China’s Impact on Global Financial Markets

China has been shifting the composition of its external assets from accumulation of foreign reserves toward private, nonofficial outflows. This article provides an overview of the allocation patterns of outward equity investment by Chinese institutional investors (IIs) across destination countries and sectors. In their foreign portfolios, Chinese IIs overweight sectors in which China has a comparative disadvantage (for instance, computer software), and they concentrate such investments in countries that have a higher comparative advantage in those sectors (for instance, the US). Diversification and country-sector information advantages (related to the sources of China’s imports) seem to influence patterns of foreign portfolio allocations, while yield-seeking and learning motives do not.

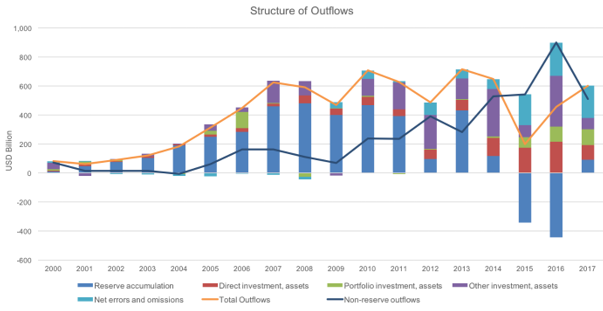

Historically, foreign exchange reserves have accounted for the bulk of China’s external assets, but these assets earn low average returns because of their role as safety and liquidity providers during periods of stress in financial markets. As a consequence, while China has been a net creditor to the rest of the world, it has paid out more in investment income to foreign investors than it has earned on its large stock of investments abroad (see Note 1). The shift in the composition of external assets from accumulation of foreign reserves toward private, nonofficial outflows over the 2009–2017 period (see Figure 1) can partly be explained by the government’s desire to generate better returns on external assets and to diversify China’s portfolio.

This shift in composition of China’s external assets to private nonofficial flows, along with recent efforts by the Chinese government to further liberalize capital outflows, and a large pool of domestic savings implies that capital outflows from the country could potentially have a significant impact on global financial markets. Capital outflows from China have become important for many countries. For instance, China accounts for more than 40 percent of the total foreign direct investment (FDI) received by Tajikistan, and almost a quarter of the total FDI received by the Kyrgyz Republic, Mongolia, and Hong Kong. Similarly, China is a major source of portfolio equity investments for nations such as Cuba, Mongolia, Hong Kong, and Macao. As China continues to open up its capital account and liberalize portfolio outflows, it will, over time, increase its impact on both fixed income and equity markets worldwide.

In a new paper, China’s Impact on Global Financial Markets, we provide an overview of the status of and prospects for China’s integration into international financial markets, from a macro perspective as well as from the perspective of institutional investors, which constitute the main channel for foreign portfolio investment outflows. Using portfolio investment data from the Coordinated Portfolio Investment Survey (CPIS) database, we find that Hong Kong and the US together account for about 70 percent of China’s foreign equity investment and countries such as Japan, Switzerland, Luxembourg, and the UK are also important destinations. The set of major destination countries for China’s outward direct investment (ODI) includes some developing countries such as Kazakhstan, Pakistan, and Zambia, but Hong Kong accounts for more than 50 percent of China’s ODI. However, the share of Hong Kong in China’s ODI has fallen over time and China’s ODI is becoming more diversified. The US was the third most important destination for Chinese ODI in 2017, after Hong Kong and Singapore.

To understand foreign equity investment patterns, we turn to a detailed, fund-level analysis using the FactSet Lionshares database. This database allows us to observe equity investment of Chinese funds in various destination countries and sectors. Following the literature on foreign capital flows, we analyze Chinese funds’ foreign investment in a given country or sector relative to a market-capitalization-weighted portfolio. We find that Chinese institutional investors (IIs) underweight developed countries and those further from China, while they overweight countries that have weak governance. Across sectors, we find that Chinese IIs underinvest in high-tech sectors in their international portfolio allocations, but overinvest in high-tech stocks in developed countries.

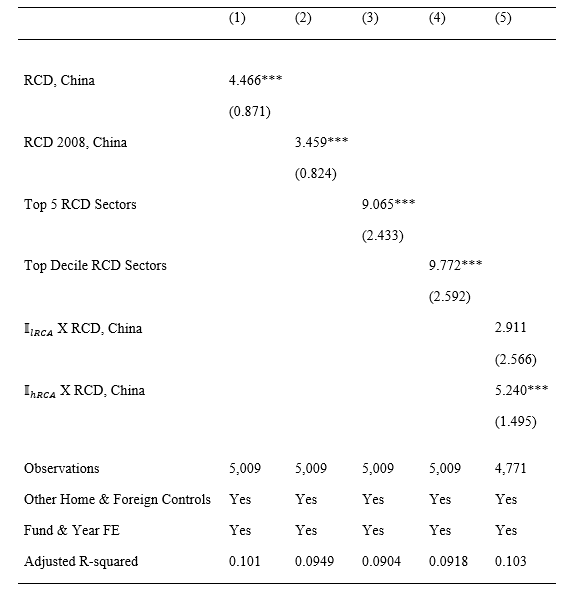

To further analyze Chinese IIs’ joint decisions on destination country-sector pairs, we construct measures of revealed comparative advantage (RCA) and disadvantage (RCD) at the country-sectoral level based on trade competitiveness patterns. If the share of a particular sector in a given country’s exports (imports) is larger than that sector’s share in global exports (imports), we classify that sector as one in which that country has an RCA (RCD). For instance, China has an RCA in computer hardware and textile sectors, while having an RCD in computer software and mining sectors. As shown in Table 1, we find that Chinese IIs overinvest abroad in sectors in which China has a comparative disadvantage (measured by RCD, China) and their investments in those sectors are concentrated in countries that have a higher relative comparative advantage in those sectors than China (measured by I_hRCA), such as high-tech stocks in the US. Further, we find that, in their domestic portfolio allocation, Chinese IIs overinvest in sectors in which China has a comparative advantage.

We explore four broad categories of possible motives that could explain the above investment patterns of Chinese: yield-seeking, diversification, information advantage, and learning. We find supportive evidence for diversification and information advantage motives, but not for yield-seeking and learning. In particular, for the information advantage motive, we find that Chinese IIs do not overweight sectors in which China has an RCA. Share of a sector in China’s domestic stock market capitalization also does not matter for Chinese II’s foreign portfolio investment. Schumacher (2018) shows that international mutual funds overweight sectors that are comparatively large in their domestic stock. He argues that the size of a sector (measured by the share of a sector in domestic stock market capitalization) reflects initial information endowments of funds and possessing these initial information endowments will induce investors to invest abroad in sectors that account for a large share of their domestic stock markets. Since we do not find share of a sector in China’s stock market capitalization to be significant for the country’s overseas equity investment, it implies that Chinese IIs are different from investors elsewhere. Our results also suggest that there is a country-specific component to sectoral information endowments: investors’ knowledge about domestic sectors does not translate to information about the same sector abroad.

Another implication of our results is that exports and imports convey different information to Chinese IIs about domestic and foreign sectors. In particular, Chinese imports convey information about sectors in foreign countries while exports convey information about sectors at home. In line with this hypothesis, we find that Chinese IIs’ foreign investment in a given sector is guided by Chinese imports in that sector (based on the RCD measure), while their domestic investment is guided by exports in a given sector (based on the RCA measure).

This paper is the first to examine in detail the allocation patterns of the rising stock of Chinese foreign portfolio investment. Another contribution of the paper is to show that Chinese IIs’ foreign equity investment allocations entail a joint sector-destination-country decision that is guided by their knowledge about both sectors and destination countries, whereas the existing literature focuses on either sector (Schumacher 2018) or country factors alone (Grinblatt and Keloharju 2001; Huberman 2001; Lane and Milesi-Ferretti 2004; Portes and Rey 2005; Okawa and van Wincoop 2012; Chiţu, Eichengreen, and Mehl 2014; Karolyi, Ng, and Prasad 2019).Note 1: Over the 2005–2018 period, in US dollar terms, the average annual return on China’s external assets was 3.6 percent and the return on external liabilities was about 7 percent.

(Isha Agarwal is an assistant professor of Finance at the University of British Columbia; Grace Weishi Gu is an Assistant Professor of Economics at the University of California at Santa Cruz; Eswar Prasad is the Tolani Senior Professor of Trade Policy and Professor of Economics at Cornell University.)

References

Agarwal, Isha, Grace Weishi Gu, and Eswar Prasad. 2019. “China’s Impact on Global Financial Markets.” NBER Working Paper No. 26311. https://www.nber.org/papers/w26311.

Chiţu, Livia, Barry Eichengreen, and Arnaud Mehl. 2014. “History, Gravity and International Finance.” Journal of International Money and Finance 46 (C): 104–29. doi: https://doi.org/10.3386/w18697.

Grinblatt, Mark, and Matti Keloharju. 2001. “How Distance, Language, and Culture Influence Stockholdings and Trades.” Journal of Finance 56, no. 3: 1053–73. https://doi.org/10.1111/0022-1082.00355.

Huberman, Gur. 2001. “Familiarity Breeds Investment.” Review of Financial Studies 14, no. 3: 659–80. https://doi.org/10.1093/rfs/14.3.659.

Karolyi, Andrew, David Ng, and Eswar Prasad. 2019. “The Coming Wave: Where Do Emerging Market Investors Put Their Money.” Journal of Financial and Quantitative Analysis, forthcoming. https://www.econstor.eu/bitstream/10419/124929/1/dp9405.pdf.

Lane, Philip, and Gian Milesi-Ferretti. 2004. “International Investment Patterns.” IMF Working Paper No. 04/134. https://www.imf.org/en/Publications/WP/Issues/2016/12/30/International-Investment-Patterns-17506.

Okawa, Yohei, and Eric van Wincoop. 2012. “Gravity in International Finance.” Journal of International Economics 87, no. 2: 205–15. https://doi.org/10.1016/j.jinteco.2012.01.006.

Portes, Richard, and Hélène Rey. 2005. “The Determinants of Cross-Border Equity Flows.” Journal of International Economics 65, no. 2: 269–96. https://doi.org/10.1016/j.jinteco.2004.05.002.

Schumacher, David. 2018. “Home Bias Abroad: Domestic Industries and Foreign Portfolio Choice.” Review of Financial Studies 31, no. 5: 1654–1706. https://doi.org/10.1093/rfs/hhx135.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email