In the Shadows of the Government: Relationship-building during Political Turnovers

We document that firms use two instruments to build relationships with local government officials in China: “perk spending” and personnel changes. Following a turnover in the positions of Party Secretary or Mayor of a city in China, firms (especially private firms) headquartered in that city significantly increase their perk spending. Both the instrumental variable-based results and heterogeneity analysis support the interpretation that perk spending is used to build relationships with local governments. Moreover, state-owned firms, particularly those controlled by the local government, tend to change their key personnel (Chairmen or CEOs) following the local political turnover. However, the Chairmen or CEOs who have connections with local government officials are less likely to be replaced.

It is well-recognized that a relationship with government officials plays a critical role for firms in emerging markets where the government casts a big shadow over the firms’ operations. Politically-connected firms may enjoy benefits such as preferential access to external financing, lower financing costs, receiving government contracts and bailouts, tax benefits, subsidies, as well as favorable policies and legislative conditions (Fisman, 2001; Faccio, 2006; Faccio et al., 2006; and Bunkanwanicha and Wiwattanakantang, 2009). However, less is known about how firms “invest” in their relationships with government officials in emerging markets where the rules of political lobbying are less well-established.

We fill this gap in the literature by examining how firms invest in their relationships with their local governments in China following the turnover of local politicians using a large and partially hand-collected panel dataset. We posit that, after a political turnover of local government officials, firms might use “perk spending” — namely, expenses for travel, business entertainment, overseas training, company cars, and board meetings and other meetings — to invest in the connections with their local governments. After political turnovers, firms may face the risk of losing existing political connections and being adversely affected by new policies introduced by the new local government officials. This gives firms an extra incentive to build new relationships. Moreover, it is relatively easy for firms to disguise relationship-building expenses as productivity-related perk spending. For example, Cai et al. (2011) argue that Chinese executives commonly use perks, such as meals, entertainment, and travel (ETC), to network with government officials, suppliers, clients, and creditors. Therefore, our first hypothesis is that firms increase their perk spending to invest in political connections after major political turnovers in the local government.

Moreover, firms may also build relationships with their local government through personnel changes; e.g., replacing senior management with people who have connections to the new local government officials. State-owned enterprises are more likely to adopt this approach perhaps because they have a weaker preference for profit maximization and face stronger influences from their local governments. Hence, our second hypothesis is that state-owned firms, particularly those controlled by the local government, tend to change their key personnel (Chairmen or CEOs) following a local political turnover.

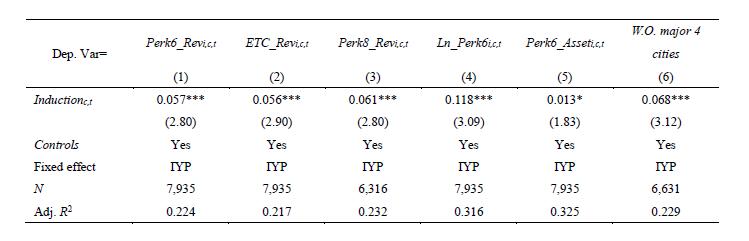

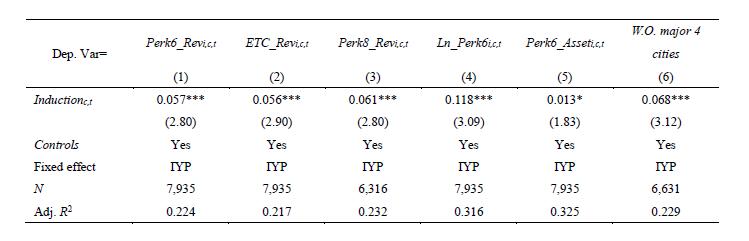

We document that, following a change in the Party Secretary or Mayor of a city in China, firms headquartered in that city significantly increase their “perk spending” after controlling for local economic conditions such as local GDP and population growth. Table 1 presents the regression results of the impact of political turnover on perk spending. The dependent variables are various measures of perk spending. The key independent variable is the dummy variable Inductionc,t, which is 1 if city c (where firm i is headquartered) experiences a turnover of its Mayor of Party Secretary at year t. We have controlled for a set of firm-level, CEO-level, and regional-level variables in the regressions, in addition to Industry (I), Year (Y), and Province (P) fixed effects. The coefficient of Inductionc,t measures the effect of political turnovers on local firms’ perk spending. As shown in Table 1, this coefficient is both statistically and economically significant. For example, the coefficient in Column (1) implies that, on average, a local firm in city c increases its perk spending by about 2.98 million RMB in the year after a new official is appointed, which is about 18 percent of the firm’s average annual perk spending.

Note: Perk6_Rev in Column (1) is the sum of the six items of perk spending; namely, expenses for travel, business entertainment, overseas training, company cars, and board meetings and other meetings, divided by revenue. ETC_Rev in Column (2) is the ratio of the sum of meals, entertainment, and travel costs over revenue. Perk8_Rev in Column (3) is the ratio of the sum of Perk6, work-related expenses and communication expenses to revenue. In Column (4), Ln_Perk6 is the log of Perk6. In Column (5), we use the ratio of Perk6 over assets. In Column (6), the dependent variable is Perk6 divided by revenue and the sample does not include observations on the “major 4” cities (Beijing, Shanghai, Tianjin, and Chongqing).

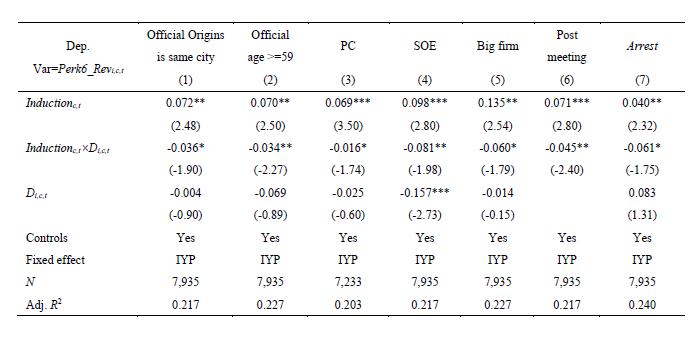

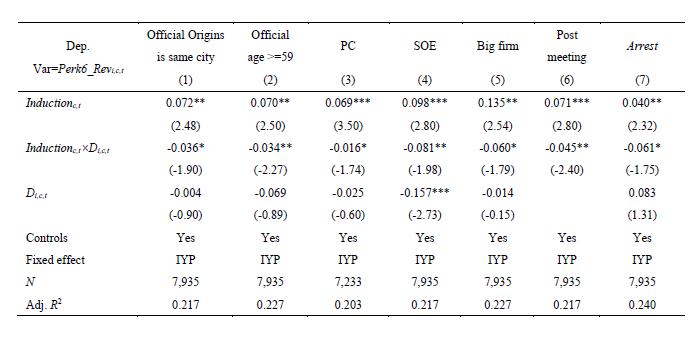

To shed further light on our interpretation, we examine the cross-sectional and time series heterogeneity in the effects of local political turnover on perk spending by including the interaction term, Inductionc,t×Di,c,t, in the regressions, where Di,c,t is defined in the Note of Table 2. The results in Table 2 show that perk spending increases more when the incentive to build relationships with local government officials is stronger. For example, when the new official is originally from a different city or when the incoming official is young, for those firms whose senior management has no political experience, private firms, or smaller firms, there are stronger increases in perk spending when the new local government officials are appointed. Moreover, perk spending appears to respond less to political turnovers when it is costlier for officials to accept perks from local firms. For example, after a recent arrest of a local politician for corruption, incoming officials would become more reluctant to accept perks. Historically, President Xi Jinping’s unprecedented anti-corruption campaign might have made officials more reluctant to accept perks due to the elevated risk of being disciplined.

Note: Perk6_Rev and Induction are defined in Table 1. Di,c,t in Column (1) is 1 if the newly-appointed official is from city c and is 0 otherwise. In Column (2), Di,c,t is 1 if the newly-appointed official is older than 59 and is 0 otherwise. In Column (3), Di,c,t is 1 if the CEO or chairman of firm i is a former government official, a member of the Committee of the Chinese People’s Political Consultative Conference, or a member of the National Congress of the Communist Party of China; otherwise it is 0. In Column (4), Di,c,t is 1 if firm i is a state-owned enterprise and is 0 otherwise. In Column (5), Di,c,t is 1 if firm i’s total assets are larger than the median of the asset value of firms in the same industry in year t and is 0 otherwise. In Column (6), Di,c,t is 1 if t is after 2012 and is 0 otherwise. In Column (7), Di,c,t is 1 if there is an arrest of a government official in city c in year t-1 and is 0 otherwise.

What do firms get in return for their perk spending? Our evidence suggests that firms with more perk expenses get larger future benefits from the local government in the form of government subsidies or accesses to financing, especially long-term financing. Moreover, this effect is also stronger after officials change, which is consistent with our interpretation that relationship-building is more valuable after political turnovers. We do not find evidence that firms with more perk expenses have better future performance as measured by their return of assets (ROA) and return on equity (ROE).

To test the conjecture that firms and local governments can establish relationships through personnel changes, we examine firms’ personnel changes during political turnovers. First, we find that local political turnovers tend to be followed by more changes of CEOs and/or Chairmen for SOEs in that city. This result is primarily driven by the changes at firms where local politicians exert influence, such as state-owned enterprises controlled by the city. This effect disappears when we conduct the same tests on private firms or on SOEs controlled by the national government. Consistent with the interpretation that appointed CEOs and Chairmen are likely to be “friends” of current local government officials, we find that they are less likely to be replaced as long as the officials who appointed them are still in office.

Our paper contributes to the literature on how firms build relationships with their government officials. Prior literature finds that firms can build political connections through a wide range of means including hiring executives with prior political experience and/or government affiliation, contributing to electoral campaigns, lobbying, and corporate investment. Our paper differs from this literature in that we focus on the important emerging economy in China and that we examine how firms’ perk spending is used as a means to build political networks with governments and how such perk spending affects firm performance. Furthermore, we find that another important aspect of relationship-building is perhaps through personnel changes as local political turnovers tend to be followed by more changes of chairmen or CEOs for firms in that city.

(Hanming Fang, University of Pennsylvania and the National Bureau of Economic Research; Zhe Li, Central University of Finance and Economics; Nianhang Xu, Renmin University of China; Hongjun Yan, DePaul University.)

Bunkanwanicha, P., and Y. Wiwattanakantang, 2009. “Big Business Owners in Politics.” Review of Financial Studies 22, 2133-2168.

Cai, H., H. Fang, and L. C. Xu, 2011. “Eat, Drink, Firms, Government: An Investigation of Corruption from Entertainment and Travel Costs of Chinese Firms.” Journal of Law and Economics 54, 55-78.

Faccio, M., 2006. “Politically-connected Firms.” American Economic Review 96, 369-386.

Faccio, M., J. J. McConnell, and R. W. Masulis, 2006. “Political Connections and Corporate Bailouts.” Journal of Finance 61, 2597-2635.

Fisman, R., 2001. “Estimating the Value of Political Connections.” American Economic Review 91, 1095-1102.

It is well-recognized that a relationship with government officials plays a critical role for firms in emerging markets where the government casts a big shadow over the firms’ operations. Politically-connected firms may enjoy benefits such as preferential access to external financing, lower financing costs, receiving government contracts and bailouts, tax benefits, subsidies, as well as favorable policies and legislative conditions (Fisman, 2001; Faccio, 2006; Faccio et al., 2006; and Bunkanwanicha and Wiwattanakantang, 2009). However, less is known about how firms “invest” in their relationships with government officials in emerging markets where the rules of political lobbying are less well-established.

We fill this gap in the literature by examining how firms invest in their relationships with their local governments in China following the turnover of local politicians using a large and partially hand-collected panel dataset. We posit that, after a political turnover of local government officials, firms might use “perk spending” — namely, expenses for travel, business entertainment, overseas training, company cars, and board meetings and other meetings — to invest in the connections with their local governments. After political turnovers, firms may face the risk of losing existing political connections and being adversely affected by new policies introduced by the new local government officials. This gives firms an extra incentive to build new relationships. Moreover, it is relatively easy for firms to disguise relationship-building expenses as productivity-related perk spending. For example, Cai et al. (2011) argue that Chinese executives commonly use perks, such as meals, entertainment, and travel (ETC), to network with government officials, suppliers, clients, and creditors. Therefore, our first hypothesis is that firms increase their perk spending to invest in political connections after major political turnovers in the local government.

Moreover, firms may also build relationships with their local government through personnel changes; e.g., replacing senior management with people who have connections to the new local government officials. State-owned enterprises are more likely to adopt this approach perhaps because they have a weaker preference for profit maximization and face stronger influences from their local governments. Hence, our second hypothesis is that state-owned firms, particularly those controlled by the local government, tend to change their key personnel (Chairmen or CEOs) following a local political turnover.

We document that, following a change in the Party Secretary or Mayor of a city in China, firms headquartered in that city significantly increase their “perk spending” after controlling for local economic conditions such as local GDP and population growth. Table 1 presents the regression results of the impact of political turnover on perk spending. The dependent variables are various measures of perk spending. The key independent variable is the dummy variable Inductionc,t, which is 1 if city c (where firm i is headquartered) experiences a turnover of its Mayor of Party Secretary at year t. We have controlled for a set of firm-level, CEO-level, and regional-level variables in the regressions, in addition to Industry (I), Year (Y), and Province (P) fixed effects. The coefficient of Inductionc,t measures the effect of political turnovers on local firms’ perk spending. As shown in Table 1, this coefficient is both statistically and economically significant. For example, the coefficient in Column (1) implies that, on average, a local firm in city c increases its perk spending by about 2.98 million RMB in the year after a new official is appointed, which is about 18 percent of the firm’s average annual perk spending.

Table 1: The Impact of Political Turnover on Perks

To shed further light on our interpretation, we examine the cross-sectional and time series heterogeneity in the effects of local political turnover on perk spending by including the interaction term, Inductionc,t×Di,c,t, in the regressions, where Di,c,t is defined in the Note of Table 2. The results in Table 2 show that perk spending increases more when the incentive to build relationships with local government officials is stronger. For example, when the new official is originally from a different city or when the incoming official is young, for those firms whose senior management has no political experience, private firms, or smaller firms, there are stronger increases in perk spending when the new local government officials are appointed. Moreover, perk spending appears to respond less to political turnovers when it is costlier for officials to accept perks from local firms. For example, after a recent arrest of a local politician for corruption, incoming officials would become more reluctant to accept perks. Historically, President Xi Jinping’s unprecedented anti-corruption campaign might have made officials more reluctant to accept perks due to the elevated risk of being disciplined.

Table 2: The Incentives to Build Up Political Connections

What do firms get in return for their perk spending? Our evidence suggests that firms with more perk expenses get larger future benefits from the local government in the form of government subsidies or accesses to financing, especially long-term financing. Moreover, this effect is also stronger after officials change, which is consistent with our interpretation that relationship-building is more valuable after political turnovers. We do not find evidence that firms with more perk expenses have better future performance as measured by their return of assets (ROA) and return on equity (ROE).

To test the conjecture that firms and local governments can establish relationships through personnel changes, we examine firms’ personnel changes during political turnovers. First, we find that local political turnovers tend to be followed by more changes of CEOs and/or Chairmen for SOEs in that city. This result is primarily driven by the changes at firms where local politicians exert influence, such as state-owned enterprises controlled by the city. This effect disappears when we conduct the same tests on private firms or on SOEs controlled by the national government. Consistent with the interpretation that appointed CEOs and Chairmen are likely to be “friends” of current local government officials, we find that they are less likely to be replaced as long as the officials who appointed them are still in office.

Our paper contributes to the literature on how firms build relationships with their government officials. Prior literature finds that firms can build political connections through a wide range of means including hiring executives with prior political experience and/or government affiliation, contributing to electoral campaigns, lobbying, and corporate investment. Our paper differs from this literature in that we focus on the important emerging economy in China and that we examine how firms’ perk spending is used as a means to build political networks with governments and how such perk spending affects firm performance. Furthermore, we find that another important aspect of relationship-building is perhaps through personnel changes as local political turnovers tend to be followed by more changes of chairmen or CEOs for firms in that city.

(Hanming Fang, University of Pennsylvania and the National Bureau of Economic Research; Zhe Li, Central University of Finance and Economics; Nianhang Xu, Renmin University of China; Hongjun Yan, DePaul University.)

This article is copyrighted. If you wish to repost or cite it, please indicate the source.

Bunkanwanicha, P., and Y. Wiwattanakantang, 2009. “Big Business Owners in Politics.” Review of Financial Studies 22, 2133-2168.

Cai, H., H. Fang, and L. C. Xu, 2011. “Eat, Drink, Firms, Government: An Investigation of Corruption from Entertainment and Travel Costs of Chinese Firms.” Journal of Law and Economics 54, 55-78.

Faccio, M., 2006. “Politically-connected Firms.” American Economic Review 96, 369-386.

Faccio, M., J. J. McConnell, and R. W. Masulis, 2006. “Political Connections and Corporate Bailouts.” Journal of Finance 61, 2597-2635.

Fisman, R., 2001. “Estimating the Value of Political Connections.” American Economic Review 91, 1095-1102.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email