The Demand for Reverse Mortgages in China

Reverse mortgages are financial products that allow older homeowners to live in their property and receive income for as long as they live; repayment is made from the proceeds of the property sales upon the homeowners’ death. A recent pilot program in China by Happy Life Insurance found almost no takeup of such products. We investigate whether, if reverse mortgates were properly designed and explained, there would be a demand for them in China. We provide evidence on the demand for reverse mortgages in urban China based on two large online surveys. We find that 89% of older Chinese homeowners aged 45–69 years are interested in reverse mortgages, and 84% of adult children aged 20–49 years would recommend reverse mortgages to their parents. We test an improved product design that overcomes the shortcomings of the unsuccessful reverse mortgage product piloted in China by Happy Life Insurance. Our results can inform the development of China’s reverse mortgage market.

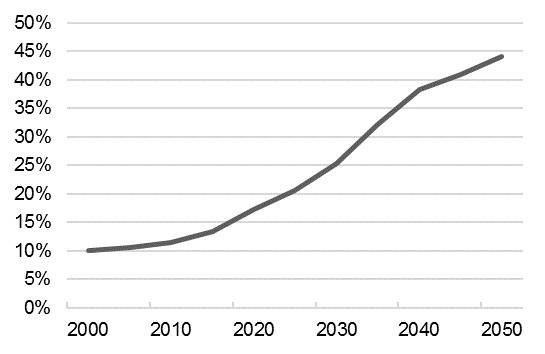

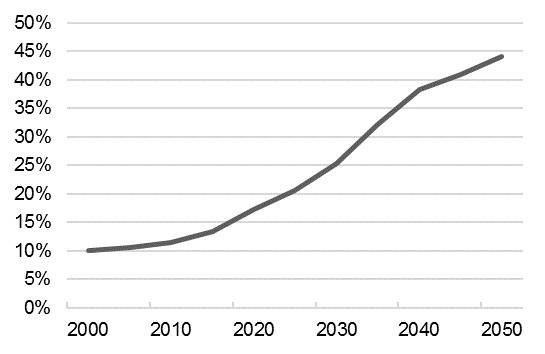

As one of the fastest-aging countries in the world, China is under tremendous pressure to provide financial resources for its rapidly growing elderly population. The government has extended and reformed the Chinese pension system, but there are concerns about the financial sustainability of the system due to the rapid increase in the share of the elderly population compared to the working-age population (Fang and Feng, 2018). Figure 1 shows that China’s old-age dependency ratio is expected to increase from 13% in 2015 to 44% in 2050 (United Nations, 2017).

Note: Ratio of population aged 65+ per 100 population 15–64, Data source: UN (2017).

Chinese households hold a large proportion of their wealth in the form of housing. Chinese house prices have appreciated at an annual rate of more than 10% since the early 2000s (Chen and Wen, 2017; Fang et al., 2015), causing large increases in household wealth. However, it is difficult for individuals to access this housing wealth. Accordingly, Yang et al. (2016) find that, on average, changes in housing wealth have limited effects on the non-housing consumption of the elderly in China.

Reverse mortgages allow homeowners to borrow against their home without having to make repayments while they still live in their home. Once the homeowner passes away or permanently moves into a nursing home, the home is sold, and the sale proceeds are used to repay the loan. In 2014, the Chinese government authorized a pilot program to introduce reverse mortgages in China. Initially, the pilot program only covered four cities over two years. The government extended the program period and regional coverage in 2016 and 2018. However, only one provider, Happy Life Insurance, started offering a reverse mortgage product. The product launched in March 2015 and is currently selling in eight cities in China (Beijing, Shanghai, Guangzhou, Wuhan, Hangzhou, Dalian, Nanjing, Suzhou). So far, the demand for the product is low: only 139 contracts were underwritten by mid-2018. The reverse mortgage product offered by Happy Life Insurance company under the name “Housing provides guarantee reverse mortgage endowment insurance for the elderly” is very complex and inflexible, and the product description is hard to understand (see Hanewald et al., 2019).

In our recent study, Hanewald et al. (2019), we tested the demand for a more flexible reverse mortgage product design that addresses the shortcomings of the unsuccessful product piloted in China. The product design also addresses consumer concerns about reverse mortgages identified in related research on other markets (e.g., Dillingh et al., 2017). Using focus group testing, we developed a clear, yet concise and comprehensive product description that illustrates potential uses of the reverse mortgage payments. The key innovation of our study is the product design and product description. Our hypothetical product allows borrowers to choose the level of debt they incur as well as the type of payment that best suits their retirement needs. Possible payment types include a lump sum, lifetime fixed regular payments, or flexible payments. In addition, our product explicitly allows the borrowers’ heirs to settle the outstanding debt and keep the property at the end of the contract, if they so prefer. We also take special care to address the potential consumers’ concerns about how the house sales will be conducted, whether rental is permitted, how the loss of the property will be handled, etc. In addition, we make sure to test the subjects’ understanding of our reverse mortgage product. The hypothetical product has a simpler debt structure and lower fees than the reverse mortgage offered by Happy Life Insurance. We tested the demand for this product in two large online surveys, one targeting older homeowners aged 45–65 as potential purchasers and the other targeting adult children aged 20–49, who represented the children of potential purchasers

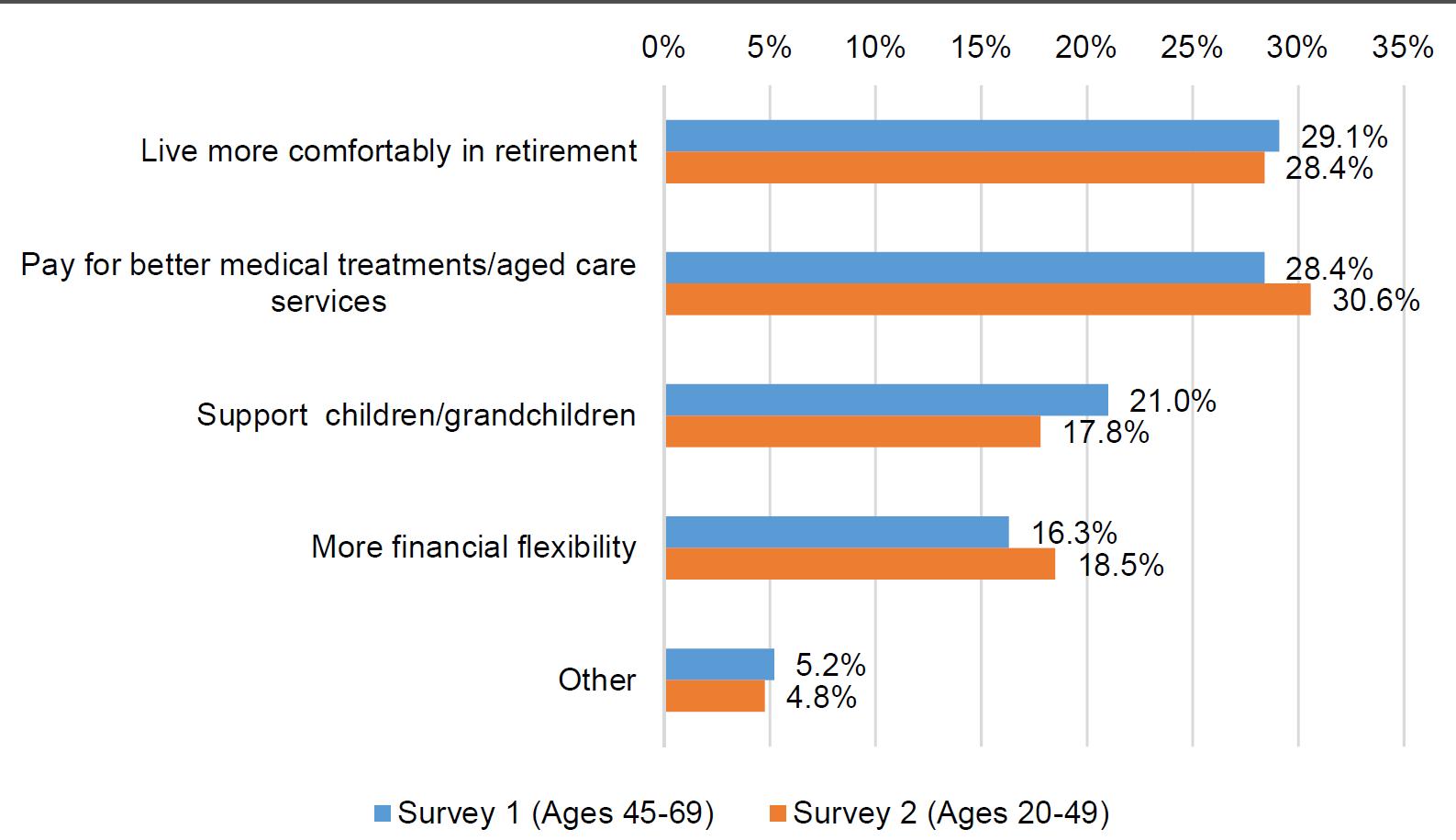

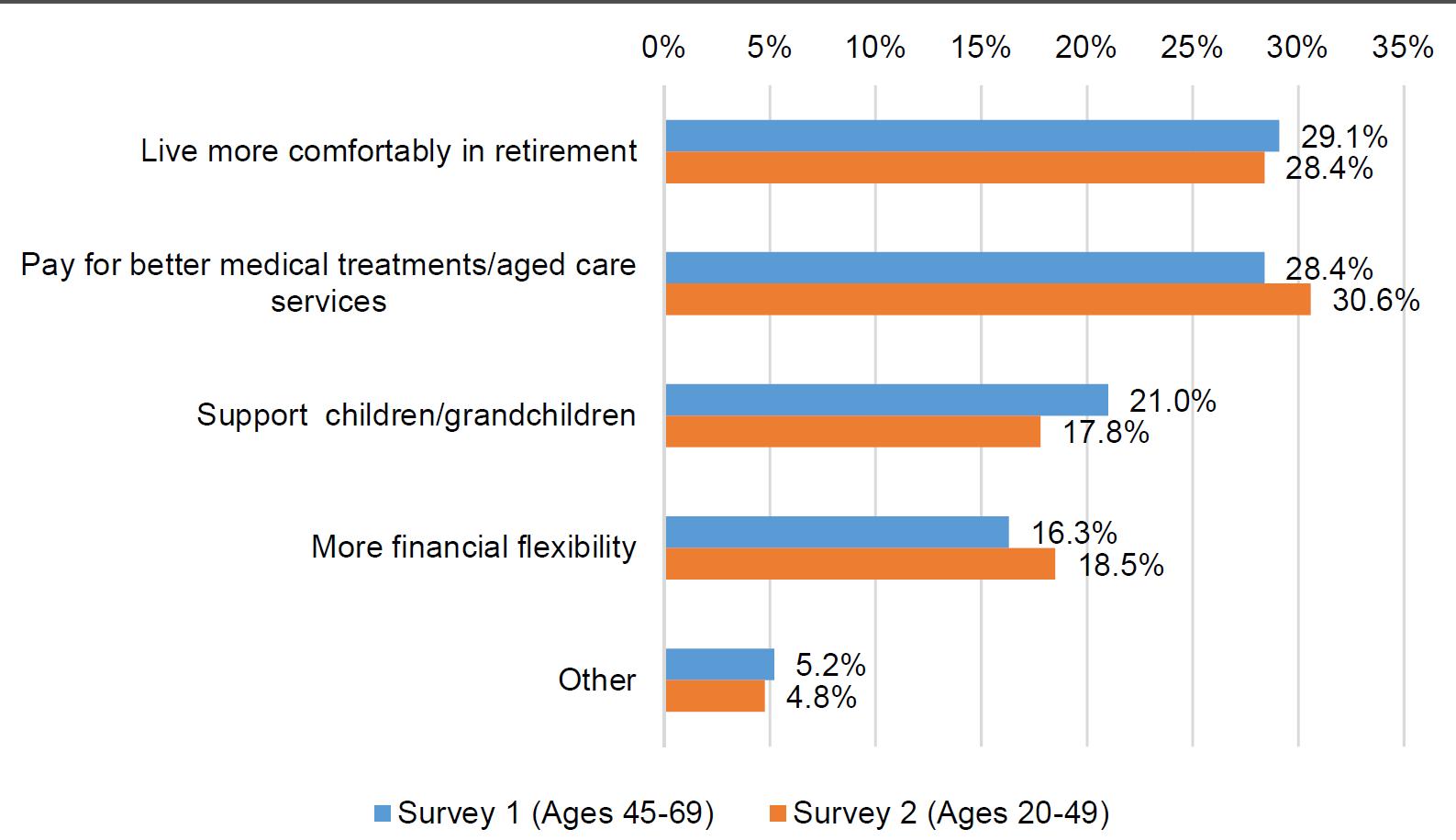

We find a high level of interest in reverse mortgages both among older homeowners and adult children of older homeowners. This result disproves widely held perceptions of intergenerational wealth transfer in China. The survey participants wanted to use the reverse mortgage payments for a range of different purposes (see Figure 2). Funding a more comfortable retirement and paying for better medical treatments or aged care services were the most important reasons given for interest in the product by both older homeowners and adult children. Consistent with previous literature, we find that product familiarity and product understanding were associated with a higher interest in the product.

Source: Hanewald et al. (2019)

Based on these findings, we offer several suggestions for the development of reverse mortgages markets in China and other countries. First, our results show that consumers are interested in reverse mortgages when these complex products are explained in an easy-to-understand way and when consumer concerns are addressed directly. Second, our results suggest that reverse mortgages should be marketed to both older homeowners and their adult children. Encouraging families to discuss the use of housing wealth in retirement can reduce expectation mismatches that parents and children have regarding the use of housing wealth and can increase the demand for reverse mortgages. Third, given that individuals want to use the products for a range of different purposes, reverse mortgages should be framed as a versatile tool to fund different retirement expenditures.

Only one provider, Happy Life Insurance, is currently offering reverse mortgages in China. Other potential providers find the product complex and are worried about risk management strategies and profitability (Asia Insurance Review, 2018). Providers have also called for more policy support as well as improved laws and regulations (Asia Insurance Review, 2018). A two-sided response involving both industry and government could help to develop the potentially large reverse mortgage market in China. Our research and the product description we have developed can inform the design of more attractive reverse mortgage products. Frameworks for pricing and risk management for different types of reverse mortgages are available in the literature (e.g., Shao, et al., 2015). The Chinese government could issue more-detailed regulations and technical documents to guide the industry. The government could also consider introducing subsidies or guarantees, as in the US, where the Federal Government provides mortgage insurance for the Home Equity Conversion Mortgage (HECM). However, a key requirement to ensure the development of a reverse mortgage market in China is an efficient distribution network to link product providers with a potentially large group of interested older homeowners and their extended families.

Asia Insurance Review (2018). China: Authorities to promote reverse mortgages nationwide. Asia Insurance Review, 09 August 2018.

Chen, K. and Y. Wen (2017). “The Great Housing Boom of China,” American Economic Journal: Macroeconomics, 9 (2), 73–114.

Dillingh, R., Prast, H., Rossi, M., & Brancati, C. U. (2017). Who wants to have their home and eat it too? Interest in reverse mortgages in the Netherlands. Journal of Housing Economics, 38, 25–37.

Fang, H., Q. Gu, W. Xiong, and L.-A. Zhou (2015). “Demystifying the Chinese Housing Boom,” NBER Macroeconomic Annual, 2015, 105–166. Edited by Martin Eichenbaum and Jonathan Parker, Chicago, IL: University of Chicago Press.

Fang, H., & Feng, J. (2018). The Chinese Pension System. NBER Working Paper No. 25088. National Bureau of Economic Research.

Hanewald, K., Bateman, H., Fang, H., & Wu, S. (2019). Is There a Demand for Reverse Mortgages in China? Evidence from Two Online Surveys. NBER Working Paper No. 25491. National Bureau of Economic Research.

Shao, A. W., Hanewald, K., & Sherris, M. (2015). Reverse mortgage pricing and risk analysis allowing for idiosyncratic house price risk and longevity risk. Insurance: Mathematics and Economics, 63, 76-90.

United Nations (2017). World Population Prospects: The 2017 Revision. United Nations, Department of Economic and Social Affairs, Population Division, New York. Custom data acquired via website.

As one of the fastest-aging countries in the world, China is under tremendous pressure to provide financial resources for its rapidly growing elderly population. The government has extended and reformed the Chinese pension system, but there are concerns about the financial sustainability of the system due to the rapid increase in the share of the elderly population compared to the working-age population (Fang and Feng, 2018). Figure 1 shows that China’s old-age dependency ratio is expected to increase from 13% in 2015 to 44% in 2050 (United Nations, 2017).

Figure 1: China’s old-age dependency ratio, 2000–2050.

Chinese households hold a large proportion of their wealth in the form of housing. Chinese house prices have appreciated at an annual rate of more than 10% since the early 2000s (Chen and Wen, 2017; Fang et al., 2015), causing large increases in household wealth. However, it is difficult for individuals to access this housing wealth. Accordingly, Yang et al. (2016) find that, on average, changes in housing wealth have limited effects on the non-housing consumption of the elderly in China.

Reverse mortgages allow homeowners to borrow against their home without having to make repayments while they still live in their home. Once the homeowner passes away or permanently moves into a nursing home, the home is sold, and the sale proceeds are used to repay the loan. In 2014, the Chinese government authorized a pilot program to introduce reverse mortgages in China. Initially, the pilot program only covered four cities over two years. The government extended the program period and regional coverage in 2016 and 2018. However, only one provider, Happy Life Insurance, started offering a reverse mortgage product. The product launched in March 2015 and is currently selling in eight cities in China (Beijing, Shanghai, Guangzhou, Wuhan, Hangzhou, Dalian, Nanjing, Suzhou). So far, the demand for the product is low: only 139 contracts were underwritten by mid-2018. The reverse mortgage product offered by Happy Life Insurance company under the name “Housing provides guarantee reverse mortgage endowment insurance for the elderly” is very complex and inflexible, and the product description is hard to understand (see Hanewald et al., 2019).

In our recent study, Hanewald et al. (2019), we tested the demand for a more flexible reverse mortgage product design that addresses the shortcomings of the unsuccessful product piloted in China. The product design also addresses consumer concerns about reverse mortgages identified in related research on other markets (e.g., Dillingh et al., 2017). Using focus group testing, we developed a clear, yet concise and comprehensive product description that illustrates potential uses of the reverse mortgage payments. The key innovation of our study is the product design and product description. Our hypothetical product allows borrowers to choose the level of debt they incur as well as the type of payment that best suits their retirement needs. Possible payment types include a lump sum, lifetime fixed regular payments, or flexible payments. In addition, our product explicitly allows the borrowers’ heirs to settle the outstanding debt and keep the property at the end of the contract, if they so prefer. We also take special care to address the potential consumers’ concerns about how the house sales will be conducted, whether rental is permitted, how the loss of the property will be handled, etc. In addition, we make sure to test the subjects’ understanding of our reverse mortgage product. The hypothetical product has a simpler debt structure and lower fees than the reverse mortgage offered by Happy Life Insurance. We tested the demand for this product in two large online surveys, one targeting older homeowners aged 45–65 as potential purchasers and the other targeting adult children aged 20–49, who represented the children of potential purchasers

We find a high level of interest in reverse mortgages both among older homeowners and adult children of older homeowners. This result disproves widely held perceptions of intergenerational wealth transfer in China. The survey participants wanted to use the reverse mortgage payments for a range of different purposes (see Figure 2). Funding a more comfortable retirement and paying for better medical treatments or aged care services were the most important reasons given for interest in the product by both older homeowners and adult children. Consistent with previous literature, we find that product familiarity and product understanding were associated with a higher interest in the product.

Figure 2: Use of reverse mortgage payments.

Based on these findings, we offer several suggestions for the development of reverse mortgages markets in China and other countries. First, our results show that consumers are interested in reverse mortgages when these complex products are explained in an easy-to-understand way and when consumer concerns are addressed directly. Second, our results suggest that reverse mortgages should be marketed to both older homeowners and their adult children. Encouraging families to discuss the use of housing wealth in retirement can reduce expectation mismatches that parents and children have regarding the use of housing wealth and can increase the demand for reverse mortgages. Third, given that individuals want to use the products for a range of different purposes, reverse mortgages should be framed as a versatile tool to fund different retirement expenditures.

Only one provider, Happy Life Insurance, is currently offering reverse mortgages in China. Other potential providers find the product complex and are worried about risk management strategies and profitability (Asia Insurance Review, 2018). Providers have also called for more policy support as well as improved laws and regulations (Asia Insurance Review, 2018). A two-sided response involving both industry and government could help to develop the potentially large reverse mortgage market in China. Our research and the product description we have developed can inform the design of more attractive reverse mortgage products. Frameworks for pricing and risk management for different types of reverse mortgages are available in the literature (e.g., Shao, et al., 2015). The Chinese government could issue more-detailed regulations and technical documents to guide the industry. The government could also consider introducing subsidies or guarantees, as in the US, where the Federal Government provides mortgage insurance for the Home Equity Conversion Mortgage (HECM). However, a key requirement to ensure the development of a reverse mortgage market in China is an efficient distribution network to link product providers with a potentially large group of interested older homeowners and their extended families.

[Katja Hanewald, Australia-China Population Ageing Research Hub, ARC Centre of Excellence in Population Ageing Research (CEPAR), University of New South Wales; Hazel Bateman, the School of Risk & Actuarial Studies at UNSW Sydney and Deputy Director of the ARC Centre of Excellence in Population Ageing Research; Hanming Fang, University of Pennsylvania and the National Bureau of Economic Research; Shang Wu, Australia-China Population Ageing Research Hub, ARC Centre of Excellence in Population Ageing Research (CEPAR), University of New South Wales.]

Asia Insurance Review (2018). China: Authorities to promote reverse mortgages nationwide. Asia Insurance Review, 09 August 2018.

Chen, K. and Y. Wen (2017). “The Great Housing Boom of China,” American Economic Journal: Macroeconomics, 9 (2), 73–114.

Dillingh, R., Prast, H., Rossi, M., & Brancati, C. U. (2017). Who wants to have their home and eat it too? Interest in reverse mortgages in the Netherlands. Journal of Housing Economics, 38, 25–37.

Fang, H., Q. Gu, W. Xiong, and L.-A. Zhou (2015). “Demystifying the Chinese Housing Boom,” NBER Macroeconomic Annual, 2015, 105–166. Edited by Martin Eichenbaum and Jonathan Parker, Chicago, IL: University of Chicago Press.

Fang, H., & Feng, J. (2018). The Chinese Pension System. NBER Working Paper No. 25088. National Bureau of Economic Research.

Hanewald, K., Bateman, H., Fang, H., & Wu, S. (2019). Is There a Demand for Reverse Mortgages in China? Evidence from Two Online Surveys. NBER Working Paper No. 25491. National Bureau of Economic Research.

Shao, A. W., Hanewald, K., & Sherris, M. (2015). Reverse mortgage pricing and risk analysis allowing for idiosyncratic house price risk and longevity risk. Insurance: Mathematics and Economics, 63, 76-90.

United Nations (2017). World Population Prospects: The 2017 Revision. United Nations, Department of Economic and Social Affairs, Population Division, New York. Custom data acquired via website.

Yang, Z., Fan, Y., & Cheung, C. H. Y. (2017). Housing assets to the elderly in urban China: To fund or to hedge? Housing Studies, 32(5), 638–658.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email