output growth, or expected inflation. Without these, estimates of the natural interest rate lack credibility.

We overcome these challenges by making use of multiple data sources. For example, we use data on GDP, import values, railway traffic, and electricity volumes to measure economic activity, and we use both the consumer and producer price indexes to measure underlying inflation. Individually, each of these measures has drawbacks, but together, they shed considerable light on the Chinese business cycle and trends in the rates of economic growth and inflation.

The natural interest rate, output gap, and potential growth

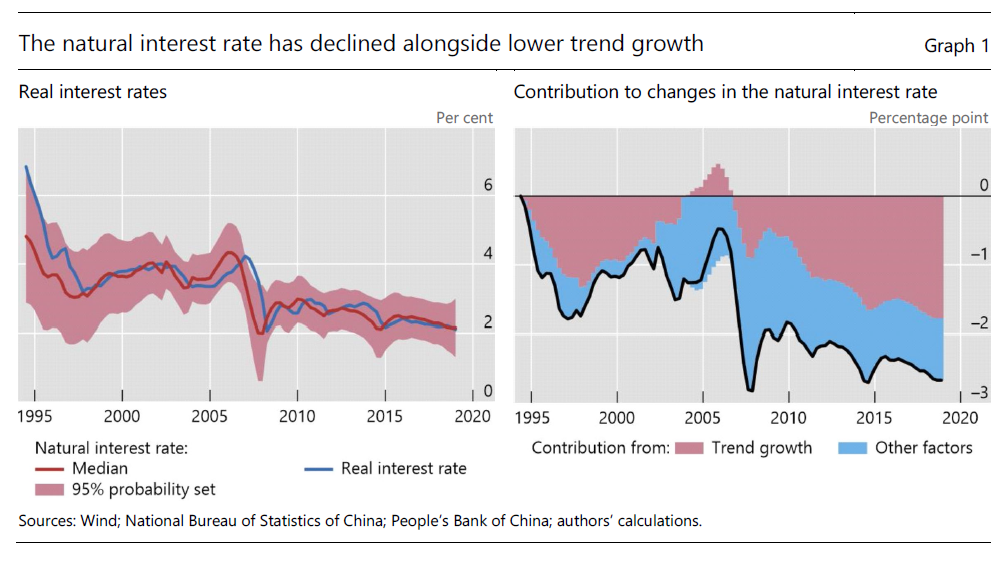

Our main result is that China’s natural interest rate averaged around 3–5 per cent between 1995 and 2010, but has declined more recently to be about 2 per cent as of the end of 2019 (Graph 1, left-hand panel). A bit over half of the decline in the natural interest rate was due to a reduction in potential output growth (right-hand panel). The rest reflects other factors, such as demographic changes, financial market development, or shifts in saving preferences as incomes have risen. Assuming an annual inflation rate of 2–3 per cent, which is consistent with recent inflation outcomes and the inflation objective laid down by the National People’s Congress, our estimates imply a natural nominal interest rate of around 4–5 per cent.

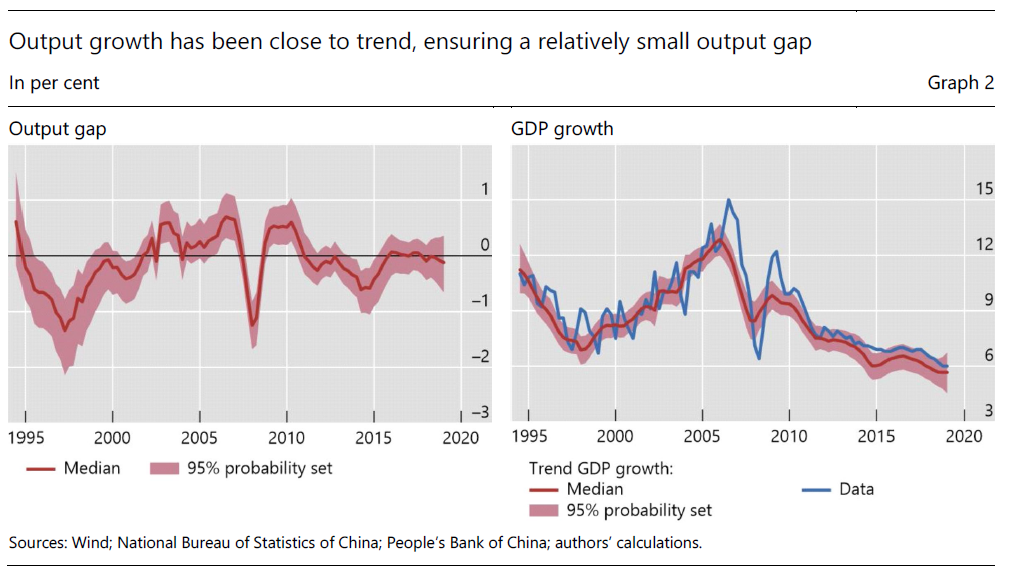

Besides the natural interest rate, we also estimate the output gap in China (Graph 2, left-hand panel). For the most part, our estimates correspond to standard accounts of Chinese economic developments. After experiencing a cyclical downturn in the late 1990s, economic activity in China picked up through the mid-to-late 2000s, likely supported by China’s entry to the WTO in 2001. Economic activity declined sharply during the Great Financial Crisis (GFC), with the output gap reaching –1%, although the downturn was extremely brief. Between 2012 and 2019, the output gap was close to zero, except for a small dip around 2015.

Consistent with the relatively small output gap, we estimate that actual GDP growth has tracked potential growth closely in recent decades (Graph 2, right-hand panel). Potential growth accelerated from around 7 per cent in the late 1990s to reach 12 per cent in 2006. Since then, it has gradually declined, and at the end of 2019 was around 6 per cent.

Tracking the natural interest rate in real time

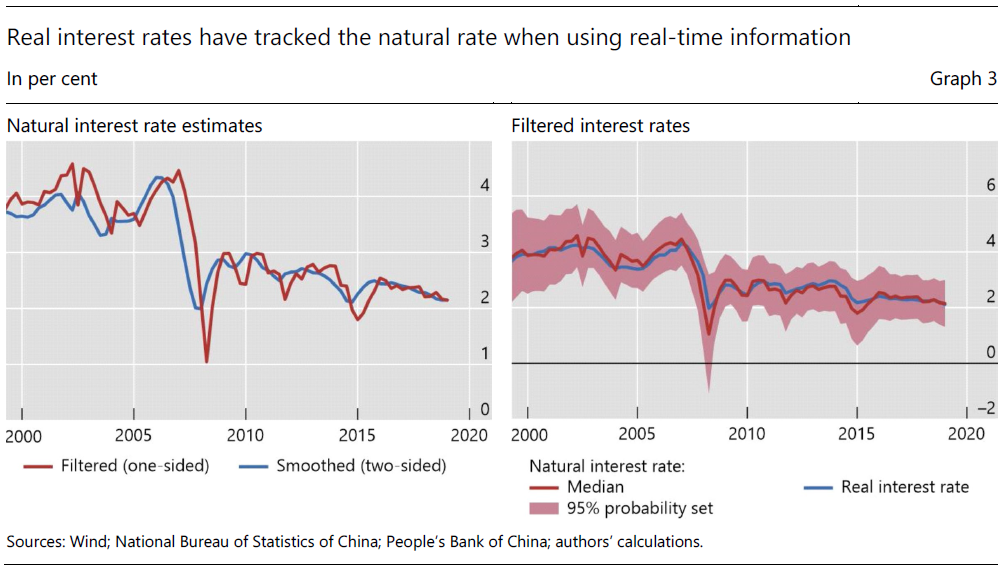

Because monetary policy affects the economy with a lag, natural interest rate estimates can be revised as new data become available. The results described above use information from the entire sample to estimate the natural rate. As such, they may overstate the predictability of the natural rate and understate the uncertainty around its level in real time. We can get a sense of this uncertainty by comparing these “full-sample” estimates of the natural rate to “real-time estimates” that use only past and current information to estimate the value of natural rate at each point in time (Graph 3, left-hand panel) (see Note 2).

Our model provides a good guide to China’s natural interest rate in real time. As one would expect, the real-time estimates lag the full-sample ones by a few quarters. For example, based on the full data sample, we estimate that China’s natural interest rate fell by a bit over a percentage point in 2008. But, with the information available at the time, this decline would not have been apparent until late 2009. On the whole, however, the pattern of the two series is similar. This is also the case for the model’s other key state variables, like the output gap, trend inflation, and potential GDP growth.

The real-time estimates also shed light on the stance of monetary policy. Policymakers do not have the benefit of hindsight and must work with the information they have at hand. Consequently, real-time estimates arguably provide a better indication of the stance that policymakers were trying to achieve at any point in time. Indeed, when measured against the “real-time” estimates, we find that the ex-post real interest rate has tracked the natural interest rate closely, even though, based on the full sample, our results suggest that real interest rates have deviated from the natural rate from time-to-time (Graph 3, right-hand panel).

Conclusion

As the Chinese financial system evolves and its links with overseas economies intensify, interest rate developments in China will assume increasing importance for macroeconomic conditions in China and globally. This creates a need for tools that can shed light on the stance of monetary policy in China, its links to cyclical developments and its medium-term anchors. The model described in this note helps to address this need by proposing a framework to estimate the natural rate of interest in China as well as related concepts such as the output gap.

Note 1: See Kerola and Mojon (2021) for a discussion of this issue.

Note 2: To be precise, the full-sample estimates represent the smoothed, two-sided, estimates and the real-time estimates represent the filtered, one-sided, estimates. Both sets of estimates are based on the same data vintage and parameter estimates.

(Daniel M. Rees is a Principal Economist at the Bank for International Settlements; Sun Guofeng is Director General of the Monetary Policy Department of the People’s Bank of China.)

References

Kerola, E and B Mojon (2021): “What 31 provinces reveal about growth in China”, BIS Working Papers, no 925, January.

Laubach, T and J Williams (2003): “Measuring the Neutral interest rate”, Review of Economics and Statistics, vol 85, no 4, 1063–70.

Sun, G and D Rees (2021): “The Natural Interest Rate in China,” BIS Working Papers, no 949, June.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email